Topics

Replies

Jimmy

03 Feb 2017, 15:54

RE:

Spotware said:

Hello.

change settings according to what Spotware allows and nothing whatsoever exists to harm traders, something we take very seriously and an ethos we built our brand around.

Spotware Team.

And what exactly can they change ?

Is it true what isomorph said above ? Can the broker alter the price feed ?

@Jimmy

Jimmy

03 Feb 2017, 15:48

RE: RE: RE:

isomorph.0 said:

moneybiz said:

Spotware said:

All server are connected to real price feeds via FIX API, Spotware also manages those integrations directly with the technology provider who supports them.

It would be impossible for a broker to compromise cServer.

cServer <- Manipulated Price Feeds Server <- LP Price Feeds Server

So you're claiming that there is no possibility for a server in the middle between cServer and liquidity provider's price feeds, because you directly manage this integration?

LOL good one. i was just gonna post something like this. good thing i came on this forum as i felt myself being lured in more and more by cTrader brokers, most of which, upon closer examination, are nothing but systematic internalizers (ICMarkets, MaxFX (TopFX), Kawase (TopFX), etc), and at best hybrid A/B-book brokers (FxPro, Pepperstone).

i am going to use a real life example, that of ICMarkets to illustrate the basic concepts pertaining to this discussion.

if you read their legal documents, the PDS, that they are force to issue publicly thanks to the Australian regulator, ASIC, you will discover that:

1- all ccys you trade with them are in fact FX derivative contracts, which they call Margined FX (think of it as CFDs on ccys), whose price is derived from the underlying rolling SPOT FX contract that is traded on the interbank market where professionals and institutional entities execute their trades;

2- the PDS document further states that if the underlying market, that is, the real market in a ccy that you happen to be trading suddenly disappears, that is, is not available for a some period of time, ICMarkets will MAKE a price for its clients, thus allowing trading to continue in that particular ccy even though there might not be any real market underlying such transactions, and of course, reserving themselves the right to refuse executing orders from the client if that does not suit their parameters--this is all in the legal docs--which means that if a trader happens to win big and there is no underlying market available at the time, they cannot hedge the risk properly, so they will refuse executing close orders. of course, if it's only a small number of traders and on aggregate the risk amount that sums up to a notional amount less than what is allowed in their operational risk capital allocation, they will eat the loss and let those traders take their profits, the traders not knowing or understanding what actually happened. this is why the first question to ask any broker should always be:

HOW DO YOU MANAGE YOUR CLIENT RISK? and based on the answers you get, you will know whether or not it is a broker that puts its interest first or tries to provide a fair win-win environment for both clients and broker;

remember how after the SNB liquidity even in January 2015 they refused to forgive their clients' negative balances? well, now you know why. same thing with SAXO Bank on the retail side of their business.

3- finally, when entering in a trade using any ICMarket provided platform, be it MT4 or cTrader, the counterparty is always ICMarket--not some other trading entity on their alleged ECN. so right there you can see that there is no TRUE ECN or STP or whatever meaningless acronym they happen to use in their marketing, regardless of the fact that your trading app might show you a DOM display with Level 2 quotes; and because their are always the trader's counterparty, they need to hedge that risk and open a similar trade in the real market (on which their contract price is based), which means they have to find a counterparty to match their trade.

therefore as moneybiz so clearly showed, the following could very well take place:

cTrader <-- cTrader Server <-- broker pricing engine <-- broker aggregator and other backend risk management software <-- PB and/or PoP feeds OR LP feeds (LP could also mean institutional ECN like HotSpotFX, for ex, which receives and aggregates institutional bid/ask volume from institutional market makers aka Tier 1 FX banks (Barckays, DB, etc))

you can see already that in this chain there is plenty of opportunity for mischief from the Tier 1 entities, down through the PBs and all the way down to the retail broker.

for ex example, the broker's pricing engin after receiving all the data from the aggregator can spike the price on the ask or bid of any instrument if they wanted. or, they could instead just purchase an aggregator solution that let's them do that instead of building their own pricing engine: go the website of OLFA Trade to read all about such capabilities.

and so in the end, whatever price data comes down into the cTrader server could be very far from pure. and even though it is of no fault of and out control from Spotware, everything upstream of cTrader server could be manipulated any which way the broker wants, such as padding the fill prices by specific amounts in order to extra more money from each trasaction on top of the commissions already paid, for ex, and these new prices are then fed into cTrader server.

