Topics

Replies

trading1

09 May 2024, 08:24

RE: RE: RE: RE: RE: RE: Problesm with Visual vs non Visual Backtesting

PanagiotisCharalampous said:

trading1 said:

PanagiotisCharalampous said:

trading1 said:

trading1 said:

PanagiotisCharalampous said:

Hi there,

If you can share the cBot code, we can have a look. Also make sure you use tick data for your backtesting.

Best regards,

Panagiotis

Here is the Bot Code .

You can find the parameters I used in the pictures above.

using System;

using System.Collections.Generic;

using System.Linq;

using System.Text;

using cAlgo.API;

using cAlgo.API.Collections;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

namespace cAlgo.Robots

{

[Robot(TimeZone = TimeZones.WEuropeStandardTime, AccessRights = AccessRights.None)]

public class EBOTTRADEIRL: Robot

{

[Parameter("Risk %", Group = "Risk",DefaultValue = 0.02)]

public double RiskPCT { get; set; }

[Parameter("ATR MA Type",Group = "ATR")]

public MovingAverageType ATRMAType { get; set; }

[Parameter("ATR Period", Group = "ATR", DefaultValue = 14)]

public int ATRPeriod { get; set; }

[Parameter("RSI MA Period", Group = " RSI", DefaultValue = 8)]

public int RSIPeriod { get; set; }

[Parameter("RSI Type", Group = " RSI" , DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType RSIType { get; set; }

[Parameter("RSIMA MA Period", Group = " RSI", DefaultValue = 8)]

public int RSIMAPeriod { get; set; }

[Parameter("RSIMA Type", Group = " RSI" , DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType RSIMAType { get; set; }

[Parameter("SSL Period", Group = " SSL ", DefaultValue = 8)]

public int SSLPeriod{ get; set; }

[Parameter("SSL Type", Group = " SSL" , DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType SSLMAType { get; set; }

[Parameter("Baseline Period", Group = " Baseline ", DefaultValue = 8)]

public int BLMAPeriod{ get; set; }

[Parameter("Baseline MA", Group = " Baseline" , DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType BLMAType { get; set; }

[Parameter("MACD Long Cycle", Group = " MACD ", DefaultValue = 21)]

public int MACDLong{ get; set; }

[Parameter("MACD Short Cycle", Group = " MACD ", DefaultValue = 8)]

public int MACDShort{ get; set; }

[Parameter("MACD Signal", Group = " MACD ", DefaultValue = 12)]

public int MACDSignal{ get; set; }

[Parameter("StopLoss Factor", Group = "Risk", DefaultValue = 1)]

public double SLM { get; set; }

[Parameter("TakeProfit Factor", Group = "Risk", DefaultValue = 1)]

public double TPM { get; set; }

//Declare Indicators and name them

private AverageTrueRange atr;

private SSLChannel ssl;

private MovingAverage rsiMA, bl;

private RelativeStrengthIndex rsi;

private MacdCrossOver macd;

public string botName;

protected override void OnStart()

{ atr = Indicators.AverageTrueRange(ATRPeriod, MovingAverageType.Exponential);

ssl = Indicators.GetIndicator<SSLChannel>(SSLPeriod,SSLMAType);

rsi = Indicators.RelativeStrengthIndex(Bars.ClosePrices, RSIPeriod);

rsiMA = Indicators.MovingAverage(rsi.Result, RSIMAPeriod, RSIMAType);

macd = Indicators.MacdCrossOver(MACDLong, MACDShort, MACDSignal);

bl = Indicators.MovingAverage(Bars.MedianPrices, BLMAPeriod, BLMAType);

}

protected override void OnBarClosed()

{

var C2 = ssl._sslUp.Last(0) - ssl._sslDown.Last(0);

var PrefC2 = ssl._sslUp.Last(1)-ssl._sslDown.Last(1);

var C2U = ssl._sslUp.Last(0);

var C2D = ssl._sslDown.Last(0);

var C6 = rsi.Result.Last(0);

var PrefC6 = rsi.Result.Last(1);

var C7 = rsiMA.Result.Last(0);

var C8 = rsiMA.Result.Last(1);

var BaseLine = bl.Result.Last(0);

var Macd = macd.MACD.Last(0);

var MacdSig = macd.Signal.Last(0);

if (C2 > 0 & Symbol.Bid > BaseLine & C7 > 50 & Macd > MacdSig & Macd > 0 )

