Warning! This section will be deprecated on February 1st 2025. Please move all your Indicators to the cTrader Store catalogue.

Description

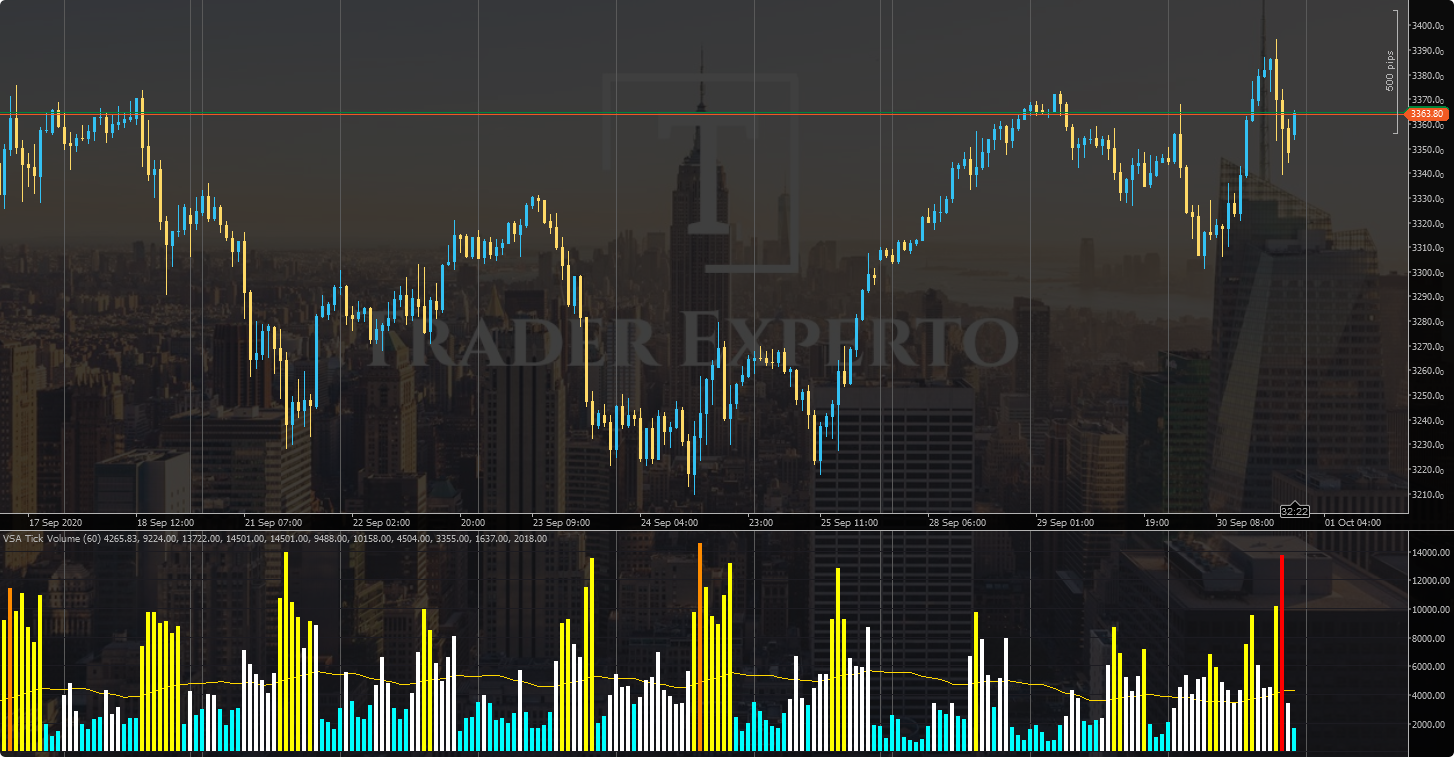

This is the Tick Volume based on Volume Spread Analisys and Volume Price Analisys

You can find me by joyining this Telegram Group http://t.me/cTraderCoders

Grupo de Telegram Para Brasileiros, Portugueses e todos aqueles que falam portugues:http://t.me/ComunidadeCtrader

