Topics

Replies

Rx1ooo

20 Jun 2024, 08:31

RE: RE: History tab now showing previous trades

herve.limousy said:

I have the same issue with cTrader Desktop 5.0.25. There's only been one trade in the history for the past few days. It seems to be showing current day's trades correctly. However, I have the entire history on cTrader for Android. Demo account with FxPro: 10580044.

PanagiotisCharalampous said:

Hi there,

Can you take full screenshots so that we can see the account number, broker and cTrader version?

Best regards,

Panagiotis

Evening,

The cTrader desktop version 4.8.34 and the broker is Pepperstone Aus, I am not willing to share my account number. I do appreciate any help you can give.

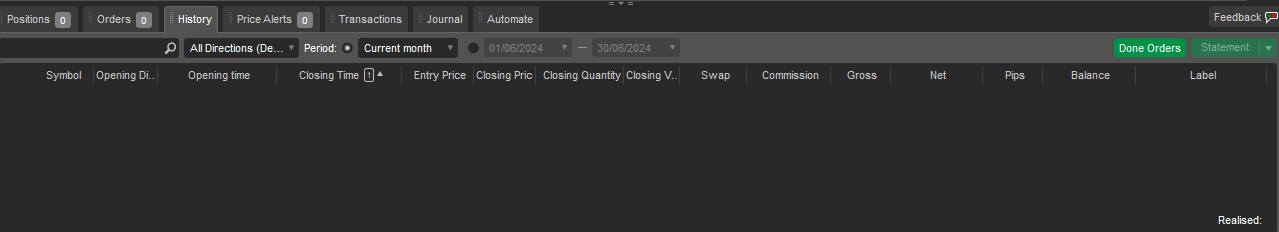

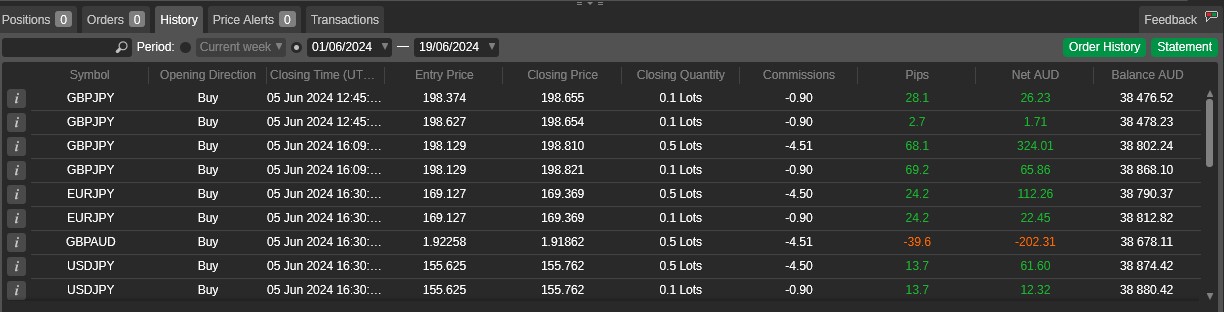

The history is appearing today it has done this before and disappearing the next day, I am wondering if a clean install would help. today's history shot

Many thanks :)

@Rx1ooo

Rx1ooo

19 Jun 2024, 05:27

RE: History tab not showing previous trades

PanagiotisCharalampous said:

Hi there,

I cannot reproduce such an issue. Can you demonstrate this problem with screenshots e.g. comparing desktop and web and showing that the trades are missing from the desktop?

Best regards,

Panagiotis

Many thanks

Desktop

Web

Web

@Rx1ooo

Rx1ooo

25 Jan 2023, 01:20

Update Error

cTrader team,

Many thanks for your response.

A clean install failed to resolve the issue, cTrader would not uninstall so I had to do it manually.

I then reinstalled windows 11 keeping my files and apps, and reinstalled cTrader to the new version this has resolved the issue.

Many thanks for your support.

bDoug

@Rx1ooo

Rx1ooo

15 Jul 2019, 01:47

Morning,

I have know solved my issue and the code buildis without any errors.

These are the changes I have made.

