Topics

Replies

jim.tollan

13 Jul 2023, 19:00

( Updated at: 13 Jul 2023, 19:01 )

Hi BBB - it would appear that v1.0.8 is now available (I just updated via my solution). This event is a timely addition and will definitely make some of my logic a lot less convoluted.

thanks cTrader team!!

@jim.tollan

jim.tollan

30 Jun 2023, 11:32

RE: RE: RE:

firemyst said:

AlexFrei said:

Hi Firemyst, thank you so much !! I didnt know about History collection. Great. Thanks ! Have a great day

No worries. That's what the forums are for :-)

also thank you so much for this nugget. i've been wrestling with as issue regarding completed orders and this looks to address the problem i was facing... ;)

@jim.tollan

jim.tollan

21 Jun 2023, 10:43

( Updated at: 21 Jun 2023, 11:12 )

RE:

emanuelgornic said:

add please oco order, i place a buy limit and a sell limit over night, if buy limit is activated, then delete the sell limit

coincidently, i just started working on some automation that does exactly this. i place a buy liimt order above the closing price and a sell limit order below the closing price (or based on trading edge of the current move). whichever order is taken, the opposing one gets cancelled. In my scenario, i'm not only focussed on market opening. I'm also focussed on news events and supply and demand zones being broken.

I have to say tho, I do need a little more data on positioning the prices and TP's etc as i'm trying to milk the super fast moves and be out on TP within the 5 minute bar. my backtesting is still in progress and nothing definitive yet. would love to hear your take on this...

In theory, I could adapt this to simply be a kind of manual helper which runs in the background and identifies an OCO set of orders and cancels the unmatched order when the other is matched. that of course would have to work using some premise regards the setup of the two orders (so that other normal orders were left unaffected - using a comment in both orders with the exact same content would work for example as this could be searched in the pending orders collection and cancelled when the promary OCO candidate is matched).

Happy to share a basic algo file (or even the code if preferred) with whatever specifications you feel would work for you.

@jim.tollan

jim.tollan

23 May 2023, 16:52

( Updated at: 21 Dec 2023, 09:23 )

RE:

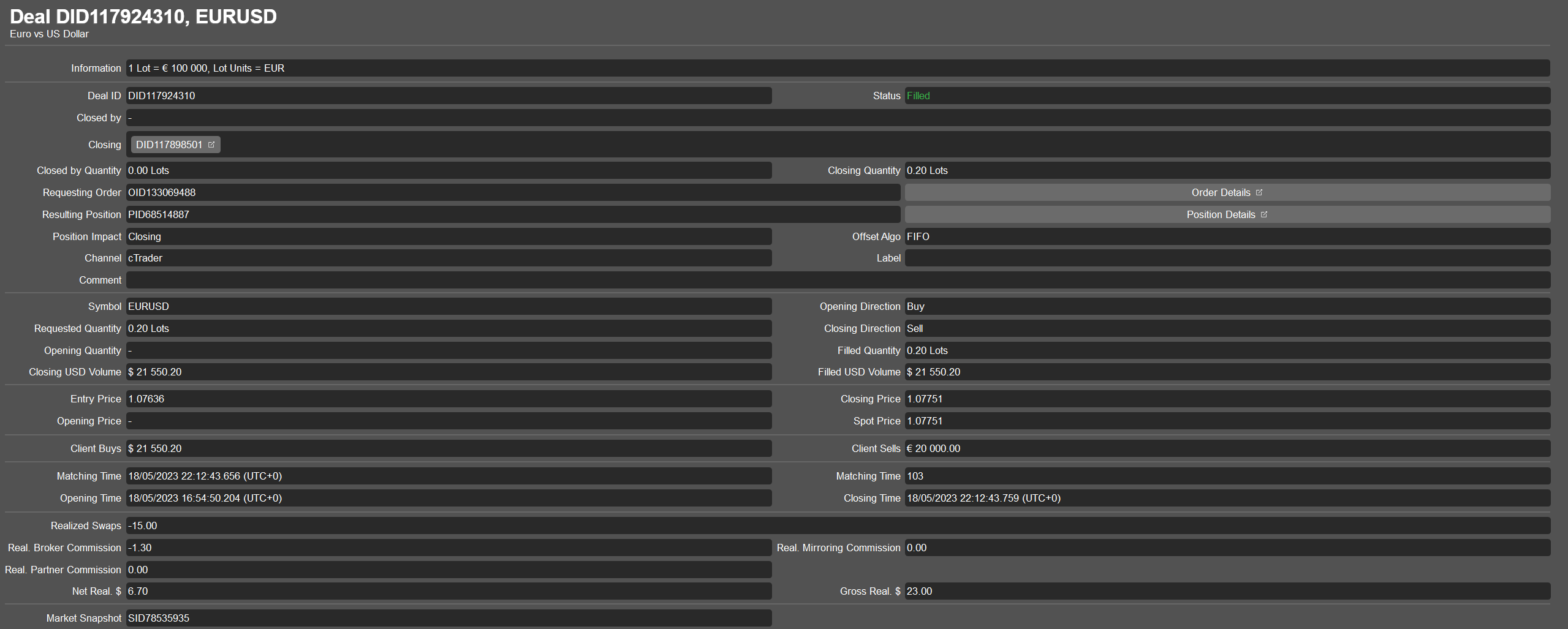

lindawati92sufi said:

i buy 0.2 lot eur/usd at 18th and closed it in 19th today

i should pay swap 1.5usd not 15usd

apologies if this was explained in the post with your other alias, but it would appear that this was an issue at the broker end and all affected trades were reversed.

