Topics

Replies

luciancastro89

01 Sep 2020, 15:16

( Updated at: 21 Dec 2023, 09:22 )

RE:

PanagiotisCharalampous said:

Hi Lucian,

What do you mean when you say it is getting "double orders"?

Best Regards,

Panagiotis

Hi Panagiotis,

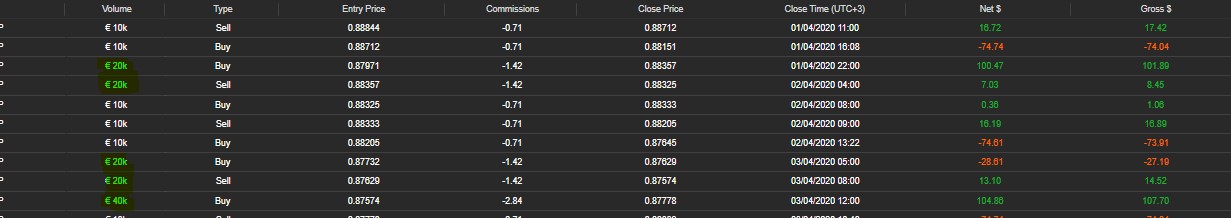

Instead open only the first trade with double volume after a loss, it is opening the first and the second trade... check image please

@luciancastro89

luciancastro89

01 Sep 2020, 12:07

Hi Panagiotis, just spent more time with my code, I think Im almost there, the issue now is that MG is getting double orders.. here is the code

using System;

using System.Linq;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using cAlgo.Indicators;

namespace cAlgo

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class rsimg : Robot

{

[Parameter("Instance Name", DefaultValue = 4, MinValue = 1, Step = 1)]

public string InstanceName { get; set; }

[Parameter("Stop Loss", DefaultValue = 50)]

public double SL { get; set; }

[Parameter("Take Profit", DefaultValue = 150)]

public double TP { get; set; }

[Parameter("Quantity (Lots)", Group = "Volume", DefaultValue = 1, MinValue = 0.01, Step = 0.01)]

public double ParamVol { get; set; }

[Parameter("Long Trades", Group = "Positions", DefaultValue = 1, MinValue = 0)]

public int MaxLongTrades { get; set; }

[Parameter("Short Trades", Group = "Positions", DefaultValue = 1, MinValue = 0)]

public int MaxShortTrades { get; set; }

[Parameter("Source", Group = "RSI")]

public DataSeries Source { get; set; }

[Parameter("Periods", Group = "RSI", DefaultValue = 14)]

public int Periods { get; set; }

[Parameter("RSI Overbought Level", Group = "RSI", DefaultValue = 80, MinValue = 1, Step = 1)]

public int RSIOverB { get; set; }

[Parameter("RSI Oversold Level", Group = "RSI", DefaultValue = 40, MinValue = 1, Step = 1)]

public int RSIOverS { get; set; }

private RelativeStrengthIndex rsi;

private int LongPositions = 0, ShortPositions = 0, MaxLong = 0, MaxShort = 0;

protected override void OnStart()

{

rsi = Indicators.RelativeStrengthIndex(Source, Periods);

MaxLong = MaxLongTrades;

MaxShort = MaxShortTrades;

}

protected override void OnBar()

{

var LongPositions = Positions.FindAll(InstanceName, Symbol, TradeType.Buy);

var ShortPositions = Positions.FindAll(InstanceName, Symbol, TradeType.Sell);

double v = Symbol.QuantityToVolumeInUnits(ParamVol);

HistoricalTrade lastClosed = History.FindLast(InstanceName, Symbol);

if (LongPositions.Length < MaxLong && rsi.Result.LastValue < RSIOverS)

{

}

ExecuteMarketOrder(TradeType.Buy, SymbolName, v, InstanceName, SL, TP);

Close(TradeType.Sell);

}

if (ShortPositions.Length < MaxShort && rsi.Result.LastValue > RSIOverB)

{

}

ExecuteMarketOrder(TradeType.Sell, SymbolName, v, InstanceName, SL, TP);

Close(TradeType.Buy);

}

}

private void Close(TradeType tradeType)

{

foreach (var position in Positions.FindAll(InstanceName, SymbolName, tradeType))

ClosePosition(position);

}

}

}

@luciancastro89

luciancastro89

13 Jul 2020, 00:51

Many thanks for your help, I'm going to backtest it right now!!

@luciancastro89

luciancastro89

08 Jul 2020, 18:08

Ok thanks for your reply!

Im trying to modify this bot, istead of buy/sell when period K cross D on the stochastic, the bot should buy when are oversold and sell when overbought on stochastic.

Also if it is possible to add a moving average to help, only buying when price closes above MA and sell when closes below.

This is the code:

using System;

using System.Linq;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using cAlgo.Indicators;

namespace cAlgo.Robots

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class StochasticBot : Robot

{

[Parameter("Quantity (Lots)", Group = "Volume", DefaultValue = 0.01, MinValue = 0.01, Step = 0.01)]

public double Quantity { get; set; }

[Parameter("Take Profit", Group = "Risk", DefaultValue = 150, MinValue = 4, Step = 1, MaxValue = 1000)]

public int takeProfit { get; set; }

[Parameter("Stop Loss", Group = "Risk", DefaultValue = 150, MinValue = 4, Step = 1, MaxValue = 1000)]

public int stopLoss { get; set; }

[Parameter("Percent K", Group = "Stochastic", DefaultValue = 150, MinValue = 4, Step = 1, MaxValue = 1000)]

public int percentK { get; set; }

[Parameter("Percent K Slow", Group = "Stochastic", DefaultValue = 150, MinValue = 4, Step = 1, MaxValue = 1000)]

public int percentKSlow { get; set; }

[Parameter("Percent D", Group = "Stochastic", DefaultValue = 150, MinValue = 4, Step = 1, MaxValue = 1000)]

public int percentD { get; set; }

private StochasticOscillator stochasticOscillator;

private double volumeInUnits;

protected override void OnStart()

{

volumeInUnits = Symbol.QuantityToVolumeInUnits(Quantity);

stochasticOscillator = Indicators.StochasticOscillator(percentK, percentKSlow, percentD, MovingAverageType.Exponential);

}

protected override void OnBar()

{

if (stochasticOscillator.PercentK.Last(2) < stochasticOscillator.PercentD.Last(2))

{

if (stochasticOscillator.PercentK.LastValue > stochasticOscillator.PercentD.LastValue)

{

Print(stochasticOscillator.PercentK.LastValue);

ExecuteMarketOrder(TradeType.Buy, SymbolName, volumeInUnits, "Stochastic", stopLoss, takeProfit);

}

}

if (stochasticOscillator.PercentK.Last(2) > stochasticOscillator.PercentD.Last(2))

{

if (stochasticOscillator.PercentK.LastValue < stochasticOscillator.PercentD.LastValue)

{

ExecuteMarketOrder(TradeType.Sell, SymbolName, volumeInUnits, "Stochastic", stopLoss, takeProfit);

}

}

}

protected override void OnStop()

{

// Put your deinitialization logic here

}

}

}

@luciancastro89

luciancastro89

01 Sep 2020, 16:06

RE:

Thanks

@luciancastro89