Two indicators in one window

10 May 2013, 14:58

Hi All!

Is it possible to place two or more indicators in one indicator window? Now i look the situation when eash indicator takes own separate window on bottom of chart.

Replies

cAlgo_Fanatic

13 May 2013, 10:06

You may create a custom indicator that references the two indicators and plots their results. e.g.

[Indicator(IsOverlay = false, ScalePrecision = 5)]

public class twoIndicators : Indicator

{

StandardDeviation standDev;

HistoricalVolatility histVolatility;

[Output("StandardDeviation")]

public IndicatorDataSeries Result { get; set; }

[Output("HistoricalVolatility")]

public IndicatorDataSeries Result2 { get; set; }

protected override void Initialize()

{

// Initialize and create nested indicators

standDev = Indicators.StandardDeviation(MarketSeries.Close, 14, MovingAverageType.Simple);

histVolatility = Indicators.HistoricalVolatility(MarketSeries.Close, 20, 262);

}

public override void Calculate(int index)

{

// Calculate value at specified index

Result[index] = standDev.Result[index];

Result2[index] = histVolatility.Result[index];

}

@cAlgo_Fanatic

jeffmichaels

19 Feb 2014, 13:30

Hello,

Im looking at switching to cTrader but to my surprise this is not possible. I have a system with 3 stochastics in one window and 5 ADX in another.

If someone could point me in the right direction how to call 2 ADX in 1 window i can probably do the rest myself. Im not really a programmer but i could get tweaks done in MQL.

using System;

using cAlgo.API;

using cAlgo.API.Indicators;

namespace cAlgo.Indicators

{

[Indicator(IsOverlay = false)]

public class ADXR : Indicator

{

[Parameter(DefaultValue = 14)]

public int interval { get; set; }

[Output("ADXR", Color = Colors.Turquoise)]

public IndicatorDataSeries adxr { get; set; }

[Output("DiMinus", Color = Colors.Red)]

public IndicatorDataSeries diminus { get; set; }

[Output("DiPlus", Color = Colors.Blue)]

public IndicatorDataSeries diplus { get; set; }

private DirectionalMovementSystem adx;

protected override void Initialize()

{

adx = Indicators.DirectionalMovementSystem(interval);

}

public override void Calculate(int index)

{

adxr[index] = (adx.ADX[index] + adx.ADX[index - interval]) / 2;

diminus[index] = adx.DIMinus[index];

diplus[index] = adx.DIPlus[index];

}

}

}

Im looking to have a 7,21,42,89, and 144 ADX in one window, preferably wthout DI+ & DI- being visible.

@jeffmichaels

Spotware

19 Feb 2014, 17:39

Please look at the following example:

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

namespace cAlgo.Indicators

{

[Indicator(IsOverlay = false, TimeZone = TimeZones.UTC)]

public class AdxR : Indicator

{

[Output("adx 7", Color = Colors.Blue)]

public IndicatorDataSeries Adx7 { get; set; }

[Output("adx 21", Color = Colors.Yellow)]

public IndicatorDataSeries Adx21 { get; set; }

[Output("adx 42", Color = Colors.Red)]

public IndicatorDataSeries Adx42 { get; set; }

private DirectionalMovementSystem _dms7;

private DirectionalMovementSystem _dms21;

private DirectionalMovementSystem _dms42;

protected override void Initialize()

{

_dms7 = Indicators.DirectionalMovementSystem(7);

_dms21 = Indicators.DirectionalMovementSystem(21);

_dms42 = Indicators.DirectionalMovementSystem(42);

}

public override void Calculate(int index)

{

Adx7[index] = _dms7.ADX[index];

Adx21[index] = _dms21.ADX[index];

Adx42[index] = _dms42.ADX[index];

}

}

}

There are 3 ADX lines in the same panel.

@Spotware

jeffmichaels

21 Feb 2014, 14:39

So i managed to build on your code and now have the 5 ADX in 1 window.

