Job Description

Greetings,

We want a custom bot that utilizes only one indicator (the Smoothed Heikenashi Indicator). However, while using this indicator, we need to have the bot structured on a known an readily available bot (the PSAR bot).

We want to retain all of the PSAR bots' functionalities. However, instead of using PSAR indicator to trigger the Buy/Sell signals, we want to have the Smoothed Heikenashi Indicator trigger the trading positions as explained below:

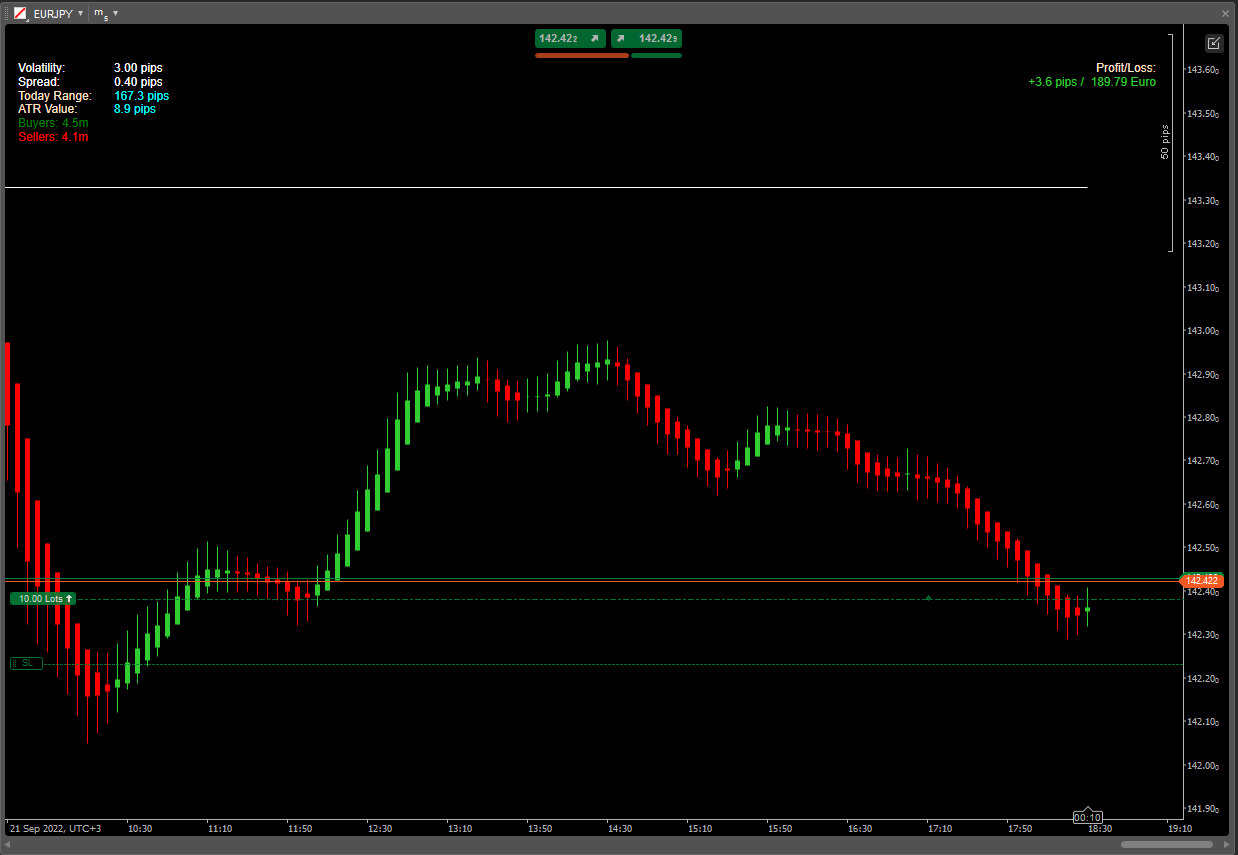

- Short Position - When the Smoothed Heiken-Ashi indicator's bars turn RED on the chart for a symbol e.g. EURJPY, the bot should automatically open a SHORT position not more than 5 pips from the position of the color change.

- Long Position - When the Smoothed Heiken-Ashi indicator's bars turn GREEN on the chart for a symbol e.g. EURJPY, the bot should automatically open a LONG position not more than 5 pips from the position of the color change.

