Topics

Replies

alexander.n.fedorov

03 Oct 2018, 12:48

How about a minimum allowed price change?

@alexander.n.fedorov

alexander.n.fedorov

02 Oct 2018, 16:54

I backtest from the first Fondex tick date, which is the 29 th of November

But I recognize the trade, the candles

With you it worked OK

I needed this release, as I could make some very important improvements and philosophy.

I hope it is going to be a bomb!

@alexander.n.fedorov

alexander.n.fedorov

02 Oct 2018, 16:46

Yes, that is the trade

I did not have, even I restarted computer a few times

I showed it to my daughter, we looked together, could not understand

May be I shall reinstall the Fondex

By the way, when the beta is avail on other brokers, is the data going to as limited as well?

Regards

Sasha

P.S. Good news anyway, I started to worry about my abilities

@alexander.n.fedorov

alexander.n.fedorov

02 Oct 2018, 16:19

using System;

using System.Linq;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using cAlgo.Indicators;

using System.Collections.Generic;

namespace cAlgo

{

[Robot(TimeZone = TimeZones.RussianStandardTime, AccessRights = AccessRights.None)]

public class FAN23 : Robot

{

#region Parameters public

[Parameter("Source")]

public DataSeries Source { get; set; }

[Parameter("Minimum Equity", DefaultValue = 1500, MinValue = 1000, Step = 100)]

public double MinEquity { get; set; }

[Parameter("Bollinger Bands Deviations", DefaultValue = 2.0, MinValue = 1.8, MaxValue = 2.4, Step = 0.1)]

public double Deviations { get; set; }

[Parameter("Bollinger Bands Periods", DefaultValue = 40, Step = 1)]

public int Periods { get; set; }

[Parameter("MA Periods", DefaultValue = 200, Step = 1)]

public int MaPeriods { get; set; }

[Parameter("GridStep in pips", MinValue = 20, MaxValue = 70, DefaultValue = 20, Step = 5)]

public double GridStep { get; set; }

[Parameter("Close on profit %", DefaultValue = 1, Step = 1, MinValue = 1, MaxValue = 10)]

public double ProfitClose { get; set; }

[Parameter("Tighten steps after ", DefaultValue = 8, MinValue = 3, Step = 1)]

public int TightenSteps { get; set; }

[Parameter("Close on Drawdonw %", DefaultValue = 35, Step = 1, MinValue = 5, MaxValue = 50)]

public double DrawDownClose { get; set; }

[Parameter("Stop Trading Hour", DefaultValue = 23, Step = 1)]

public int StopHour { get; set; }

[Parameter("Stop Trading minutes", DefaultValue = 45, Step = 1)]

public int StopMinutes { get; set; }

[Parameter("Open Trades Hour", DefaultValue = 2, Step = 1, MinValue = 0)]

public int OpenTradesHour { get; set; }

#endregion

#region Parameters private

private const int GridsExponent = 2;

private string Instance;

private MovingAverage ma;

private MovingAverage BBma;

private double volume, minVolume, accountBalance, equity, profit, gridStep;

private BollingerBands BB;

private double shortPrice, longPrice;

private int totalLongPositions, totalShortPositions;

#endregion

#region cBot onStart

protected override void OnStart()

{

accountBalance = 0;

accountBalance = Account.Balance > accountBalance ? Account.Balance : accountBalance;

Instance = ToString() + ", " + Symbol.Code + ", " + TimeFrame.ToString() + ", " + Account.BrokerName + ", " + Account.Number.ToString();

BB = Indicators.BollingerBands(Source, Periods, Deviations, MovingAverageType.Simple);

ma = Indicators.MovingAverage(Source, MaPeriods, MovingAverageType.Simple);

BBma = Indicators.MovingAverage(Source, Periods, MovingAverageType.Triangular);

minVolume = 1000;

gridStep = GridStep * Symbol.PipSize;

equity = Account.Equity;

