Topics

Replies

TraderM

15 Aug 2016, 20:03

Hi,

I have also now logged into the trading account directly. No Internet breaks for over a week.

Also, the platform coped with the weekend stop/start seamlessly - the reconnect when the trading session restarted after the weekend worked fine. This previously often did not work.

I will stay logged in to the account directly, and not use the cTID/cTrader ID to log in.

It is great to get this problem solved. Thanks for the tip!

TraderM

@TraderM

TraderM

01 Aug 2016, 21:44

( Updated at: 21 Dec 2023, 09:20 )

Hi,

I have had many similar problems and have been monitoring my Internet connection which is fine.

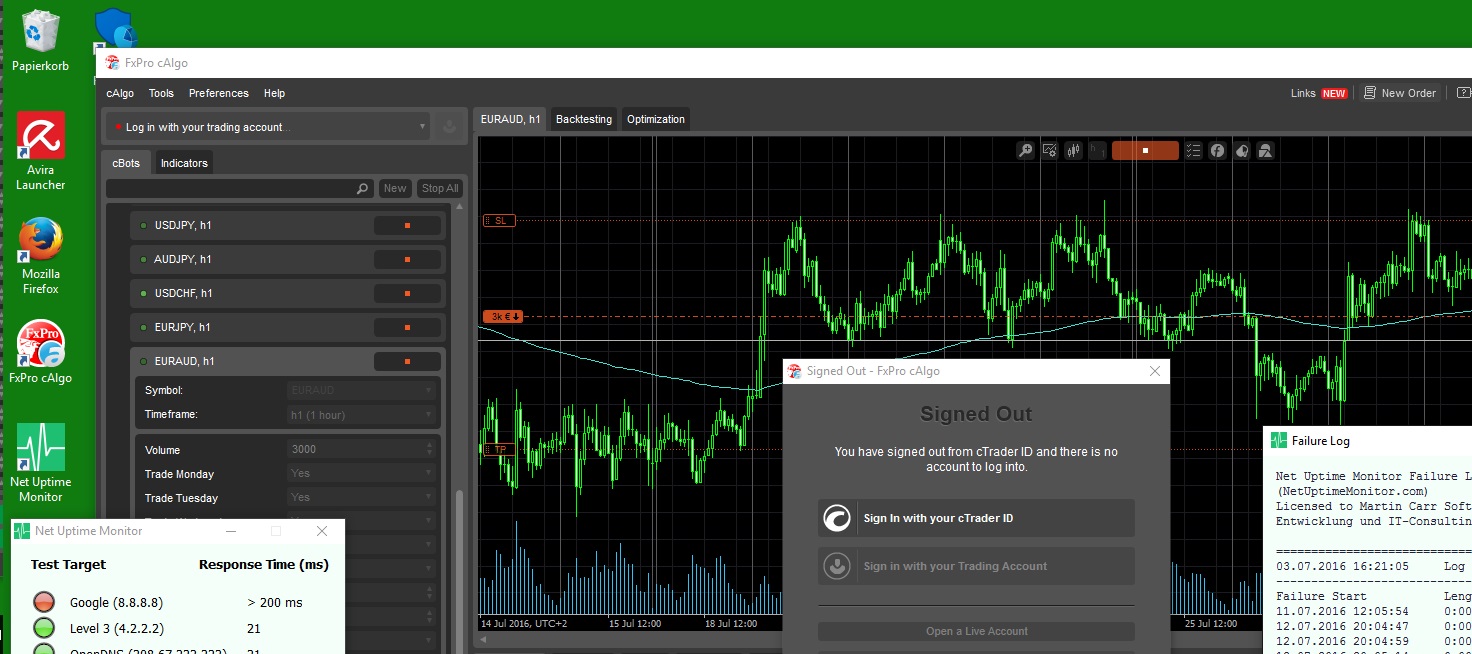

Today I came home to the following screen...which could confirm what Boomslam suggests - that the problem indeed lies with the cTrader ID.

I will log on with the Trading Account ID and see if this is better.

Spotware: Please let us know what information we can gather to solve this problem.

Thanks!

TraderM

@TraderM

TraderM

01 Apr 2016, 20:55

Hi Everyone,

some input from me on this interesting topic:

1) Did you develop the system yourself?

Yes, you must do this yourself!

