Description

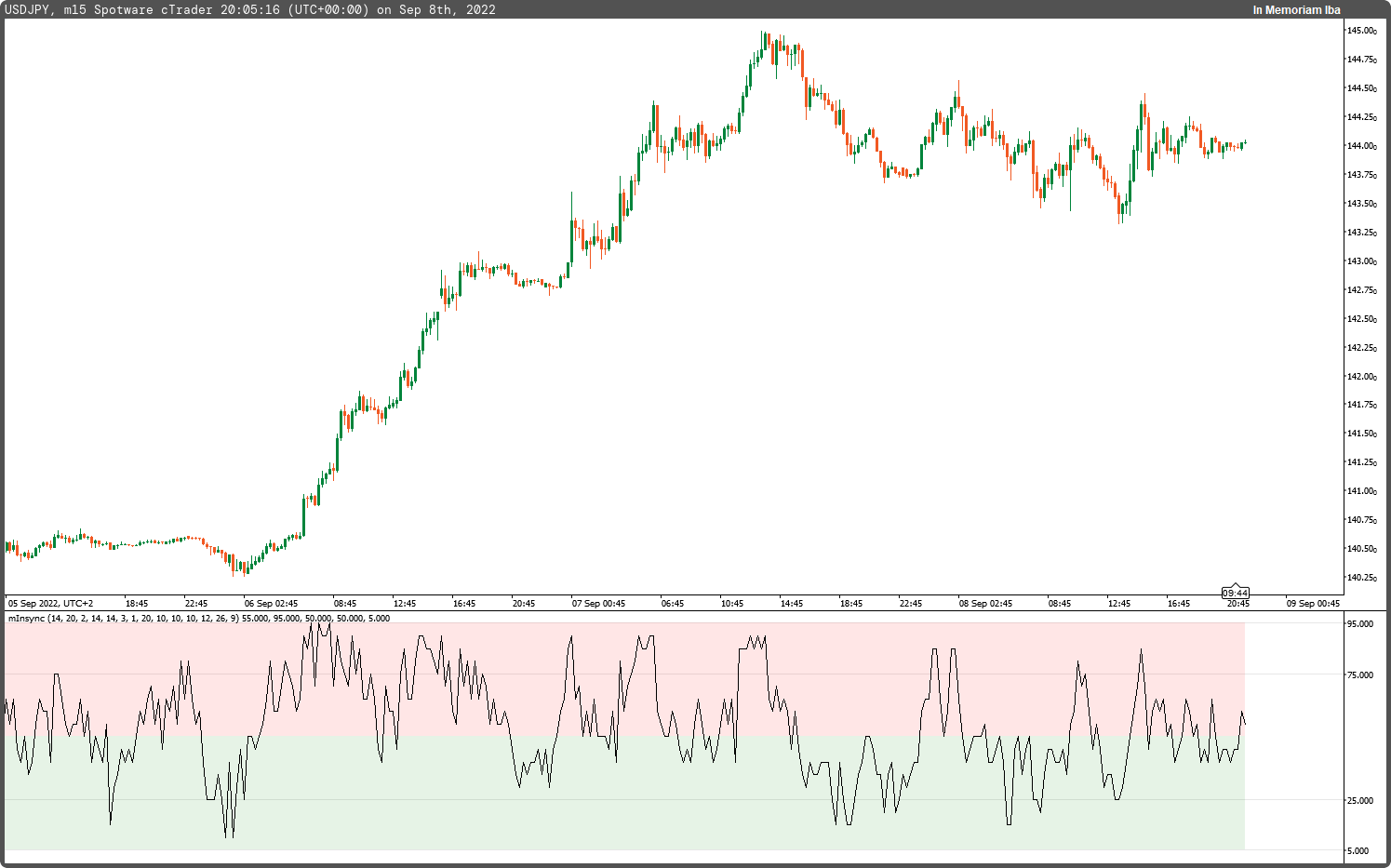

Insync Index, by Norm North, is a consensus indicator. It uses RSI, MACD, MFI, DPO, ROC, Stoch, CCI and %B to calculate a composite signal. Basically, this index shows that when a majority of underlying indicators is in sync, a turning point is near.