Print("Instance = {0}, Account Balanace = {1}, Account Equity = {2}, volume = {3}", Instance, Account.Balance, Account.Equity, volume);

}

#endregion

#region onBar

protected override void OnBar()

{

if ((MarketSeries.OpenTime.Last(0).Hour >= StopHour && MarketSeries.OpenTime.Last(0).Minute >= StopMinutes) || (MarketSeries.OpenTime.Last(0).Hour <= OpenTradesHour))

{

return;

}

TradeManagement();

if (volume == 0)

{

return;

}

totalShortPositions = Positions.FindAll(Instance, Symbol, TradeType.Sell).Count();

totalLongPositions = Positions.FindAll(Instance, Symbol, TradeType.Buy).Count();

#region short entries

if (MarketSeries.Close.Last(2) > BB.Top.Last(2))

{

if (MarketSeries.Close.Last(1) < BB.Top.Last(1) && MarketSeries.Low.Last(1) > BB.Main.Last(1))

{

if (totalShortPositions == 0)

{

var orderVolume = volume * Math.Pow(GridsExponent, totalShortPositions);

var result = ExecuteMarketOrder(TradeType.Sell, Symbol, orderVolume, Instance);

if (result.IsSuccessful)

{

shortPrice = result.Position.EntryPrice;

totalShortPositions = totalShortPositions + 1;

Print("Short Price = {0}, gridStep = {1}, MarketSeries.Close.Last(1) = {2}", shortPrice, gridStep, MarketSeries.Close.Last(1));

}

}

if (totalShortPositions > 0)

{

if (MarketSeries.Close.Last(1) > shortPrice + gridStep)

{

var orderVolume = volume * Math.Pow(GridsExponent, totalShortPositions);

var result = ExecuteMarketOrder(TradeType.Sell, Symbol, orderVolume, Instance);

if (result.IsSuccessful)

{

shortPrice = result.Position.EntryPrice;

totalShortPositions = totalShortPositions + 1;

Print("Short Price = {0}, gridStep = {1}, MarketSeries.Close.Last(1) = {2}", shortPrice, gridStep, MarketSeries.Close.Last(1));

}

}

}

}

}

#endregion

#region long entries

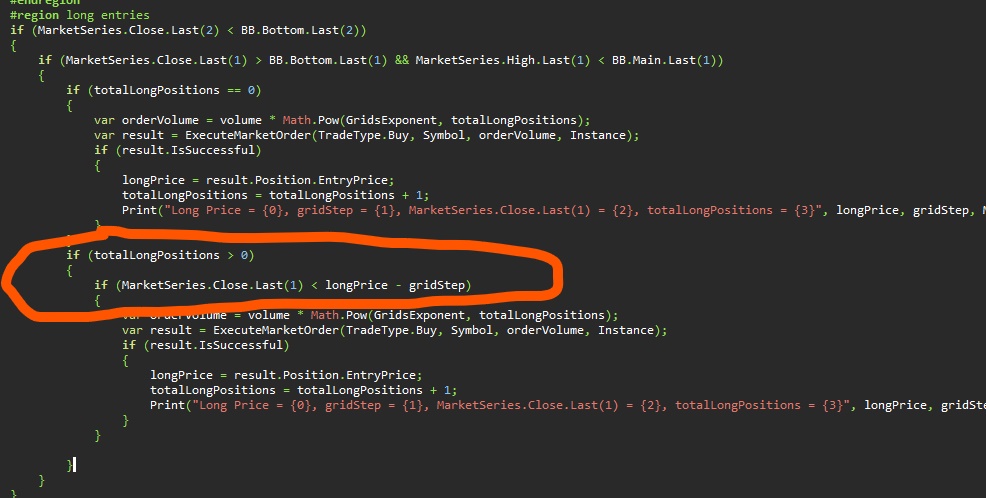

if (MarketSeries.Close.Last(2) < BB.Bottom.Last(2))