{ Open ( TradeType.Buy, "SSL Buy");

}

else if(C2 < 0 & Symbol.Ask < BaseLine & C7 < 50 & Macd < MacdSig & Macd < 0)

{ Open(TradeType.Sell, "SSL Sell");

}

if (C2 < 0) // & C6 < C7)

{

Close (TradeType.Buy, "SSL Buy");

}

else if (C2 > 0) // & C6 > C7)

{

Close (TradeType.Sell, "SSL Sell");

}

}

// New Function for Opening trades

private void Open(TradeType tradeType, string Label)

{

var ATR = Math.Round(atr.Result.Last(1) / Symbol.PipSize);

var position = Positions.Find( Label, SymbolName, tradeType);

if (position == null & Server.Time.Hour > 1 & Server.Time.Hour < 23)

{

ExecuteMarketOrder (tradeType , SymbolName ,20, Label, SLM * ATR, TPM * ATR ); //TradeAmount/2

}

}

private void Close(TradeType tradeType, string Label)

{

foreach (var position in Positions.FindAll(Label, SymbolName, tradeType))

ClosePosition(position);

}

// Handle cBot stop here

}

}

As per your suggestion , I ran the bot with Tick data and also found that there is no consistency in the Visual and non visual testing.

The bot now did not show a profit with the Tick data, but it made 2000 trades more with the non visual vs visual testing and it stopped 2 weeks later when the balance ran to zero.

This is a problem which CTrader must address because it leaves a situation where no algo supplier can be be trusted with their bots on any broker platform.

Hi there,

We are still missing the SSL Channel indicator you are using. Can you please share it with us?

Best regards,

Panagiotis

You can find the SSL indicator on the community indicators forum at Spotware. but as you can see from the code I did not use it.

The code does not build without the indicator. Please either provide a link to the actual indicator or provide cBot code that builds without the need of a reference

Apologies I see I used it. You can get the SSL Channel indicator on the CTrader indicators pages.

@trading1

trading1

08 May 2024, 19:29

RE: RE: RE: RE: Problesm with Visual vs non Visual Backtesting

PanagiotisCharalampous said:

trading1 said:

trading1 said:

PanagiotisCharalampous said:

Hi there,

If you can share the cBot code, we can have a look. Also make sure you use tick data for your backtesting.

Best regards,

Panagiotis

Here is the Bot Code .

You can find the parameters I used in the pictures above.

using System;

using System.Collections.Generic;

using System.Linq;

using System.Text;

using cAlgo.API;

using cAlgo.API.Collections;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

namespace cAlgo.Robots

{

[Robot(TimeZone = TimeZones.WEuropeStandardTime, AccessRights = AccessRights.None)]

public class EBOTTRADEIRL: Robot

{

[Parameter("Risk %", Group = "Risk",DefaultValue = 0.02)]

public double RiskPCT { get; set; }

[Parameter("ATR MA Type",Group = "ATR")]

public MovingAverageType ATRMAType { get; set; }

[Parameter("ATR Period", Group = "ATR", DefaultValue = 14)]

public int ATRPeriod { get; set; }

[Parameter("RSI MA Period", Group = " RSI", DefaultValue = 8)]

public int RSIPeriod { get; set; }

[Parameter("RSI Type", Group = " RSI" , DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType RSIType { get; set; }

[Parameter("RSIMA MA Period", Group = " RSI", DefaultValue = 8)]

public int RSIMAPeriod { get; set; }

[Parameter("RSIMA Type", Group = " RSI" , DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType RSIMAType { get; set; }

[Parameter("SSL Period", Group = " SSL ", DefaultValue = 8)]

public int SSLPeriod{ get; set; }

[Parameter("SSL Type", Group = " SSL" , DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType SSLMAType { get; set; }

[Parameter("Baseline Period", Group = " Baseline ", DefaultValue = 8)]

public int BLMAPeriod{ get; set; }

[Parameter("Baseline MA", Group = " Baseline" , DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType BLMAType { get; set; }