From this:

[Parameter("Kelt Priod", DefaultValue = 35, MinValue = 1, MaxValue = 100, Step = 1)]

public int KeltPeriod { get; set; }

[Parameter("Kelt ATR Priod", DefaultValue = 35, MinValue = 1, MaxValue = 100, Step = 1)]

public int KeltATRPeriod { get; set; }

ExponentialMovingAverage SlowMA, FastMA, KeltEMA;

SimpleMovingAverage KeltSMA;

KeltnerChannels Kelt;

protected override void OnStart()

{

SlowMA = Indicators.ExponentialMovingAverage(MarketSeries.Close, SlowMAPeriods);

FastMA = Indicators.ExponentialMovingAverage(MarketSeries.Close, FastMAPeriods);

Kelt = Indicators.KeltnerChannels(KeltPeriod, KeltEMA, KeltATRPeriod, KeltSMA, 2);

}

To this:

[Parameter("Kelt Priod", DefaultValue = 35, MinValue = 1, MaxValue = 100, Step = 1)]

public int KeltPeriod { get; set; }

[Parameter("Kelt ATR Priod", DefaultValue = 35, MinValue = 1, MaxValue = 100, Step = 1)]

public int KeltATRPeriod { get; set; }

[Parameter("KeltEMA MAtype")]

public MovingAverageType KeltEMA { get; set; }

[Parameter("KeltSMA MAtype")]

public MovingAverageType KeltSMA { get; set; }

private DataSeries Price { get; set; }

ExponentialMovingAverage SlowMA, FastMA;

KeltnerChannels Kelt;

protected override void OnStart()

{

SlowMA = Indicators.ExponentialMovingAverage(MarketSeries.Close, SlowMAPeriods);

FastMA = Indicators.ExponentialMovingAverage(MarketSeries.Close, FastMAPeriods);

Kelt = Indicators.KeltnerChannels(KeltPeriod, KeltEMA, KeltATRPeriod, KeltSMA, 2);

}

Not sure that I understand all of the reasons why, but happy now to build some logic around this indicator.

To all those that helped many thanks.

Have a good trading day. :)

@Rx1ooo

Rx1ooo

12 Jul 2019, 07:57

Perhaps I have asked the wrong question.

I want to be able to optimise the cbot.

That includes the Keltner Channel indicator periods, hence the declaration in the Onstart section.

OnStart()

{

SlowMA = Indicators.ExponentialMovingAverage(MarketSeries.Close, SlowMAPeriods);

FastMA = Indicators.ExponentialMovingAverage(MarketSeries.Close, FastMAPeriods);

Kelt = Indicators.KeltnerChannels(KeltPeriod, KeltEMA, KeltATRPeriod, KeltSMA, 2);

....

Sorry for any confusion.

This line of code is currently generator errors, that I am trying to resolve.

Kelt = Indicators.KeltnerChannels(KeltPeriod, KeltEMA, KeltATRPeriod, KeltSMA, 2);

Many thanks for any help

@Rx1ooo

Rx1ooo

12 Jul 2019, 04:26

Many thanks

Understand the code you have suggested, that was going to be my approach. :)

My issue is that the build is generating errors on the following line of code.

Kelt = Indicators.KeltnerChannels(KeltPeriod, KeltEMA, KeltATRPeriod, KeltSMA, 2);

the errors include the following:

Error CS1502: The best overloaded method match for 'cAlgo.API.Internals.IIndicatorsAccessor.KeltnerChannels(int, cAlgo.API.MovingAverageType, int, cAlgo.API.MovingAverageType, double)' has some invalid arguments

Error CS1503: Argument 2: cannot convert from 'cAlgo.API.Indicators.ExponentialMovingAverage' to 'cAlgo.API.MovingAverageType'

Error CS1503: Argument 4: cannot convert from 'cAlgo.API.Indicators.SimpleMovingAverage' to 'cAlgo.API.MovingAverageType'

Unable to move past this point.

@Rx1ooo

Rx1ooo

12 Jul 2019, 03:54

OK I will try to explain.

Code so far.

