Topics

Replies

jelle2500

01 Nov 2018, 16:14

RE:

Panagiotis Charalampous said:

Hi jelle2500,

Here you are

var tpBuy = Math.Round((MarketSeries.Low.Last(3) - Symbol.Ask) / Symbol.PipSize, Symbol.Digits); var tpSell = Math.Round((Symbol.Bid - MarketSeries.High.Last(3)) / Symbol.PipSize, Symbol.Digits);Best Regards,

Panagiotis

you are the best! thanks Panagiotis!

@jelle2500

jelle2500

01 Nov 2018, 16:01

RE:

Panagiotis Charalampous said:

Hi jelle2500,

Yes this is right.

Best Regards,

Panagiotis

thanks Panagiotis! for the last part of my bot i'm tryping to make a take profit on last(3)

so when a buy trade is open take profit should be on MarketSeries.Low.Last(3)

and when a sell trade is open take profit should be on MarketSeries.High.Last(3)

can you help me with this?

@jelle2500

jelle2500

30 Oct 2018, 12:33

RE:

Panagiotis Charalampous said:

Change this one as well

var stopLossSell = MarketSeries.High.Last(1) + Symbol.PipSize * SL;Best Regards,

Panagiotis

oh didn't see thisone yet..

works perfect! thanks Panagiotis!!

@jelle2500

jelle2500

30 Oct 2018, 12:27

RE:

Panagiotis Charalampous said:

Hi jelle2500,

Try this line of code

var SLSell = Math.Round((stopLossSell - Symbol.Bid) / Symbol.PipSize);Best Regards,

Panagiotis

got another sollution..

i'm making 2 different types of stoploss parameters..

for example:

BuyStopLoss: 10 pips

SellStopLoss: -10 pips

@jelle2500

jelle2500

30 Oct 2018, 12:19

RE:

Panagiotis Charalampous said:

Hi jelle2500,

Try this line of code

var SLSell = Math.Round((stopLossSell - Symbol.Bid) / Symbol.PipSize);Best Regards,

Panagiotis

i did celebrate to soon.. the stoploss still is below the high instead of above the high..

@jelle2500

jelle2500

30 Oct 2018, 12:15

RE:

Panagiotis Charalampous said:

Hi jelle2500,

Try this line of code

var SLSell = Math.Round((stopLossSell - Symbol.Bid) / Symbol.PipSize);Best Regards,

Panagiotis

hero!

thank!

@jelle2500

jelle2500

29 Oct 2018, 12:46

RE:

freemangreat said:

The result of the indicator will be in the Log. For the best filtering of candles see how to change the function checkCandle.

using System; using cAlgo.API; using cAlgo.API.Internals; using cAlgo.API.Indicators; using cAlgo.Indicators; namespace cAlgo { [Indicator(IsOverlay = false, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)] public class TestCandle : Indicator { [Parameter(DefaultValue = 0.0)] public double Parameter { get; set; } [Output("Main")] public IndicatorDataSeries Result { get; set; } bool bFirst =true; protected override void Initialize() { // Initialize and create nested indicators } public override void Calculate(int index) { CANDLE candle; if(IsLastBar && bFirst) { int c =5; // check last 5 bars index -=(c - 1); while(c-- > 0) { candle =checkCandle(index); Print("Bar: {0} - Body: {1} PinUp: {2} PinDown: {3} DiffPins: {4}", index++, candle.fBody, candle.fPinUp, candle.fPinDown, candle.fDiffPins); } bFirst =false; } } //........................................................................ public CANDLE checkCandle(int iCandle) { CANDLE candle = new CANDLE {}; candle.fBody =(MarketSeries.Close[iCandle] - MarketSeries.Open[iCandle]); // if bull candle if(candle.fBody > 0) { candle.fPinUp =(MarketSeries.High[iCandle] - MarketSeries.Close[iCandle]); candle.fPinDown =(MarketSeries.Open[iCandle] - MarketSeries.Low[iCandle]); } // if bear or 0 else { candle.fPinUp =(MarketSeries.High[iCandle] - MarketSeries.Open[iCandle]); candle.fPinDown =(MarketSeries.Close[iCandle] - MarketSeries.Low[iCandle]); } candle.fDiffPins =0; // compare pins if(candle.fPinUp >= Symbol.PipSize && candle.fPinDown >= Symbol.PipSize) if(candle.fPinUp > candle.fPinDown) candle.fDiffPins =(candle.fPinUp / candle.fPinDown); else if(candle.fPinUp < candle.fPinDown) candle.fDiffPins =(-candle.fPinDown / candle.fPinUp); candle.fDiffPins *=100; return(candle); } //------------------------------------------------------------------------ public struct CANDLE { public double fBody; // +/0/- ; bullish - positive, bearish - negative public double fPinUp; // +/0 ; allways positive or 0 public double fPinDown; // +/0 ; allways positive or 0 public double fDiffPins; // +/-(%); PinUp > PinDown (+) : PinUp < PinDown (-) } } }

got it thanks!!

