Topics

Replies

Athena

19 Apr 2025, 00:45

( Updated at: 19 Apr 2025, 00:48 )

RE: RE: Positions Tab Removed for live trades monitoring

tbssecurett said:

Athena said:

if SP has choen to not show open trades, the open trade tab on SP acct wont be visible.

This concerns the Windows desktop app only. I can understand if that is an option for persons who are not invested in them or who are demo trading. As an investor, you have the right to see how the strategies or any person is investing your money on this platform. You can't just remove that feature and get up every morning to see if you won or you lost, or if the strategist has blown your account. That is not an option he/she should have, to block you from seeing what is doing live. Well at least give us the option to contact the strategist about our concerns.

Before the changes even if SP chose to not show open trades, investors/subscribers can still view open trades on their OWN subscriber account (copy trade account, that is created by spotware automatically once you chose to copy that signal). After the updates, if SP has chosen to hide open trades, you wont be able to view open trades even on your OWN subs acct. This is very concerning and i have raise this to spotware support.

For MQL ("mother" of MT), SP open trades are automatically hidden. Whats NOT hidden its the floating P/L so that a potential subscriber or current subscriber could view this detail in the SP open trades tab and decide to subscribe, eg, when floating p/l=$0 (meaning all trades are closed), or when floating p/l is very small. This is not so in ctrade copy. Even floating p/l is completely blocked,often resulted in many subscribers subscribed to a signal base off past history to be hit with large batches of long held losing trades. Or subscribers can get hit with trades that were about to be closed and instead of getting profits same as SP, subscriber may lost some money due to spreads/entry prices at time of copy. You also cant even tell about this by looking at SP current equity on SP page, it wont include the current equity even if there were floating trades either.

I have also uploaded a simple screenshot of what it should look like with just floating p/l showed on SP open trade tab instead of hiding everything to help investors. Until then Caveat Emptor. Learn to navigate and monitor your own subscribed/copy account by setting Equity Stop Loss. You can eg set it at 30% of balance if thats what you are ready to lose. Do note that in highly volatile market, this 30% can be breached. One of my copy accounts i set USD100 and when stop out i had USD98.90 left. Learn and practice good habits of moving ESL (equity stop loss) whenever your account gains some profits. Eg if you start off with USD1000 and ESL=$300, and now Balance=USD1100, ESL should be set to USD400. Always be aware and monitored closely by checking at your own balances vs previous ESL. Use Excel if you have a lot of copy accounts

@Athena

Athena

27 Jan 2025, 15:19

spotware took care of the copying functions, whatever price that hits the subscriber acct depends on market. If subscriber has a good ECN brokerage likelihood of bad spreads will be lower, but you can still expect some slippages.

Some brokerage may have qty=1 for indices (like ICmarket) while others its 0.1 as lowest qty. Some may have symbols like US 30 (with a space) and some US30 (without spaces). For certain symbols, spotware is able to match correctly but others it might be skipped in subscribers acct

Calculating minimum investment and giving general guidelines on symbols traded might be helpful infor for subscribers. A lot of other factors are at play including eg your acct currency=USD and subscribers EUR. There is exrate gain/loss everytime a trade is open/closed. It might be out of your control. Reason for general info about your strategy,

You cant really improve the accuracy of copying, spotware controls the process. Perhaps start a channel n invite your subscribers by placing a TG link in signal subscription to feedback on difficulties they faced if you wanted to support issues. IMHO: its better you dont as some subscribers might be rude, try inject their own ideas, expect 100% hand holdings, etc.

You might want to consider choosing to show open trades for complete transparency.

