Topics

Replies

jcr1818

03 Dec 2024, 12:13

RE: the optimization results - are these credible enough?

PanagiotisCharalampous said:

Hi there,

I just tested it and the results are identical

There is probably something wrong in your configuration that we cannot see. Please check a bit more.

Best regards,

Panagiotis

Over the past year, I have done well over 3,000 optimizations, and it’s definitely not always been clear to me what the logic behind the results is, as the optimization and backtest results should match, which they don’t at all. I can’t see where a potential error could be in my configuration. Maybe I can get a more precise hint? We agree that the results should be the same when I import the optimization result into the parameters, right? Once this is done, I click on backtest and, of course, check the data from the optimization and the backtest parameters, including the date. What I can’t see is whether the import of the backtest includes things like wrap and other criteria, but logically, these things should be included when importing the optimization data. I am trying to perform another simple test based on one of your robots from your system.

@jcr1818

jcr1818

02 Dec 2024, 12:56

( Updated at: 02 Dec 2024, 13:25 )

RE: RE: RE: RE: the optimization results - are these credible enough?

jcr1818 said:

PanagiotisCharalampous said:

jcr1818 said:

PanagiotisCharalampous said:

Hi there,

Please provide us with more information on how to reproduce this problem. Share your cBot code, cBot parameters, dates and broker and explain to us what you expected to see and what you see instead.

Best regards,

Panagiotis

In this example I use following from the c-trader cbot system: SAMPLE RSI CBOT.

Data ticks: EURUSD 1 HOUR: Optimisation settings: TF 1 hour. Quantity: 1 lot. Source: Close. Periods: min: 5 max 20 and step 1.

Optimisation Criteria: Standard. Max netto profit. Min equity DD (%) and Max winnings trades.

Test period: 30.10.24 - 30.11.24

The system shows: AUTOSELECT THE BEST PASS: = 14. Netto profit: = 2773,72. Trades 27 etc.

Then I import the result and backtest it without changing nothing. Now the netto results shows me just 380,75 + 1 open position = 225,33 (euro)

What do I wrong?

Code:

// -------------------------------------------------------------------------------------------------

//

// This code is a cTrader Automate API example.

//

// This cBot is intended to be used as a sample and does not guarantee any particular outcome or

// profit of any kind. Use it at your own risk.

//

// All changes to this file might be lost on the next application update.

// If you are going to modify this file please make a copy using the "Duplicate" command.

//

// The "Sample RSI cBot" will create a buy order when the Relative Strength Index indicator crosses the level 30,

// and a Sell order when the RSI indicator crosses the level 70. The order is closed be either a Stop Loss, defined in

// the "Stop Loss" parameter, or by the opposite RSI crossing signal (buy orders close when RSI crosses the 70 level

// and sell orders are closed when RSI crosses the 30 level).

//

// The cBot can generate only one Buy or Sell order at any given time.

//

// -------------------------------------------------------------------------------------------------

using cAlgo.API;

using cAlgo.API.Indicators;

namespace cAlgo

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None, AddIndicators = true)]

public class SampleRSIcBot : Robot

{

[Parameter("Quantity (Lots)", Group = "Volume", DefaultValue = 1, MinValue = 0.01, Step = 0.01)]

public double Quantity { get; set; }

[Parameter("Source", Group = "RSI")]

public DataSeries Source { get; set; }

[Parameter("Periods", Group = "RSI", DefaultValue = 14)]

public int Periods { get; set; }

private RelativeStrengthIndex rsi;

protected override void OnStart()

{

rsi = Indicators.RelativeStrengthIndex(Source, Periods);

}

protected override void OnTick()

{

if (rsi.Result.LastValue < 30)

{

Close(TradeType.Sell);

Open(TradeType.Buy);

}

else if (rsi.Result.LastValue > 70)

{

Close(TradeType.Buy);

Open(TradeType.Sell);

}

}

private void Close(TradeType tradeType)

{

foreach (var position in Positions.FindAll("SampleRSI", SymbolName, tradeType))

ClosePosition(position);

}

private void Open(TradeType tradeType)

{

var position = Positions.Find("SampleRSI", SymbolName, tradeType);

var volumeInUnits = Symbol.QuantityToVolumeInUnits(Quantity);

if (position == null)

ExecuteMarketOrder(tradeType, SymbolName, volumeInUnits, "SampleRSI");

}

}

}

Are the backtesting settings the same (dates, source, commissions

Yes 100%. I am very careful about consistent data. However, In my backtests and optimizations, I can choose live spread but not swap. If the ticks option covers commission, swap, etc. then there should be no difference at all. ??