@jelle2500

jelle2500

27 Aug 2018, 10:52

RE: RE:

patrick.sifneos@gmail.com said:

Hey Jelle

Difference in Pips:

(MarketSeries.High.Last(1) - MarketSeries.Low.Last(1)) / Symbol.PipSizeSo this part (and more then a number of pips) is solved then.

thanks!

jelle2500 said:

Can someone fix this for me?

I need this:

the difference between MarketSeries.High.Last(1) and MarketSeries.Low.Last(1) = 100 %

and more then (number of pips).then if the difference between MarketSeries.Low.Last(1) and MarketSeries.Close.Last(1) = more then 50% of the candle

{

Buy signal = true.

Else if the difference between MarketSeries.High.Last(1) and MarketSeries.Close.Last(1) = more than 50% of the candle

{

Sell signal = true.

Thanks,

Jelle

@jelle2500

jelle2500

17 Aug 2018, 16:33

( Updated at: 21 Dec 2023, 09:20 )

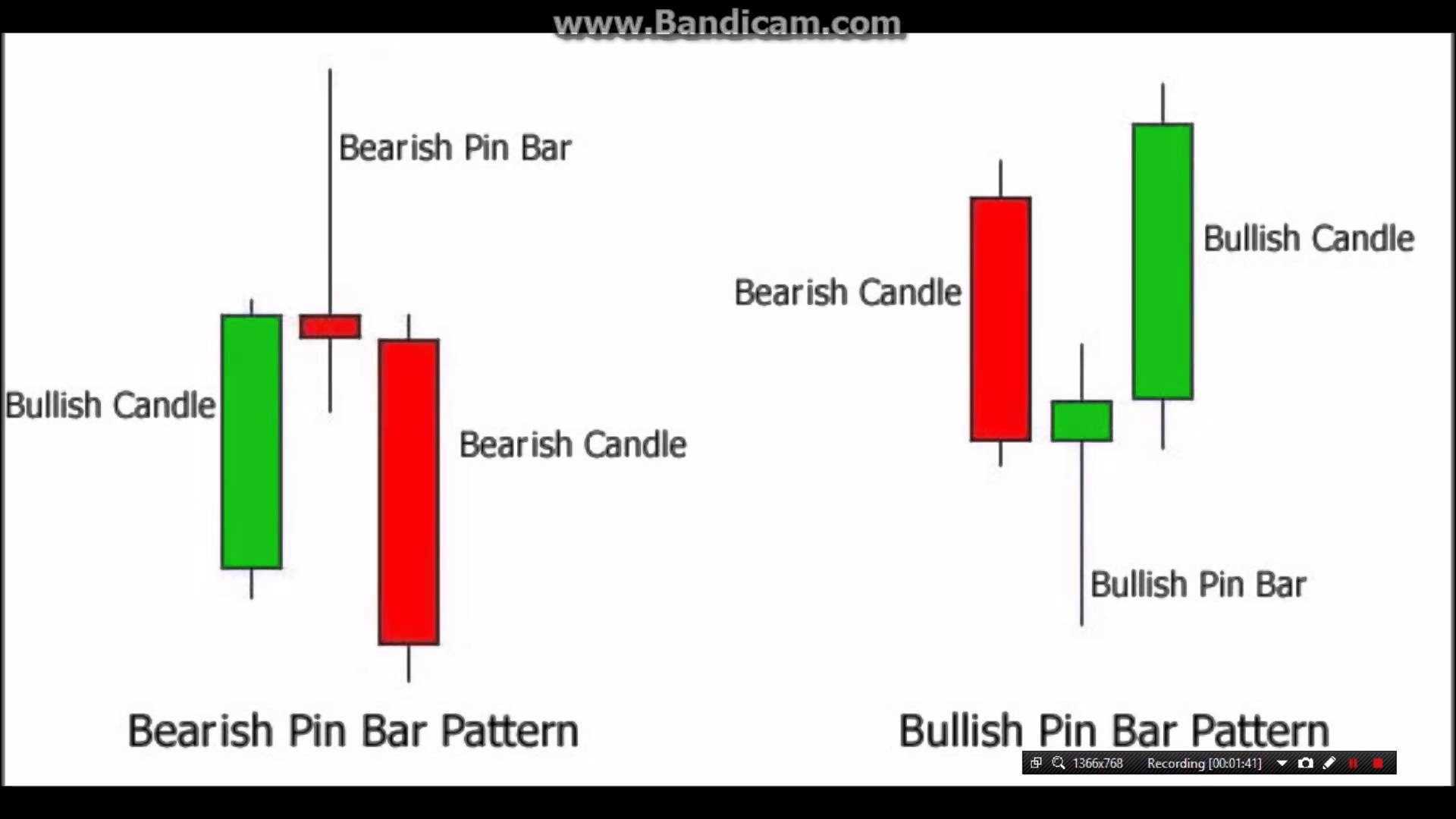

just need a simple bot who takes buy after the bullish pin bar is closed ans sell after the bearish pin bar is closed.

but i need to have a parameter witch i can use to set the minimal percentage of tail in the candle

@jelle2500

jelle2500

24 May 2018, 09:47

RE:

Panagiotis Charalampous said:

Hi,

You can try something like this

_volume = (long)Math.Ceiling(Account.Equity / 1000) * 1000Best Regards,

Panagiotis

Thanks Panagiotis!

@jelle2500

jelle2500

14 May 2018, 09:51

RE:

Panagiotis Charalampous said:

Hi jelle2500,

You can use a condition like below

if (Positions.Count(x => x.TradeType == TradeType.Buy) == 0) { // Execute Buy Trade }?Let me know if this helps you

Best Regards,

Panagiotis

Again, thanks a lot Panagiotis!

@jelle2500

jelle2500

14 May 2018, 09:49

RE:

Panagiotis Charalampous said:

Hi jelle2500,

See below

if(AllowBuy1 || AllowBuy2) { // Execute Buy Order } if(AllowSell1 || AllowSell2) { // Execute Sell Order }Let me know if this is what you are looking for.

Best Regards,

Panagiotis

Perfect! thanks a lot Panagiotis!

@jelle2500

jelle2500

23 Apr 2018, 16:03

RE:

tradermatrix said:

you have to program one command at a time

can be like that;