Lastly, consider this, (from an investor point of view: all investors wanted profits. We are “INVESTING” not “GAMBLING”. It would be more ethical to ensure your strategy is well tested. Profits is not guarantee but some SP play games but hiding open trades and having trades dated 2 months ago opened. Subscribers will copy all these floating trades (n usually these tend to be top losers) if they just joined. Also allow a demo so that subscribers knew what they are getting

@Athena

Athena

27 Jan 2025, 06:50

Hi all, i found out why. I was login via ct.spotware.com instead of my brokerage ctrader url eg ct.brokeragename.com. When i am login via my brokerage ctrader url. I can now view the open trades. FYI, the open trade tab on my subs acct has been visible for 2weeks before last friday 24Jan2025 while i login via ct.spotware.com. Anyone like to comment on why this happened? (*NOTE: the view of open trades have always been visible to subscribers on subscribers own acct, even if SP hide his/her own open trades. It has been working well for few years even and i have always login via spotware url instead after spotware introduce capability to view other brokerage ctrader under their url. I have never anticipated or experienced inability to view my own open trades in my subs acct

@Athena

Athena

23 Jan 2025, 23:10

You can simply right click against the subs acct (3 dots on RHS) to select “REMOVE FUNDS” option to remove funds. This will allow you to transfer the funds from subs acct back to main funding account. Eg you have 3 ctrader accts C1, C2, C3 and only C2 has a subs account. Funds will return to C2. Once funds are back in main funding acct you can now proceed to brokerage site to do a withdrawal

You can also stop copying by RIGHT click against the 3 dots on RHS against the subs acct “Stop copying” option to COMPLETELY stop the copying, This will also automatically returns whatever funds subtract all closed trades NET p/l into main funding account. STOP copying will first CLOSED OUT all open positions before returning funds into main funding account. Please consider carefully before doing so!

If funds are not being used and you knew there are open trades likely your acct does not have such symbol or that you might not have enuf margin to copy the trades. If you cant see any open trades (coz SP has chosen to hide open trades) perhaps SP has yet to open a trade. To track this, you can try viewing SP history page to check whether any close trades done for that day on the next day or after some hours on same day (it depends on frequency of SP trading, there might be 0 closed trades n 0 open trades for sometime)

@Athena

Athena

23 Jan 2025, 22:55

( Updated at: 23 Jan 2025, 22:59 )

You missed the point COMPLETELY! In ctrader copy functionality, a SUB (subscriber) account is created. You can indeed view your prop firm ctrader acct once you have login via ct.spotware.com or via your prop firm ctid that they have given you.

DO note that for most prop firms, they will give you their own ctid and password thats unique to you only. Even other prop traders from same prop firm, DONT have and cant access your prop firm acct for security/accountability/tracking purposes. Prop firms might not have a “fix” ctid unlike brokerage (for brokerage its usually eg “ct.brokeragename.com”. Prop firms usually work with brokerage to provide the price feed/execution as they are not brokerages, they usually dont have access to the market and they likely wont invest into providing that ECN model structure that spotware designed specifically for ctrader

If you login to prop firm ctid you can only view the prop firm accts NOT your own ctrader. Its only via “ct.spotware.com” that you could view all ctrader accts.

Since spotware auto create a subs account for subscriber, the trades NEVER went into the actual ctrader account. Using the subscription mode for prop firm account meant, the trades are in SUB acct not in prop firm ctrader acct EVER. Prop firm can view that sub acct but cant keep track the way they wanted and you will be DQ: disqualified). Prop firms might even placed restrictions for you to use the account for trade copying. Check the terms n conditions with the prop firm

@Athena

Athena

23 Jan 2025, 22:42

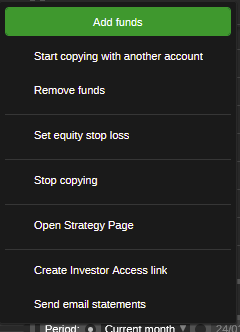

of course! for each ctrader account they need to fund it then allocate the funds to your strategy to start copying. There is now an added function: “Start Copying with Another account” which subscriber can choose by right clicking against their subs acct (Right click on the 3 dots against a subs acct to select "start copying with another account, refer below options). This must be done against one of the subs acct that has subscribed to your signal.