Trying to do the same myself now for 3 stochastics in 1 window, but to no avail. Im not a coder, im fine tweaking stuff but cant seem to get this done.

Any help would be appreciated. I like the lightness of ctrader but i need my MT4 system if i want to switch

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

namespace cAlgo.Indicators

{

[Indicator(IsOverlay = false, TimeZone = TimeZones.UTC)]

public class AdxR : Indicator

{

[Output("Slow", Color = Colors.Yellow)]

public IndicatorDataSeries _stochasticslow { get; set; }

[Output("Medium", Color = Colors.Red)]

public IndicatorDataSeries _stochasticmedium { get; set; }

[Output("Fast", Color = Colors.Blue)]

public IndicatorDataSeries _stochasticfast { get; set; }

private StochasticOscillator _stochasticslow;

private StochasticOscillator _stochasticmedium;

private StochasticOscillator _stochasticsfast;

protected override void OnStart

{

_stochasticslow = Indicators.StochasticOscillator(100, 10, 10, SMA);

_stochasticmedium = Indicators.StochasticOscillator(21, 10, 10, SMA);

_stochasticsfast = Indicators.StochasticOscillator(8, 3, 3, SMA);

}

public override void Calculate(int index)

{

Slow[index] = _stochasticslow[index];

Medium[index] = _stochasticmedium[index];

Fast[index] = _stochasticfast[index];

}

}

}

@jeffmichaels

jeffmichaels

05 Mar 2014, 10:27

Could you please explain me about the stochastics too ?

@jeffmichaels

Forex19

05 Mar 2014, 11:00

( Updated at: 21 Dec 2023, 09:20 )

RE:

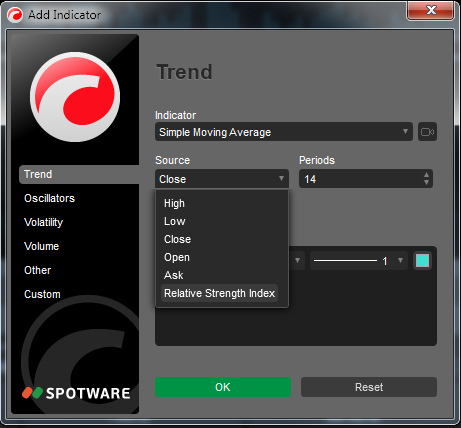

Spotware said:

First of all, add RSI to the chart:

.........

Second of all, add Moving Average with source "Relative Strength Index":

.........

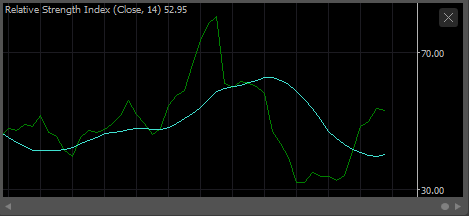

As a result you will see moving average built over RSI:

It works. thanks

Can you tell me which formula is used to normalize the SMA chart, on the scale of 0 -100 RSI chart?

@Forex19

jeffmichaels

05 Mar 2014, 11:01

RE: RE:

Spotware said:

jeffmichaels said:

Could you please explain me about the stochastics too ?

What do you want to do with stochastics?

from my last post :

So i managed to build on your code and now have the 5 ADX in 1 window.

Trying to do the same myself now for 3 stochastics in 1 window, but to no avail. Im not a coder, im fine tweaking stuff but cant seem to get this done.

