Topics

Replies

lorddevil

25 Feb 2016, 11:05

Well since you can't download tick data yourself - it will be hard time to use real values for backtesting... that's why it would be totally great if you could filter night cycles from the live chart... atm you need to use other software - which is cumbersome - in order to achieve this...

@lorddevil

lorddevil

25 Feb 2016, 11:03

Well I don't mean CFD's based on Futures... I mean true Futures... - I looked at every broker which has cTrader support, none of them has true futures... they all have CFD's so I thought cTrader is not able to use futures.

Hmm... so if you say it would support real futures... then maybe none of the real future brokers has cTrader in their offerings?

@lorddevil

lorddevil

22 Feb 2016, 14:31

RE: RE:

trend_meanreversion said:

lorddevil said:

Is there any way to filter the night sessions for specific CFDs indices etc.(like other platforms)? Or maybe would there be a way to create a cAlgo Indicator which could do this (but I am not sure how this would be possible)? It's really hard to do gap strategies with cTrader due to this limitation...

Hi lorddevil, i do use such strategies and thus i also need a similar filter. I use a spread filter to differentiate main session from overnight session.

if (Symbol.Spread >= sprdThreshold

{

}

Well you could also do the same for checking the times but I wonder how you would filter out the chart with this? I don't know of any API possibility where I could hide this time frames in the chart view. Because I would need that the chart is viewed like there was no night session (showing a gap) - like I am used from other platforms - so that also the indicators only work on the "day sessions".

@lorddevil

lorddevil

04 Feb 2016, 18:11

RE:

Spotware said:

Dear Trader,

We would like to inform you that we do not discuss about design choices in cTDN. We more than glad to receive your feedback/suggestions and to assist you with specific questions about cTrader and cAlgo.API.

Sure I totally understand that, but since cTrader wants to be a more modern platform, I would imagine that something this trivial is possible here? Don't get me wrong, I really love the cTrader platform.. it is advanced in a lot of ways.... But at the moment when entering orders we are having a hard time and always need to calculate SL, TP, etc. from prices back to pips... even though all related infos would be there already (as seen in those readonly fields)?

In the suggestions and vote area there are already several split up issues related to the entry of orders (and even question for risk calculator etc.). But I think this is all not necessary - if those field wouldn't be read only it would fix all those issues and make the order entry fast and intuitive?

@lorddevil

lorddevil

02 Feb 2016, 16:13

RE:

I am having the exact same issue... not able to backtest indices...- the charts is empty when selecting tick data - why is that?

@lorddevil

lorddevil

22 Jan 2016, 00:20

RE:

Strange but I can see the 19/01/2016 daily candle just fine with demo and live account!

@lorddevil

lorddevil

20 Jan 2016, 19:55

RE:

scandisk said:

Please watch the video and tell me whats different?? https://www.youtube.com/watch?v=KcC3maFOz2w

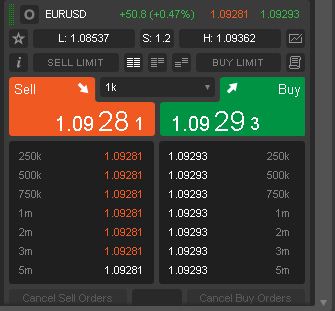

And that is what it makes it really even more confusing... on USD/CHF I have exactly the same behavior as on the video...that looks pretty ok...!

But when looking at the EUR/USD etc, it doesn't matter at which time the values are almost always the same -> 1,4,5,9,20+m (throughout the whole day and now for over a week no changes) - so this can't be true... but as it looks like they aren't interested in this issue... so for now this feature is really useless... :(

@lorddevil

lorddevil

15 Jan 2016, 13:13

( Updated at: 21 Dec 2023, 09:20 )

RE: RE:

trend_meanreversion said:

lorddevil said:

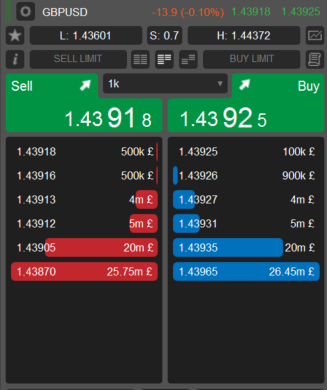

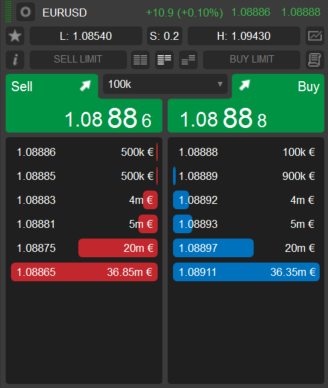

Look that's a snapshot from now... I mean we have a discrepancy of only 300k Pounds and 500k Euro... and if you follow the view... its always almost the same (surely it changes a bit)- but for me this doesn't look any useful... so where is the catch?

Or am I seeing something wrong here, but shouldn't we see much bigger differences between sell and buy positions in volumes?

Lorddevil, i have access to real price feeds from banks and i can see that even in those there is pretty much balanced buy and sell volume ( approx) at any point in time so cTrader Standard DOM looks fine to me. [ i don't know how to use that information successfully for my trading though yet ] . There is normally a minimum commitment from a LP to provide quotes for 'X' volume so it am not surprised to see pretty balanced order book. I suppose only Spotware team can clarify the technical side of it.

I see but then I stll wonder what this market depth is all about - looks like some random numbers than. Just look at my example both show almost exactly the same volume seperation. When I am looking right now again at the charts - its almost the same as yesterday... even the 1m, 4m, 20m, 40m is again here all the time for both currencies... - I mean if we are trading real makets here those numbers should be different most of the time - not always the same. For me this looks very suspious to either have a bug and wrong data or those values are just generated by LPs at will.....

@lorddevil

lorddevil

14 Jan 2016, 15:01

( Updated at: 21 Dec 2023, 09:20 )

Look that's a snapshot from now... I mean we have a discrepancy of only 300k Pounds and 500k Euro... and if you follow the view... its always almost the same (surely it changes a bit)- but for me this doesn't look any useful... so where is the catch?

Or am I seeing something wrong here, but shouldn't we see much bigger differences between sell and buy positions in volumes?

@lorddevil

lorddevil

14 Jan 2016, 14:38

( Updated at: 21 Dec 2023, 09:20 )

RE:

trend_meanreversion said:

My humble 2 cents lorddevil on this issue..i think you are looking at vWAP DOM view which shows same volume on both sides because that's what it should reflect ie..vWAP price for a given volume on each side.

vWAP mode

Standard Mode -> This shows the real ECN volume as per brokers LPs. Unfortunately it is aggregated at volume level so you can't distinguish it it is coming from LP1 or LP2 or combination of both.

This has been my understanding so far but i might be wrong.

Hey there... well actually I am talking about this Standard DoM view. As you can see in your screenshot the volume is about the same on both sides - and that is what is actually very strange. We all know markets move because we have different Volumens on Sell and Buy - but if you follow the DoM view over time in cTrader its pretty much almost the same on each side at any time period with all brokers - and this is something which can't be true - if it would be true than it would mean the LPs are market makers because they always take opposite positions so the volume is always almost exactly the same!

Don't know if you have ever experienced a real Depth of Market Level II view - but there you would have seen that Volumens always differ across the board.

@lorddevil

lorddevil

13 Jan 2016, 23:41

RE:

Spotware said:

Dear Traders,

Spotware is the technology provider who provides services to brokers. It is up to the Brokers which LPs they will use to stream prices and up to the LPs on how much volume is available for the prices they stream. Due to contractual agreement, we are not at liberty to disclose any information of this type. In general, any questions regarding execution, prices, account should be addressed to your Brokers.

Thanks for your answer, well but since we can see this behavior with any cTrader Broker out there - I think there is definite something wrong and worth investigating? I have already contacted my broker and they moved it up to the management team, because they found it strange too - so hopefully I can get an reply from there. But still some people say that it had worked a few versions ago (which I can't comment as I haven't use it back then) and if you are advertising a feature of your software - which actually would be a great one - it would be sad to see that this issue is ignored - I mean we all know that it can't be ture that the volumes on both sides are almost equal everytime...

