Topics

Replies

trend_meanreversion

31 Jan 2018, 15:33

RE:

Spotware said:

Hi trend_meanreversion,

Thanks for letting us know. Our team is already looking at this. Could you also please tell us your browser/platform and/or mobile device you use?

Best Regards,

Hi, i have faced this issue only my local PC ( windows 10 ) with cTrader desktop application .( Chrome) cTrader web or mobile is working fine for me.

@trend_meanreversion

trend_meanreversion

31 Jan 2018, 12:47

( Updated at: 21 Dec 2023, 09:20 )

RE:

nguyenbaocuong said:

Dear cTrader,

Today, I see the difference of price data between ctrader software and ctrader web/mobile in many currencies

In ctrader software doesn't have the gap, but in web/mobile has.

Which is right?

I found the same issue in last 2-3 days in cTrader. Basically cTrader is not able to load properly the chart data so if you change it to some other timeFrame and come back to your original TimeFrame, charts will be all good.

@trend_meanreversion

trend_meanreversion

23 Jan 2018, 14:41

( Updated at: 19 Mar 2025, 08:57 )

RE:

Panagiotis Charalampous said:

Hi trend_meanreversion,

There are no general issues with cTrader at the moment. Can you please send some more information (your cTID, your trading account) to support@ctrader.com so that our support team can troubleshoot? Also please send us some troubleshooting information. You can do so by pressing Ctrl + Alt + Shift + T and press Submit on the form that appears. It the textbox, please put the link to this discussion.

Best Regards,

Panagiotis

Hi mate, it has magically fixed itself :) . Now everything seems fine.

@trend_meanreversion

trend_meanreversion

02 Nov 2017, 08:28

( Updated at: 21 Dec 2023, 09:20 )

RE:

trend_meanreversion said:

Hi cAlgo/cTrader team,

I recently observed that your bollinger bands indicator can move out of sync of what i would have understood otherwise.

I mean i expected BB to move in parallel by basic defintions ..something like below

- Middle Band = 20-day simple moving average (SMA)

- Upper Band = 20-day SMA + (20-day standard deviation of price x 2)

- Lower Band = 20-day SMA – (20-day standard deviation of price x 2)

But your implementation can give Upper Band moving lower while Lower Band moving higher or flat at times. Can you please explain why it should happen. I am not questioning but trying to understand how are you calculating upper and lower bands

Sorry ignore it..what a stupid question !! ...need some sleep :)

@trend_meanreversion

trend_meanreversion

11 Sep 2017, 10:28

RE:

Spotware said:

Dear trend_meanreversion,

Thanks for posting this question. There is no inherent limitation in cTrader that disallows placing/changing pending orders when markets are closed. However, during weekends maintenance is taking place and some times services might become unavailable. You could also discuss this with your broker as it could be a broker setting. Could you please provide some more information on the issue your experienced e.g. a screenshot, so we can investigate further?

Best Regards,

cTrader Team

Thanks for the reply . My broker was ICMarkets and error was indeed ' Maintenance related' as i can see that while trying to change my TP/SLs . I haven't got the snapshot this time but will let you know next time this happens.

@trend_meanreversion

trend_meanreversion

10 Sep 2017, 16:15

RE:

trend_meanreversion said:

Hi Team,

Can you explain why can't one amend (cancel/change TP/SL etc ) for Pending Orders on their live accounts over weekend (when market is closed) ?

Please advise on urgent basis and rectify your backend to allow to amend the Pending Orders irrespective of market or closed ( because it doesn't make sense to restrict it). One should be able to place new any limit/stop orders and amend their existing Pending orders over-weekend !!

-TRMR

CTDN team, can you please provide an answer to my above query ?

@trend_meanreversion

trend_meanreversion

31 Aug 2017, 05:08

( Updated at: 21 Dec 2023, 09:20 )

August also went fine despite some volatility in DAX : ~0.7% in August.

