Topics

Replies

burakbirer

26 Apr 2018, 20:26

I believe we've been waiting enough :) Give us the damn renko beta at least. Please? :D

@burakbirer

burakbirer

25 Apr 2018, 06:29

Tick charts are good for stocks. Renko and range bars are good for forex. Still waiting for renko or range bars.for 3 years?

@burakbirer

burakbirer

16 Mar 2018, 15:16

( Updated at: 21 Dec 2023, 09:20 )

RE:

would be nice to have it on web trader also. I don't have a windows pc. so the only option for me is web trader. btw web trader is faster :)

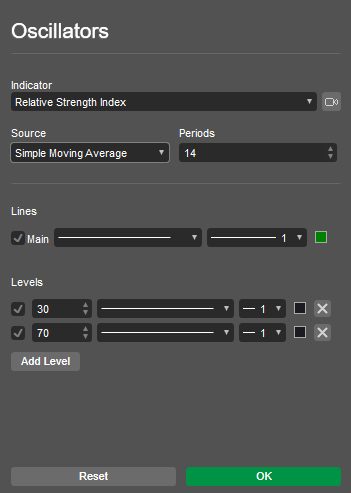

Panagiotis Charalampous said:

Hi PapaGohan,

Thanks for sharing your suggestion with us. Just to let you know that it is already possible to use an indicator as an input to another indicator, if the indicator has already beed added to the chart. See example below

Best Regards,

Panagiotis

@burakbirer

burakbirer

03 Mar 2018, 13:22

( Updated at: 21 Dec 2023, 09:20 )

RE:

,Panagiotis Charalampous said:

Hi tradingu,

cTrader Copy can cater both types of clients. Are there any features you believe professional money managers should have?