@jcr1818

jcr1818

02 Dec 2024, 12:55

RE: RE: RE: the optimization results - are these credible enough?

PanagiotisCharalampous said:

jcr1818 said:

PanagiotisCharalampous said:

Hi there,

Please provide us with more information on how to reproduce this problem. Share your cBot code, cBot parameters, dates and broker and explain to us what you expected to see and what you see instead.

Best regards,

Panagiotis

In this example I use following from the c-trader cbot system: SAMPLE RSI CBOT.

Data ticks: EURUSD 1 HOUR: Optimisation settings: TF 1 hour. Quantity: 1 lot. Source: Close. Periods: min: 5 max 20 and step 1.

Optimisation Criteria: Standard. Max netto profit. Min equity DD (%) and Max winnings trades.

Test period: 30.10.24 - 30.11.24

The system shows: AUTOSELECT THE BEST PASS: = 14. Netto profit: = 2773,72. Trades 27 etc.

Then I import the result and backtest it without changing nothing. Now the netto results shows me just 380,75 + 1 open position = 225,33 (euro)

What do I wrong?

Code:

// -------------------------------------------------------------------------------------------------

//

// This code is a cTrader Automate API example.

//

// This cBot is intended to be used as a sample and does not guarantee any particular outcome or

// profit of any kind. Use it at your own risk.

//

// All changes to this file might be lost on the next application update.

// If you are going to modify this file please make a copy using the "Duplicate" command.

//

// The "Sample RSI cBot" will create a buy order when the Relative Strength Index indicator crosses the level 30,

// and a Sell order when the RSI indicator crosses the level 70. The order is closed be either a Stop Loss, defined in

// the "Stop Loss" parameter, or by the opposite RSI crossing signal (buy orders close when RSI crosses the 70 level

// and sell orders are closed when RSI crosses the 30 level).

//

// The cBot can generate only one Buy or Sell order at any given time.

//

// -------------------------------------------------------------------------------------------------

using cAlgo.API;

using cAlgo.API.Indicators;

namespace cAlgo

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None, AddIndicators = true)]

public class SampleRSIcBot : Robot

{

[Parameter("Quantity (Lots)", Group = "Volume", DefaultValue = 1, MinValue = 0.01, Step = 0.01)]

public double Quantity { get; set; }

[Parameter("Source", Group = "RSI")]

public DataSeries Source { get; set; }

[Parameter("Periods", Group = "RSI", DefaultValue = 14)]

public int Periods { get; set; }

private RelativeStrengthIndex rsi;

protected override void OnStart()

{

rsi = Indicators.RelativeStrengthIndex(Source, Periods);

}

protected override void OnTick()

{

if (rsi.Result.LastValue < 30)

{

Close(TradeType.Sell);

Open(TradeType.Buy);

}

else if (rsi.Result.LastValue > 70)

{

Close(TradeType.Buy);

Open(TradeType.Sell);

}

}

private void Close(TradeType tradeType)

{

foreach (var position in Positions.FindAll("SampleRSI", SymbolName, tradeType))

ClosePosition(position);

}

private void Open(TradeType tradeType)

{

var position = Positions.Find("SampleRSI", SymbolName, tradeType);

var volumeInUnits = Symbol.QuantityToVolumeInUnits(Quantity);

if (position == null)

ExecuteMarketOrder(tradeType, SymbolName, volumeInUnits, "SampleRSI");

}

}

}

Are the backtesting settings the same (dates, source, commissions

@jcr1818

jcr1818

01 Dec 2024, 16:59

( Updated at: 01 Dec 2024, 17:34 )

RE: the optimization results - are these credible enough?

PanagiotisCharalampous said:

Hi there,

Please provide us with more information on how to reproduce this problem. Share your cBot code, cBot parameters, dates and broker and explain to us what you expected to see and what you see instead.

Best regards,

Panagiotis

In this example I use following from the c-trader cbot system: SAMPLE RSI CBOT.

Data ticks: EURUSD 1 HOUR: Optimisation settings: TF 1 hour. Quantity: 1 lot. Source: Close. Periods: min: 5 max 20 and step 1.

