Topics

Replies

alexander.n.fedorov

07 Mar 2018, 10:31

Stop Loss Hunting!

Panagiotis,

Thank you for the answer.

My concern is mostly about the platform, as it looks like the have a robot, and really, my question was if is possible from the platform point of view.

There is no reason to talk to broker, as the will deny, it is big money involved.

I am really disapointed, cause I made a cBot, and it was working well, then in a matter of minutes I lost 80% of my profits and what I saw was happening with

the price action leave me almost no doubts.

You don't have to reply to this, evrything is quite obvious, I just want other users of cBots know about this issue, so the would be carefull against their own brokers

Regards,

Alexander

@alexander.n.fedorov

alexander.n.fedorov

07 Mar 2018, 01:30

( Updated at: 21 Dec 2023, 09:20 )

Stop Loss Hunting!

Just for comarison, printscreen from another broker.

@alexander.n.fedorov

alexander.n.fedorov

07 Mar 2018, 01:21

Stop Loss Hunting!

Dear Pangiotis,

Can you, please, comment on this?

To me that looks very much like a stop loss hunting. The price was up and down like crasy. I have lost on this. Who shall I speak to about this? May be there is some licensing authority to who I shall send the video?

Please advise

Alexander

@alexander.n.fedorov

alexander.n.fedorov

06 Mar 2018, 00:14

Midnight datetime is not good for my TimeZone

Everything started to work fine after 1 am

@alexander.n.fedorov

alexander.n.fedorov

05 Mar 2018, 23:39

Midnight datetime is not good for my TimeZone

The Bot has to place orders at midnight but instead, as expected after the said above, it gives an error message smth like "Bad epxpiry date"

@alexander.n.fedorov

alexander.n.fedorov

05 Mar 2018, 12:55

OnBar() ?

Thank you.

I am using smth simiilar, I was not sure that I have to use a workaround, but now I do

@alexander.n.fedorov

alexander.n.fedorov

05 Mar 2018, 12:37

OnBar() ?

Pangiotis,

Thank you for your kind answer.

Yes, it does

But what about my second question?

@alexander.n.fedorov

alexander.n.fedorov

04 Mar 2018, 19:41

OnStart() - continuation

what I put and it does not show any errors is this

"

protected override void OnBar()

{

var newDate = MarketSeries.OpenTime.LastValue.Date;

if (newDate >= NextDay[0])

{

OnStart();

}

else

{

// OnBar () logic here

}

}

"

But I cannot test it because no signal from the server on the weekend :)

@alexander.n.fedorov

alexander.n.fedorov

04 Mar 2018, 19:29

use of OnBar()

One more thing.

Let' us say my Bot is working on a chart H1, which means H1 is a major timeframe.

And suppose I am using second Timeframe Daily

How can a set up a function OnBar() for a second TimeFrame, for example if a new day opens?

Regards

@alexander.n.fedorov

alexander.n.fedorov

03 Mar 2018, 11:53

Dear Pangiotis

Late repy, because of the market situation. Was very busy with equities falling.

It looks like this code is working, but I am not sure if it functioning all right. Meaning, it does not show me any mistakes when building, but I do not see any change on the backtesting.

Just tell, if syntax is correct, or if there are any traps in this code.

"

...

[Parameter("Use ADX filter", DefaultValue = false)]

public bool ADXFilter { get; set; }

[Parameter("ADX period", DefaultValue = 14)]

public int ADXperiod { get; set; }

......

private bool ADX_OKtoBuy;

private bool ADX_OKtoSell;

#endregion

#region cBot onStart

protected override void OnStart()

{

InstanceName = InstanceName + " " + Symbol.Code;

Source2 = MarketData.GetSeries(Timeframe2);

var Source3 = MarketData.GetSeries(Timeframe2);

BB = Indicators.BollingerBands(Source, Periods, Deviations, MovingAverageType.Exponential);

BB2 = Indicators.BollingerBands(Source, Periods, Deviations / 2, MovingAverageType.Exponential);

ATR = Indicators.AverageTrueRange(Periods, MovingAverageType.Exponential);

MA2 = Indicators.MovingAverage(Source2.Close, Periods, MovingAverageType.Exponential);

_ATR = ATR.Result.LastValue;

_SL = _ATR * _ATR_SL_Factor / Symbol.PipSize;

_TP = _SL * _TP_Factor;

ADX = Indicators.DirectionalMovementSystem(Source3, ADXperiod);

CloseTrade = false;

}

"