fact: "The city and state of New York and US Department of Justice have filed separate lawsuits against Bank of New York Mellon, alleging the world’s largest custody bank defrauded pension funds, US banks and millions of investors nationwide on currency transactions for 10 years."

source: https://www.ft.com/content/c3b27d78-eec7-11e0-959a-00144feab49a

so as you can see, if this is the environment at the highest levels of finance, what do you really expect at the bottom of the barrel, ie the retail sector?

but please, Spotware rep, feel free to prove me wrong. we would all learn something new then.

Thank you, i have just lost all trust in Spotware.

@Jimmy

Jimmy

26 Jan 2017, 22:24

Offline backtest

Yes this is a primary need, it HAS to be possible to do offline backtesting with imported data.

I have written some highly profitable robots in MQL but i do not trust them, i know what 'they' can do with my trades on the other side.

Somehow i feel that there exists an element of trust when it comes to spotware, don't ask me why.

Now my idea is to convert my MQL robots to Calgo but if i can not run a backtest offline i will not proceed.

I have historic data from 1970 up to today.

I see NO reason as to why the terminal has to be online for me to run these backtests.

Please implement the feauture.

@Jimmy

Jimmy

26 Jan 2017, 22:11

This is utter horror.

I joined years ago but left quickly because there was so many things wrong with the spotware software.

Now, years later i decided to re-install the platform and give it another shot, just to decide it is still utter horror.

WHY does it have to be online WHY can you not simply run back tests offline WHY ?????

I do not want my pc to be connected all the time especially since this software only runs on windows !!!.

So many limitations WHY ???

Why can't the developers use common sense and create something useful in stead of a software piece that fails on so many levels?

@Jimmy

Jimmy

15 Apr 2016, 20:53

( Updated at: 21 Dec 2023, 09:20 )

So i was disappointed to find that i can not create / design GUI on chart so now i create my hedge center in VS but i need to capture the event and i can not find the correct way to do so.

I used to read article about how to do it but i can not locate it anymore.

@Jimmy

Jimmy

22 Jan 2016, 11:10

RE:

Spotware said:

Dear Trader,

We receive prices from various LPs for demonstration purposes.

Yes, i understand that.

But my question is about the platform run in Demo mode.

It seems to me that when i place an order, price magically gravitates towards my take profit point.

This causes suspicion to me, it is almost as if the platform 'helps' to win the trade by manipulating and moving the price in my favor.

I read that there was no price feed intervention possible, so my question is simple.

Does this also apply to the platform run in demo mode ?

A simple Yes or No will be sufficient.

Thanks.

Jim.

@Jimmy

Jimmy

21 Jan 2016, 16:53

( Updated at: 21 Dec 2023, 09:20 )

Ah okay i understand now.

But i have another question, is the demo platform rigged ?

What i mean by that, does the demo platform use real live quotes, or is it rigged in some way that it produces unrealistic results ?

