Topics

Replies

AlexanderRC

07 Apr 2015, 13:37

RE:

cprcrack said:

Will selected colors be saved in any way? This is very important. If I chose a random color, such as #98DFCB, I need a way to chose the same color again without having to memorize its code. Something like saving the last 10 colors used would be a good idea.

Would be a nice feature to have.

Also, if the new color picker is coming to cTrader, Spotware, are going to add support for arbitrary colors to cAlgo API?

@AlexanderRC

AlexanderRC

07 Apr 2015, 13:32

RE:

Spotware said:

You can use IsBacktesting in optimization as well. It is true for both backtesting and optimization.

It would be trivial to implement IsOptimizing() call to return true if the cBot was launched under the optimizer. The cBot may do some internal optimizations by caching data somehow between invocations.

@AlexanderRC

AlexanderRC

26 Mar 2015, 12:24

That really depends of your broker's liquidity provider. Stop orders are essentially market orders triggered when a bid or ask approaches the stop loss level. It really depends on your broker's liquidity provider, whether they are good at executing market orders when the market is volatile (for example, when a news is out). Contact your broker for details.

@AlexanderRC

AlexanderRC

19 Mar 2015, 18:24

RE:

Spotware said:

PS ie how to use such as ClosePosition with slippage?

cAlgo.API doesn't provide the ability to close position with slippage.

If the account is netted, isn't enough to call ExecuteMarketOrder with the different direction than the current position and adding slippage to the call?

If the account is hedged or netted, isn't it enough to place TP with ModifyPosition below the current bid price (for buy position), just where the max slippage should be? Even if TP is negative?

@AlexanderRC

AlexanderRC

19 Mar 2015, 18:16

RE:

Spotware said:

No, it is not known issue. Please specify strategy page.

id 55674

@AlexanderRC

AlexanderRC

06 Mar 2015, 11:42

We did a source code based solution for exactly that. Even with timers and different timeframes for different cBots.

@AlexanderRC

AlexanderRC

14 Feb 2015, 23:13

You may look at the Spotware's Trading Time Interval sample.

@AlexanderRC

AlexanderRC

13 Feb 2015, 16:57

And adding the option to not notify for your own post would keep the inbox cleaner...

@AlexanderRC

AlexanderRC

13 Feb 2015, 16:42

( Updated at: 21 Dec 2023, 09:20 )

RE:

Dogtrader said:

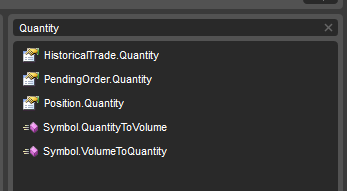

According this description the ExecuteMarketOrder() method takes volume as long type (long is integer type). This method doesn't take double (floating point value). I can only recalculate lots to volume by contract size or account balance.

Yes that is exactly that, you need to recalculate "Quantity" in lots (lots are different per instrument) into "Volume".

These are newly added functions to do the recalculation. Screenshot from built-in cAlgo help.

@AlexanderRC

AlexanderRC

13 Feb 2015, 02:03

If someone else craves for this feature, please vote for Multi-Currency Backtesting on vote.spotware.com

@AlexanderRC

AlexanderRC

13 Feb 2015, 01:46

Any news when this will be available when backtesting/optimizing?

@AlexanderRC

AlexanderRC

12 Feb 2015, 23:25

It is not implemented yet.

You may want to vote for Async callbacks for all trading events (requests and responses to the cServer), including from GUI on vote.spotware.com

@AlexanderRC

AlexanderRC

12 Feb 2015, 23:23

Point him at VolumeToQuantity() and QuantityToVolume() methods.

@AlexanderRC

AlexanderRC

12 Feb 2015, 12:19

You may save the data from the GetFitness() method somewhere in an external database (cache). In OnStart() you can see if the optimization run has be done with the tried parameters and call Stop() if the run has already been done. I am not sure if optimization engine will call GetFitness() if the cBot is stopped with Stop().

@AlexanderRC

AlexanderRC

11 Feb 2015, 00:32

RE: RE:

tynamite said:

OK now, after updating java - everything is fine again.

How is Java related to cTrader/cAlgo? These application are written on top of .Net...

@AlexanderRC

AlexanderRC

07 Apr 2015, 13:39

RE:

JeremyG said:

Windows XP is officially End-of-Life by Microsoft. No new updates are provided, including security ones.

@AlexanderRC