Regards,

Alexander

@alexander.n.fedorov

alexander.n.fedorov

03 Mar 2018, 10:17

new release

Dear Spotware,

Would be nice of you to supply a complete description of the changes to API and the user's features

@alexander.n.fedorov

alexander.n.fedorov

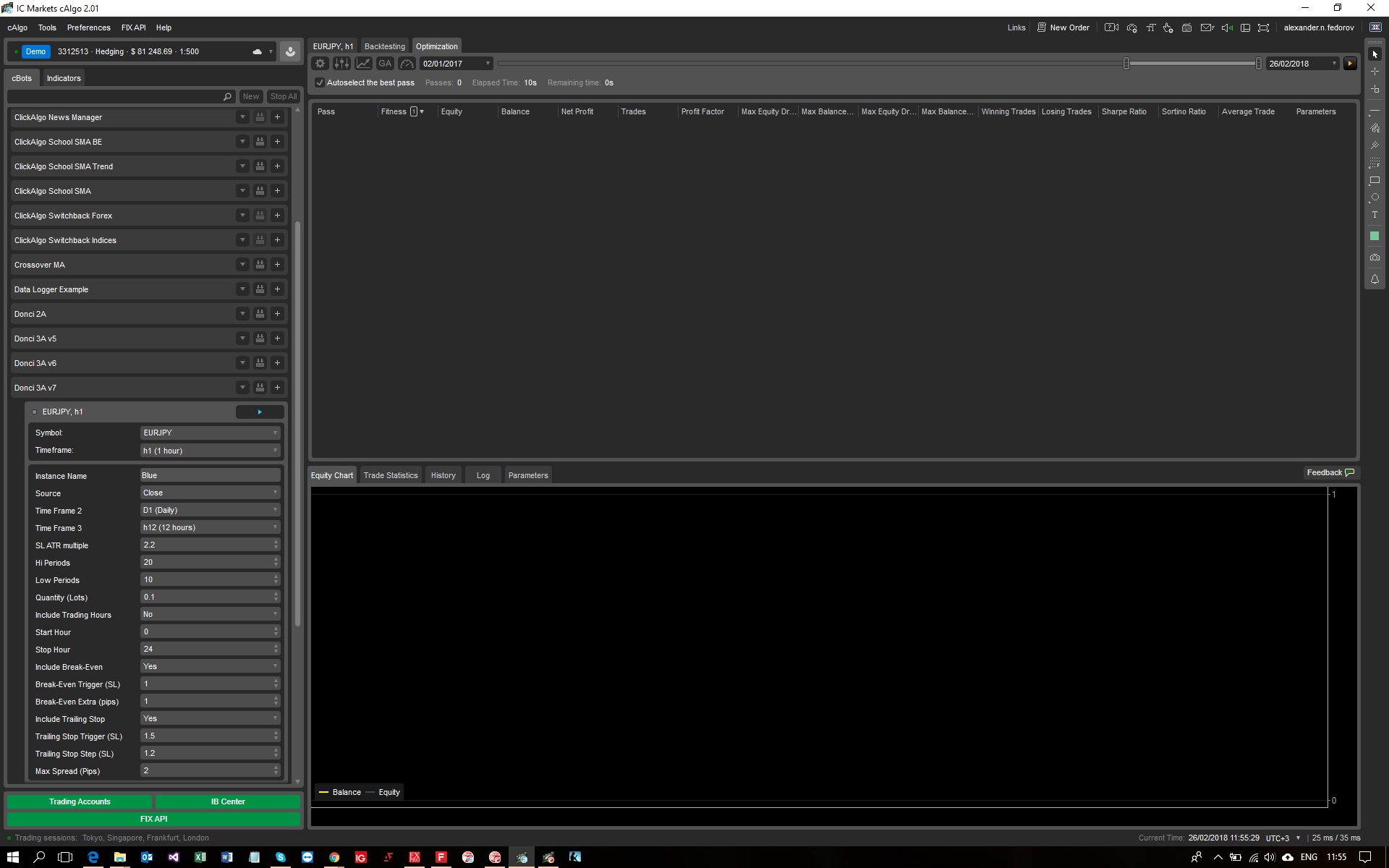

26 Feb 2018, 13:16

Backtesting

Panagiotis,

I tryied to do it on two differen computers. On both it did not work

Now it is working on both.

Out of that I think it was something with a server connection.