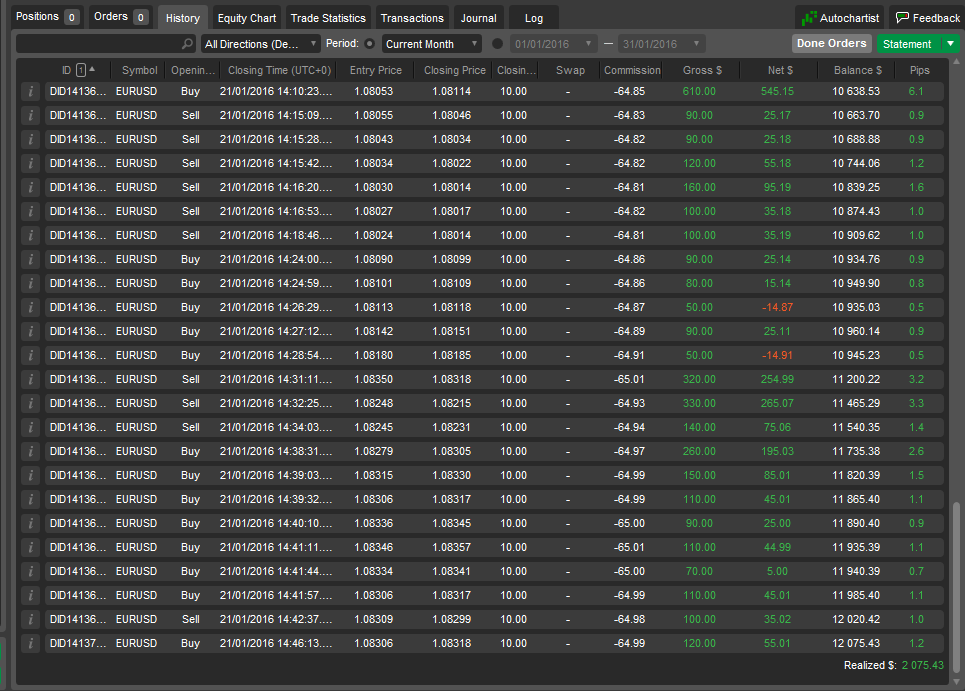

Here is just a few minutes of my trading:

It seems too good to be true, so am i just that good of a Trader, or does the platform manipulate the price feed in favor of the practicing user ?

@Jimmy

Jimmy

20 Jan 2016, 13:21

( Updated at: 19 Mar 2025, 08:57 )

RE: RE:

Jimmy said:

Spotware said:

Dear Trader,

We are not aware of any similar issues. Could you please press Ctrl+Alt+Shift+T while you experience this? It will submit troubleshooting information to our support team.

In addition, you should put your username cTID "Jimmy" as a comment in the comment section of the troubleshooting information and send an email confirming that he send the information.

Please send us also an email at support@ctrader.com with the exact time, Timezone, right after you submit the troubleshooting information.

[IMG]http://spotware.ctrader.com/c/4lxJn[/IMG]