I have outlined the Source Code for the Indicator and the Bot that will serve as a base/ guide to developing this bot below.

You can find the link to the bots on the Freelance website:

____________________________________________________________________________________________________________

Heiken-Ashi Smoothed Indicator Source Code

using System;

using cAlgo.API;

using cAlgo.API.Indicators;

namespace cAlgo.Indicators

{

[Indicator(IsOverlay = true, AccessRights = AccessRights.FullAccess)]

public class HeikenAshiSmoothed : Indicator

{

[Parameter(DefaultValue = 5, MinValue = 1)]

public int Periods { get; set; }

[Parameter("MA Type", DefaultValue = MovingAverageType.Exponential)]

public MovingAverageType MAType { get; set; }

private MovingAverage maOpen;

private MovingAverage maClose;

private MovingAverage maHigh;

private MovingAverage maLow;

private IndicatorDataSeries haClose;

private IndicatorDataSeries haOpen;

protected override void Initialize()

{

maOpen = Indicators.MovingAverage(MarketSeries.Open, Periods, MAType);

maClose = Indicators.MovingAverage(MarketSeries.Close, Periods, MAType);

maHigh = Indicators.MovingAverage(MarketSeries.High, Periods, MAType);

maLow = Indicators.MovingAverage(MarketSeries.Low, Periods, MAType);

haOpen = CreateDataSeries();

haClose = CreateDataSeries();

}

public override void Calculate(int index)

{

double haHigh;

double haLow;

Colors Color;

if (index > 0 && !double.IsNaN(maOpen.Result[index - 1]))

{

haOpen[index] = (haOpen[index - 1] + haClose[index - 1]) / 2;

haClose[index] = (maOpen.Result[index] + maClose.Result[index] + maHigh.Result[index] + maLow.Result[index]) / 4;

haHigh = Math.Max(maHigh.Result[index], Math.Max(haOpen[index], haClose[index]));

haLow = Math.Min(maLow.Result[index], Math.Min(haOpen[index], haClose[index]));

Color = (haOpen[index] > haClose[index]) ? Colors.Red : Colors.LimeGreen;

ChartObjects.DrawLine("BarHA" + index, index, haOpen[index], index, haClose[index], Color, 5, LineStyle.Solid);

ChartObjects.DrawLine("LineHA" + index, index, haHigh, index, haLow, Color, 1, LineStyle.Solid);

}

else if (!double.IsNaN(maOpen.Result[index]))

{

haOpen[index] = (maOpen.Result[index] + maClose.Result[index]) / 2;

haClose[index] = (maOpen.Result[index] + maClose.Result[index] + maHigh.Result[index] + maLow.Result[index]) / 4;

haHigh = maHigh.Result[index];

haLow = maLow.Result[index];

}

}

}

}

____________________________________________________________________________________________________________

PSAR Bot Code

using System;

using cAlgo.API;

using System.Linq;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using cAlgo.Indicators;

namespace cAlgo.Robots

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.FullAccess)]

public class PSARStrategy : Robot

{

public enum ENUM_TP_TYPE

{

Fixed = 0,

RiskRatio = 1

}

public enum ENUM_RISK_SOURCE

{

Equity = 0,

Balance = 1

}

public enum ENUM_LOT_TYPE

{

Fixed_Lot = 0,

Percent = 1

// Fixed_Amount = 2

}

public enum ENUM_BAR_CHECK

{

Current_Bar = 0,

Formed_Bar = 1

}

#region Input Trade Parameters

[Parameter("Bar to Check", Group = "Trade Parameters", DefaultValue = ENUM_BAR_CHECK.Formed_Bar)]

public ENUM_BAR_CHECK barCheck { get; set; }

[Parameter("Label", Group = "Trade Parameters", DefaultValue = "PSAR Strategy")]

public string Label { get; set; }

[Parameter("Stop Loss in pips", Group = "Trade Parameters", DefaultValue = 0)]

public double SL { get; set; }

[Parameter("Take Profit type", Group = "Trade Parameters", DefaultValue = ENUM_TP_TYPE.Fixed)]

public ENUM_TP_TYPE tpType { get; set; }

[Parameter("Take Profit value", Group = "Trade Parameters", DefaultValue = 0)]