Grupo CTrader en Español para Latinos: http://t.me/ComunidadCtrader

using System;

using cAlgo.API;

using cAlgo.API.Indicators;

namespace cAlgo.Indicators

{

[Indicator(IsOverlay = false, AccessRights = AccessRights.None)]

public class TickVolumeVSA : Indicator

{

[Parameter("MA Length", DefaultValue = 60)]

public int Period { get; set; }

[Output("Moving Average", LineColor = "Gold")]

public IndicatorDataSeries MovingAverageLine { get; set; }

[Output("Up Ultra Volume", LineColor = "Red", PlotType = PlotType.Histogram, Thickness = 4)]

public IndicatorDataSeries UpUltraVolume { get; set; }

[Output("Down Ultra Volume", LineColor = "Red", PlotType = PlotType.Histogram, Thickness = 4)]

public IndicatorDataSeries DownUltraVolume { get; set; }

[Output("Up High Volume", LineColor = "DarkOrange", PlotType = PlotType.Histogram, Thickness = 4)]

public IndicatorDataSeries UpHighVolume { get; set; }

[Output("Down High Volume", LineColor = "DarkOrange", PlotType = PlotType.Histogram, Thickness = 4)]

public IndicatorDataSeries DownHighVolume { get; set; }

[Output("Up Average Volume", LineColor = "Yellow", PlotType = PlotType.Histogram, Thickness = 4)]

public IndicatorDataSeries UpAverageVolume { get; set; }

[Output("Down Average Volume", LineColor = "Yellow", PlotType = PlotType.Histogram, Thickness = 4)]

public IndicatorDataSeries DownAverageVolume { get; set; }

[Output("Up Low Volume", LineColor = "White", PlotType = PlotType.Histogram, Thickness = 4)]

public IndicatorDataSeries UpLowVolume { get; set; }

[Output("Down Low Volume", LineColor = "White", PlotType = PlotType.Histogram, Thickness = 4)]

public IndicatorDataSeries DownLowVolume { get; set; }

[Output("Up Low Activity", LineColor = "Aqua", PlotType = PlotType.Histogram, Thickness = 4)]

public IndicatorDataSeries UpLowActivity { get; set; }

[Output("Down Low Activity", LineColor = "Aqua", PlotType = PlotType.Histogram, Thickness = 4)]

public IndicatorDataSeries DownLowActivity { get; set; }

public IndicatorDataSeries dataUltraVolume { get; set; }

public IndicatorDataSeries dataHighVolume { get; set; }

public IndicatorDataSeries dataAverageVolume { get; set; }

public IndicatorDataSeries dataLowVolume { get; set; }

private SimpleMovingAverage smaVol;

private StandardDeviation stdDev;

protected override void Initialize()

{

smaVol = Indicators.SimpleMovingAverage(Bars.TickVolumes, Period);

stdDev = Indicators.StandardDeviation(Bars.TickVolumes, Period, MovingAverageType.Simple);

}

public override void Calculate(int index)

{

MovingAverageLine[index] = smaVol.Result[index];

double open = Bars.OpenPrices[index];

double high = Bars.HighPrices[index];

double low = Bars.LowPrices[index];

double close = Bars.ClosePrices[index];

double volume = Bars.TickVolumes[index];

double stdbar = (volume - smaVol.Result[index]) / stdDev.Result[index];

if (Bars.ClosePrices[index] >= Bars.OpenPrices[index] && stdbar > 3.5)

{

UpUltraVolume[index] = Bars.TickVolumes[index];

}

else if (Bars.ClosePrices[index] >= Bars.OpenPrices[index] && stdbar > 2.5)

{

UpHighVolume[index] = Bars.TickVolumes[index];

}

else if (Bars.ClosePrices[index] >= Bars.OpenPrices[index] && stdbar > 1)

{

UpAverageVolume[index] = Bars.TickVolumes[index];

}

else if (Bars.ClosePrices[index] >= Bars.OpenPrices[index] && stdbar > -0.5)

{

UpLowVolume[index] = Bars.TickVolumes[index];

}

else if (Bars.ClosePrices[index] >= Bars.OpenPrices[index] && stdbar <= -0.5)

{

UpLowActivity[index] = Bars.TickVolumes[index];

}

if (Bars.ClosePrices[index] < Bars.OpenPrices[index] && stdbar > 3.5)

{

DownUltraVolume[index] = Bars.TickVolumes[index];

}

else if (Bars.ClosePrices[index] >= Bars.OpenPrices[index] && stdbar > 2.5)

{

DownHighVolume[index] = Bars.TickVolumes[index];

}

else if (Bars.ClosePrices[index] < Bars.OpenPrices[index] && stdbar > 1)

{

DownAverageVolume[index] = Bars.TickVolumes[index];

}

else if (Bars.ClosePrices[index] < Bars.OpenPrices[index] && stdbar > -0.5)

{

DownLowVolume[index] = Bars.TickVolumes[index];

}

else if (Bars.ClosePrices[index] < Bars.OpenPrices[index] && stdbar <= -0.5)

{

DownLowActivity[index] = Bars.TickVolumes[index];

}

}

}

}

TraderExperto

Joined on 07.06.2019

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: Tick Volume VSA.algo

- Rating: 5

- Installs: 4375

- Modified: 13/10/2021 09:54

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

No comments found.