My VPS is getting heavy due to demo accounts in midst of my live trading accounts , so i have decided it is time to retire DAX HFT from demo ( it has been live along with several other algos for a long time now and will remain so ..).

DAX HFT has proven its resilience in last 1 year with 33.5% return with 0% monthly drawdown https://www.myfxbook.com/members/TRMR/dax-hft/2059675

Note: I will run my DAX Portfolio for next couple of months (which has DAX HFT as part of portfolio) and recently included CurrencyStrength bot https://www.myfxbook.com/members/TRMR/dax-portfolio/1953723

@trend_meanreversion

trend_meanreversion

19 Aug 2017, 04:40

Looking forward to it. Any ETA on 'next major' release :)

@trend_meanreversion

trend_meanreversion

10 Aug 2017, 02:03

( Updated at: 09 Oct 2017, 09:46 )

Do you have any plans to provide this orderType in cAlgo ? It will be really useful for us ( traders) and i see no reason why it shouldn't be available in cAlgo ( and only through UIs)

@trend_meanreversion

trend_meanreversion

01 Aug 2017, 09:55

( Updated at: 21 Dec 2023, 09:20 )

July went smooth as well with good returns for bot : ~1.7% in July .

Solid returns of 32.6% in 11 months !! (https://www.myfxbook.com/members/TRMR/dax-hft/2059675)

Side note: Returns have been quite impressive after addition of my currency Strength bot in my DAX Portfolio ( 12.2% in July after 23.5% in June ..!! ) -> https://www.myfxbook.com/members/TRMR/dax-portfolio/1953723

@trend_meanreversion

trend_meanreversion

02 Jul 2017, 13:02

( Updated at: 21 Dec 2023, 09:20 )

June was a tough month but brought volatility and good returns for bot : ~5% in June .

Solid returns of 30.3% in 10 months !! ( https://www.myfxbook.com/members/TRMR/dax-hft/2059675 )

Side note: Returns have been quite impressive after addition of my currency Strength bot in my DAX Portfolio ( 23% in June alone ..!! ) -> https://www.myfxbook.com/members/TRMR/dax-portfolio/1953723

@trend_meanreversion

trend_meanreversion

20 Jun 2017, 17:01

( Updated at: 21 Dec 2023, 09:20 )

RE: RE: RE:

payment said:

No I'm not arguing, I think your bot is great. By the way I've fixed mine now to have a more reasonable equity DD see attached - 100% in on e month if you've got the guts

trend_meanreversion said:

payment said:

Well let's see your most recent backtest of the DAX between May and June this year,

Yes look at how equity dropped to '0' in your bot mate, not mine :)

Also don't wish to encourage an argument here, but you can see demo run ( not just back-test for May & June ) -> https://www.myfxbook.com/members/TRMR/dax-hft/2059675

As i said before, Good Luck to your trading and thanks for your advice !

Just my 2 cents mate --> Your equity profile reflects too much leverage, try to limit that and DD should come under control. In its current form your bot doesn't seem feasible to a viable trading strategy but keep exploring & All the Best :)

@trend_meanreversion

trend_meanreversion

20 Jun 2017, 16:35

RE:

payment said:

Well let's see your most recent backtest of the DAX between May and June this year,

Yes look at how equity dropped to '0' in your bot mate, not mine :)

Also don't wish to encourage an argument here, but you can see demo run ( not just back-test for May & June ) -> https://www.myfxbook.com/members/TRMR/dax-hft/2059675

As i said before, Good Luck to your trading and thanks for your advice !

@trend_meanreversion

trend_meanreversion

20 Jun 2017, 16:28

( Updated at: 21 Dec 2023, 09:20 )

RE:

payment said:

I've already got the formula, but if the DAX starts trending like now, watch out ! It crashes

ha ha ..Good luck mate with your formula !! ..Clearly yours' is no where near the logic which i have but all the best to you also !!

Thanks for your attempt though .