much as this is painful at the time, i've found that these issues are usually a glitch on the broker side and are usually resolved within a small timeframe.

@jim.tollan

jim.tollan

23 May 2023, 16:20

( Updated at: 23 May 2023, 16:25 )

RE: RE: RE: RE: RE: RE: RE:

meeting.chegini said:

firemyst said:

meeting.chegini said:

Dear friend, do you want to teach me how to split the nucleus of an atom?This is a simple question! If you know the solution, please guide me

How to split the nucleus of an atom: there's plenty of "how to's" on Google and YouTube already on how to do it.

Guiding you on this issue - I already started. Second post in this thread is how you would start going about doing it through C# code. If you're not trying by writing any code, I'm not writing code for you. Best way to learn is to do it on your own.

If you're just looking at the chart and wondering where they are on the chart, then look for the indicator name on the chart:

If the name of the indicator isn't on your chart, then put it there by choosing to display "Indicator Titles":

I wanted to find out through C# what oscillators are placed on the chart, but I couldn't find a solution. And I think there is no way

And I respect your wrong way of thinking.

Good luck.

You seem to be under the illusion that firemyst is one of your employees. I suggest you adopt a better bedside manner. Thereafter, you'll be pleasantly surprised at the number of folk that that will be willing to help out with any issues you have. Until then - business as usual.

FWIW - this was the extended approach that firemyst was alluding to:

foreach (var indicatorArea in Chart.IndicatorAreas)

{

foreach (var indicator in indicatorArea.Objects)

{

Print($"Indicator => Area: {indicatorArea.GetType().Name} Name: {indicator.Name}");

}

}

Whilst it is frustrating to not be presented with the answer that you WANT, sometimes you just have to be grateful that folk have taken the time to point you in the right direction.

@jim.tollan

jim.tollan

22 May 2023, 10:57

While I understand your motivation, I think there are definitely many issues in this thinking:

1. The skillset required for desktop (c++/c#) will differ from the web front end (probably using React)

2. A single codebase would be unable to target both platforms, so you'd still effectively require two teams/sets of code

3. The actual mechanics of rolling out code and testing are very different between desktop and web based

4. A feature may be super easy to deliver in one platform but not in the other. so you have conflicts on whether to include that feature

This is just the very top level few that occurred to me. I think we all do have a tendency to underestimate the challenges in keeping platform targets in sync. There is definitely a case for having as many common functions present in both platforms, and I'm sure the product lead will be juggling these priorities as we speak ;)

Let's see how well my contribution on this AGES as cTrader continues to evolve - lol

@jim.tollan

jim.tollan

19 May 2023, 11:01

RE: RE: RE:

lisandronahuelhillebrand said:

Yes, I am aware of your proposal and I up-voted it. I just wanted to put it again to raise attention at Spotware. Thanks for your comment.

jim.tollan said:

lisandronahuelhillebrand said:

Is it possible to program a cBot/system to do walk-forward testing for algos on cTrader? Or is Spotware considering adding this feature to the platform in the near future?

yes, i weirdly proposed an approach for this in this thread:

it's definitely a must have in my opinion. might be worth upvoting that thread also, plus adding some further commentary..

yup -i agree it's well worth keeping it in the spotlight. That said, i have a feeling that not many folk have explored the topic nor realised the advantages of such a feature. This is demonstrated by the low upvote count on the proposal. Of course, it could be that this type of feature has no appeal for the wider audience - hence the lowish upvote count.

I believe our friend The Nomad Trader has also cottoned on to the huge benefits of this and explains in laypersons terms the key benefits:

@jim.tollan

jim.tollan

18 May 2023, 14:32

RE:

lisandronahuelhillebrand said:

Is it possible to program a cBot/system to do walk-forward testing for algos on cTrader? Or is Spotware considering adding this feature to the platform in the near future?

yes, i weirdly proposed an approach for this in this thread:

it's definitely a must have in my opinion. might be worth upvoting that thread also, plus adding some further commentary..

@jim.tollan

jim.tollan

16 May 2023, 13:27

RE:

firemyst said:

That is one thing that is soooooooooooooooooo annoying with the API's Spotware created as they're not consistent across indicators.

I wrote my own multi time frame fractal indicator. Basically, I did it by getting the bars data series time frame I wanted, and then doing the calculations (eg, looking for the midpoint between x number of bars, making sure "x" is an odd number).