Alexander

@alexander.n.fedorov

alexander.n.fedorov

26 Feb 2018, 12:55

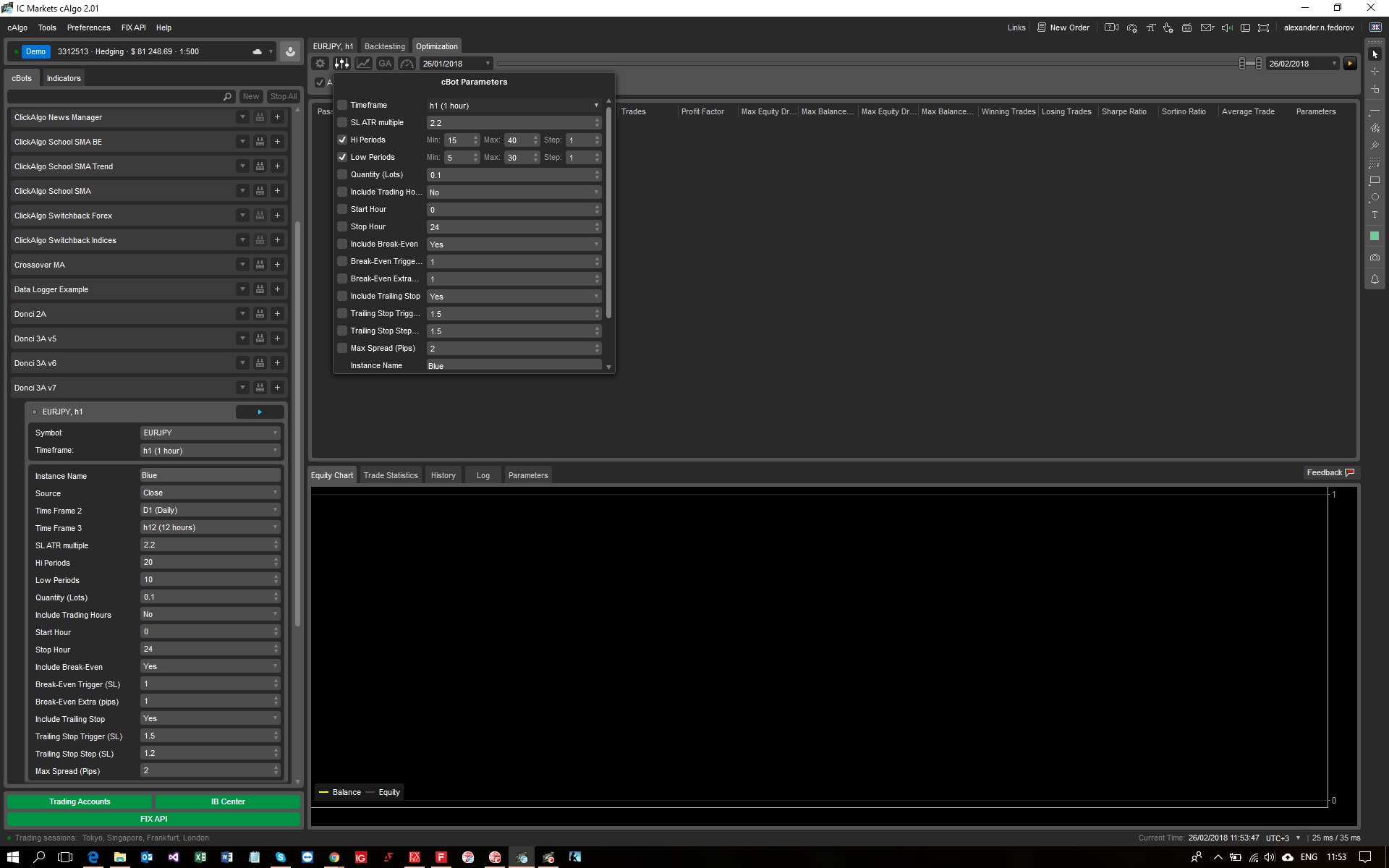

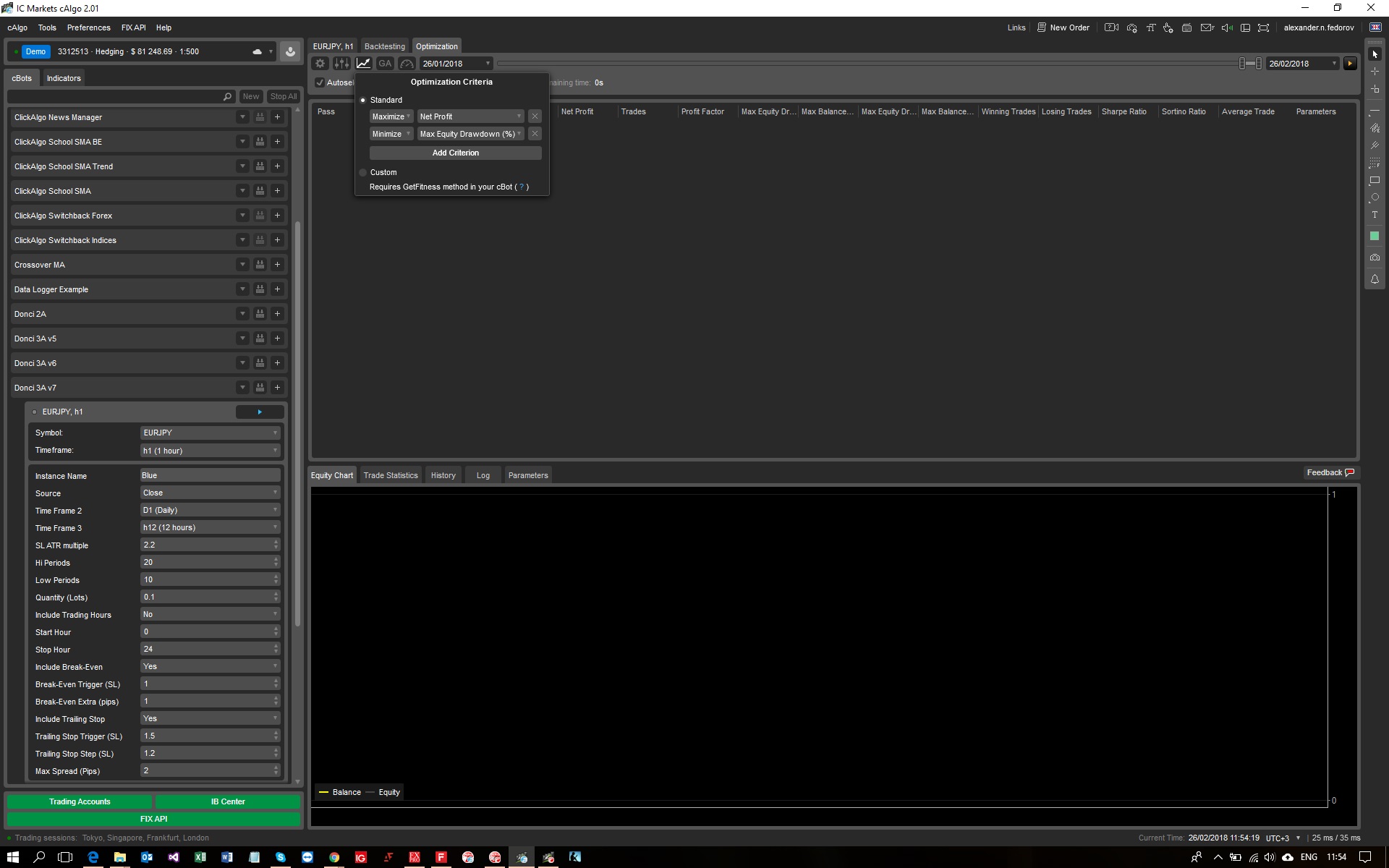

Backtesting

the Bot code is up the screen

I will try the image button again

@alexander.n.fedorov

alexander.n.fedorov

26 Feb 2018, 12:52

Backtesting

If you could send me your skype or e-mail,

I could send you the screenshots

just in case my skype is alexander.n.fedorov

and mail is alexander.n.fedorov@gmail.com

@alexander.n.fedorov

alexander.n.fedorov

26 Feb 2018, 12:50

Hi, Panagiotis,

it starts, and after few seconds it stops with remaining time 0 seconds

I tryied to drop the *.png screenshot files, or *.jpg, but also could not do much, as it was taking the whole screen. How do I upload a jpg file?

@alexander.n.fedorov

alexander.n.fedorov

13 Mar 2018, 13:07

That is what I did:

"

[Robot(TimeZone = TimeZones.RussianStandardTime, AccessRights = AccessRights.None)]

public class LondonRange : Robot

{

...

public HistoricalTrade FindLast;

...

OnStart()

...

Severity Code Description Project File Line Suppression State

Error CS0501 'LondonRange.FindLast(string)' must declare a body because it is not marked abstract, extern, or partial London Range C:\Users\User\Documents\cAlgo\Sources\Robots\London Range\London Range\London Range.cs 77 Active

"

After that I am lost

please advise

@alexander.n.fedorov