@Athena

Athena

23 Jan 2025, 22:30

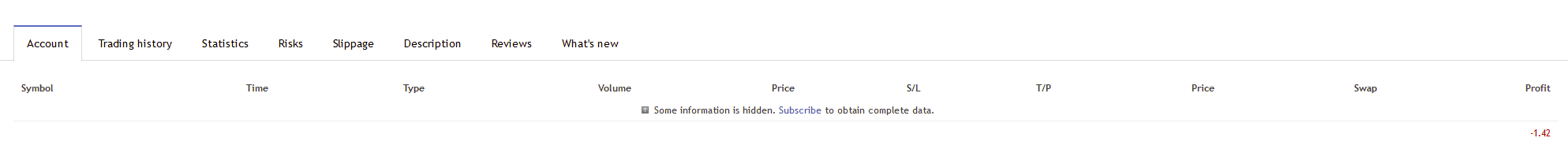

No open positions

No open positions displayed

If sp chose not to display open positions you cant view them even if you are a subscriber of this SP

Equity Stop Loss

Equity stop loss as the term implies meant that when your EQUITY falls below or equal (EQUITY ≤ set EQSL), position is then liquidated with the largest lossing trade (in account currency $) till your EQUITY is > set EQSL

*EQSL=EQUITY STOP LOSS

Equity = account balance ADD floating p/l. Note if floating p/l is negative, eg given balance=USD1000, floating p/l= -100. EQUITY= USD1000 + (-100) ==> $900.

$50 is the minimum EQSL that spotware automatically applied to your subs acct when u subscribed to a strategy. You have a floating p/l of -$72.07 and your EQUITY = $130 (Balance=200 + (-72) ==> about $128). As you notice your equity will keep changing due to market conditions/price movement etc

@Athena

Athena

23 Jan 2025, 08:11

RE: Copy - Scam

ncel01 said:

Hi,

There you have the reason!

Maybe his broker allows 0.1 or even 0.01 units on indices, meaning that you were trading 10x or even 100x more than him on NASDAQ, reason why your account has blown!

Note that Spotware is not protecting traders regarding this. Equity-to-equity ratio is not applicable when it comes to the minimum trading quantities.

For instance, even if the equity-to-equity ratio is 1:1 and the volume ratio is 1:100, a position will always be open with the min. applicable trading quantity!!

Interesting, isn't it?

Suggestion: I would avoid any broker with min. trading quantities of 1.0 units at all costs as these conditions are not acceptable at all.