public double TP { get; set; }

[Parameter("Close on the opposite signal", Group = "Trade Parameters", DefaultValue = true)]

public bool oppositeClose { get; set; }

[Parameter("Only one trade in one direction", Group = "Trade Parameters", DefaultValue = true)]

public bool onlyOne { get; set; }

[Parameter("Use Reverse Trade", Group = "Trade Parameters", DefaultValue = true)]

public bool reverseTrade { get; set; }

#endregion

#region Input Main Psar Parameters

[Parameter("TimeFrame", Group = "Main Parabolic SAR", DefaultValue = 0.02, MinValue = 0)]

public TimeFrame mainTF { get; set; }

[Parameter("Min AF", Group = "Main Parabolic SAR", DefaultValue = 0.02, MinValue = 0)]

public double mainMinAF { get; set; }

[Parameter("Max AF", Group = "Main Parabolic SAR", DefaultValue = 0.2, MinValue = 0)]

public double mainMaxAF { get; set; }

#endregion

#region Input Confirmation Psar Parameters

[Parameter("Use Higher TF Confirmation", Group = "Confirmation Parabolic SAR", DefaultValue = 0.02, MinValue = 0)]

public bool useHigherConfirm { get; set; }

[Parameter("TimeFrame", Group = "Confirmation Parabolic SAR", DefaultValue = 0.02, MinValue = 0)]

public TimeFrame confirmTF { get; set; }

[Parameter("Min AF", Group = "Confirmation Parabolic SAR", DefaultValue = 0.02, MinValue = 0)]

public double confirmMinAF { get; set; }

[Parameter("Max AF", Group = "Confirmation Parabolic SAR", DefaultValue = 0.2, MinValue = 0)]

public double confirmMaxAF { get; set; }

#endregion

#region Input Lot Size Parameters

[Parameter("Lot Type", Group = "Lot Size", DefaultValue = ENUM_LOT_TYPE.Fixed_Lot)]

public ENUM_LOT_TYPE lotType { get; set; }

[Parameter("Risk Source", Group = "Lot Size", DefaultValue = ENUM_RISK_SOURCE.Balance)]

public ENUM_RISK_SOURCE riskSource { get; set; }

[Parameter("Risk/Lot Value", Group = "Lot Size", DefaultValue = 0.1)]

public double risk { get; set; }

#endregion

#region Input Break Even Parameters

[Parameter("Use BreakEven", Group = "BreakEven", DefaultValue = false)]

public bool UseBE { get; set; }

[Parameter("BreakEven Start(pips)", Group = "BreakEven", DefaultValue = 10)]

public double BEStart { get; set; }

[Parameter("BreakEven Profit(pips)", Group = "BreakEven", DefaultValue = 0)]

public double BEProfit { get; set; }

#endregion

private ParabolicSAR parabolicSARMain;

private ParabolicSAR parabolicSARConfirm;

public MarketSeries mainSeries;

public MarketSeries confirmSeries;

protected override void OnStart()

{

mainSeries = MarketData.GetSeries(mainTF);

confirmSeries = MarketData.GetSeries(confirmTF);

parabolicSARMain = Indicators.ParabolicSAR(mainSeries, mainMinAF, mainMaxAF);

parabolicSARConfirm = Indicators.ParabolicSAR(confirmSeries, confirmMinAF, confirmMaxAF);

// Put your initialization logic here

}

DateTime lastTrade;

double psar1;

double psar2;

double psar1Prev;

// double psar2Prev;

protected override void OnTick()

{

if (UseBE)

BreakEven();

if (lastTrade == mainSeries.OpenTime.Last())

{

return;

}

else

{

if (barCheck == ENUM_BAR_CHECK.Formed_Bar)

lastTrade = mainSeries.OpenTime.Last();

}

psar1 = parabolicSARMain.Result.Last((int)barCheck);

psar1Prev = parabolicSARMain.Result.Last((int)barCheck + 1);

if (useHigherConfirm)

{

psar2 = parabolicSARConfirm.Result.Last();

// psar2Prev = parabolicSARConfirm.Result.Last();

}

if (CheckPSAR(psar1Prev, mainSeries.High.Last(), TradeType.Sell) && CheckPSAR(psar1, mainSeries.Low.Last(), TradeType.Buy))

{

if (oppositeClose)

{

CloseOrders(TradeType.Sell);

