Topics

Replies

ncel01

04 Jun 2023, 19:00

Hello,

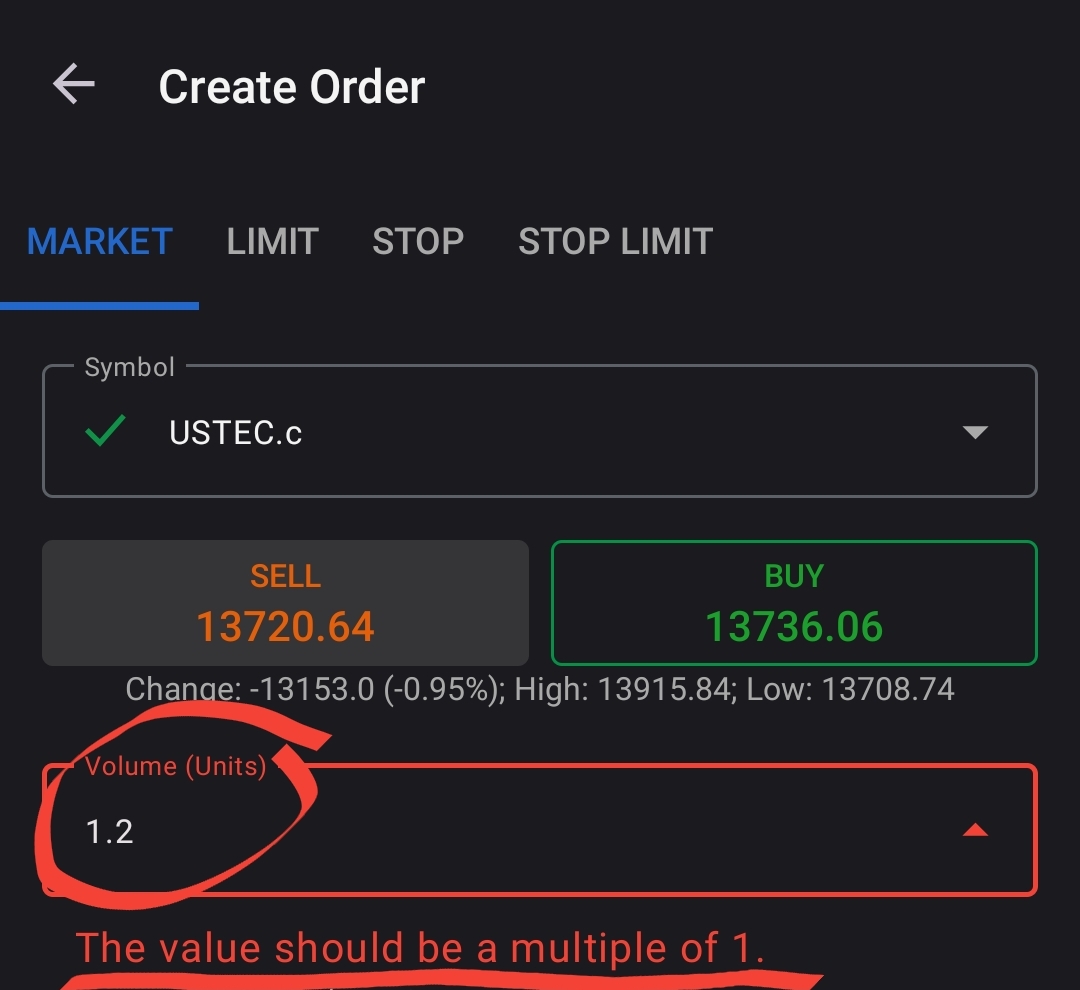

A minimum quantity of 1 unit on indices is not a cTrader limitation since some brokers allow a minimum of 0.01 by default. Even if this quantity is not available by default, some brokers still allow micro lots (0.01 units) as a min. trading quantity on these instruments to be applied to the respective trading account upon request.

I would avoid this broker to trade indices since a min. quantity of 1 unit represents a huge limitation and risk when trading these instruments. Something not acceptable.