[Parameter("MACD Long Cycle", Group = " MACD ", DefaultValue = 21)]

public int MACDLong{ get; set; }

[Parameter("MACD Short Cycle", Group = " MACD ", DefaultValue = 8)]

public int MACDShort{ get; set; }

[Parameter("MACD Signal", Group = " MACD ", DefaultValue = 12)]

public int MACDSignal{ get; set; }

[Parameter("StopLoss Factor", Group = "Risk", DefaultValue = 1)]

public double SLM { get; set; }

[Parameter("TakeProfit Factor", Group = "Risk", DefaultValue = 1)]

public double TPM { get; set; }

//Declare Indicators and name them

private AverageTrueRange atr;

private SSLChannel ssl;

private MovingAverage rsiMA, bl;

private RelativeStrengthIndex rsi;

private MacdCrossOver macd;

public string botName;

protected override void OnStart()

{ atr = Indicators.AverageTrueRange(ATRPeriod, MovingAverageType.Exponential);

ssl = Indicators.GetIndicator<SSLChannel>(SSLPeriod,SSLMAType);

rsi = Indicators.RelativeStrengthIndex(Bars.ClosePrices, RSIPeriod);

rsiMA = Indicators.MovingAverage(rsi.Result, RSIMAPeriod, RSIMAType);

macd = Indicators.MacdCrossOver(MACDLong, MACDShort, MACDSignal);

bl = Indicators.MovingAverage(Bars.MedianPrices, BLMAPeriod, BLMAType);

}

protected override void OnBarClosed()

{

var C2 = ssl._sslUp.Last(0) - ssl._sslDown.Last(0);

var PrefC2 = ssl._sslUp.Last(1)-ssl._sslDown.Last(1);

var C2U = ssl._sslUp.Last(0);

var C2D = ssl._sslDown.Last(0);

var C6 = rsi.Result.Last(0);

var PrefC6 = rsi.Result.Last(1);

var C7 = rsiMA.Result.Last(0);

var C8 = rsiMA.Result.Last(1);

var BaseLine = bl.Result.Last(0);

var Macd = macd.MACD.Last(0);

var MacdSig = macd.Signal.Last(0);

if (C2 > 0 & Symbol.Bid > BaseLine & C7 > 50 & Macd > MacdSig & Macd > 0 )

{ Open ( TradeType.Buy, "SSL Buy");

}

else if(C2 < 0 & Symbol.Ask < BaseLine & C7 < 50 & Macd < MacdSig & Macd < 0)

{ Open(TradeType.Sell, "SSL Sell");

}

if (C2 < 0) // & C6 < C7)

{

Close (TradeType.Buy, "SSL Buy");

}

else if (C2 > 0) // & C6 > C7)

{

Close (TradeType.Sell, "SSL Sell");

}

}

// New Function for Opening trades

private void Open(TradeType tradeType, string Label)

{

var ATR = Math.Round(atr.Result.Last(1) / Symbol.PipSize);

var position = Positions.Find( Label, SymbolName, tradeType);

if (position == null & Server.Time.Hour > 1 & Server.Time.Hour < 23)

{

ExecuteMarketOrder (tradeType , SymbolName ,20, Label, SLM * ATR, TPM * ATR ); //TradeAmount/2

}

}

private void Close(TradeType tradeType, string Label)

{

foreach (var position in Positions.FindAll(Label, SymbolName, tradeType))

ClosePosition(position);

}

// Handle cBot stop here

}

}

As per your suggestion , I ran the bot with Tick data and also found that there is no consistency in the Visual and non visual testing.

The bot now did not show a profit with the Tick data, but it made 2000 trades more with the non visual vs visual testing and it stopped 2 weeks later when the balance ran to zero.

This is a problem which CTrader must address because it leaves a situation where no algo supplier can be be trusted with their bots on any broker platform.

Hi there,

We are still missing the SSL Channel indicator you are using. Can you please share it with us?

Best regards,

Panagiotis

You can find the SSL indicator on the community indicators forum at Spotware. but as you can see from the code I did not use it.

@trading1

trading1

02 May 2024, 13:10

RE: RE: Problesm with Visual vs non Visual Backtesting

trading1 said:

PanagiotisCharalampous said:

Hi there,

If you can share the cBot code, we can have a look. Also make sure you use tick data for your backtesting.