Any help would be appreciated. I like the lightness of ctrader but i need my MT4 system if i want to switch

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

namespace cAlgo.Indicators

{

[Indicator(IsOverlay = false, TimeZone = TimeZones.UTC)]

public class AdxR : Indicator

{

[Output("Slow", Color = Colors.Yellow)]

public IndicatorDataSeries _stochasticslow { get; set; }

[Output("Medium", Color = Colors.Red)]

public IndicatorDataSeries _stochasticmedium { get; set; }

[Output("Fast", Color = Colors.Blue)]

public IndicatorDataSeries _stochasticfast { get; set; }

private StochasticOscillator _stochasticslow;

private StochasticOscillator _stochasticmedium;

private StochasticOscillator _stochasticsfast;

protected override void OnStart

{

_stochasticslow = Indicators.StochasticOscillator(100, 10, 10, SMA);

_stochasticmedium = Indicators.StochasticOscillator(21, 10, 10, SMA);

_stochasticsfast = Indicators.StochasticOscillator(8, 3, 3, SMA);

}

public override void Calculate(int index)

{

Slow[index] = _stochasticslow[index];

Medium[index] = _stochasticmedium[index];

Fast[index] = _stochasticfast[index];

}

}

}

@jeffmichaels

Spotware

05 Mar 2014, 11:39

( Updated at: 21 Dec 2023, 09:20 )

RE: RE:

Forex19 said:

Spotware said:

First of all, add RSI to the chart:

.........

Second of all, add Moving Average with source "Relative Strength Index":

.........

As a result you will see moving average built over RSI:

It works. thanks

Can you tell me which formula is used to normalize the SMA chart, on the scale of 0 -100 RSI chart?

In that example SMA is not normalized. SMA is build over RSI data series. That means that SMA[i] = (RSI[i] + RSI[i - 1] + ... RSI[i - period + 1]) / period

@Spotware

Spotware

05 Mar 2014, 11:43

jeffmichaels, please contact one of our Partners or post a job in Jobs section. We can not tweak all indicators for you.

@Spotware

Forex19

05 Mar 2014, 15:45

( Updated at: 21 Dec 2023, 09:20 )

RE: RE: RE:

Spotware said:

Forex19 said:

Spotware said:

First of all, add RSI to the chart:

.........

Second of all, add Moving Average with source "Relative Strength Index":

.........

As a result you will see moving average built over RSI:

It works. thanks

Can you tell me which formula is used to normalize the SMA chart, on the scale of 0 -100 RSI chart?

In that example SMA is not normalized. SMA is build over RSI data series. That means that SMA[i] = (RSI[i] + RSI[i - 1] + ... RSI[i - period + 1]) / period

@Forex19

Forex19

05 Mar 2014, 15:47

( Updated at: 21 Dec 2023, 09:20 )

RE: RE: RE:

Spotware said:

Forex19 said:

Spotware said:

First of all, add RSI to the chart:

.........

Second of all, add Moving Average with source "Relative Strength Index":

.........

As a result you will see moving average built over RSI:

It works. thanks

Can you tell me which formula is used to normalize the SMA chart, on the scale of 0 -100 RSI chart?

In that example SMA is not normalized. SMA is build over RSI data series. That means that SMA[i] = (RSI[i] + RSI[i - 1] + ... RSI[i - period + 1]) / period

I don't understand the calculation to build SMA over RSI data series.

You can actually see me please?

Suppose, at this time, to have a RSI (14) = 65 and you want to build over the SMA (20) = 140.350 (for the currency Euro / Yan).

What is the calculation?

Thank you.

@Forex19

Forex19

05 Mar 2014, 16:17

RE:

Spotware said:

It seems like calculating SMA over RSI doesn't suit your needs. If you want to display SMA and RSI into the same panel you need to write a custom indicator. In this case you will need to normalize somehow values of SMA to fit RSI scale.

The calculating SMA over RSI is good but I would like to have this so you can use it in other ways and not only on chart.

Starting from the exact calculation would be easier to write a custom indicator.

Can you help me, please?

@Forex19

Timmi

16 May 2014, 20:40

RE:

Spotware said:

In order to normalize values of indicator you need to know about visible min and max of another indicator. cAlgo API doesn't expose such information at the moment.

Currently drawing two indicators with independent scales into one panel is not possible.

what if you bring both onto a common scale?

using formulas to bring them to a common denominator?