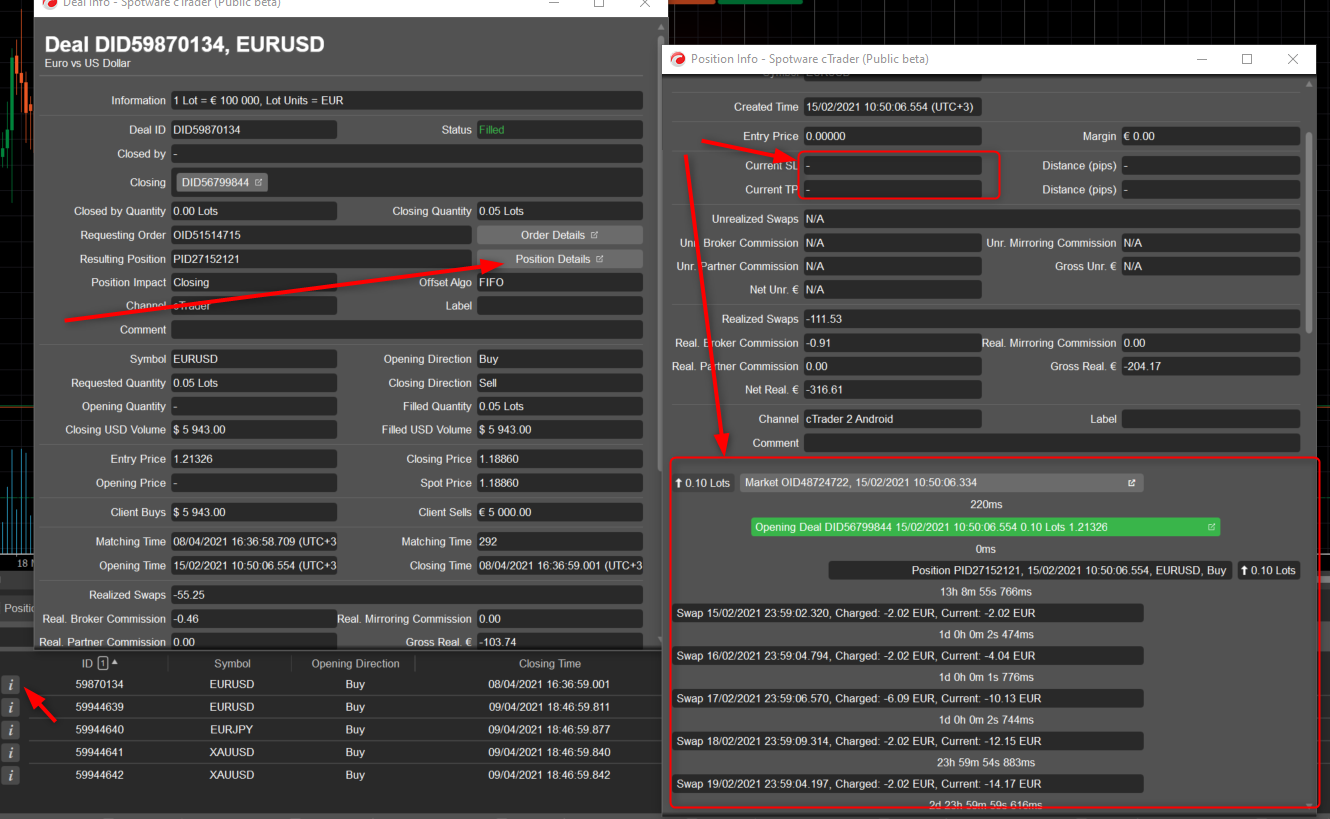

Hi i do agree that leverage can be a “blessing” as well as “danger”. I lobbied for spotware to display floating p/l without displaying the trades or details of the trades. Historical records would have given a subscriber some clues what SP might be trading. This request was ignored. Without this and the fact that spotware allowed SP to hide their open trades without consideration of providing some sorta of ability to view the floating p/l for subscribers, its just hard to know whether SP had huge losses floating in their current open positions

Spotware seems to want to protect the SP more than the subscribers. I dont understand, why spotware find it so difficult to just display ONE line the total floating p/l. Pls refer picture below. I am not a subscriber of this signal, but i could clearly see the floating loss on this SP and make a decision whether i wanted to subscribe, combined with going thru the history of SP trades, duration, ROI pump activity etc. I actually posted this similar screen to suggest that spotware implement this even while allowing SP to hide open trades. Its a win-win situation for both. Caveat emptor

@Athena

Athena

29 Jul 2021, 13:08

RE:

amusleh said:

Hi,

We just want to be sure that there is such an issue, and if possible can you post a sample cBot code that can replicate this issue.

cant post sample code as i dont own the bot. For summary reporting, sometimes its correct. I will continue monitor and check again. I am aware that summary wont report till test is completed. If test was incomplete likely no summary so is not a case whereby test was ongoing. I am checking to make sure that backtest has ended n the end period that i selected has ended (the "needle" or progress bar with date shown is my end date) to ensure completeness as well

@Athena

Athena

29 Jul 2021, 11:22

amusleh said:

SmallStep said:

Hi is v4.0 and brokerage=ICMarkets

I am also getting weird data, eg, I ran VBT from 1/1/2012 to 31/12/2020, start time 0101 to 2359 (bot trading times) i cant get any 2019 or 2020 trades at all. It might be the bot settings, but when i tried with same date ranges, same other settings and time 0101 to 0459, i got some 2020 trades. It might be some bugs with the bot, but would like to know whether there might be the issue and not with ctrader VBT

I test but I couldn't replicate the issue, can you record a short video?

