Warning! This section will be deprecated on February 1st 2025. Please move all your Indicators to the cTrader Store catalogue.

Description

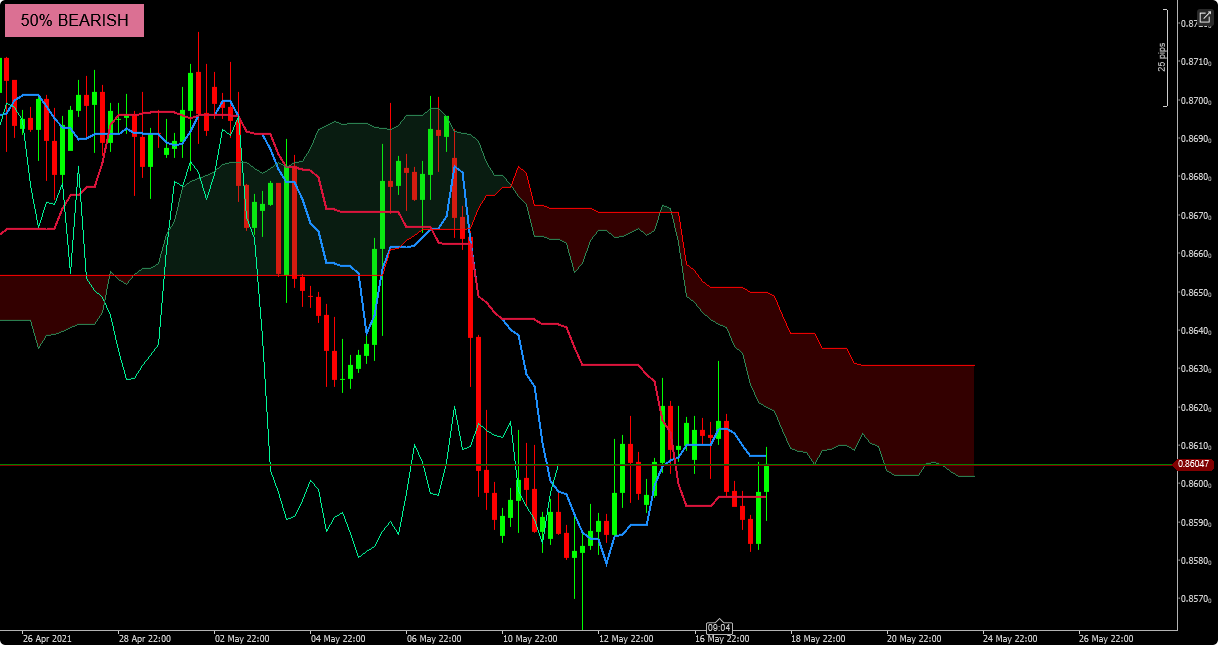

Based on Ichimoku Timeframe H4 & D1

- Indicator: Ichimoku Timeframe Analysis: D1 & H4 T

- Platform: ctrader

- Broker: ICMarkets https://www.icmarkets.com/?camp=41744

- Strategy Details...

- 1. Baseline and conversion line cross on D1

- 2. Baseline and conversion line cross on H4

- 3. Price cross conversion line on H4

- 4. Price Kumo Breakout H4

- 5. Kumo Status: Rising of Falling H4

You can enter trades using stop orders when indicators displays a 80% .

Note: This indicator does not give entry signals, It only displays trend bias.

- For more details: Telergram: @orglobalng

- Take trades at your risk.

// OrglobalFx_Ichimoku_DoubleTimeFrame_Indicator_v1_0

// Based on Ichimoku Timeframe H4 & D1

//

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

using System.Collections.Generic;

using System.Net;

namespace cAlgo.Indicators

{

[Indicator(IsOverlay = true, TimeZone = TimeZones.WCentralAfricaStandardTime, AccessRights = AccessRights.None)]

public class OrglobalFx_Ichimoku_DoubleTimeFrame_Indicator_v1_0 : Indicator

{

public TimeFrame Time_frame1 = TimeFrame.Daily;

public TimeFrame Time_frame2 = TimeFrame.Hour4;

private Bars series1, series2;

private IchimokuKinkoHyo cloud1, cloud2;

public bool res1bull, res2bull, res3bull, res4bull, res5bull, res6bull, res7bull, res8bull;

public bool res1bear, res2bear, res3bear, res4bear, res5bear, res6bear, res7bear, res8bear;

protected override void Initialize()

{

series1 = MarketData.GetBars(Time_frame1);

series2 = MarketData.GetBars(Time_frame2);

cloud1 = Indicators.IchimokuKinkoHyo(series1, 9, 26, 52);

cloud2 = Indicators.IchimokuKinkoHyo(series2, 9, 26, 52);

}

public override void Calculate(int index)

{

//Price and tensen on timeframe1

res1bear = series1.ClosePrices.Last(1) < cloud1.TenkanSen.Last(0);

res1bull = series1.ClosePrices.Last(1) > cloud1.TenkanSen.Last(0);

//tensen and kijun on timeframe1

res2bear = cloud1.TenkanSen.Last(0) < cloud1.KijunSen.Last(0);

res2bull = cloud1.TenkanSen.Last(0) > cloud1.KijunSen.Last(0);