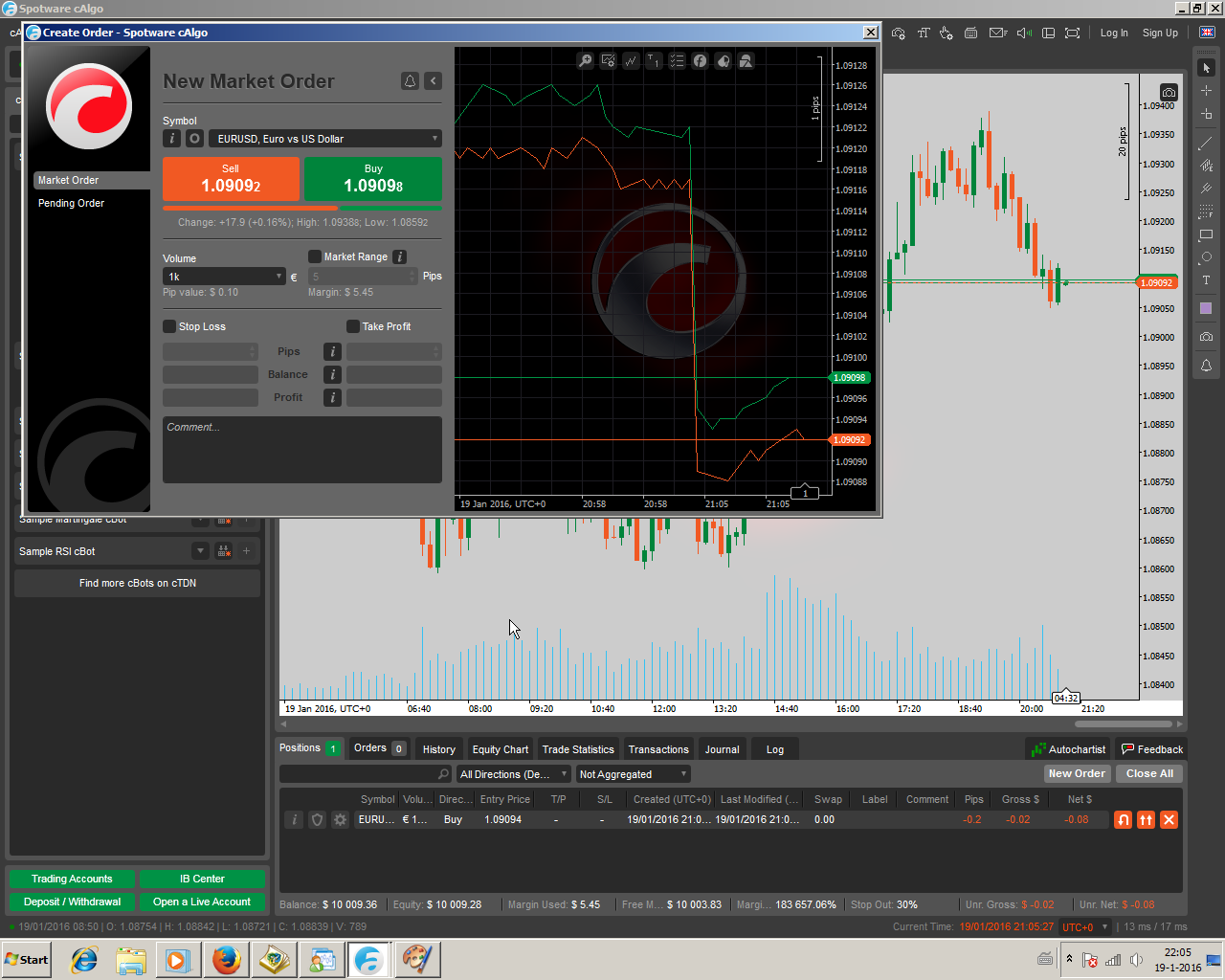

Well it's still visible on the M1 chart.

There are missing candles between 20:58 and 21:05

@Jimmy

Jimmy

20 Jan 2016, 13:19

( Updated at: 19 Mar 2025, 08:57 )

RE:

Spotware said:

Dear Trader,

We are not aware of any similar issues. Could you please press Ctrl+Alt+Shift+T while you experience this? It will submit troubleshooting information to our support team.

In addition, you should put your username cTID "Jimmy" as a comment in the comment section of the troubleshooting information and send an email confirming that he send the information.

Please send us also an email at support@ctrader.com with the exact time, Timezone, right after you submit the troubleshooting information.

<img src='http://spotware.ctrader.com/images/screens/4lxJn.png'>

Well it's still visible on the M1 chart.

There are missing candles between 20:58 and 21:05

@Jimmy

Jimmy

19 Jan 2016, 23:20

( Updated at: 21 Dec 2023, 09:20 )

same

i had a weird thing also it's Wednesday today and i wanted to place an order, then the terminal replied to me that market was closed.... which of course is nonsense, this continued for several minutes and then the terminal appeared to come back online and the price had dropped significant resulting in a huge gap.

This all happened only minutes after i decided to give Calgo a try.... and now i wonder if this platform is stable i mean what could possibly cause the terminal to say market is closed ???????????

@Jimmy

Jimmy

05 Oct 2014, 14:26

I am not sure if you developers trade yourself because traders will realize that without Multi-Currency support the Calgo platform is utterly useless.

Without Multi-Currency support it is a platform for losers, people that want to lose money.

Professional Traders know wheres the money at and it not in backtesting a single Symbol with some foolish moving average strategy.

Just so you know.

@Jimmy

Jimmy

05 Jul 2014, 12:16

I still don't get it it must be me.

Comparing the closing and average can not be an or, you are either extracting the highest value, the lowest value, or the value average.

If you want the average you add them all up and divide them by 4 it is actually in the Heiken Ashi formula.

But in your case you use the close of the four bars instead of open high low close etc.from just one.

var haClose = (open + high + low + close) / 4;

You can also simply compare the last four bars out of the array with the multiple if statements or use the math functions to end up with the highest/lowest value.

For high something like this with Math.Max

var haHigh = Math.Max(Math.Max(high, haOpen), haClose);

Or low like this with Math.Min

var haLow = Math.Min(Math.Min(low, haOpen), haClose);

@Jimmy

Jimmy

04 Jul 2014, 13:25

RE: RE:

Forex19 said:

Jimmy said:

You could try the one of the Math functions first compare the first two then you get one end result then compare that with the third and what comes out of that with the fourth and so untill you are left with the result you want.

How? An example please.

Take a look at the Heiken Ashi formula which is an excellent example.

Like this:

/algos/indicators/show/60

or other?