There are couple of ways to use this indicator.

- Buy when crossing up 5, sell when crossing down 95.

- Market is typically bullish when index is above 50, bearish when below 50. This can be a great confirmation signal for price action + trend lines .

Also, since this is typical oscillator, look for divergences between price and index.

Levels 75/25 are early warning levels. Note that, index > 75 (and less than 95) should be considered very bullish and index below 25 (but above 5) as very bearish . Levels 95/5 are equivalent to traditional OB/OS levels.

The various values of the underlying components can be tuned via options page. I have also provided an option to color bars based on the index value.

More info: The Insync Index by Norm North, TASC Jan 1995

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

namespace cAlgo

{

[Levels(25, 75, 5, 95)]

[Cloud("LimitUp1", "LimitDn1", FirstColor = "Red", Opacity = 0.1, SecondColor = "Red")]

[Cloud("LimitUp2", "LimitDn2", FirstColor = "Green", Opacity = 0.1, SecondColor = "Aqua")]

[Indicator(IsOverlay = false, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class mInsync : Indicator

{

[Parameter("Period CCI (14):", DefaultValue = 14)]

public int prmPeriodCCI { get; set; }

[Parameter("Period Bollinger (20):", DefaultValue = 20)]

public int prmPeriodBollinger { get; set; }

[Parameter("Deviation Bollinger (2):", DefaultValue = 2.0)]

public double prmDeviationBollinger { get; set; }

[Parameter("Period RSI (14):", DefaultValue = 14)]

public int prmPeriodRSI { get; set; }

[Parameter("Period Stoch (14):", DefaultValue = 14)]

public int prmPeriodStoch { get; set; }

[Parameter("Period Stoch D (3):", DefaultValue = 3)]

public int prmPeriodStochD { get; set; }

[Parameter("Period Stoch K (1):", DefaultValue = 1)]

public int prmPeriodStochK { get; set; }

[Parameter("Period MFI (14):", DefaultValue = 20)]

public int prmPeriodMFI { get; set; }

[Parameter("Period EOM (10):", DefaultValue = 10)]

public int prmPeriodEOM { get; set; }

[Parameter("Period ROC (10):", DefaultValue = 10)]

public int prmPeriodROC { get; set; }

[Parameter("Period DPO (18):", DefaultValue = 18)]

public int prmPeriodDPO { get; set; }

[Parameter("Period MACD Fast (12):", DefaultValue = 12)]

public int prmPeriodMACDFast { get; set; }

[Parameter("Period MACD Slow (26):", DefaultValue = 26)]

public int prmPeriodMACDSlow { get; set; }

[Parameter("Period MACD Signal (9):", DefaultValue = 9)]

public int prmPeriodMACDSignal { get; set; }

[Output("Main", LineColor = "Black", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outInSync { get; set; }

[Output("LimitUp1", LineColor = "Transparent", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries LimitUp1 { get; set; }

[Output("LimitDn1", LineColor = "Transparent", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries LimitDn1 { get; set; }

[Output("LimitUp2", LineColor = "Transparent", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries LimitUp2 { get; set; }

[Output("LimitDn2", LineColor = "Transparent", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries LimitDn2 { get; set; }

private CommodityChannelIndex _cci;

private BollingerBands _bb;

private RelativeStrengthIndex _rsi;

private StochasticOscillator _stoc;

private MoneyFlowIndex _mfi;

private EaseOfMovement _eom;

private PriceROC _roc;

private DetrendedPriceOscillator _dpo;

private MacdCrossOver _macd;

private IndicatorDataSeries _cci_res;

private IndicatorDataSeries _bbres;

private IndicatorDataSeries _bb_res;

private IndicatorDataSeries _rsi_res;

private IndicatorDataSeries _stoc_res;

private IndicatorDataSeries _mfi_res;

private IndicatorDataSeries _eom_res;

public IndicatorDataSeries _roc_res;

public IndicatorDataSeries _dpo_res;

public IndicatorDataSeries _macd_res;

protected override void Initialize()

{

_cci = Indicators.CommodityChannelIndex(prmPeriodCCI);