Optimisation Criteria: Standard. Max netto profit. Min equity DD (%) and Max winnings trades.

Test period: 30.10.24 - 30.11.24

The system shows: AUTOSELECT THE BEST PASS: = 14. Netto profit: = 2773,72. Trades 27 etc.

Then I import the result and backtest it without changing nothing. Now the netto results shows me just 380,75 + 1 open position = 225,33 (euro)

What do I wrong?

Code:

// -------------------------------------------------------------------------------------------------

//

// This code is a cTrader Automate API example.

//

// This cBot is intended to be used as a sample and does not guarantee any particular outcome or

// profit of any kind. Use it at your own risk.

//

// All changes to this file might be lost on the next application update.

// If you are going to modify this file please make a copy using the "Duplicate" command.

//

// The "Sample RSI cBot" will create a buy order when the Relative Strength Index indicator crosses the level 30,

// and a Sell order when the RSI indicator crosses the level 70. The order is closed be either a Stop Loss, defined in

// the "Stop Loss" parameter, or by the opposite RSI crossing signal (buy orders close when RSI crosses the 70 level

// and sell orders are closed when RSI crosses the 30 level).

//

// The cBot can generate only one Buy or Sell order at any given time.

//

// -------------------------------------------------------------------------------------------------

using cAlgo.API;

using cAlgo.API.Indicators;

namespace cAlgo

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None, AddIndicators = true)]

public class SampleRSIcBot : Robot

{

[Parameter("Quantity (Lots)", Group = "Volume", DefaultValue = 1, MinValue = 0.01, Step = 0.01)]

public double Quantity { get; set; }

[Parameter("Source", Group = "RSI")]

public DataSeries Source { get; set; }

[Parameter("Periods", Group = "RSI", DefaultValue = 14)]

public int Periods { get; set; }

private RelativeStrengthIndex rsi;

protected override void OnStart()

{

rsi = Indicators.RelativeStrengthIndex(Source, Periods);

}

protected override void OnTick()

{

if (rsi.Result.LastValue < 30)

{

Close(TradeType.Sell);

Open(TradeType.Buy);

}

else if (rsi.Result.LastValue > 70)

{

Close(TradeType.Buy);

Open(TradeType.Sell);

}

}

private void Close(TradeType tradeType)

{

foreach (var position in Positions.FindAll("SampleRSI", SymbolName, tradeType))

ClosePosition(position);

}

private void Open(TradeType tradeType)

{

var position = Positions.Find("SampleRSI", SymbolName, tradeType);

var volumeInUnits = Symbol.QuantityToVolumeInUnits(Quantity);

if (position == null)

ExecuteMarketOrder(tradeType, SymbolName, volumeInUnits, "SampleRSI");

}

}

}

@jcr1818

jcr1818

27 Nov 2024, 08:51

( Updated at: 27 Nov 2024, 11:59 )

RE: data export options

PanagiotisCharalampous said:

Hi there,

Please post your suggestions here

https://ctrader.com/forum/suggestions/

Best regards,

Panagiotis

OK.

@jcr1818

jcr1818

17 Nov 2024, 11:04

RE: Data import (optimizing)

PanagiotisCharalampous said:

Hi there,

The files used to save optimization parameters are .optset files. I just tried this and looks good to me.

Best regards,

Panagiotis

Very important info. Thank you.

@jcr1818

jcr1818

12 Jul 2024, 12:40

RE: optimizing tick charts?

PanagiotisCharalampous said:

Hi there,

Support for tick based candles will be added in a future release of the application.

Best regards,

Panagiotis

Ok sounds good. Do you have any idea when that will be? Weeks, months etc?

@jcr1818

jcr1818

23 Jan 2024, 09:53

( Updated at: 23 Jan 2024, 12:55 )

RE: RE: RE: synchronizes workspaces 4-5 times p.m.