}

if (!useHigherConfirm || CheckPSAR(psar2, confirmSeries.Low.Last(), TradeType.Buy))

{

if (!onlyOne || CheckOrder(TradeType.Buy))

{

if (barCheck == 0)

lastTrade = mainSeries.OpenTime.Last();

OpenOrder(TradeType.Buy);

}

}

}

//sell

if (CheckPSAR(psar1, mainSeries.High.Last(), TradeType.Sell) && CheckPSAR(psar1Prev, mainSeries.Low.Last(), TradeType.Buy))

{

if (oppositeClose)

{

CloseOrders(TradeType.Buy);

}

if (!useHigherConfirm || CheckPSAR(psar2, confirmSeries.High.Last(), TradeType.Sell))

{

if (!onlyOne || CheckOrder(TradeType.Sell))

{

if (barCheck == 0)

lastTrade = mainSeries.OpenTime.Last();

OpenOrder(TradeType.Sell);

}

}

}

}

bool CheckPSAR(double value, double valuePrev, TradeType type)

{

if (type == TradeType.Buy)

{

if (value < valuePrev)

return true;

return false;

}

else

{

if (value > valuePrev)

return true;

return false;

}

return false;

}

void CloseOrders(TradeType type)

{

if (reverseTrade)

type = type == TradeType.Buy ? TradeType.Sell : TradeType.Buy;

foreach (var pos in Positions.FindAll(Label, Symbol, type))

{

ClosePosition(pos);

}

}

bool CheckOrder(TradeType type)

{

if (reverseTrade)

type = type == TradeType.Buy ? TradeType.Sell : TradeType.Buy;

if (Positions.Find(Label, Symbol, type) != null)

return false;

return true;

}

void OpenOrder(TradeType type)

{

if (reverseTrade)

type = type == TradeType.Buy ? TradeType.Sell : TradeType.Buy;

double op;

double tp = tpType == ENUM_TP_TYPE.Fixed ? TP : SL * TP;

double sl;

double source = riskSource == ENUM_RISK_SOURCE.Balance ? Account.Balance : Account.Equity;

double volumeInUnits = 0;

if (lotType == ENUM_LOT_TYPE.Fixed_Lot)

volumeInUnits = Symbol.QuantityToVolumeInUnits(risk);

else

volumeInUnits = CalculateVolume(SL, risk, source);

if (volumeInUnits == -1)

return;

ExecuteMarketOrder(type, SymbolName, volumeInUnits, Label, SL, TP);

}

private double CalculateVolume(double stopLossPips, double riskSize, double source)

{

// source = Account.Balance or Account.Equity

double riskPerTrade = source * riskSize / 100;

double totalPips = stopLossPips;

double _volume;

double exactVolume = riskPerTrade / (Symbol.PipValue * totalPips);

if (exactVolume >= Symbol.VolumeInUnitsMin)

{

_volume = Symbol.NormalizeVolumeInUnits(exactVolume);

}

else

{

_volume = -1;

Print("Not enough Equity to place minimum trade, exactVolume " + exactVolume + " is not >= Symbol.VolumeInUnitsMin " + Symbol.VolumeInUnitsMin);

}

return _volume;

}

private void BreakEven()

{

if (!UseBE)

return;

foreach (var pos in Positions.FindAll(Label, SymbolName))

{

if (pos.TradeType == TradeType.Buy)

{

if (Symbol.Ask >= pos.EntryPrice + BEStart * Symbol.PipSize && (pos.StopLoss < pos.EntryPrice + BEProfit * Symbol.PipSize || pos.StopLoss == null))

{

ModifyPosition(pos, pos.EntryPrice + BEProfit * Symbol.PipSize, pos.TakeProfit);

}

}

if (pos.TradeType == TradeType.Sell)

{

if (Symbol.Bid <= pos.EntryPrice - BEStart * Symbol.PipSize && (pos.StopLoss > pos.EntryPrice - BEProfit * Symbol.PipSize || pos.StopLoss == null))

{

ModifyPosition(pos, pos.EntryPrice + BEProfit * Symbol.PipSize, pos.TakeProfit);

}

}

}

}

protected override void OnStop()

{

// Put your deinitialization logic here

}

}

}

Hi Sam,

We can help you with your project. Feel free to reach out to me at development@clickalgo.com

Aieden Technologies

Need Help? Join us on Telegram