//tenksen crossess kijun on timeframe2

res3bear = cloud2.TenkanSen.Last(0) < cloud2.KijunSen.Last(0);

res3bull = cloud2.TenkanSen.Last(0) > cloud2.KijunSen.Last(0);

//Price and kumo on timeframe2

var sekuA = cloud2.SenkouSpanA;

var sekuB = cloud2.SenkouSpanB;

var cloudupper = Math.Max(sekuA.Last(26), sekuB.Last(26));

var cloudlower = Math.Min(sekuA.Last(26), sekuB.Last(26));

res4bear = series2.ClosePrices.Last(1) < cloudlower;

res4bull = series2.ClosePrices.Last(1) > cloudupper;

//Price and Tensen

res5bear = series2.ClosePrices.Last(0) < cloud2.TenkanSen.Last(0);

res5bull = series2.ClosePrices.Last(0) > cloud2.TenkanSen.Last(0);

//chiku and price

res6bear = cloud2.ChikouSpan.Last(0) < series2.LowPrices.Last(26);

res6bull = cloud2.ChikouSpan.Last(0) > series2.HighPrices.Last(26);

//Kumo

res7bear = (cloud2.SenkouSpanA.Last(0) < cloud2.SenkouSpanA.Last(1)) && (cloud2.SenkouSpanB.Last(0) < cloud2.SenkouSpanB.Last(1));

res7bull = (cloud2.SenkouSpanA.Last(0) > cloud2.SenkouSpanA.Last(1)) && (cloud2.SenkouSpanB.Last(0) > cloud2.SenkouSpanB.Last(1));

if (res1bull == true && res2bull == true && res3bull == true && res4bull == true && res5bull == true && res6bull == true && res7bull == true)

{

var text = new TextBlock

{

FontSize = 18,

BackgroundColor = Color.LimeGreen,

ForegroundColor = Color.Black,

Text = "100% BULLISH",

Padding = "12 8",

VerticalAlignment = VerticalAlignment.Top,

HorizontalAlignment = HorizontalAlignment.Left,

Margin = 5

};

Chart.AddControl(text);

}

else if (res1bear == true && res2bear == true && res3bear == true && res4bear == true && res5bear == true && res6bear == true && res7bear == true)

{

var text = new TextBlock

{

FontSize = 18,

BackgroundColor = Color.Red,

ForegroundColor = Color.Black,

Text = "100% BEARISH",

Padding = "12 8",

VerticalAlignment = VerticalAlignment.Top,

HorizontalAlignment = HorizontalAlignment.Left,

Margin = 5

};

Chart.AddControl(text);

}

else if (res1bull == true && res2bull == true && res3bull == true && res4bull == true && res5bull == true && res6bull == true && res7bull == false)

{

var text = new TextBlock

{

FontSize = 18,

BackgroundColor = Color.Green,

ForegroundColor = Color.Black,

Text = " 80% BULLISH ",

Padding = "12 8",

VerticalAlignment = VerticalAlignment.Top,

HorizontalAlignment = HorizontalAlignment.Left,

Margin = 5

};

Chart.AddControl(text);

}

else if (res1bear == true && res2bear == true && res3bear == true && res4bear == true && res5bear == true && res6bear == true && res7bear == false)

{

var text = new TextBlock

{

FontSize = 18,

BackgroundColor = Color.DarkRed,

ForegroundColor = Color.Black,

Text = " 80% BEARISH ",

Padding = "12 8",

VerticalAlignment = VerticalAlignment.Top,

HorizontalAlignment = HorizontalAlignment.Left,

Margin = 5

};

Chart.AddControl(text);

}

else if ((res1bull == true && res2bull == true) && (res3bull == false || res4bull == false || res5bull == false || res6bull == false || res7bull == false))

{

var text = new TextBlock

{

FontSize = 18,

BackgroundColor = Color.LightGreen,

ForegroundColor = Color.Black,

Text = " 50% BULLISH ",

Padding = "12 8",

VerticalAlignment = VerticalAlignment.Top,

HorizontalAlignment = HorizontalAlignment.Left,

Margin = 5

};

Chart.AddControl(text);

}

else if ((res1bear == true && res2bear == true) && (res3bear == false || res4bear == false || res5bear == false || res6bear == false || res7bear == false))

{

var text = new TextBlock

{

FontSize = 18,

BackgroundColor = Color.PaleVioletRed,

ForegroundColor = Color.Black,

Text = " 50% BEARISH ",

Padding = "12 8",

VerticalAlignment = VerticalAlignment.Top,

HorizontalAlignment = HorizontalAlignment.Left,

Margin = 5

};

Chart.AddControl(text);

}

else

{

var text = new TextBlock

{

FontSize = 18,

BackgroundColor = Color.Yellow,

ForegroundColor = Color.Black,

Text = " NEUTRAL ",

Padding = "12 8",

VerticalAlignment = VerticalAlignment.Top,

HorizontalAlignment = HorizontalAlignment.Left,

Margin = 5

};

Chart.AddControl(text);

}

}

}

}

Orglobalfx01

Joined on 03.03.2021

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: OrglobalFx_Ichimoku_DoubleTimeFrame_Indicator_v1_0.algo

- Rating: 0

- Installs: 1619

- Modified: 13/10/2021 09:54

Note that publishing copyrighted material is strictly prohibited. If you believe there is copyrighted material in this section, please use the Copyright Infringement Notification form to submit a claim.

Comments

Log in to add a comment.

No comments found.