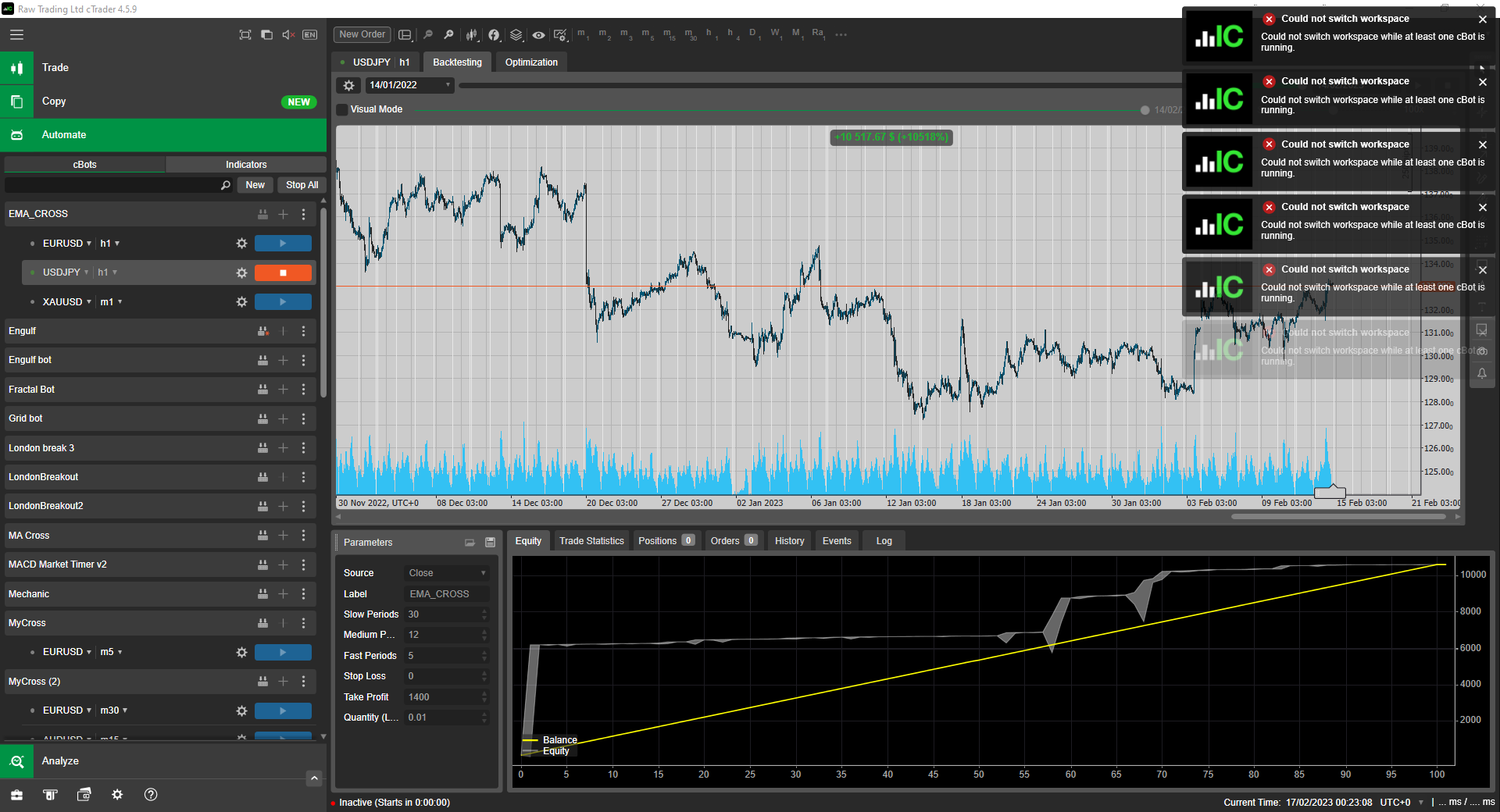

Done today. It happens again!

PanagiotisCharalampous said:

jcr1818 said:

PanagiotisCharalampous said:

Dear trader,

It sounds like a problem with your connection to the proxy server. Please send us some troubleshooting information the next time this happens? Paste a link to this discussion inside the text box before you submit it.

Best regards,

Panagiotis

Today it happens again. What kind of a proxy server do you mean? What do I need to look after in my system? I have a high speed connection and sometimes I use Express VPN (updated). What can I do? I need my information (who dissapears) for trading! I already have send you a troubleshooting 4-5 times on friday 19.01.23.

Dear jcr1818,

Unfortunately we have not received any reports with this link in the message. Next time, please make sure to paste a link to this discussion inside the text box before you submit it.