Is this something that you'd be willing to share?? I'm not so interested in a visual indicator,. I'm more interested in using the data generated from the multiple instances... You of course kindly point out an approach, but it would be nice to have (even a cut down) version of the code if that wasn't giving away any IP.

cheers

jim

@jim.tollan

jim.tollan

04 May 2023, 12:58

RE: how do we vote for the offline backtesting request.

davidmwabuka said:

please add this funtionality, to store download tickdata and backtes

you click on the thumbs-up on the original post..;)

@jim.tollan

jim.tollan

04 May 2023, 12:47

( Updated at: 08 May 2023, 17:33 )

OMG - I literally navigated to the suggestions section to suggest this very idea.

Here's how i see it working:

1. Define the DateRange of the optimisation run

2. Define a sliding window (percentage) of which data is used for the backtest and which data is used for forward testing - i.e. 80/20, 90/10 etc

Having a combined *window* on the data that accommodated backtesting with out of sample data would truly be a gamechanger.

-----------------

FYI - I currently do this in a number of ways:

1. Select a daterange (say 01/01/2017-01/05/2023)

2. Set the Optimization daterange from 01/01/2017-30/04/2022

3. set the Backtest daterange to 01/05/2022-01/05/2023

4. Run the optimisation

5. From the optimisation, select the candidate set and apply it to the backtest window

6. rinse and repeat

----------------

It's quite cumbersome, but works. Combining this behaviour into the optimisation window would be amazing and offer huge insights.

Hope you get the gist. Still revelling at the weirdness of the timing of this request

@jim.tollan

jim.tollan

20 Apr 2023, 12:03

( Updated at: 20 Apr 2023, 14:56 )

RE:

Hello there - would this not work:

var profitPanel = new StackPanel

{

HorizontalAlignment = HorizontalAlignment.Left,

VerticalAlignment = VerticalAlignment.Bottom,

BackgroundColor = Color.Black,

Opacity = 25,

Margin = 5

};

looks like the Opacity property would fit the bill... (?)

@jim.tollan

jim.tollan

19 Apr 2023, 17:47

( Updated at: 20 Apr 2023, 11:57 )

RE:

bjarman16 said:

sorry this is the algo

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

using System.Collections.Generic;

namespace cAlgo

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.FullAccess)]

public class SupplyDemandRobot : Robot

{

[Parameter("Trade Volume", Group = "Basic Setup", DefaultValue = 10000)]

public int TradeVolume { get; set; }

[Parameter("Instance", DefaultValue = "Instance")]

public string Instance { get; set; }

private SupplyandDemand supplyAndDemand;

protected override void OnStart()

{

supplyAndDemand = Indicators.GetIndicator<SupplyandDemand>(5, TimeFrame.Hour, "Red", "Lime", 20);

}

protected override void OnBar()

{

// Check if price is in a supply or demand zone

foreach (var zone in supplyAndDemand.sList)

{

// Check if current bar's high price is greater than zone's high price

// AND previous bar's high price was lower than zone's high price

if (Bars.HighPrices.Last(1) > zone.high && Bars.HighPrices.Last(2) <= zone.high)

{

// Enter short trade as price entered a supply zone

ExecuteMarketOrder(TradeType.Sell, Symbol, TradeVolume, Instance, null, null, null, "Supply Zone");

}

}

foreach (var zone in supplyAndDemand.dList)

{

// Check if current bar's low price is lower than zone's low price

// AND previous bar's low price was higher than zone's low price

if (Bars.LowPrices.Last(1) < zone.low && Bars.LowPrices.Last(2) >= zone.low)

{

// Enter long trade as price entered a demand zone

ExecuteMarketOrder(TradeType.Buy, Symbol, TradeVolume, Instance, null, null, null, "Demand Zone");

}

}

}

}

}

Hello there - I actually took a look at this inside visual studio and noticed that the indicator Calculate() method isn't getting fired (when using the Robot - it's actually fine when using purely as an indicator).

I'm using cTrader v4.7.7 - could there be an issue here?? I tried creating a basic indicator from scratch inside cTrader and wiring it up to your Robot also and it also didn't fire the Calculate() override. I then went back to basics and created a vanilla custom indicator and robot and referenced the indicator from the new robot. same outcome - Calculate() doesn't get fired.

Can anyone else confirm the same outcome?? - oh and hello everyone, been lurking for a long-time due to my username getting blocked for no apparent reason!! However, big thanks to the cTrader community team, now unblocked and ready for, ermmm responding!! ;).

Happy to attach my vanilla code examples that illustrate the issue when using an indicator inside a robot script using v4.7.7.

anyway -cheers and hello from me.

@jim.tollan

jim.tollan

20 Jul 2023, 13:14

RE:

Spotware said:

hasn't this issue been around for quite some time. ?? I know that since I started using cTrader about 9 months ago, the issue was present even then.

Not sure if a fix came in that sorted it at some point between times and that that fix no longer works?

@jim.tollan