Mysteriously, unlike leverage, min. trading quantities have not yet been regulated within EU. Meanwhile, brokers are able to do whatever they want regarding this.

@ncel01

ncel01

24 May 2023, 15:15

Hi J.Lo,

Although Spotware's approach to this issue is always the same (requesting for cBot code), it has become evident that this is a cTrader core issue, which has nothing to do with any cBots, as you just proved, like many other traders did in the past.

This issue has been reported since 2013, so don't expect it to get fixed anytime soon.

Also, don't expect any reply from Spotware after it becomes clear in your post that cBots are not the issue.

@ncel01

ncel01

24 May 2023, 12:14

( Updated at: 24 May 2023, 12:16 )

Panagiotis,

1.

The issue raised in this post was reflected in the trading conditions, was fixed soon after and traders were compensated.

How do you know this? As far as I can see, the screenshot on the original post does not show any trading conditions but the unrealized swaps.

2.

What you see is what you get. So there is no issue with the platform.

As I've shown, this is not always the case. Refer to 3., 4. and 5.

3.

Can you provide evidence of this?

What further evidence is required, apart from the screenshot I've already provided? Do I need to prove that the value of 1 Nasdaq is ~$13.7k and not $1?

See 5.

4.

So another case where somebody messed up with the symbol configurations.

Maybe. The main point here is that this information is not always linked, without fail, to the real trading conditions, as proven. Refer to 3. and 5.

This goes against what you have stated in 2.

Remark: The conditions shown remain and, probably, will always remain like this.

5.

How does this support your claim that applicable conditions and the conditions shown are not always matching?

This has been explained in 3.