Best regards,

@jcr1818

jcr1818

22 Jan 2024, 13:54

( Updated at: 23 Jan 2024, 06:28 )

RE: synchronizes workspaces 4-5 times p.m.

PanagiotisCharalampous said:

Dear trader,

It sounds like a problem with your connection to the proxy server. Please send us some troubleshooting information the next time this happens? Paste a link to this discussion inside the text box before you submit it.

Best regards,

Panagiotis

Today it happens again. What kind of a proxy server do you mean? What do I need to look after in my system? I have a high speed connection and sometimes I use Express VPN (updated). What can I do? I need my information (who dissapears) for trading! I already have send you a troubleshooting 4-5 times on friday 19.01.23.

@jcr1818

jcr1818

19 Jan 2024, 10:34

( Updated at: 21 Jan 2024, 11:24 )

RE: synchronizes workspaces 4-5 times p.m.

PanagiotisCharalampous said:

Dear trader,

It sounds like a problem with your connection to the proxy server. Please send us some troubleshooting information the next time this happens? Paste a link to this discussion inside the text box before you submit it.

Best regards,

Panagiotis

I will do thx

@jcr1818

jcr1818

19 Jan 2024, 10:34

( Updated at: 21 Jan 2024, 11:24 )

RE: synchronizes workspaces 4-5 times p.m.

Dear trader,

It sounds like a problem with your connection to the proxy server. Please send us some troubleshooting information the next time this happens? Paste a link to this discussion inside the text box before you submit it.

Best regards,

Panagiotis

@jcr1818

jcr1818

17 Feb 2023, 13:44

( Updated at: 21 Dec 2023, 09:23 )

RE: Connection problem for me

amolinarotra said:

Hi do you get something like this ?

No, but today it`s totally hopeless. I need to close dawn my trades. It`s freezing, the indicators doesn`t uploade when I create a new workspace and so on. It`s still sync a lot and use a lot power.

@jcr1818

jcr1818

19 Mar 2021, 23:02

RE: 3.8 version

intraflay said:

After posting with my concerns over the moving of the time periods along with other tools, plus the non-visible "workspace" open now, what are people's thoughts?

Panagiotis kindly responded and explained that a lot of traders requested for the time frame period buttons to be moved to the top to create more chart space - but as I explained, there were/are(!) a LOT of traders who liked them where they were... But just did not 'request for them to never be moved' in future versions. Browsing the forum again today, it's clear from a large number of posts that I am not alone in disliking this layout.

Maybe getting a group of peoples opinions here together may make the overall feelings from cTrader's users clearer, rather than lots of different posts either praising or moaning about it!

There are some great new features in 4.0 which make our lives easier, such as the duplicate chart, speedier drawing shortcuts etc - a lot of which were a long time coming - and so I want to make it clear that I am not here just to bash Spotware and their team... I love the software. BUT, moving the basics around when so many are used to it for me is a huge no no, and even after a few days with it, I hate it more than the first. It feels as if someone has upgraded the sound system and given me another 100BHP in my car, but swapped the clutch and accelerator pedals around whilst they were doing it!

Of course, the ultimate solution would be to have the choice; a "classic" layout, and then this "new" layout.

But, IF, that's not possible, please vote, a simple yes or no; YES, keep the current 4.0 layout, or NO, bring back the 3.8 layout.

Thanks

3,8 version was much easyer to work with.4.0 version is awful.

@jcr1818

jcr1818

02 Mar 2021, 00:43

RE:

PanagiotisCharalampous said:

Hi jcr1818,

This usually happens when cTrader is disconnected and connected again. cTrader needs to be synchronized with the server when connection is reestablished.

Best Regards,

Panagiotis

Ok, thanks for reply.

Best regards

jcr1818

@jcr1818

jcr1818

01 Mar 2021, 22:05

RE:

PanagiotisCharalampous said:

Hi jcr1818,

Can you explain what do you mean with synchronization?

Best Regards,

Panagiotis

Hi. There is a circle around the middle of the screen where there is some text showing, like "synchronization workspaces". This often happens when I shut down the client and where the text is specified.

In cases where the same thing happens in the middle of the trades, I only see the circle, candlesticks disappear and return to the chart after the sync.

@jcr1818

jcr1818

03 Dec 2024, 17:03

RE: RE: RE: the optimization results - are these credible enough?

PanagiotisCharalampous said:

I will record a video soon.

@jcr1818