@trend_meanreversion

trend_meanreversion

20 Jun 2017, 16:25

( Updated at: 21 Dec 2023, 09:20 )

RE: RE: RE:

payment said:

Raphael,

This is just a hedging strategy which works as long as the pair is ranging. To be safe, I'd only use it on EURCHF because this one tends to come back to the original price eventually. I calculated it to bring in about 120% per year, but watch out, if things start to trend, it will empty an account.

Which pair is this for ? No doubt EURUSD will draw down equity too much espacially in May

raphael.mca@hotmail.com said:

trend_meanreversion said:

Finally something which is looking good to earn quick bucks !!.. ( Thanks to everyone who suggested that martingale isn't always a bad option )

New version of DAX_HFT released !!

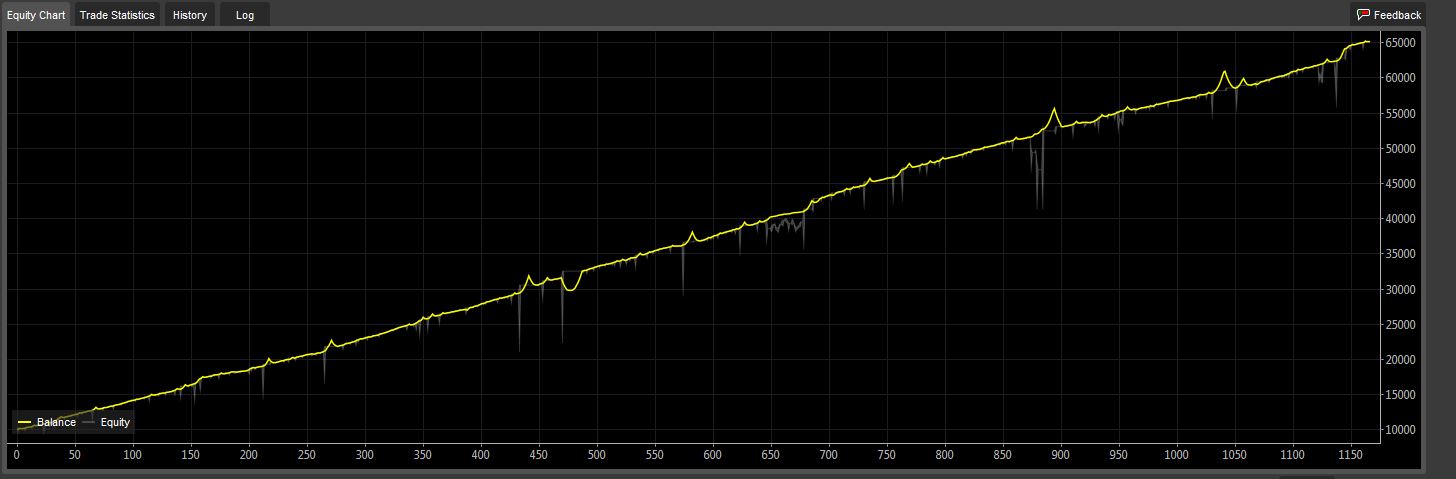

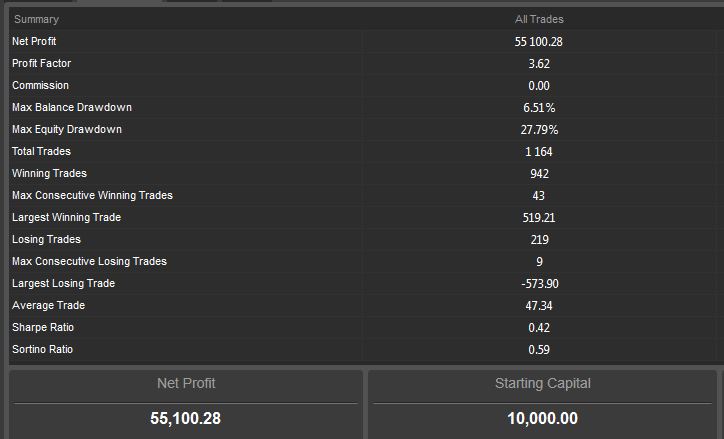

From 21 Sep 2014 - 16 Aug 2016

Total Return : 550%

Max DD : 6.5% ( balance)