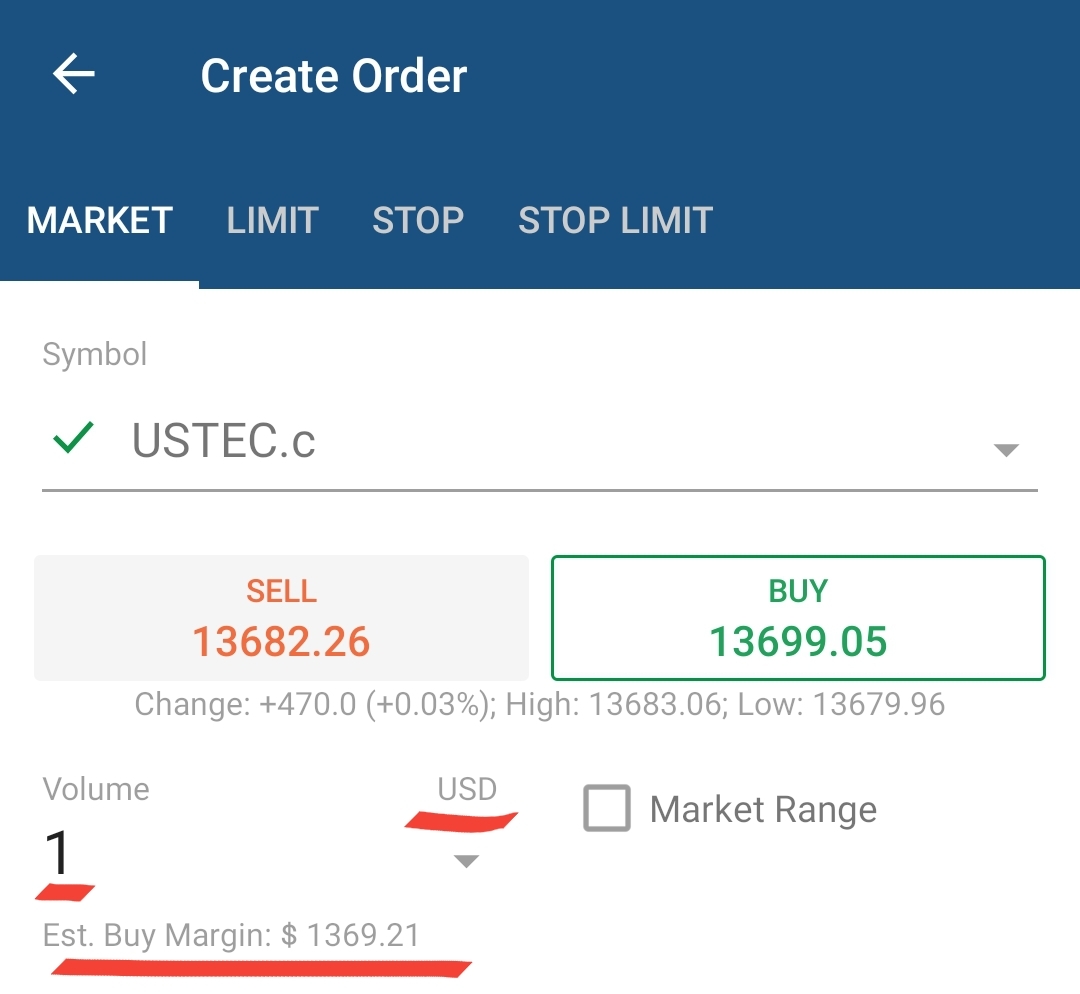

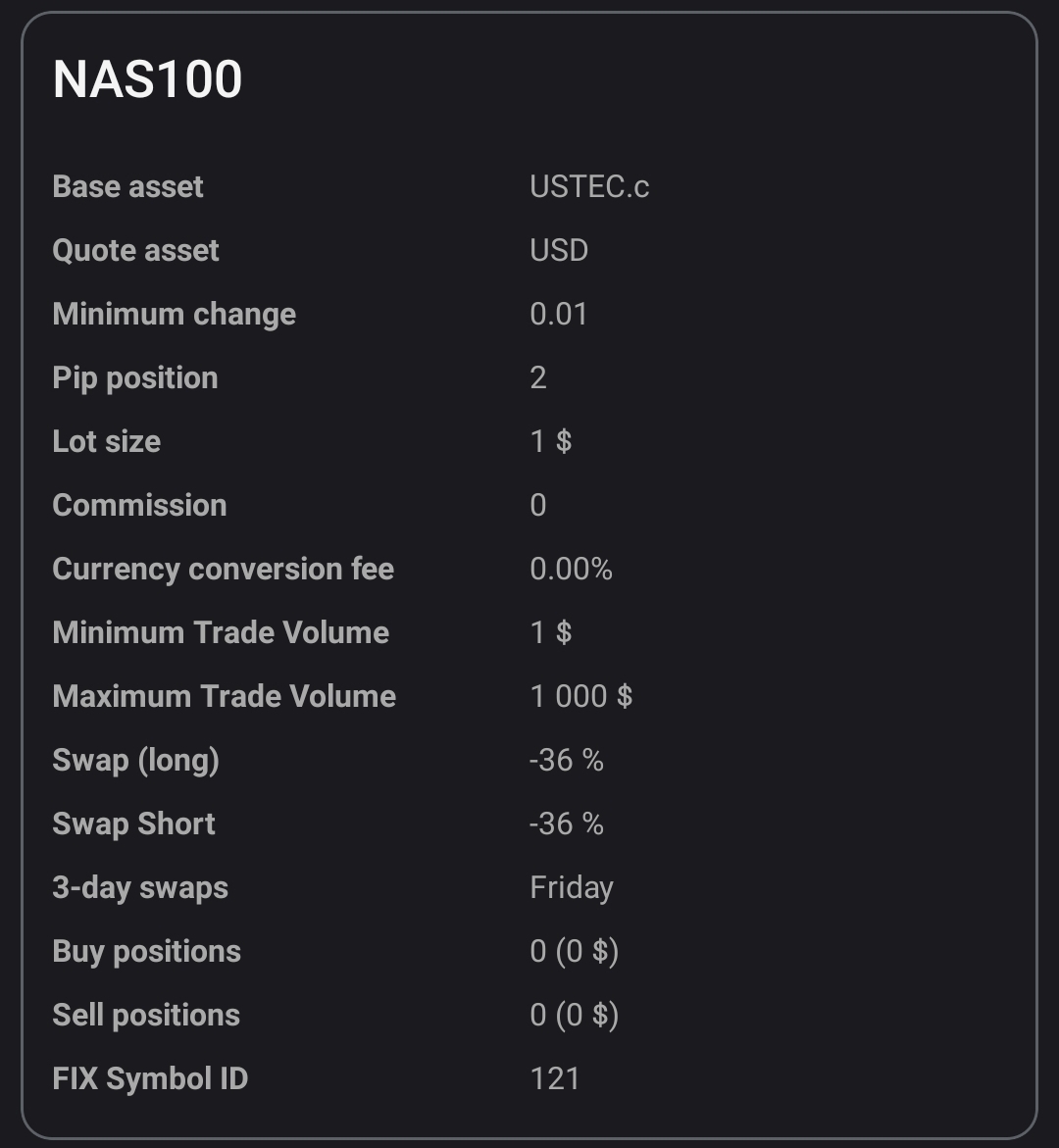

Trading conditions, which traders use as reference and rely on, a min. investment of $1 is clearly stated. Outcome: you get a min. investment of 1 unit on this indice, whose value is not $1 but ~$13.7k.

Clear as crystal.

@ncel01

ncel01

23 May 2023, 13:32

Hi Panagiotis,

To clarify:

It's okay if someone makes a mistake, that happens and it is normal.

What I would like to know is if, at the moment the wrong swaps have been applied, these have been reflected in the trading conditions or not. In other words, I'd like to know if the trading conditions shown in cTrader are, without fail, always liked to the real conditions applied or not.

No need to explain how serious the implications can be in case of a mismatch here.

Rather than qualifying pertinent/uncomfortable questions as a conspiracy, it would be great to see those clarified.

Also, don't expect me to believe that traders and brokers play on the same team.

In fact I don't think that the applicable conditions and the conditions shown are always matching. Why?