{

if (MarketSeries.Close.Last(1) > BB.Bottom.Last(1) && MarketSeries.High.Last(1) < BB.Main.Last(1))

{

if (totalLongPositions == 0)

{

var orderVolume = volume * Math.Pow(GridsExponent, totalLongPositions);

var result = ExecuteMarketOrder(TradeType.Buy, Symbol, orderVolume, Instance);

if (result.IsSuccessful)

{

longPrice = result.Position.EntryPrice;

totalLongPositions = totalLongPositions + 1;

Print("Long Price = {0}, gridStep = {1}, MarketSeries.Close.Last(1) = {2}, totalLongPositions = {3}", longPrice, gridStep, MarketSeries.Close.Last(1), totalLongPositions);

}

}

if (totalLongPositions > 0)

{

if (MarketSeries.Close.Last(1) < longPrice - gridStep)

{

var orderVolume = volume * Math.Pow(GridsExponent, totalLongPositions);

var result = ExecuteMarketOrder(TradeType.Buy, Symbol, orderVolume, Instance);

if (result.IsSuccessful)

{

longPrice = result.Position.EntryPrice;

totalLongPositions = totalLongPositions + 1;

Print("Long Price = {0}, gridStep = {1}, MarketSeries.Close.Last(1) = {2}, totalLongPositions = {3}", longPrice, gridStep, MarketSeries.Close.Last(1), totalLongPositions);

}

}

}

}

}

#endregion

#region hedge difference

#region hedge with short

if (totalLongPositions - totalShortPositions >= 4)

{

var orderVolume = volume * Math.Pow(GridsExponent, totalShortPositions + 1);

var result = ExecuteMarketOrder(TradeType.Sell, Symbol, orderVolume, Instance, null, null);

if (result.IsSuccessful)

{

totalShortPositions = totalShortPositions + 1;

}

}

#endregion

#region hedge with long

if (totalShortPositions - totalLongPositions >= 4)

{

var orderVolume = volume * Math.Pow(GridsExponent, totalLongPositions + 1);

var result = ExecuteMarketOrder(TradeType.Buy, Symbol, orderVolume, Instance, null, null);

if (result.IsSuccessful)

{

totalLongPositions = totalLongPositions + 1;

}

}

#endregion

#endregion

#region close multiple position on opposite

#region close long

if (MarketSeries.High.Last(1) >= BB.Top.Last(1))

{

if (totalLongPositions > 0 && totalShortPositions == 0)

{

var positions = Positions.FindAll(Instance, Symbol, TradeType.Buy);

foreach (var position in positions)

{

if (position.NetProfit > 0)

{

ClosePositionAsync(position);

totalLongPositions = totalLongPositions - 1;

}

}

if (totalLongPositions == 0)

{

longPrice = 0;

}

longPrice = positions.OrderByDescending(x => x.Id).Last().EntryPrice;

}

}

#endregion

#region close short

if (MarketSeries.Low.Last(1) <= BB.Bottom.Last(1))

{

if (totalLongPositions == 0 && totalShortPositions > 0)

{

var positions = Positions.FindAll(Instance, Symbol, TradeType.Sell);

foreach (var position in positions)

{

if (position.NetProfit > 0)

{

ClosePositionAsync(position);

totalShortPositions = totalShortPositions - 1;

}

}

if (totalShortPositions == 0)

{

shortPrice = 0;

}

shortPrice = positions.OrderByDescending(x => x.Id).Last().EntryPrice;

}

}

#endregion

#endregion

#region close bunch of same positions

#region close longs

if (totalLongPositions > 0 && totalShortPositions == 0)

{

var positions = Positions.FindAll(Instance, Symbol, TradeType.Buy);

profit = 0;

foreach (var position in positions)

{

profit = profit + position.NetProfit;

}

if (profit > 0)

{

foreach (var position in positions)

{

ClosePositionAsync(position);

}

}

longPrice = 0;