Best regards,

Panagiotis

Here is the Bot Code .

You can find the parameters I used in the pictures above.

using System;

using System.Collections.Generic;

using System.Linq;

using System.Text;

using cAlgo.API;

using cAlgo.API.Collections;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

namespace cAlgo.Robots

{

[Robot(TimeZone = TimeZones.WEuropeStandardTime, AccessRights = AccessRights.None)]

public class EBOTTRADEIRL: Robot

{

[Parameter("Risk %", Group = "Risk",DefaultValue = 0.02)]

public double RiskPCT { get; set; }

[Parameter("ATR MA Type",Group = "ATR")]

public MovingAverageType ATRMAType { get; set; }

[Parameter("ATR Period", Group = "ATR", DefaultValue = 14)]

public int ATRPeriod { get; set; }

[Parameter("RSI MA Period", Group = " RSI", DefaultValue = 8)]

public int RSIPeriod { get; set; }

[Parameter("RSI Type", Group = " RSI" , DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType RSIType { get; set; }

[Parameter("RSIMA MA Period", Group = " RSI", DefaultValue = 8)]

public int RSIMAPeriod { get; set; }

[Parameter("RSIMA Type", Group = " RSI" , DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType RSIMAType { get; set; }

[Parameter("SSL Period", Group = " SSL ", DefaultValue = 8)]

public int SSLPeriod{ get; set; }

[Parameter("SSL Type", Group = " SSL" , DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType SSLMAType { get; set; }

[Parameter("Baseline Period", Group = " Baseline ", DefaultValue = 8)]

public int BLMAPeriod{ get; set; }

[Parameter("Baseline MA", Group = " Baseline" , DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType BLMAType { get; set; }

[Parameter("MACD Long Cycle", Group = " MACD ", DefaultValue = 21)]

public int MACDLong{ get; set; }

[Parameter("MACD Short Cycle", Group = " MACD ", DefaultValue = 8)]

public int MACDShort{ get; set; }

[Parameter("MACD Signal", Group = " MACD ", DefaultValue = 12)]

public int MACDSignal{ get; set; }

[Parameter("StopLoss Factor", Group = "Risk", DefaultValue = 1)]

public double SLM { get; set; }

[Parameter("TakeProfit Factor", Group = "Risk", DefaultValue = 1)]

public double TPM { get; set; }

//Declare Indicators and name them

private AverageTrueRange atr;

private SSLChannel ssl;

private MovingAverage rsiMA, bl;

private RelativeStrengthIndex rsi;

private MacdCrossOver macd;

public string botName;

protected override void OnStart()

{ atr = Indicators.AverageTrueRange(ATRPeriod, MovingAverageType.Exponential);

ssl = Indicators.GetIndicator<SSLChannel>(SSLPeriod,SSLMAType);

rsi = Indicators.RelativeStrengthIndex(Bars.ClosePrices, RSIPeriod);

rsiMA = Indicators.MovingAverage(rsi.Result, RSIMAPeriod, RSIMAType);

macd = Indicators.MacdCrossOver(MACDLong, MACDShort, MACDSignal);

bl = Indicators.MovingAverage(Bars.MedianPrices, BLMAPeriod, BLMAType);

}

protected override void OnBarClosed()

{

var C2 = ssl._sslUp.Last(0) - ssl._sslDown.Last(0);

var PrefC2 = ssl._sslUp.Last(1)-ssl._sslDown.Last(1);

var C2U = ssl._sslUp.Last(0);

var C2D = ssl._sslDown.Last(0);

var C6 = rsi.Result.Last(0);

var PrefC6 = rsi.Result.Last(1);

var C7 = rsiMA.Result.Last(0);

var C8 = rsiMA.Result.Last(1);

var BaseLine = bl.Result.Last(0);

var Macd = macd.MACD.Last(0);

var MacdSig = macd.Signal.Last(0);

if (C2 > 0 & Symbol.Bid > BaseLine & C7 > 50 & Macd > MacdSig & Macd > 0 )

{ Open ( TradeType.Buy, "SSL Buy");

}

else if(C2 < 0 & Symbol.Ask < BaseLine & C7 < 50 & Macd < MacdSig & Macd < 0)