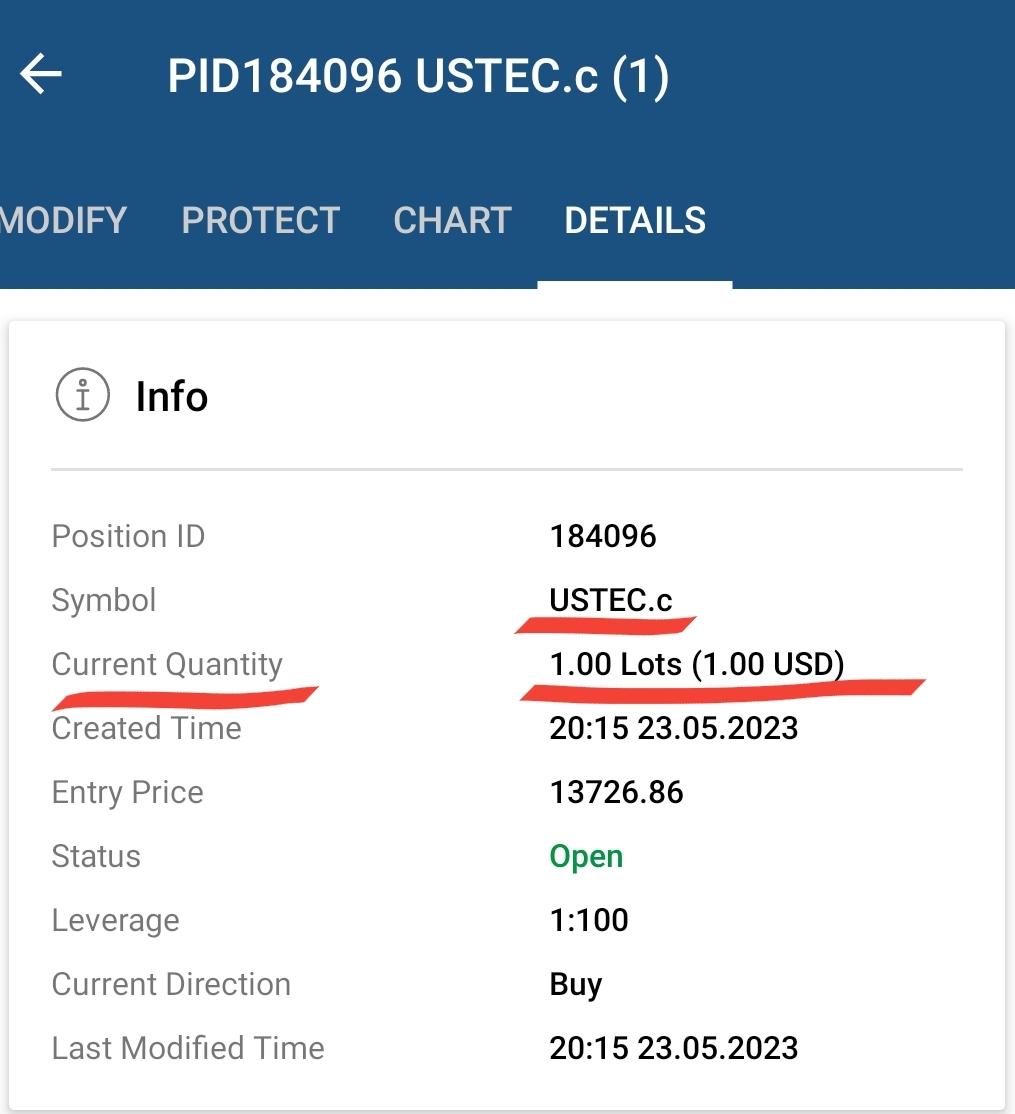

Below is an example taken some time ago for a certain broker. Lot size is in fact not $1 but 1 unit.

Am I wrong by thinking this is not a detail and it can have serious implications on any trading account? I don't think so.

Swaps: do not deserve any comments.

@ncel01

ncel01

23 May 2023, 10:58

How can be that a broker is able to circumvent the trading conditions as they are shown and mess with these?

Describing this simply an "issue" is an understatement as this should never be allowed by cTrader. Something that definitely must be clarified by Spotware.

Moreover, "issues" are never in favour of traders.

It is totally unacceptable that traders cannot even trust the trading conditions as they are shown.

@ncel01

ncel01

15 May 2023, 16:18

RE: RE:

ctid4575606 said:

Hi, thank you for your reply.

I voted for your post, although I am not sure how the features are selected and planned.

ncel01 said:

Hi there,

I have also suggested for this some time ago but, apparently, no one cares:

Hi,

Based on the votes only, I guess.

I believe that low vote suggestions will never get off the drawing board, no matter how relevant these can be. However I am not completely sure about this.

@ncel01

ncel01

12 May 2023, 19:36

Hi heinrich,

No, they are not stored in the server but on the client PC in the environment of the cTrader application.

I see. It makes even more sense.

Anyway, the inputs defined on cTrader are somehow stored and it would be great to have an option to apply these.

However, it was said in the demo video that the final release will have the ability to pass the parameters in a file...

Yes. However, it would be great to also see the option to get these directly from cTrader.

In addition to above, I am also expecting the following:

1. The possibility to check (at a glance), on cTrader, all the cBots running from the the console, so that traders can easily keep control/track on these.

2. That console will be multi instance and that a single instance can have the ability to run multiple cBots within the same account.

3. Last but not least: I really hope that memory usage will remain stable and that it will not rise overtime.

What is bothering me much more is the fact that the cTrader console can be used for live trading ONLY - as I understand it.

I really hope not as this would be too bad to be true.

Why do you need/want to backtest strategies from the console btw?

@ncel01

ncel01

12 May 2023, 10:11

This was a Spotware demonstration of the console, I see.

Apparently it was intended to be released with cTrader 4.2 (Nov 2021), one year and a half ago, but hasn't been released yet.

I wonder what priority has been given to this..

I'll maybe be able to convert all my cBot code to MT4/5 sooner than this is made available..

60MB: seems to be a lot of memory usage for a simple console. More than the memory used by MT4/5.