@Timmi

Spotware

19 May 2014, 09:17

RE: RE:

Timmi said:

Spotware said:

In order to normalize values of indicator you need to know about visible min and max of another indicator. cAlgo API doesn't expose such information at the moment.

Currently drawing two indicators with independent scales into one panel is not possible.

what if you bring both onto a common scale?

using formulas to bring them to a common denominator?

You can try to do that. If you have any example please share it with the community.

@Spotware

khorshidi07

23 May 2014, 13:55

stochastic & MFI in one Window

Hello.

could anybody setup stochastic & MFI indicators in one Window?!

Thanks a lot...

@khorshidi07

Timmi

24 May 2014, 20:35

RE: RE: RE:

Spotware said:

Timmi said:

Spotware said:

In order to normalize values of indicator you need to know about visible min and max of another indicator. cAlgo API doesn't expose such information at the moment.

Currently drawing two indicators with independent scales into one panel is not possible.

what if you bring both onto a common scale?

using formulas to bring them to a common denominator?

You can try to do that. If you have any example please share it with the community.

This stuff is all way over my head. I am not a developer or a programmer.

What I am trying to say, is this:

oscillators that use a scale from 0-100, for example, have an indicator that has source data which is in the HLC-Vol-Time data - because there is no other data to work on- it's all you get. So if you are able to transform that datafeed, to build an oscillator that goes from between 0-100 (just for example - but it can be any range), then you can also take any other data, and bring it to such a range. If it goes from 1-1000, divide the values by 10. Or a square root, or square something, or whatever - I don't kow the formulas behind any existing oscillators and indicators, so I am not the person to ask this question. I just find it funny that we are told that something is NOT possible because they don't share a common scale. That makes no sense at all - why stop at "scale" and just say no? We just have to rebuild the same indicators and oscillators to share a common scale/range, that is all - and your condition has been met.

We are TRADERS, NOT programmers, who would like to use cTrader for one or another characteristic that we like. You aren't making it easy for us... it's much easier to just throw up our arms, say I give up, and go back to MT and continue doing what we want to be doing: TRADING.

@Timmi

Timmi

31 May 2014, 03:54

RE:

Spotware said:

We plan to support adding two indicators to one indicator panel in the future.

wow! THANK YOU!

Please do not limit it to two! If you must max it out, allow up to 4 or 5. Let me explain why:

for example, in MT, I have Accelerator oscillator in the background, Stochastic over it, plus CCI and another line oscillator - all in their own contrasting colors of course, so you can distinguish them out at a glance.

two is a great improvement... half a dozen is great flexibility. the thing is, if you have the chance, don't limit things - that way, you won't have people asking you to add more. let's do it right the first time.

@Timmi

halvardu

28 Jun 2015, 01:15

RE:

jeffmichaels said:

So i managed to build on your code and now have the 5 ADX in 1 window.

Trying to do the same myself now for 3 stochastics in 1 window, but to no avail. Im not a coder, im fine tweaking stuff but cant seem to get this done.

Any help would be appreciated. I like the lightness of ctrader but i need my MT4 system if i want to switch

using System; using cAlgo.API; using cAlgo.API.Internals; using cAlgo.API.Indicators; namespace cAlgo.Indicators { [Indicator(IsOverlay = false, TimeZone = TimeZones.UTC)] public class AdxR : Indicator { [Output("Slow", Color = Colors.Yellow)] public IndicatorDataSeries _stochasticslow { get; set; } [Output("Medium", Color = Colors.Red)] public IndicatorDataSeries _stochasticmedium { get; set; } [Output("Fast", Color = Colors.Blue)] public IndicatorDataSeries _stochasticfast { get; set; } private StochasticOscillator _stochasticslow; private StochasticOscillator _stochasticmedium; private StochasticOscillator _stochasticsfast; protected override void OnStart { _stochasticslow = Indicators.StochasticOscillator(100, 10, 10, SMA); _stochasticmedium = Indicators.StochasticOscillator(21, 10, 10, SMA); _stochasticsfast = Indicators.StochasticOscillator(8, 3, 3, SMA); } public override void Calculate(int index) { Slow[index] = _stochasticslow[index]; Medium[index] = _stochasticmedium[index]; Fast[index] = _stochasticfast[index]; } } }

Here is a working version, if someone wants it?

