Topics

Replies

ColossusFX

21 Jan 2017, 18:29

It depends on what you are backtesting...

If you are backtesting an algo with about 1000 indicators that calculate on tick, then you will suffer from the consequences.

With an i7, you should be flying through 4 years of tick data backtesting.

I am running full tick data backtests in a few minutes on i7.

@ColossusFX

ColossusFX

21 Jan 2017, 18:24

Can you post some real live data from trades from Live account?

If you can provide profitable results proven with a live account I may have an offer for you.

Looking at your results, with a $1000 account you should be making money now,so give me some live results and we can maybe offer you something.

:)

@ColossusFX

ColossusFX

12 Jan 2017, 18:43

Try 1m data, as that is up to date

Check the events tab too, you can see what position/s are open still and the P/L

@ColossusFX

ColossusFX

12 Jan 2017, 16:49

Check the events tab, this is normally because a trade is still open

@ColossusFX

ColossusFX

31 Dec 2016, 17:21

( Updated at: 21 Dec 2023, 09:20 )

RE:

davidp13 said:

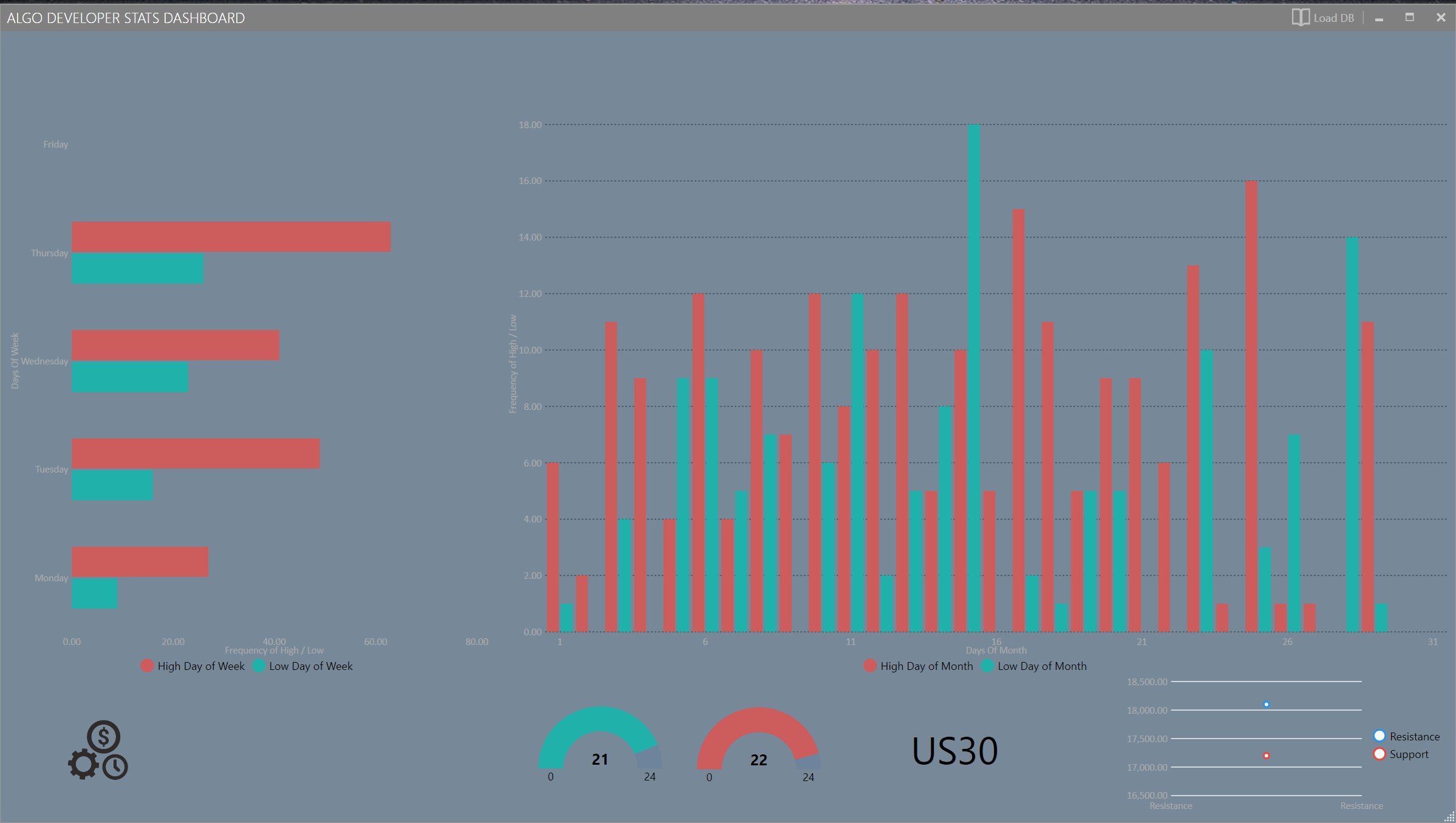

Hi. Would anyone know how to test which day of the week is best to trade a certain strategy by using the paramters function? So basically optimising your strategy by DayOfWeek?

