Description

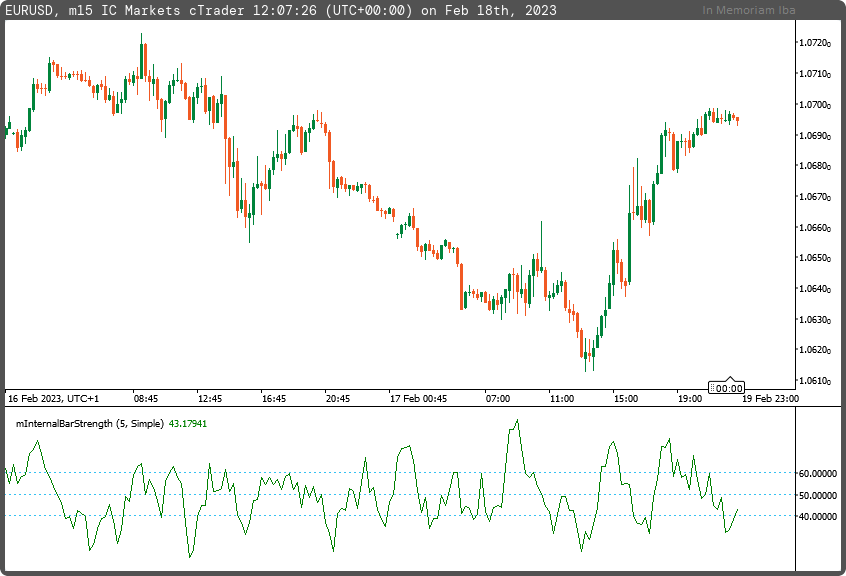

This indicator developed by Volker Knapp. It is calculated as the moving average of the values of the internal bars strength that represent the ratio (close-low)/(high-low) * 100% for each of them

The crossing of 60% level means the overbuying and the crossing of 40% level means overselling, and so they are the signals for selling and buying respectively.

using System;

using cAlgo.API;

using cAlgo.API.Collections;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

namespace cAlgo

{

[Levels(40,50,60)]

[Indicator(AccessRights = AccessRights.None)]

public class mInternalBarStrength : Indicator

{

[Parameter("Periods (5)", DefaultValue = 5)]

public int inpPeriods { get; set; }

[Parameter("SmoothType (sma)", DefaultValue = MovingAverageType.Simple)]

public MovingAverageType inpSmoothType { get; set; }

[Output("Internal Bar Strength", LineColor = "Black", PlotType = PlotType.Line, LineStyle = LineStyle.Solid, Thickness = 1)]

public IndicatorDataSeries outIBS { get; set; }

private IndicatorDataSeries _deltahl, _rawibs;

private MovingAverage _smoothibs;

protected override void Initialize()

{

_deltahl = CreateDataSeries();

_rawibs = CreateDataSeries();

_smoothibs = Indicators.MovingAverage(_rawibs, inpPeriods, inpSmoothType);

}

public override void Calculate(int i)

{

_deltahl[i] = Bars.HighPrices[i] - Bars.LowPrices[i];

_rawibs[i] = _deltahl[i] > 0 ? (Bars.ClosePrices[i] - Bars.LowPrices[i]) / _deltahl[i] : 0;

outIBS[i] = 100.0 * _smoothibs.Result[i];

}

}

}

mfejza

Joined on 25.01.2022

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: mInternalBarStrength.algo

- Rating: 5

- Installs: 482

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

No comments found.