Max DD : 27.8% ( equity )

Return/DD(balance): 84:1 (approx)

Return/DD(Equity): 20:1 (approx) [ So you can leverage according to your needs ]

My friend, I appreciate the work you do with your cBot's. Is this the same image from this link? /algos/cbots/show/1622

Not sure mate if you are talking to me or Raphael. It is my thread so i can tell you that this particular bot DAX_HFT is meant to be run only on DAX CFDs ( not on FX pairs ) and contrary to your observation/assumption is based on trend ( not mean-reversion) !

Cheers.

@trend_meanreversion

trend_meanreversion

13 Jun 2017, 18:27

( Updated at: 21 Dec 2023, 09:20 )

May was not so great but given low vol environment it is still good ie.. 0.71% in May. June is going good though so far !

Solid returns of ~25.4% in 10 months !!

@trend_meanreversion

trend_meanreversion

03 May 2017, 15:15

( Updated at: 21 Dec 2023, 09:20 )

April had a good month also . 2.6% in April .

Solid returns of 23.4% in 8 months !!

https://www.myfxbook.com/members/TRMR/dax-hft/2059675

@trend_meanreversion

trend_meanreversion

25 Apr 2017, 00:27

RE: RE: RE: RE: RE:

derekszyszka said:

raphael.mca@hotmail.com said:

trend_meanreversion said:

raphael.mca@hotmail.com said:

trend_meanreversion said:

It does a couple of things like very good few stable martingales strategies 1) Find good entry 2) Have a determinsintic approach to grid 3) Have a proper approach for Take Profit. Of course you can use wrong settings and it is easy to blow account with a Martingale bot. Also such bots expect market reversals so not sure what were you asking. In any case, good luck !!I'm following up with your work and recently I'm using your cBot in my demo account. I did countless backtest's and everyone gave me satisfactory results, congratulations for your work. I'll keep using the demo account to evaluate his behavior live. I have an excellent strategy and trend, but I do not have the necessary knowledge to create a cBot, if you are willing and with time, I can explain the step-by-step in detail so that you create the cBot and we can even merge the condition of Martingale next to my strategy, what do you think?

Sure mate, drop me an email @ "trend_meanreversion@yahoo.com" and we can carry this conversation in detail there. I don't promise anything but dependant on your strategy, i can be able evaluate if it is under my expertise of implementation and value of my time/effort.

I emailed you with some information about my proposal.

I did not get any email. I emailed you directly to trend_meanreversion@yahoo.com

Hi derekszyszka:: That statement of proposal was directed to me from raphael.mca@hotmail.com . Hope it clears the doubt.

@trend_meanreversion

trend_meanreversion

24 Apr 2017, 05:04

RE:

derekszyszka said:

Weird, is your bot somehow disabled now? I am unable to run any back testing in cAlgo, or test this with an addon I build on a demo account.

Check post #42 mate ---->

trend_meanreversion said:

I have created a new version of V2 ( which is updated in first post ) which contains 2 new parameters as requested by some users. Please have a look and play around. I have extended expiry till 22nd April !!

See first post for new algo file and explanation of parameters.

@trend_meanreversion

trend_meanreversion

06 Feb 2018, 14:04

RE:

Panagiotis Charalampous said:

Sure mate, i have already dropped broker an email with the details and waiting for their response.

But i would like to understand how TPs are implemented in cTrader ( as it seems to me it is implementation thing rather than broker related execution ..unless their is dealer plugin which can move my fills etc ). Please advise more from trading implementation perspective about how Take Profits are implemented in cTrader.

@trend_meanreversion