Topics

Replies

firemyst

24 Jun 2023, 17:19

This is a multistep process:

1) create a global variable that counts the number of crossovers.

private int _maCrossOverCount;

2) In the OnStart method, set the count to zero:

_maCrossOverCount = 0;

3) Every time a cross over happens, increase the count by 1. However, you have to decide if you want the cross over to count if it happens when a "tick" comes in or a new bar. Reason being is obviously if the MA's are close, they could cross over hundreds of time within a bar on every tick depending on how much price fluctuates

if (_sma1.Result.LastValue > _sma2.Result.LastValue)

{

_maCrossOverCount += 1;

//and

if (_sma1.Result.LastValue < _sma2.Result.LastValue)

{

_maCrossOverCount += 1;

4) Check the crossover count before you open a position:

if (_maCrossOverCount > 1)

{

/// code what you need to in order to open your position

}

@firemyst

firemyst

24 Jun 2023, 05:32

Someone can correct me if I'm wrong, but the PRC is retrofitted to price action. Only the current value of the PRC is not repainted. This is similar to a linear regression channel which is also retrofitted to price action. This means that the entire graph is repainted, with the exception of the current value of the channel, which can be used for an automated strategy.

This has already been discussed somewhat here:

@firemyst

firemyst

21 Jun 2023, 15:41

( Updated at: 21 Dec 2023, 09:23 )

I've experienced the same issue and I wasn't doing any backtesting -- only running a bot.

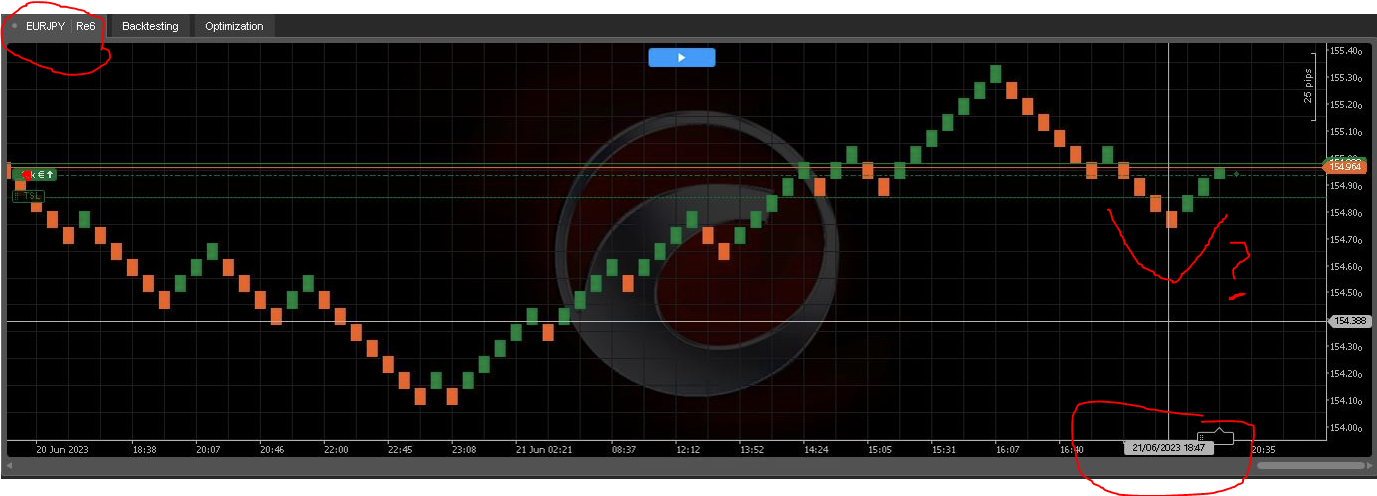

Renko 6 EURJPY. Date/time is UTC + 8 running cTrader 4.7.12.

Chart on one computer under "automate" when running/stopping a cBot:

Chart on second computer in trading tab (automate has the same chart too on this computer that was not running any cBots) :

@firemyst

firemyst

20 Jun 2023, 11:19

RE:

PanagiotisChar said:

Hi firemyst,

I guess when the data is downloaded once, it is then cached and reused by other instances too

Need help? Join us on Telegram

I would hope that's the way it is set to work. But if so, I think it would be better to only show one message saying data is being downloaded instead of 15 (like the screen capture) as that gives off the wrong impression.

Unless that's a "glitch" I came across :-)

@firemyst

firemyst

20 Jun 2023, 04:40

RE:

ncel01 said:

Hi firemyst,

I suppose that your account currency is AUD and that's for currency conversion purposes.

Thank you. that makes sense.

But be that as it may, I'm not sure why there has to be 15 separate threads downloading the SAME conversion rate data? Surely Spotware could implement it so that the data is downloaded ONCE and then shared between any number of child threads that may launch?

@firemyst

firemyst

17 Jun 2023, 06:04

Your bot is closing all positions because you tell it to:

private void CloseAllPositions()

{

foreach (var position in Positions)

{

ClosePosition(position);

}

}

If you only want to close positions that your bot has specifically opened, then it's a two step process:

1) when you open a position, you need to assign a label to it (eg, "acBotPosition"), which is a string.

2) when looping through all the open positions, only close those positions whose label matches "acBotPosition":

private void CloseAllPositions()

{

foreach (var position in Positions)

{

if (position.Label == "acBotPosition")

ClosePosition(position);

}

}

As for the cut scenario, I wouldn't use the "HasCrossedAbove" method.

Instead, I would use logic similar to the following:

if (_fastMA.Result.Last(1) > _slowMA.Result.Last(1))

{

ExecuteStrategy(TradeType.Buy);

}

else if (_fastMA.Result.Last(1) < _slowMA.Result.Last(1))

{

ExecuteStrategy(TradeType.Sell);

}

@firemyst

firemyst

17 Jun 2023, 05:54

This happens a lot with WIndows Programs (not just cTrader). I find it happens when you have two displays that are different resolutions (eg, laptop screen FHD, monitor 4k) and the higher resolution monitor gets disconnected _before_ running program is brought over to the primary display. Windows remembers program display locations, so as a result, it appears off screen when the second display isn't connected any more. It's a hassle.

Ways to try fixing it which have helped me in the past:

@firemyst

firemyst

26 Jun 2023, 05:30

JSON works perfectly with cAlgo. I use it in all my bots for saving states.

I'm using the NewtonSoft json package in Visual Studio.

You haven't stated anything on how you have your VS configured (if you're using it), nor any sample code reproducing your issue.

@firemyst