Topics

Replies

158197794

09 Sep 2019, 16:50

RE:

Panagiotis Charalampous said:

Hi 158197794,

This is not what Symbol digits means. Symbol digits indicates the digit where the minimum change in price can be expected. So for GBPJPY, the minimum change occurs at the third digit e.g. the price will be 171.215 or 171.216. It will never be 171.2154 or 171.2157. Values returned in the spot events are always specified in 1/100000 of unit of a price. Read more here.

Best Regards,

Panagiotis

so,if it is like this,What is the general way to convert a spot value to a double value?

how can I convert GBPJPY spot: 17121500 to double :171.215?

@158197794

158197794

09 Sep 2019, 16:23

RE:

Panagiotis Charalampous said:

Hi 158197794,

Why do you think that symbol digits is wrong?

Best Regards,

Panagiotis

because double price = spot price *10^(-Symbol Digits).

so : EURUSD spot: 135381 double: 1.35381 Symbol Digits : 5 => 135381 * 10 ^ (-5) = 1.35381.

but , GBPJPY spot: 17121500 double :171.215 Symbol Digits : 3 => 17121500 * 10 ^ (-3) = 17121.5 ??????????? Is this not wrong?

@158197794

158197794

04 Aug 2019, 10:23

( Updated at: 21 Dec 2023, 09:21 )

RE:

Panagiotis Charalampous said:

Hi 158197794,

Sorry I didn't notice the price well. I made a typo in my first answer, should have been baseSlippagePrice = 1.11335. In that case the slippage price should be baseSlippagePrice = 135.079

Best Regards,

Panagiotis

HI ,Panagiotis

I have found another problem, in here,

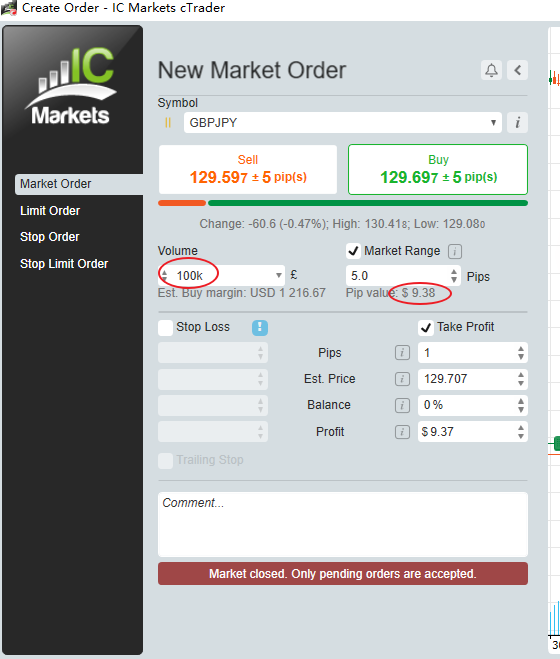

If I buy 100k, it show one pip value is $9.38, so , This means when the price changes, 1 pips means 0.01.

so, when I set market range to 5.0 pips, This means that the specified range of prices is 129.697- 0.05 to 129.697+0.05.

but ,Follow the advice you gave above,If I use API, I must set baseSlippagePrice = 129.697,and slippageInPoints = 50.

so, in this parameter: slippageInPoints , one point = 10* one pips ?

@158197794

158197794

26 Jul 2019, 11:22

RE:

Panagiotis Charalampous said:

Hi 158197794,

Sorry I didn't notice the price well. I made a typo in my first answer, should have been baseSlippagePrice = 1.11335. In that case the slippage price should be baseSlippagePrice = 135.079

Best Regards,

Panagiotis

I understand, thank you very much.

@158197794

158197794

26 Jul 2019, 11:13

RE:

Panagiotis Charalampous said:

Hi 158197794,

The order is cancelled because you ser as baseSlippagePrice = 135.014 and slippageInPoints = 40 which makes the limit 135.054 while the market price is 135.092 therefore the order is cancelled.

Best Regards,

Panagiotis

But I just asked you above:

for GBPJPY , if I can accept any price opening between 135.029 and 135.129 , I can use baseSlippagePrice = 135.029 and slippageInPoints = 50 ?

You said it is correct。

so , if I can accept any price opening buy,between 135.014 and 135.094.

set baseSlippagePrice = 135.014 and set slippageInPoints = 80?

@158197794

158197794

26 Jul 2019, 10:51

RE:

Panagiotis Charalampous said:

Hi 158197794,

Yes this is correct.

Best Regards,

Panagiotis

There seems to be some problems 。

just now , GBPJPY market price ,ask = 135.092.

and I can accept any price opening buy,between 135.014 and 135.094. so I send a

MarketRangeOrder, and set baseSlippagePrice = 135.014 and slippageInPoints = 40 ,

but, I receive PROTO_OA_EXECUTION_EVENT, and executiontype = ORDER_CANCELLED。

@158197794

158197794

26 Jul 2019, 10:34

RE:

Panagiotis Charalampous said:

Hi 158197794,

Thanks for posting in our forum. You can use baseSlippagePrice = 1.11305 and slippageInPoints = 30.

Best Regards,

Panagiotis

thank you .

so, for EURUSD, a points = 0.00001?

for GBPJPY , if I can accept any price opening between 135.029 and 135.129 , I can use baseSlippagePrice = 135.029 and slippageInPoints = 50 ?

@158197794

158197794

09 Sep 2019, 16:57

RE:

Panagiotis Charalampous said:

Can all currency pairs and indices use this method?

@158197794