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

namespace cAlgo.Indicators

{

[Indicator(IsOverlay = false, TimeZone = TimeZones.UTC)]

public class Stochastic3 : Indicator

{

[Output("Slow", Color = Colors.Yellow)]

public IndicatorDataSeries Slow { get; set; }

[Output("Medium", Color = Colors.Red)]

public IndicatorDataSeries Medium { get; set; }

[Output("Fast", Color = Colors.Blue)]

public IndicatorDataSeries Fast { get; set; }

private StochasticOscillator _stochasticslow;

private StochasticOscillator _stochasticmedium;

private StochasticOscillator _stochasticsfast;

protected override void Initialize()

{

_stochasticslow = Indicators.StochasticOscillator(100, 10, 10, MovingAverageType.Simple);

_stochasticmedium = Indicators.StochasticOscillator(21, 10, 10, MovingAverageType.Simple);

_stochasticsfast = Indicators.StochasticOscillator(8, 3, 3, MovingAverageType.Simple);

}

public override void Calculate(int index)

{

Slow[index] = _stochasticslow.PercentK[index];

Medium[index] = _stochasticmedium.PercentK[index];

Fast[index] = _stochasticsfast.PercentK[index];

}

}

}

@halvardu

Timmi

29 Jun 2015, 22:39

RE: RE:

Timmi said:

Spotware said:

We plan to support adding two indicators to one indicator panel in the future.

wow! THANK YOU!

Please do not limit it to two! If you must max it out, allow up to 4 or 5. Let me explain why:

for example, in MT, I have Accelerator oscillator in the background, Stochastic over it, plus CCI and another line oscillator - all in their own contrasting colors of course, so you can distinguish them out at a glance.

two is a great improvement... half a dozen is great flexibility. the thing is, if you have the chance, don't limit things - that way, you won't have people asking you to add more. let's do it right the first time.

Correction:

the indicators that I like to have, depending on if I'm swing trading or scalping are:

Accelerator Oscillator and Stochastic, as well as another one such as CCI or Rainbow or RSI, all overlaid in the same window.

Ultimate Oscillator and Stochastic, plus CCI or RSI.

I am really not a C programmer... I wish I had the knowledge to just do this on my own instead of having to rely on cTrader team for this.

If anyone is interested in doing this, please post. Thank you.

@Timmi

Timmi

17 Nov 2015, 22:23

RE:

Let me EDIT my post:

Still no news on this huh?

You would rather have #ctraderusers all be working on creating their own variants, instead of just one of the spotware employees doing it for all?

What I mean here, is for each combination, like having a stochastic with an overlapping RSI (or rainbow), it will take a spotware person a few minutes, or it will take 1 million users, collectively, 15million minutes (that is 350,000 man-hours) to to it all for themselves. How do you justify that? You are annoying a whole lot of people with that. We don't want to program - we have already taken time out of trading, to reluctantly come here... now we learn that things don't get fixed - we'll have to do programming too now.

@Timmi

birlatrimayacontact

05 Aug 2023, 09:31

How it is possible

how can we do that exactly , can you please ellaborate it

@birlatrimayacontact

PanagiotisChar

07 Aug 2023, 11:40

( Updated at: 21 Dec 2023, 09:23 )

RE: How it is possible

birlatrimayacontact said:

how can we do that exactly , can you please ellaborate it

You can choose where the indicator will be displayed here

Need help? Join us on Telegram

@PanagiotisChar

Scott

10 May 2013, 16:09

RE:

I've tried to work this one out in the past with no luck, you can however have more than 2 indicators overlayed on a chart

@Scott