So hopefully we can figure out what is wrong here, otherwise it would be better to just remove this feature - as now it is just very confusing and making all ecn broker using ctrader look like market makers.

@lorddevil

lorddevil

12 Jan 2016, 23:36

RE:

lorddevil said:

Eeeek I guess I just found the problem... if I am using the OnBar() - which is called every beginning of the candle, then the Close and Weighted Close is the same because it is not finished yet?

If so then sorry for the wrong report!!

Yeah sorry I now have a better understanding on how OnBar() works - so surely there can't be a weighted close on the start of a new candle ;) Sorry for taking your time!

@lorddevil

lorddevil

12 Jan 2016, 20:20

RE:

scandisk said:

It was working before all the updates because I used trade with it and know not working at all!! I am waiting to hear back from my broker??? Did you contact your broker?

Nope I haven't talked to our broker yet about this because from what I can see it is happening with almost ALL cTrader brokers (so you maybe right in assuming it is a bug). I have demo accounts at several ctrader brokers - and all are showing the same strange behaviour of almost same sell and buy quantities (all that differs from broker to broker is the amount). So they say they are no market maker brokers but if we can trust the DoM view of cTrader than it would tell us that all ECN's still market makers, thus having the same buy and sell position depth, due to the fact of taking the opposite part...

But since all those brokers advertise being ECN it looks really strange to me (and you say it worked before?)... so Spotware... what do you think about this issue? I mean ATM it is totally useless, but you are advertising this feature as Level II Market depth - so what is happening here?

Thanks in advance for your help,

Oliver

@lorddevil

lorddevil

12 Jan 2016, 18:13

Eeeek I guess I just found the problem... if I am using the OnBar() - which is called every beginning of the candle, then the Close and Weighted Close is the same because it is not finished yet?

If so then sorry for the wrong report!!

@lorddevil

lorddevil

12 Jan 2016, 18:09

Hmm all I do is taking the last MarketSeries Close and Weighted Close Value. E.g. on a EUR/USD M1 or M5 chart?

protected override void OnBar()

{

Print("WC: {0}", MarketSeries.WeightedClose[MarketSeries.Close.Count - 1]);

Print("C: {0}", MarketSeries.Close[MarketSeries.Close.Count - 1]);

}

Am I doing something wrong here - as both values are always the same.

@lorddevil

lorddevil

12 Jan 2016, 17:39

RE:

Spotware said:

Dear Trader,

There is no such method to change the user input by opening a window to change parameters. However, you can take advantage of the C# language used in cAlgo and you can write some methods of your own to achieve it. A simple search using any search engine will show you several examples of how to create a new Window.

Surely I could make my own window at the start of the script (I am a .NET/C# developer myself). However what I mean is, it would be great to create a button on the chart directly so I can react on user input quickly. What I need is something like DrawObjects.Button(Text, Widht, Height, Location...) - which can be placed and can be reacted via events? Is that possible somehow?

@lorddevil

lorddevil

11 Jan 2016, 20:41

Ok that's what I thought but then it must be a bug -> try using the MarketSeries.WeightedClose -> it is exactly the same as MarketSeries.Close!

@lorddevil

lorddevil

11 Jan 2016, 15:01

I guess we all know this video, but actually it just tells us how it should work :). Right now as you can see by my initial post this feature is totally useless - the DoM view doesn't seem to work with any broker or there is some bug and/or wrong data.... That's why I hope to get a reply and explanation from Spotware or from a broker... !

I mean it is a advertised feature which right now has absolutely no use at all - really curious because since it effects all ctrader brokers - why there are not more people complaining?

@lorddevil

lorddevil

07 Jan 2016, 12:28

So noone able to explain this strange behavior? Didn't anyone of you wonder too, why the DoM view is almost the same on both sides - just some minor fluctuation in aggregated price listings... nothing of any value though...

I just wonder because this feature gets advertised as Level II Market Depth, however this can't be true or there is something seriously wrong - maybe Spotware can explain?

@lorddevil

lorddevil

26 Feb 2016, 12:55

RE: RE:

tmc. said:

Nah its not really complicated, I want to do them as human on live chart :) Thus I need to filter out the old data and need the indicators to behave like that there would not be a night session :)

@lorddevil