2) Did you develop the bot yourself?

Yes, you must do this yourself!

3) How many indicators does the system use (to give us an idea of complexity)?

Robot1: 4 EMAs + time to trade, Hourly chart

Robot2: 1 EMA + time to trade, Hourly chart

The indicators are just small part of the process.

4) How often does the bot trade?

Robot1: When conditions are met, typically 1-2 times a week

Robot2: Once each day

5) How many pairs does the bot trade?

Live account: 6

Demo account (next week): around 30 to forward test. Testing real time forwards, as mentioned above (trend_meanreversion) is essential for me!

6) What level of return are you getting on average per trade (either by percent or by pips)?

Varies, SL between 40-50 pips, TP 50-70 pips. Many of the next set to be tested on the Demo account will have wider SL (up to 90 pips) and TP (up to 180 pips).

7) How much maintenance does the bot require (i.e. can it be left running 24 hours a day for 1 week, 1 month, 1 year without intervention / updates)?

No maintenance! For me that is the point - I want my trading to be able to do much more than if I was manually trading and it should do it better! The only thing I do regularly is check the Internet connection.

Other points: Keep it simple, money management is key. Learn about statistics and sampling. Test forwards. Balance with something else so if things don't work out, you still have a good life!

Hope this adds something useful to this thread!

TraderM

@TraderM

TraderM

19 Dec 2015, 15:43

A different approach

Hi,

my approach is a little different.

I have two dedicated PCs, one runs a live account, the other a demo account. Both PCs have the same low end spec: 4GB RAM, Win 10, Duo Core 3,0 GHz. This is perfectly adequate to run 15+ instances (trading at slightly different times throughout the day). These PCs do nothing but run a single platform each and trade in the hourly chart. They are only touched for maintenance or updating robots.

But I also have much quicker PCs for development, optimization and backtesting, as this is where power (for me) counts. Paticularly as optimization takes time.

I place a lot of emphasis on stability, reliability and only touching my trading systems when absolutely necessary. This is easier when the PCs are not high end. Buying expensive PCs to run my robots would be a waste.

TraderM

@TraderM

TraderM

26 Nov 2015, 17:33

Set the platform UTC settings

newbee said:

Hello, I've struck a situation in calgo while back testing and am hoping someone can assist or point me in the right direction.

My cbot includes a parameter for trading hours. (ie Start Hour & Stop Hour - - eg Trade between 8pm & 10pm etc)

When the back testing is complete, in the results it seems that there are trades with an entry time outside the selected time parameter, in this case between Start hour 19 & stop hour 21.(or 7pm to 9pm)

One would expect to only see trades with an entry time between the filtered start & stop times. Is this correct or am I missing something?

Any assistance would be appreciated

Thank you

Hi,

this sounds like the following problem:

/forum/calgo-support/6978

Essentially, when backtesting over a long time period, there may have been a clock change. This is not reflected in the charts.

Unfortunately you have to backtest in stages, for example for me living in Europe:

Summertime, 29.3 - 24.10, set the platform to UTC+2

Wintertime, 25.10 - 28.3, set the platfrom to UTC+1

If you do this, each trade should be executed at the "right" time and shown on the chart at the time expected.

Note: You will have to choose the right UTC settings for your time zone and clock changes.

Hope this helps,

TraderM

@TraderM

TraderM

22 Nov 2015, 15:05

My solution

Hi Everyone,

thanks for the input. It is good to see other people are interested in this too.

In the short-term I will create a seperate robot that:

- checks balance, then if necessary

- deletes pending orders

- closes positions

- close cAlgo (as mindbreaker suggests above)

It seems a bit harsh to close cAlgo, but this is a solution and not too difficult to implement.

Maybe in the future there could be an account protection feature added to the platform, a type of airbag, which performs these actions if balance gets too low.

Thanks for you help and input!

TraderM

@TraderM

TraderM

21 Nov 2015, 13:43

Short update

Hi,

the problem did not occur again naturally during the week.

At the end of the week I provoked a connection loss. The platform recovered fully when the connection was made available again.

So, I cannot reproduce the problem currently. Should it occur again I will post any troubleshooting infos.

Thanks again for the info above and the support!

TraderM

@TraderM

TraderM

16 Nov 2015, 14:39

RE:

Hi,

I would like to have a single robot that turns off all other robots, for example if the account balance goes under a certain level.