{ Open(TradeType.Sell, "SSL Sell");

}

if (C2 < 0) // & C6 < C7)

{

Close (TradeType.Buy, "SSL Buy");

}

else if (C2 > 0) // & C6 > C7)

{

Close (TradeType.Sell, "SSL Sell");

}

}

// New Function for Opening trades

private void Open(TradeType tradeType, string Label)

{

var ATR = Math.Round(atr.Result.Last(1) / Symbol.PipSize);

var position = Positions.Find( Label, SymbolName, tradeType);

if (position == null & Server.Time.Hour > 1 & Server.Time.Hour < 23)

{

ExecuteMarketOrder (tradeType , SymbolName ,20, Label, SLM * ATR, TPM * ATR ); //TradeAmount/2

}

}

private void Close(TradeType tradeType, string Label)

{

foreach (var position in Positions.FindAll(Label, SymbolName, tradeType))

ClosePosition(position);

}

// Handle cBot stop here

}

}

As per your suggestion , I ran the bot with Tick data and also found that there is no consistency in the Visual and non visual testing.

The bot now did not show a profit with the Tick data, but it made 2000 trades more with the non visual vs visual testing and it stopped 2 weeks later when the balance ran to zero.

This is a problem which CTrader must address because it leaves a situation where no algo supplier can be be trusted with their bots on any broker platform.

@trading1

trading1

02 May 2024, 12:30

RE: Problesm with Visual vs non Visual Backtesting

PanagiotisCharalampous said:

Hi there,

If you can share the cBot code, we can have a look. Also make sure you use tick data for your backtesting.

Best regards,

Panagiotis

Here is the Bot Code .

You can find the parameters I used in the pictures above.

using System;

using System.Collections.Generic;

using System.Linq;

using System.Text;

using cAlgo.API;

using cAlgo.API.Collections;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

namespace cAlgo.Robots

{

[Robot(TimeZone = TimeZones.WEuropeStandardTime, AccessRights = AccessRights.None)]

public class EBOTTRADEIRL: Robot

{

[Parameter("Risk %", Group = "Risk",DefaultValue = 0.02)]

public double RiskPCT { get; set; }

[Parameter("ATR MA Type",Group = "ATR")]

public MovingAverageType ATRMAType { get; set; }

[Parameter("ATR Period", Group = "ATR", DefaultValue = 14)]

public int ATRPeriod { get; set; }

[Parameter("RSI MA Period", Group = " RSI", DefaultValue = 8)]

public int RSIPeriod { get; set; }

[Parameter("RSI Type", Group = " RSI" , DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType RSIType { get; set; }

[Parameter("RSIMA MA Period", Group = " RSI", DefaultValue = 8)]

public int RSIMAPeriod { get; set; }

[Parameter("RSIMA Type", Group = " RSI" , DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType RSIMAType { get; set; }

[Parameter("SSL Period", Group = " SSL ", DefaultValue = 8)]

public int SSLPeriod{ get; set; }

[Parameter("SSL Type", Group = " SSL" , DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType SSLMAType { get; set; }

[Parameter("Baseline Period", Group = " Baseline ", DefaultValue = 8)]

public int BLMAPeriod{ get; set; }

[Parameter("Baseline MA", Group = " Baseline" , DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType BLMAType { get; set; }

[Parameter("MACD Long Cycle", Group = " MACD ", DefaultValue = 21)]

public int MACDLong{ get; set; }

[Parameter("MACD Short Cycle", Group = " MACD ", DefaultValue = 8)]

public int MACDShort{ get; set; }

[Parameter("MACD Signal", Group = " MACD ", DefaultValue = 12)]

public int MACDSignal{ get; set; }

[Parameter("StopLoss Factor", Group = "Risk", DefaultValue = 1)]

public double SLM { get; set; }

[Parameter("TakeProfit Factor", Group = "Risk", DefaultValue = 1)]

public double TPM { get; set; }

//Declare Indicators and name them

private AverageTrueRange atr;

private SSLChannel ssl;

private MovingAverage rsiMA, bl;

private RelativeStrengthIndex rsi;

private MacdCrossOver macd;

public string botName;

protected override void OnStart()

