Topics

Replies

ME-Pepper

20 Feb 2023, 15:10

( Updated at: 21 Dec 2023, 09:23 )

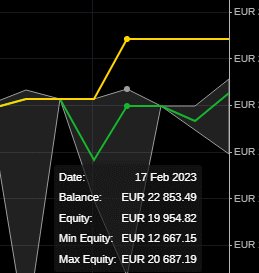

Show time in Backtesting Equity Window

This is how it looks on ctrader Copy! Date in 1st line!

Is this so difficult to implement in Automate as well?

@ME-Pepper

ME-Pepper

18 Oct 2022, 08:10

RE:

Spotware said:

Dear traders,

Thanks for reporting this issue. The team is aware of it and working on a solution. In the meanwhile, you need to downgrade the cTrader Automate package to 1.0.2.

Best regards,

cTrader Team

How do I do a downgrade?

@ME-Pepper

ME-Pepper

12 Oct 2022, 15:42

( Updated at: 21 Dec 2023, 09:22 )

RE: Answer about Sharpe and Sortino Ratio calculation

public static double SharpeSortino(bool isSortino, IEnumerable<double> vals)

{

if (vals.Count() < 2) return double.NaN;

double average = vals.Average();

double sd = Math.Sqrt(vals.Where(val => (!isSortino || val < average)).Select(val => (val - average) * (val - average)).Sum() / (vals.Count() - 1));

return average / sd;

}

And so can you call it:

var SharpeRatio = SharpeSortino(false, History.Select(trade => trade.NetProfit));

var SortinoRatio = SharpeSortino(true, History.Select(trade => trade.NetProfit));

This will give you the exact same results as Spotware is calculating it.

You are welcome

PS: The secret is the division by (vals.Count() - 1) and not just vals.Count for the standard deviation as described here:

(look for "sample standard deviation"

Waxy said:

Hello Spotware,

I've been trying to replicate the result of Sharpe Ratio given by the backtester, but I've been unable to come with the same result, the formula I found online is:

So my questions are:

1 - What value are you giving for "risk-free rate of return"

2 - The standard deviation is calculated from returns trade by trade, or maybe returns on a monthly, weekly or even daily basis?

Regards,

@ME-Pepper

ME-Pepper

06 Oct 2022, 14:45

RE:

mmnniinn said:

Hello,

I would like to propose this relatively simple query :). I would love to be able to limit my cBot with its number of daily trades.

Thanks in advance!

Why don't you just code the limitation into your cBot and use a Parameter so the user can set the limit?

@ME-Pepper

ME-Pepper

06 Oct 2022, 14:42

RE:

For a state of the art solution, also the Swaps should be evaluated accordingly. At the moment they are completely ignored :-(

@ME-Pepper

ME-Pepper

24 Sep 2022, 09:25

RE:

PanagiotisCharalampous said:

Hi ME-Pepper,

If you download and install the link I provided, you will be able to access your Pepperstone account.

Best Regards,

Panagiotis

Ok, seems to work now.

Thx

@ME-Pepper

ME-Pepper

22 Sep 2022, 11:02

RE:

PanagiotisCharalampous said:

Hi ME-Pepper,

Can you try reproducting this on 4.3.12? It's a cross broker version and this issue should have been fixed there.

Best Regards,

Panagiotis

How do I get the newer Version 4.3.12 on a Pepperstone account?

@ME-Pepper

ME-Pepper

22 Sep 2022, 10:41

( Updated at: 22 Sep 2022, 10:49 )

RE:

PanagiotisCharalampous said:

Hi ME-Pepper,

Which version of cTrader do you use?

Best Regards,

Panagiotis

Version 4.2.22

PS: I think it is easier to reproduce the bug when memory on the computer gets limited. I.e. On a 4GByte computer starting Visual studio while the bot is running.

@ME-Pepper

ME-Pepper

17 Nov 2023, 10:50

RE: Reply to: Difference in cTraders's Margin Calculation between opening several trades separately vs. modyfying volume

PanagiotisCharalampous said:

4.8.30

@ME-Pepper