I would prefer a single robot because:

- no code redundancy, functionality is centralised and only has to run in one instance

- parameters only have to be set once, which is less prone to user error

- I could attach this single robot to a faster time frame (OnTick or 5M OnBar) rather than to the one which my robots currently use (Hourly OnBar). (If I have to code this in all my instances OnTick, then this would seriously increase required resources and impact performance.

I found this old thread...I guess this hasn't been implemented, has it? Or is there an alternative solution?

Thanks!

MTrader

@TraderM

TraderM

16 Nov 2015, 12:11

Hi,

I will monitor the problem and if/when it occurs again (naturally) I will gather the information as described above.

If the problem does not occur again (naturally) in the next few days I will try to reproduce it artificially (by breaking the internet connection), and then at least see what happens in terms of recovery.

Thank you very much for the information and support!

TraderM

@TraderM

TraderM

20 Jul 2013, 16:27

Hi,

I think I have found the problem. Each time the comparison is made OnBar() it uses a different data set. This means that the current EMA at time X is not the previous EMA value at time Y (one bar later). (You can verify this with print statements.) It is therefore possible that the EMA cross happens but it is not recognised by:

if (previousSlowMa > previousFastMa && currentSlowMa <= currentFastMa && !isLongPositionOpen)

as you are not comparing the same things.

To fix this I have set all these variables to be global when the robot is created. And on each bar:

1. Overwrote the previous values:

previousSlowMa = currentSlowMa;

previousFastMa = currentFastMa;

2. Then calculated the new values:

currentSlowMa = slowMa.Result[lastIndex];

currentFastMa = fastMa.Result[lastIndex];

3. Then made the comparison:

if (previousSlowMa >= previousFastMa && currentSlowMa < currentFastMa && !isLongPositionOpen)

//and so on

This seems to work.

But I think the sample (Trend robot 2, using OnBar() for the comparison, with the Stop Loss and Take Profit added) may be flawed and should be looked at again.

Thanks for you comments above!

TraderM

@TraderM

TraderM

07 Jun 2013, 16:33

Hi,

but above I posted (#4):

I have installed cTrader on the Live PC and now we have cAlgo showing a long wick, and cTrader showing a short wick.

Summary:

Short wick on:

- Live PC (Win 8) cTrader

...Long wick on:

- Live (Win 8) PC cAlgo

So here we have a difference between the platforms using the same Live account (not a difference between account types).

(I am also using FXPro.)

TraderM

@TraderM

TraderM

25 May 2013, 11:33

Hi,

the long wick appears in cAlgo on my Live PC in both the backtesting chart and in the live chart.

(I never really understood these as seperate charts. Just to be sure: For me the live chart is when I click on the "EURUSD" sysmbol and the backtesting chart is when I click on "Backtest" -> "Chart".)

And, yes I only use one broker (but I don't know whether I should mention the name here).

TraderM.

@TraderM

TraderM

19 May 2013, 16:36

Hi,

This is the sort of calculation I needed.

// profit > 0 => Calculate Volume based on Risk and Pip value var risk = (int)(RiskPercent * Account.Balance / 100); var volumeOnRisk = (int)(risk * Symbol.Ask / (Symbol.PipSize * StopLoss));

I found this in the "Example Based on Martingale Robot".

Thanks for posting this!

TraderM

@TraderM

TraderM

19 May 2013, 16:28

Hi,

I have deleted the cache but the two computers still show different candles, one with a longer wick (as shown above).

But even if deleting the cache had made the candles the same, why were they different in the first place and which would have been "correct"?

I would really like to understand this issue, as it is important for testing.

Any other ideas why charts are shown differently on different comnputers?

Thanks,

TraderM

@TraderM

TraderM

16 Mar 2013, 15:10

Hi,

I tried to do this, but I could only get it to work in real time only, not back-testing.

One of the examples is qualified by: if(IsRealTime), so I assume that this can only be done in real time.

It would be great if this can be done backtesting, it would save so much time!

M

@TraderM

TraderM

28 Sep 2016, 11:36

Hi,

just to confirm - 6 weeks have gone by with no more reconnect problems, even over the weekends.

Logging directly into the account rather than using the cTrader ID has worked.

TraderM

@TraderM