}

#endregion

#region close shorts

if (totalShortPositions > 0 && totalLongPositions == 0)

{

var positions = Positions.FindAll(Instance, Symbol, TradeType.Sell);

profit = 0;

foreach (var position in positions)

{

profit = profit + position.NetProfit;

}

if (profit > 0)

{

foreach (var position in positions)

{

ClosePositionAsync(position);

}

}

shortPrice = 0;

}

#endregion

}

#endregion

#endregion

#region tradeManagement

private void TradeManagement()

{

var totalPositions = Positions.FindAll(Instance);

if (totalPositions.Count() == 0)

{

equity = Account.Equity;

var newVolume = Math.Floor(equity / MinEquity) * minVolume;

volume = newVolume;

return;

}

if (totalPositions.Count() > 0)

{

profit = 0;

foreach (var position in Positions.FindAll(Instance))

{

profit = profit + position.NetProfit;

}

if (profit > equity * ProfitClose / 100 || profit < -equity * DrawDownClose / 100)

{

foreach (var position in Positions.FindAll(Instance))

{

ClosePositionAsync(position);

}

Print("closed all");

equity = Account.Equity;

shortPrice = 0;

longPrice = 0;

}

}

}

#endregion

}

}

@alexander.n.fedorov

alexander.n.fedorov

02 Oct 2018, 16:10

( Updated at: 21 Dec 2023, 09:20 )

No, the candlestick I am pointing to is green color, it is bullish, it opens below and closes above BB bottom. Just try to increase the picture

@alexander.n.fedorov

alexander.n.fedorov

02 Oct 2018, 14:35

Please, help! what do I do wrong?

Regards,

Sasha

@alexander.n.fedorov

alexander.n.fedorov

26 Sep 2018, 12:04

I calculate on Tick availabel margin, before I plasce market order

So, the

"

private void CalculatePosition()

{

}

"

mast check the dynamic leverage

@alexander.n.fedorov

alexander.n.fedorov

26 Sep 2018, 11:59

So , it was a misprint in API reference?

@alexander.n.fedorov

alexander.n.fedorov

26 Sep 2018, 11:57

Thank you Panagiotis, and let God me be in large positions

@alexander.n.fedorov

alexander.n.fedorov

24 Sep 2018, 10:56

Panagiotis!

Such a pity. Should not be difficult to implement, but very helpful!

Regards

Sasha

P.S. You guys made a fantasic visusalization (I saw it on Fondex). The only problem - there is no data on Fondex

@alexander.n.fedorov

alexander.n.fedorov

17 Sep 2018, 20:50

sorry for misprints .

"

I coulds use...

"

@alexander.n.fedorov

alexander.n.fedorov

17 Sep 2018, 20:49

Thank you for you very clear answer, Paul

I used to do some programming in VBA for Excel.

If I had and array of data I could loop through the data. It would take some time and processor power if aray is big enoungh

At the same time I could you some standart Excel functions (like "Match" or "Index" for example) and they would work many times faster

As I am new to c# and especially it is virtually impossible to find a textbook for this API, I was assumning, maybe there is a standart function.

But thank you anyway!

Regards,

Sasha

@alexander.n.fedorov

alexander.n.fedorov

17 Sep 2018, 13:06

It is strange . In MT4 very convinient to drag and drop

But thank you anyway

@alexander.n.fedorov

alexander.n.fedorov

06 Sep 2018, 12:57

Hi, Panagiotis,

Thanks for reply ,

Unfortunately it does not work

Regards,

Sahsa

@alexander.n.fedorov

alexander.n.fedorov

06 Sep 2018, 12:56

Hi, Panagiotis,

Thanks for the reply

Unfortunately, it does not work

Regards,

Sasha

@alexander.n.fedorov

alexander.n.fedorov

03 Oct 2018, 13:01 ( Updated at: 21 Dec 2023, 09:20 )

@alexander.n.fedorov