_bb = Indicators.BollingerBands(Bars.ClosePrices, prmPeriodBollinger, prmDeviationBollinger, MovingAverageType.Simple);

_rsi = Indicators.RelativeStrengthIndex(Bars.ClosePrices, prmPeriodRSI);

_stoc = Indicators.StochasticOscillator(prmPeriodStoch, prmPeriodStochD, prmPeriodStochK, MovingAverageType.Simple);

_mfi = Indicators.MoneyFlowIndex(prmPeriodMFI);

_eom = Indicators.EaseOfMovement(prmPeriodEOM, MovingAverageType.Simple);

_roc = Indicators.PriceROC(Bars.ClosePrices, prmPeriodROC);

_dpo = Indicators.DetrendedPriceOscillator(Bars.ClosePrices, 18, MovingAverageType.Simple);

_macd = Indicators.MacdCrossOver(prmPeriodMACDSlow, prmPeriodMACDFast, prmPeriodMACDSignal);

_cci_res = CreateDataSeries();

_bbres = CreateDataSeries();

_bb_res = CreateDataSeries();

_rsi_res = CreateDataSeries();

_stoc_res = CreateDataSeries();

_mfi_res = CreateDataSeries();

_eom_res = CreateDataSeries();

_roc_res = CreateDataSeries();

_dpo_res = CreateDataSeries();

_macd_res = CreateDataSeries();

}

public override void Calculate(int index)

{

if (index < 3)

{

LimitUp1[index] = 95;

LimitDn1[index] = 50;

LimitUp2[index] = 50;

LimitDn2[index] = 5;

outInSync[index] = 50;

return;

}

_cci_res[index] = (_cci.Result[index] > 100.0 ? +5.0 : (_cci.Result[index] < -100.0 ? -5.0 : 0.0));

_bbres[index] = (Bars.ClosePrices[index] - _bb.Bottom[index]) / (_bb.Top[index] - _bb.Bottom[index]);

_bb_res[index] = (_bbres[index] < 0.05 ? -5 : (_bbres[index] > 0.95 ? +5 : 0));

_rsi_res[index] = (_rsi.Result[index] > 70 ? 5 : (_rsi.Result[index] < 30 ? -5 : 0));

_stoc_res[index] = (_stoc.PercentD[index] > 80 ? 5 : (_stoc.PercentD[index] < 20 ? -5 : 0)) + (_stoc.PercentK[index] > 80 ? 5 : (_stoc.PercentK[index] < 20 ? -5 : 0));

_mfi_res[index] = (_mfi.Result[index] > 80 ? 5 : (_mfi.Result[index] < 20 ? -5 : 0));

_eom_res[index] = (_eom.Result[index] > 0 && _eom.Result[index] > _eom.Result[index - 1] ? 5 : (_eom.Result[index] < 0 && _eom.Result[index] < _eom.Result[index - 1] ? -5 : 0));

_roc_res[index] = (_roc.Result[index] > 0 && _roc.Result[index] > _roc.Result[index - 1] ? 5 : (_roc.Result[index] < 0 && _roc.Result[index] < _roc.Result[index - 1] ? -5 : 0));

_dpo_res[index] = (_dpo.Result[index] > 0 && _dpo.Result[index] > _dpo.Result[index - 1] ? 5 : (_dpo.Result[index] < 0 && _dpo.Result[index] < _dpo.Result[index - 1] ? -5 : 0));

_macd_res[index] = (_macd.MACD[index] > 0 && _macd.MACD[index] > _macd.MACD[index - 1] ? 5 : (_macd.MACD[index] < 0 && _macd.MACD[index] < _macd.MACD[index - 1] ? -5 : 0));

outInSync[index] = 50 + _cci_res[index] + _bb_res[index] + _rsi_res[index] + _stoc_res[index] + _mfi_res[index] + _eom_res[index] + _roc_res[index] + _dpo_res[index];

LimitUp1[index] = 95;

LimitDn1[index] = 50;

LimitUp2[index] = 50;

LimitDn2[index] = 5;

}

}

}

mfejza

Joined on 25.01.2022

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: mInsync.algo

- Rating: 5

- Installs: 721

The various values of the underlying components can be adjusted via the options page. I've also included the option to color bars based on the index value. basket random