using System; using System.Linq; using cAlgo.API; using cAlgo.API.Indicators; using cAlgo.API.Internals; using cAlgo.Indicators; namespace cAlgo { [Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)] public class EMACross_RSI : Robot { [Parameter("Source")] public DataSeries SourceSeries { get; set; } [Parameter("Slow Periods", DefaultValue = 30)] public int SlowPeriods { get; set; } [Parameter("Fast Periods", DefaultValue = 14)] public int FastPeriods { get; set; } [Parameter("Quantity (Lots)", DefaultValue = 1, MinValue = 0.01, Step = 0.01)] public double Quantity { get; set; } [Parameter("Stop Loss (pips)", DefaultValue = 20, MinValue = 0)] public int StopLossInPips { get; set; } [Parameter("Take Profit (pips)", DefaultValue = 60, MinValue = 0)] public int TakeProfitInPips { get; set; } private ExponentialMovingAverage slowMa; private ExponentialMovingAverage fastMa; private const string label = "EMA"; private Position longPosition; private Position shortPosition; protected override void OnStart() { fastMa = Indicators.ExponentialMovingAverage(SourceSeries, FastPeriods); slowMa = Indicators.ExponentialMovingAverage(SourceSeries, SlowPeriods); } protected override void OnBar() { var cBotPositions = Positions.FindAll(label); longPosition = Positions.Find(label, Symbol, TradeType.Buy); shortPosition = Positions.Find(label, Symbol, TradeType.Sell); if (cBotPositions.Length >= 1) return; if (slowMa.Result.Last(1) < fastMa.Result.Last(1) && longPosition == null) { ExecuteMarketOrder(TradeType.Buy, Symbol, VolumeInUnits, label, StopLossInPips, TakeProfitInPips); } else if (slowMa.Result.Last(1) > fastMa.Result.Last(1) && shortPosition == null) { ExecuteMarketOrder(TradeType.Sell, Symbol, VolumeInUnits, label, StopLossInPips, TakeProfitInPips); } } private long VolumeInUnits { get { return Symbol.QuantityToVolume(Quantity); } } } }thanks a lot for your reply, but can i put a rule that make 1 trade posible each MA Crossover till the next crossover comes?

because when i set a stoploss of trailing stoploss and the trade is closed my bot takes another trade when my signals are still active..

my bot needs to wait for the next MA Crossover.

@jelle2500

jelle2500

20 Feb 2019, 01:03

RE:

erisoftdevelop said:

Thanks fot your help! i've got it.

Jelle

@jelle2500