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

namespace cAlgo.Robots

{

[Robot(TimeZone = TimeZones.EAustraliaStandardTime, AccessRights = AccessRights.None)]

public class Keltner100 : Robot

{

[Parameter("Trade Start Hour", DefaultValue = 0, MinValue = 0, MaxValue = 24, Step = 1)]

public int TradeStart { get; set; }

[Parameter("Trade End Hour", DefaultValue = 23, MinValue = 0, MaxValue = 24, Step = 1)]

public int TradeEnd { get; set; }

[Parameter("Take Profit (Pips)", DefaultValue = 500, MinValue = 1, MaxValue = 500, Step = 1)]

public int TakeProfit { get; set; }

[Parameter("Stop Loss (Pips)", DefaultValue = 100, MinValue = 1, MaxValue = 100, Step = 1)]

public int StopLoss { get; set; }

[Parameter("Calculate Volume by Percentage?", DefaultValue = false)]

public bool RiskPercent { get; set; }

[Parameter("Quantity (%Risk or Lots)", DefaultValue = 0.1, MinValue = 0.01, Step = 0.01)]

public double Quantity { get; set; }

[Parameter("SlowMA Periods", DefaultValue = 50, MinValue = 1, MaxValue = 200, Step = 1)]

public int SlowMAPeriods { get; set; }

[Parameter("FastMA Periods", DefaultValue = 20, MinValue = 1, MaxValue = 100, Step = 1)]

public int FastMAPeriods { get; set; }

[Parameter("Advanced Protection", DefaultValue = 35, MinValue = 1, MaxValue = 100, Step = 1)]

public int AdProtection { get; set; }

[Parameter("Kelt Priod", DefaultValue = 35, MinValue = 1, MaxValue = 100, Step = 1)]

public int KeltPeriod { get; set; }

[Parameter("Kelt ATR Priod", DefaultValue = 35, MinValue = 1, MaxValue = 100, Step = 1)]

public int KeltATRPeriod { get; set; }

private DataSeries Price { get; set; }

// protected override double GetFitness(GetFitnessArgs args)

// {

// //maximize count of winning trades and minimize count of losing trades

// return args.WinningTrades / args.LosingTrades;

// }

ExponentialMovingAverage SlowMA, FastMA, KeltEMA;

SimpleMovingAverage KeltSMA;

KeltnerChannels Kelt;

protected override void OnStart()

{

SlowMA = Indicators.ExponentialMovingAverage(MarketSeries.Close, SlowMAPeriods);

FastMA = Indicators.ExponentialMovingAverage(MarketSeries.Close, FastMAPeriods);

Kelt = Indicators.KeltnerChannels(KeltPeriod, KeltEMA, KeltATRPeriod, KeltSMA, 2);

}

protected override void OnBar()

{

int PosCount = 0;

if (Time.Hour >= TradeStart || Time.Hour < TradeEnd)

{

foreach (var position in Positions.FindAll("Keltner100", Symbol))

{

PosCount += 1;

}

CheckTrades();

AdvancedProtection();

if (PosCount < 4)

{

if (FastMA.Result.Last(1) > SlowMA.Result.Last(1) && FastMA.Result.Last(3) < SlowMA.Result.Last(3) && FastMA.Result.IsRising())

{

Open(TradeType.Buy);

}

else if (FastMA.Result.Last(1) < SlowMA.Result.Last(1) && FastMA.Result.Last(3) > SlowMA.Result.Last(3) && FastMA.Result.IsFalling())

{

Open(TradeType.Sell);

}

}

}

}

private void Open(TradeType tradeType)

{

var volumeInUnits = CalculateVolume();

ExecuteMarketOrder(tradeType, Symbol, volumeInUnits, "Keltner100", StopLoss, TakeProfit);

}

double CalculateVolume()

{

if (!RiskPercent)

{

return (Symbol.QuantityToVolumeInUnits(Quantity));

}

else

{

// Calculate the total risk allowed per trade.