Yes look at the logic used.

var haClose = (open + high + low + close) / 4;

double haOpen;

if (index > 0)

haOpen = (_haOpen[index - 1] + _haClose[index - 1]) / 2;

else

haOpen = (open + close) / 2;

var haHigh = Math.Max(Math.Max(high, haOpen), haClose);

var haLow = Math.Min(Math.Min(low, haOpen), haClose);

So once more what end result do you want ?

You have four candles what do you need to know?

Averages?

Highest?

Lowest?

You say you want to compare four candlesticks but you do not say what exactly it is you want to compare so how are we to give an answer if we do not know what end result your aiming at.

Say for example you want the highest value you then first compare the first two and you end up with the highest value of the first two, and this you compare to the third, so now you know the highest value from candle one two and three then you compare this to candle four and you are left with the one highest candle but i have no idea what you are trying to accomplish so please clarify.

@Jimmy

Jimmy

29 Jun 2014, 13:27

It depends on which result you are aiming at.

You want to compare then as to end up with what exactly?

The one that is highest? or lowest? or ??

You could try the one of the Math functions first compare the first two then you get one end result then compare that with the third and what comes out of that with the fourth and so untill you are left with the result you want.

Take a look at the Heiken Ashi formula which is an excellent example.

@Jimmy

Jimmy

29 Jun 2014, 13:15

Maybe you can load the indicator in visual studio and see where it goes into an endless loop and fix it then save it and restart Calgo to see if it loads the repaired indicator.

Or you can try to rename the indicator itself so that Calgo can not find it anymore upon loading and can do nothing but skip it or maybe you already tried that?

I too had 3 hard weeks with Calgo in the beginning.

@Jimmy

Jimmy

19 May 2014, 08:40

RE:

Thank You.

With the information you provided i actually got it to work properly.

Do you maybe also know the solution as to how we can implement a shift in the sma method?

I have been trying to work around it but i hope there is a more easy method

bp2012 said:

mt4 uses index 0 to be the current bar, but ctrader uses a more traditional approach where index 0 is the first (oldest) bar in the series. Personally I prefer the ctrader perspective.

There is a bit of a learning curve for cTrader, but once you have a few indicators and robots under your belt I think that most people will find it superior to other platforms.

The information you are looking for can be found below. I've pasted in the relevant section and a link to the source. I'd recommend writing indicators before doing heavy lifting on a robot. (Just my 2 cents.)

Good Luck!

/api/guides/indicators

Calculate

The calculate method is the main method of the indicator. It is called for each historic bar starting from the beginning of the series up to the current bar and then on each incoming tick. In the case of multi-symbol / multi-timeframe implementation, it will be called on each tick of each symbol that is used in the indicator.

It is typically used for the calculation of an indicator based on a formula. In this case, it is the difference of the High and the Low prices of each bar. The index parameter, represents each bar, ranging from 0 up to the current (last) bar. So, at each bar the Calculate method will be called and the Result will be assigned with the difference between the High and the Low of that bar.

@Jimmy

Jimmy

18 May 2014, 15:13

trouble with code

What do you MEAN??

The first value on the chart ?? the first candle on the most left side of the chart?? the oldest bar??

The first/ last value on the right side of the chart?? the newest bar whilst the newer that did not close is still being made??

Please be specific.

I have written many indicators and many robots on a different platform and i am now trying to begin using Calgo but i find it to be EXTREMELY HARD because nothing seems to work in the last two days i have written at least 8 robots and none of them work the way i want them to work i can not get the MarketSeries. to pull correct values it either opens up one trade and stays there or it starts flipping orders at each tick i am really getting a headache and becoming depressed about this the documentation on these methods is so POOR extremely POOR for all i know bar-1 is the oldest bar and bar [1] is the last newest closed bar and bar [0] is the bar currently being made but i can find no reference or guide what so ever of what these array indexes are in Calgo.

It always says build succeeded but it never actually works the way i wrote it.

Somebody ought to write a decent manual on this thing or it will be a complete fail you can't expect coders to spend day's on just a few simple methods that somehow refuse to function the way they are supposed to or at least the way they are experienced with.

I used to be so fast producing working code and now all of a sudden i am stuck at one point barely moving forward because i just have no reference or manual that comes with the code.

I see many people are having many problems like these

@Jimmy

Jimmy

04 Feb 2017, 12:57

I was under the impression it was DMA Lvl-2 without interference.

I know enough now.

Thank you so much.

@Jimmy