Hi I could do a vbt and record it, but results is only after testing is done, so i am not really sure, how video can proof the summary function may have bugs?

@Athena

Athena

28 Jul 2021, 15:19

Hi is v4.0 and brokerage=ICMarkets

I am also getting weird data, eg, I ran VBT from 1/1/2012 to 31/12/2020, start time 0101 to 2359 (bot trading times) i cant get any 2019 or 2020 trades at all. It might be the bot settings, but when i tried with same date ranges, same other settings and time 0101 to 0459, i got some 2020 trades. It might be some bugs with the bot, but would like to know whether there might be the issue and not with ctrader VBT

@Athena

Athena

12 Apr 2021, 09:13

( Updated at: 21 Dec 2023, 09:22 )

RE:

PanagiotisCharalampous said:

Hi SmallStep,

History displays the executed deals. TP and SL are a property of the position on not of the individual deals. Also it might change many times during the position's lifetime. So a column in the History tab with not represent meaningful information. To see information about the TP and SL, you need to go to Deals information > Position Details and there you can see the current TP and SL, as well as the history of TP and SL modifications.

Best Regards,

Panagiotis

Thank u, this is indeed more useful than the usual s/l, t/p levels shown on mt4/mt5 columns

@Athena

Athena

05 Apr 2021, 10:44

Hi margin level formula

(Balance + floating P/L (equity) / margin used) * 100%

if provider or you has a lower margin level these could be the reason

1) Provider/you have a higher leverage eg if provider=500 leverage and you have=100. Having less leverage meant a higher margin required

FORMULA for margin required/needed

Basically formula for margin required==> Vol of trades x contract size x entry price / leverage

eg vol of trades=0.05, contract size=100.000, entry price=1.22573 (for EURUSD)

for an account with 500 leverage margin needed/used==>0.05 x 100,000 x 1.22573 /500==>$12.26 (its a currency thus its rounded to 2 decimal)

for an account with just 100 leverage margin needed/used==> 5x as much $61.29 (5000x1.22573/100)

For some instruments eg BTCUSD there might be different margin requirements. You have to look at the instrument's specifications to calculate margin as above formula

===================================================

Formula for margin level

When a trade is open there would be floating p/l, cause by

a) market movement eg you buy 5000 EURUSD, bid price=1.22574

b) spreads

c) commission as charged by brokerage

d) swaps is any

Due to differences in margin used the same floating p/l eg $100 negative have different impact on the account,

Assume that both accounts have $1000

For account with 500 leverage, the margin used as calculated above was $12.26, thus a floating negative of $100,

Margin level[=$1000 + (-100) / $12.26] x 100%==>7340.94%

For account with 100 leverage, the margin used as calculated above as $61.29

Margin level=[$1000 + (-100) / $61.29] x 100%==>1468%

==================================================

I suggest you goto babypips.com to learn about basic concept of margin/margin level

@Athena

Athena

11 Mar 2021, 00:36

( Updated at: 21 Dec 2023, 09:22 )

RE: Disallow Provider to start with a balance below minimum stated on his/her strategy

In addition, I realised that I cant withdraw till below minimum investment amount unless i stop copying. Since this is the case

1) Provider should not be allowed to withdraw below minimum investment amount at any point

2) Provider should not have a balance BELOW his/her stated minimum investment. It wont make reasonable proportionate ratio if provider has eg $100 and stated a minimum investment of $200, thus forcing an investor to invest MORE than his/her own starting balance. Preventing this will forced any provider to decide carefully on the minimum to be invested into the strategy "putting his/her money to match his/her strategy"