double riskPerTrade = (Account.Balance * Quantity) / 100;

double totalSLPipValue = (StopLoss + Symbol.Spread) * Symbol.PipValue;

double calculatedVolume = riskPerTrade / totalSLPipValue;

double normalizedCalculatedVolume = Symbol.NormalizeVolumeInUnits(calculatedVolume, RoundingMode.ToNearest);

return normalizedCalculatedVolume;

}

}

private void CheckTrades()

{

foreach (var position in Positions.FindAll("Keltner100", Symbol))

{

if (position.TradeType == TradeType.Buy)

{

if (FastMA.Result.IsFalling())

{

ClosePosition(position);

}

}

else if (position.TradeType == TradeType.Sell)

{

if (FastMA.Result.IsRising())

{

ClosePosition(position);

}

}

}

}

private void AdvancedProtection()

{

double ST_ls = 0;

double TA_pr = 0;

double TrailingStop = 0;

foreach (var position in Positions.FindAll("Keltner100", Symbol))

{

TA_pr = 0;

ST_ls = 0;

TrailingStop = 0;

if (position.SymbolCode == Symbol.Code)

{

if (position.Pips > AdProtection)

{

TrailingStop = position.Pips / 3;

}

if (TrailingStop > 0)

{

if (position.TradeType == TradeType.Sell)

{

TA_pr = position.EntryPrice - TakeProfit * Symbol.PipSize;

ST_ls = position.EntryPrice - TrailingStop * Symbol.PipSize;

if (ST_ls < position.StopLoss)

{

ModifyPosition(position, ST_ls, TA_pr);

}

}

if (position.TradeType == TradeType.Buy)

{

TA_pr = position.EntryPrice + TakeProfit * Symbol.PipSize;

ST_ls = position.EntryPrice + TrailingStop * Symbol.PipSize;

if (ST_ls > position.StopLoss)

{

ModifyPosition(position, ST_ls, TA_pr);

}

}

}

}

}

}

}

}

My intention is to add code to onbar section once I can reference the Keltner CHannel indicator. To test the closing price is above or below the upper & lower bands of the Keltner Channel to initiate a trade.

I hope this clarifies my intentions.

Many thanks

@Rx1ooo

Rx1ooo

12 Jul 2019, 03:31

Many thanks for the quick response.

This is a snippet of the code I have written, trying to get Keltner Channel indicator referenced in my cbot.

Currently generating errors on build

[Parameter("SlowMA Periods", DefaultValue = 50, MinValue = 1, MaxValue = 200, Step = 1)]

public int SlowMAPeriods { get; set; }

[Parameter("FastMA Periods", DefaultValue = 20, MinValue = 1, MaxValue = 100, Step = 1)]

public int FastMAPeriods { get; set; }

[Parameter("Advanced Protection", DefaultValue = 35, MinValue = 1, MaxValue = 100, Step = 1)]

public int AdProtection { get; set; }

[Parameter("Kelt Priod", DefaultValue = 35, MinValue = 1, MaxValue = 100, Step = 1)]

public int KeltPeriod { get; set; }

[Parameter("Kelt ATR Priod", DefaultValue = 35, MinValue = 1, MaxValue = 100, Step = 1)]

public int KeltATRPeriod { get; set; }

ExponentialMovingAverage SlowMA, FastMA, KeltEMA;

SimpleMovingAverage KeltSMA;

KeltnerChannels Kelt;

protected override void OnStart()

{

SlowMA = Indicators.ExponentialMovingAverage(MarketSeries.Close, SlowMAPeriods);

FastMA = Indicators.ExponentialMovingAverage(MarketSeries.Close, FastMAPeriods);

Kelt = Indicators.KeltnerChannels(KeltPeriod, KeltEMA, KeltATRPeriod, KeltSMA, 2);

}

Many thanks

@Rx1ooo

Rx1ooo

21 Jun 2024, 06:56

RE: RE: RE: RE: History tab not showing previous trades

Spotware said:

Many thanks,

I have not tried V5.0 version only version 4.8.34.

If you recommend I will give it a try and upgrade to V5.

The history came back yesterday is is also ok today, I restart the platform once a day.

One question where is the history stored local machine or broker ?

Appreciate your support.

:)

@Rx1ooo