{ atr = Indicators.AverageTrueRange(ATRPeriod, MovingAverageType.Exponential);

ssl = Indicators.GetIndicator<SSLChannel>(SSLPeriod,SSLMAType);

rsi = Indicators.RelativeStrengthIndex(Bars.ClosePrices, RSIPeriod);

rsiMA = Indicators.MovingAverage(rsi.Result, RSIMAPeriod, RSIMAType);

macd = Indicators.MacdCrossOver(MACDLong, MACDShort, MACDSignal);

bl = Indicators.MovingAverage(Bars.MedianPrices, BLMAPeriod, BLMAType);

}

protected override void OnBarClosed()

{

var C2 = ssl._sslUp.Last(0) - ssl._sslDown.Last(0);

var PrefC2 = ssl._sslUp.Last(1)-ssl._sslDown.Last(1);

var C2U = ssl._sslUp.Last(0);

var C2D = ssl._sslDown.Last(0);

var C6 = rsi.Result.Last(0);

var PrefC6 = rsi.Result.Last(1);

var C7 = rsiMA.Result.Last(0);

var C8 = rsiMA.Result.Last(1);

var BaseLine = bl.Result.Last(0);

var Macd = macd.MACD.Last(0);

var MacdSig = macd.Signal.Last(0);

if (C2 > 0 & Symbol.Bid > BaseLine & C7 > 50 & Macd > MacdSig & Macd > 0 )

{ Open ( TradeType.Buy, "SSL Buy");

}

else if(C2 < 0 & Symbol.Ask < BaseLine & C7 < 50 & Macd < MacdSig & Macd < 0)

{ Open(TradeType.Sell, "SSL Sell");

}

if (C2 < 0) // & C6 < C7)

{

Close (TradeType.Buy, "SSL Buy");

}

else if (C2 > 0) // & C6 > C7)

{

Close (TradeType.Sell, "SSL Sell");

}

}

// New Function for Opening trades

private void Open(TradeType tradeType, string Label)

{

var ATR = Math.Round(atr.Result.Last(1) / Symbol.PipSize);

var position = Positions.Find( Label, SymbolName, tradeType);

if (position == null & Server.Time.Hour > 1 & Server.Time.Hour < 23)

{

ExecuteMarketOrder (tradeType , SymbolName ,20, Label, SLM * ATR, TPM * ATR ); //TradeAmount/2

}

}

private void Close(TradeType tradeType, string Label)

{

foreach (var position in Positions.FindAll(Label, SymbolName, tradeType))

ClosePosition(position);

}

// Handle cBot stop here

}

}

@trading1

trading1

27 May 2022, 13:08

( Updated at: 21 Dec 2023, 09:22 )

RE: Screenshots

trading1 said:

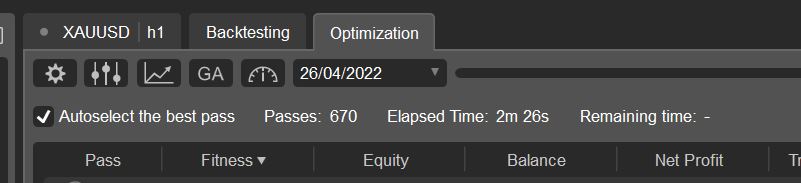

As you can see in the screenshot above, The remaining time just shows a Dash while the optimization is still working. In fact it will go down to zero wity the optimization not complete and then oscillates between a zero and dash as it completes and then sets at a dash at completion leaving me to wonder if it has completed or not. It would be far better to show a zero at completion than a dash.

I am testing the Simple MA bot found on the forum

@trading1

trading1

09 Dec 2021, 00:48

I had a futher look at this and now believe this is a Ctrader Bug.

I have done extensive testing and this happens with the crossover method on the 1, 2 an 5 min forex charts where it leaves trades open no matter a stop loss or indicators crossing..

This is dangerous for trading and can lead to heavy losses for Bots. I beleive there is something wrong with the crossover method in C trader.

@trading1

trading1

10 May 2024, 07:29 ( Updated at: 10 May 2024, 13:57 )

RE: RE: RE: RE: RE: RE: RE: RE: Problesm with Visual vs non Visual Backtesting

PanagiotisCharalampous said:

https://ctrader.com/algos/indicators/show/2151

@trading1