Best Regards,

Panagiotis

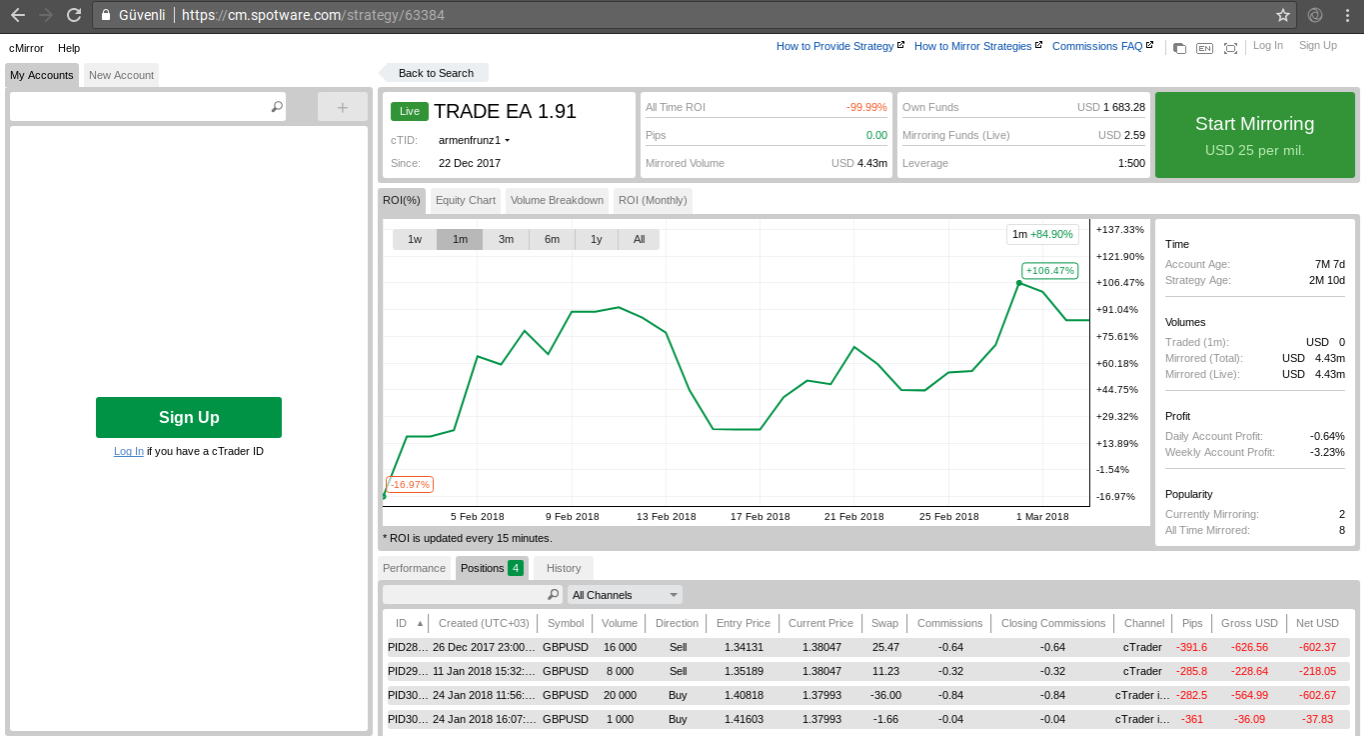

Hi Panagiotis,

I have some fundamental thoughts about cMirror.

VOLUME

I believe subscribers should be able to copy the signal based on their available free margin as a percentage. This way if a signal provider is using %20 of his/her free margin than subscriber will use the %20 of his/her free margin. This way volume calculation will be fully automated.

FEE

First of all, please understand that not all signals are scalping signals. Currently, you can copy/see long-term trades for free. Please see the screenshot.

So it's obvious that "open positions" should be subscribed users only. And a weekly / monthly fee is a must for subscribing.

COMMISIONS

After having a basic fee the reward for the signal providers might be based on winning trades only. No one would be happy to pay for a losing signal.

And again the reward/commission could be based on the realized profit's percentage instead of the position volume.

Please feel free to contact me.

@burakbirer

burakbirer

03 Mar 2018, 12:35

( Updated at: 21 Dec 2023, 09:20 )

RE:

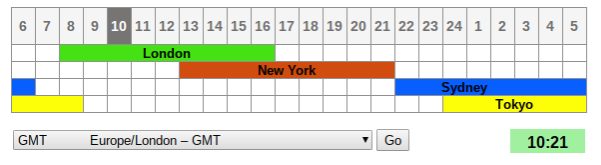

cTrader - Session Candles (Hope you see the benefits and consider)

A total of 7 candles for 24 hours period;

1. Tokyo Only Candle (1 hour)

2. Tokyo + London Candle (1 hour)

3. London Only Candle (4 hours)

4. London + Newyork Candle (4 hours)

5. Newyork Only Candle (5 hours)

6. Sydney Only Candle (2 hours)

7. Sydney + Tokyo Candle (7 hours)

Two attachments;

@burakbirer

burakbirer

07 Aug 2017, 14:42

Volume profile could be made of real ctrader traders volume. (just like sentiment but detailed as volume profile for each price range)

@burakbirer

burakbirer

26 Dec 2016, 17:09

yes ctrader is simply not using the depth of market data fully. with such kind of data there could be amazing stuff inside charts and also dom itself.

@burakbirer

burakbirer

01 Nov 2018, 23:32 ( Updated at: 21 Dec 2023, 09:20 )

RE:

Spotware said:

These are amazing updates! Thanks for keeping cTrader even better everyday. Here is a game changer idea for the industry. I hope you considers this as well;

The problem with signal services is that it's more like scalping rather than fund management. At the moment a hedge fund manager wouldn't provide signals as all are positions are visible to public. At some point even the subscriber might get all his/her knowledge for free. (Subscribe with a 200 USD account and get the positions, unless they are scalping orders this would work) Well, you may say a signal provider (fund manager) might choose who can copy. Here is a solution to that situation which anyone can benefit;

A new type of signal copying style might be added to the cCopy platform (no ideas for naming) which subscriber reserve funds for the signal but cannot see the open positions until they are realized / closed.

Signal Subscriber can;

1. Check history of signal provider

2. Access all historical data and analysis

3. See his funds live profit or live loss

4. Stop copying any time

Benefits for subscriber

Subscriber keeps the money in his/her account while it's managed. Don't have to give funds to another broker or managers account.

Gets a good reliable service from professional managers who wouldn't share positions publicly

Pays only fees or profit based

Cancel anytime (no hedge fund lock-up period)

Benefits for provider;

Provide industry class fund management without scalping

Secure positions

No legal obligations for fund raising yet secure like a hedge fund

Best Regards,

@burakbirer