Topics

Replies

usynn

10 Aug 2015, 13:43

( Updated at: 21 Dec 2023, 09:20 )

RE:

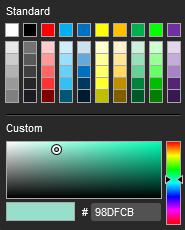

Now that this has been implemented, how can we chose a custom colour in code? The intellisense when you type Colors. shows only the old colours such as AliceBlue etc. How can we input a custom colour such as Colors.Custom("98DFCB") or something similar?

Thanks

Spotware said:

Custom color picker will be available in next releases:

@usynn

usynn

07 Apr 2015, 17:22

( Updated at: 21 Dec 2023, 09:20 )

RE: RE:

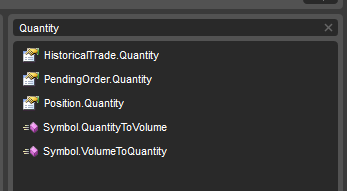

In my cTrader, there is no definition for the method Symbol.QuantityToVolume. If you check the API for the interface, the method also isn't listed. What's the workaround for this?

Thanks

AlexanderRC said:

Dogtrader said:

According this description the ExecuteMarketOrder() method takes volume as long type (long is integer type). This method doesn't take double (floating point value). I can only recalculate lots to volume by contract size or account balance.

Yes that is exactly that, you need to recalculate "Quantity" in lots (lots are different per instrument) into "Volume".

These are newly added functions to do the recalculation. Screenshot from built-in cAlgo help.

@usynn

usynn

26 Feb 2015, 20:47

RE:

thanks for the tip, there's a guy called Lukas who already did create a request and i commented and upvoted it. he's called it trade symulation

cjdduarte said:

Get signed up something similar in http://vote.spotware.com/

If not, register there your idea.

@usynn

usynn

26 Feb 2015, 20:43

RE: RE:

So, spotware have a system that can do this? How much is it

olddirtypipster said:

Yes. Tools such as this do exist, but are extremely expensive. Sorry.

usynn said:

Hi there, is it possible for us to be able to backtest/run a simulator which runs through tick data and simulates historical data as if it were happening in real time. There are many such simulators for MT4 where you can speed up and slow down the simulator. I usually use MT4 for simulator trading but I've created my own custom indicator with cAlgo and would like to sim trade in cTrader with historical data. Also, the ability to use tick-data, certain points or just every bar would be ideal.

If this concept doesn't exist within cTrader, would it be possible to be put down on the to-do's for the devs?

btw, when i mean sim trade i don't mean running a cBot but visually running through historical data as if were real-time but faster.

Many thanks

@usynn

usynn

14 Feb 2015, 18:50

Hey guys, I'm trying to debug my custom indicator in Visual Studio Ultimate 2013 and I've followed the guide on the ctdn website. I've built the project in debug mode and attached to process cAlgo. The problem arises when i try to attach to the cAlgo process as whenever i attach it, cAlgo crashes, the windows dialog box comes up saying cAlgo has stopped working and there button appears to "close program". During this time, Visual Studio does go into debug mode but as cAlgo crashes, and i clsoe the program, visual studio exits debug mode.

I was wondering if it is even possible to debug indicators or can you only debug cBots? I followed the guide but it's not working for me.

Many thanks

@usynn

usynn

15 Dec 2015, 01:34

RE:

Is there an ETA for this feature?

Spotware said:

@usynn