Thanks

I have been working on a app for this..

It will be ready soon.. its 90% atm.

@ColossusFX

ColossusFX

14 Dec 2016, 14:54

( Updated at: 21 Dec 2023, 09:20 )

There is a tool called cMulti

https://www.algodeveloper.com/17-cmulti

Managing multiple trading accounts at same time from same platform is one of the best feature a trading platform can provide and cMulti allows cTrader platform users to have that, It's built to help you copy one account trades to another account with different risk exposures without any delay.

cMulti use Spotware connect API to access your account and it has all the features you need for a trade copier like:

- Copy all type of orders(market, stop and limit) from one account to another

- Running multiple copying process at same time for different accounts

- One account can copy multiple accounts trades and vice versa

- Supporting the partial closing of positions

- Copying stop loss and take profit levels

- No delay in copying

- Connecting multiple cID profiles and brokers accounts

- Managing the risk exposure of each copying process separate

- Modifying the order based on the account it copied the order

@ColossusFX

ColossusFX

13 Dec 2016, 14:43

( Updated at: 21 Dec 2023, 09:20 )

Have you guys seen this?

cMulti

Copy trades to & from multiple cTrader accounts.

cMulti - Copy trades to & from multiple cTrader accounts.

I have been using this to manage accounts for friends.

You set which account/s you want to copy from and all trades are copied in real time.

https://www.algodeveloper.com/17-cmulti

@ColossusFX

ColossusFX

03 May 2016, 21:25

You are trying to sell a bot with 1m bar backtests with a 32% DD and no live results?

You need to show tick data back tests and DD a lot lower than that!

This will lose money 100%.

@ColossusFX

ColossusFX

01 May 2016, 10:58

( Updated at: 03 May 2016, 16:12 )

This post was removed by moderator because it duplicates another post. /forum/calgo-support/9006?page=1#9

@ColossusFX

ColossusFX

06 Mar 2016, 17:41

Thanks for the help.

It works, but optimization went from 2hrs to 12hrs!

Thanks again

@ColossusFX

ColossusFX

22 Feb 2016, 18:49

What I was asking is it possible during optimization for parameters to move in sync.

eg;

RSI Period 14 - 21

ATR Period 14 - 21

But when optimizing they can be linked so they test the same periods together

Eg; 14 / 14, 15 / 15 etc.

Thanks

@ColossusFX

ColossusFX

20 Feb 2016, 19:44

Those results do not look correct.

Run a backtest using $25 per million and tick data from server, then see what the results are

@ColossusFX

ColossusFX

20 Feb 2016, 19:41

bool Fisherlong = Fischer.Fish[index] > Fischer.trigger[index];

bool Fishershort = Fischer.Fish[index] < Fischer.trigger[index];

example of use

@ColossusFX

ColossusFX

20 Feb 2016, 19:38

RE:

Piratetunes said:

[Parameter("Fischer Length", DefaultValue = 13, MinValue = 2)] public int Len { get; set; } private FisherTransform Fischer; Fischer = Indicators.GetIndicator(Len);

Then reference fisher indicator

@ColossusFX

ColossusFX

20 Feb 2016, 19:38

[Parameter("Fischer Length", DefaultValue = 13, MinValue = 2)]

public int Len { get; set; }

private FisherTransform Fischer;

Fischer = Indicators.GetIndicator<FisherTransform>(Len);

@ColossusFX

ColossusFX

12 Feb 2016, 09:56

RE:

Piratetunes said:

You have tested without commissions?

My bad, no commissions on DE30 :)

@ColossusFX

ColossusFX

04 Feb 2016, 12:32

When to BUY:

- Fisher Transformation: Trigger Line is BELOW Fisher line. <<<<<<<<<

- Center of Gravity: LAG line is BELOW CoG line. <<<<<<<<

- Candlestick M15 is ALL BUY.

- Candlestick M30 is ALL BUY.

- Distance from bar close to last fractal is more than 10 pips!

When to SELL:

- Fisher Transformation: Trigger Line is ABOVE Fisher line. <<<<<<<<<

- Center of Gravity: LAG line is ABOVE CoG line. <<<<<<<<<

- Candlestick M15 is ALL SELL.

- Candlestick M30 is ALL SELL.

- Distance from bar close to last fractal is more than 10 pips!

Think you have the LAG / COG and TRIGGER / FISCHER entries round the wrong way???

I have made this into a cBot, on 1m bar backtest its great, but on tick data test it consistently loses... :(

@ColossusFX

ColossusFX

21 Jan 2017, 18:39 ( Updated at: 21 Dec 2023, 09:20 )

RE:

Paul_Hayes said:

Hey Paul,

If you would like some beta testing done on Win 7 & Win 10 let me know, would be happy to help.

If you can figure out how to reduce RAM usage on cAlgo / cTrader that would be fantastic for the community.

EG

Running 2 backtest on i7 with 32gb DDR3 ram (XMP) im getting 50% usage!

I can see that people with much lower specs will be getting issues with ram usage.

All the best.

Paul (AlgoDeveloper)

@ColossusFX