This request is to ensure that BOTH provider and subscriber have the SAME investment condition during withdrawal and during trading

https://ct.icmarkets.com/copy/strategy/20490

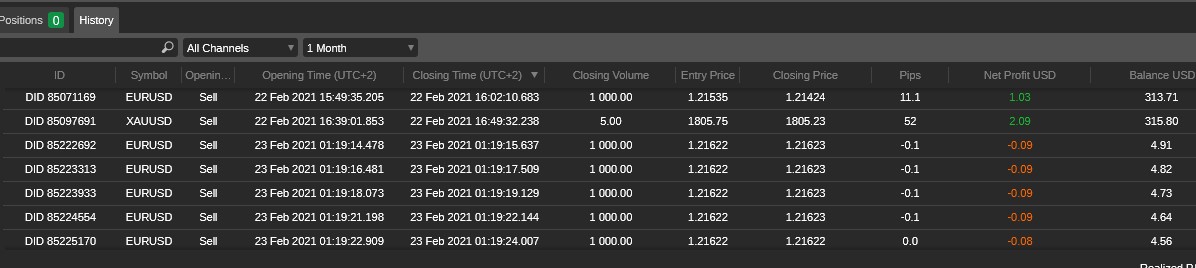

The provider stated minimum invested amount of $250, charged a 25% performance fees and also $25/$million USD volume fee. Notice that balance was $315.8. All of a sudden followed by at least 50 or so trades all closed within less than 1 min and balance for 1st lost trade went to $4.91. This meant that provider purposely withdraw his funds to about $5, quickly started to fire off loads of trades and make sure closed them within 1min. This then created an imbalance into subscriber's acct creating huge lots into subscriber who had the minimum of $250 (as was stated)

This is obvious churning of accounts

SUGGESTION: Spotware should check and disallow provider to WITHDRAW more than the his/her own stated minimum balance so that to remain proportionate and appropriate for his/her own strategy. This will also reduce this kind of churning behavior so that provider realised he also had something more to lose

At point at which a subscriber followed/copy a strategy ctrader copy logic will check and disallow if subscriber has LESS than whats stated as minimum, as well as alert the subscriber if he/she has lesser leverage than provider. This should be reciprocal applied to provider too block withdrawal below his/her own stated minimum investment amt

@Athena

Athena

24 Feb 2021, 10:36

open ctrader accounts from same ctrader.exe

Hi Panagiotis

My issue is that i have 2 brokerages and i did sign up with same email and notified that all accounts to be linked to my ctid. I downloaded from brokerage A the ctrader.exe and installed that (on desktop). I am able to open a few sessions each with different accounts for SAME brokerage but not able for different brokerage. I just cant view brokerage B's accts under brokerage A ctrader despite using same ctid.

In mt4 its easily solved by doing a "search' and just login and install mt4.exe to different folder. So basically i can download brokerage A mt4.exe installed into eg Folder=Brokerage A, folder=BrokerB to get 2 mt4. Then i login to mt4/1 with brokerage A details for my accts. Open mt4 and do a search for brokerage B and click against that, and login to brokerage B mt4 account. If search didnt return anything meaningful its always possible to directly typed the server name, account number and password.

I have asked around and seems nobody can give an intelligent answer how to use the same ctrader installer from brokerage A to view brokerage B ctrader acct thats has the same CTID. even the cweb (ctrader web base) used different URL for different brokerages. I dont quite mind the different URL as i can always open a new tab or a new window and work with that, but for desktop ctrader it should be easy to login to ONE ctid and able to view all brokerage accts. Or i am doing something wrong, coz I have watched the tutorial video and its suppose to be working and its working under cweb at the moment. My friend show me that he had 3 brokerages ctrader all able to view under cweb under same ctid

@Athena

Athena

19 Apr 2025, 00:54

RE: RE: Can I use cTrader Copy for my Prop firm accounts?

Routik said:

@Athena