Also being limited to the cBot default parameters makes the console useless, from my point of view. Moreover, this doesn't make much sense to me, reason:

Cbot parameters when defined in cTrader remain there even when closing and launching the application again, meaning that these are stored somewhere in the server. So, why not an option to use these values (defined in cTrader user interface) when running the cBots through the console?

Last but not least:

As expected, this video shows that not only with me cTrader gets unresponsive.

@ncel01

ncel01

11 May 2023, 12:41

firemyst,

If you consider this as a bug how would you classify cTrader memory leaks? A detail?

Although it is okay to report any issue (of course), I prefer to focus on cTrader core issues, that's why I said I didn't even consider this to be an issue.

By core issues I mean issues that directly have impact on your trading outcome/results, which is not the case here.

@ncel01

ncel01

11 May 2023, 10:59

firemyst,

I can confirm the same discrepancy between cTrader desktop and cTrader mobile.

However, I don't even consider this to be an issue. In other words, I'd love all the cTrader inconsistencies/"issues" to be like this.

I am much more worried about the fact that cTrader RAM usage doubles each few hours and that I am not able to perform any algorithmic trading. That's is for me an issue, not this matter and, about that, I haven't seen any comments lately.

By looking at many posts here, sometimes I wonder if traders are expecting cTrader to be an effective trading solution or, on the other hand, only a fancy, visually attractive and highly inefficient application.

After all, as desired, you're able to sort all the trades in history, right?

Just keep the filter that suits your needs in cTrader mobile and that's it. In fact, there are only two options to select from: ascending/descending. No need to solve any complex equation to get this done.

@ncel01

ncel01

11 May 2023, 03:13

Hi firemyst,

Yes, it still can make sense.

As far as I can see, there is no mention to ascending/descending in cTrader desktop. This means that, most likely, what you consider to be a descending order has been defined as an ascending order.

This makes sense if the criteria is, for instance, the elapsed time between the closing and current times.

@ncel01

ncel01

10 May 2023, 17:18

( Updated at: 21 Dec 2023, 09:23 )

RE:

firemyst said:

@Spotware or anyone:

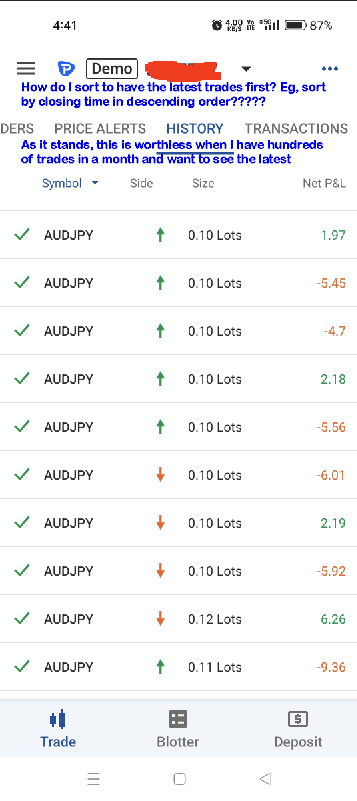

I want to check my most recent trades on the mobile platform. Is there no way to sort the data by any kind of date in descending order so all my latest trades are at the top? I have hundreds of trades across multiple symbols in this list:

Thank you

Hi firemyst,

Did you try the filter (3 dots at the top right corner)?

@ncel01

ncel01

10 May 2023, 14:01

RE: RE:

heinrich.munz said:

ncel01 said:

Dear cTrader team,

Will this be a standalone app or, can it only be launched with cTrader?

Thanks.

Yes it will be stand alone.

See this demo video of cTrader Console starting at around 29Min, 47 Secs

Hi heinrich,

Thanks for sharing the video, I'll look into it later.

I really hope it will be standalone!

Does this mean that a console has been already available in the past? I am a bit confused..

@ncel01

ncel01

06 Jun 2023, 10:32

firemyst,

I'd make it clear that Pepperstone doesn't support cTrader copy when suggesting this broker, since it is quite likely that traders are also looking for this.

@ncel01