Trade copier between account (not copy trading)

02 Aug 2021, 16:27

What is it?

A forex copier between cTrader account.

Why do we need it?

It makes it easier for people who has multiple accounts to copy 1 trade over the other as it doesn't need 3rd party copier.

Main Features:

1. Market order and pending order.

2. Lot size management between accounts.

3. Can adjust trade specification such as when you adjust your TP/SL.

4. Adjust to different instrument name as different brokers assign different name for each instrument (ex: GBPUSD (broker a) -> GBPUSDn (broker b)).

Details:

1. This is mainly for the pending order.

Problem: Different broker have different quotes. If we put a pending order on a broker, it might not trigger / take stop losses because of the difference in quotes.

How the solution works: Main Acc pending order submitted -> Receiver Acc didn't get a pending order -> Main Acc pending order got triggered -> The system send the trade specification

(Entry, TP, SL, advanced protection, Etc) to the receiver account for it to execute on market order.

Pros: The trade will trigger 100% and wouldn't take out your stop loss (except for bad trade placement).

Cons: The execution time will vary as there's time delay before the trade gets executed in the receiver acc (might not be suitable for news trading).

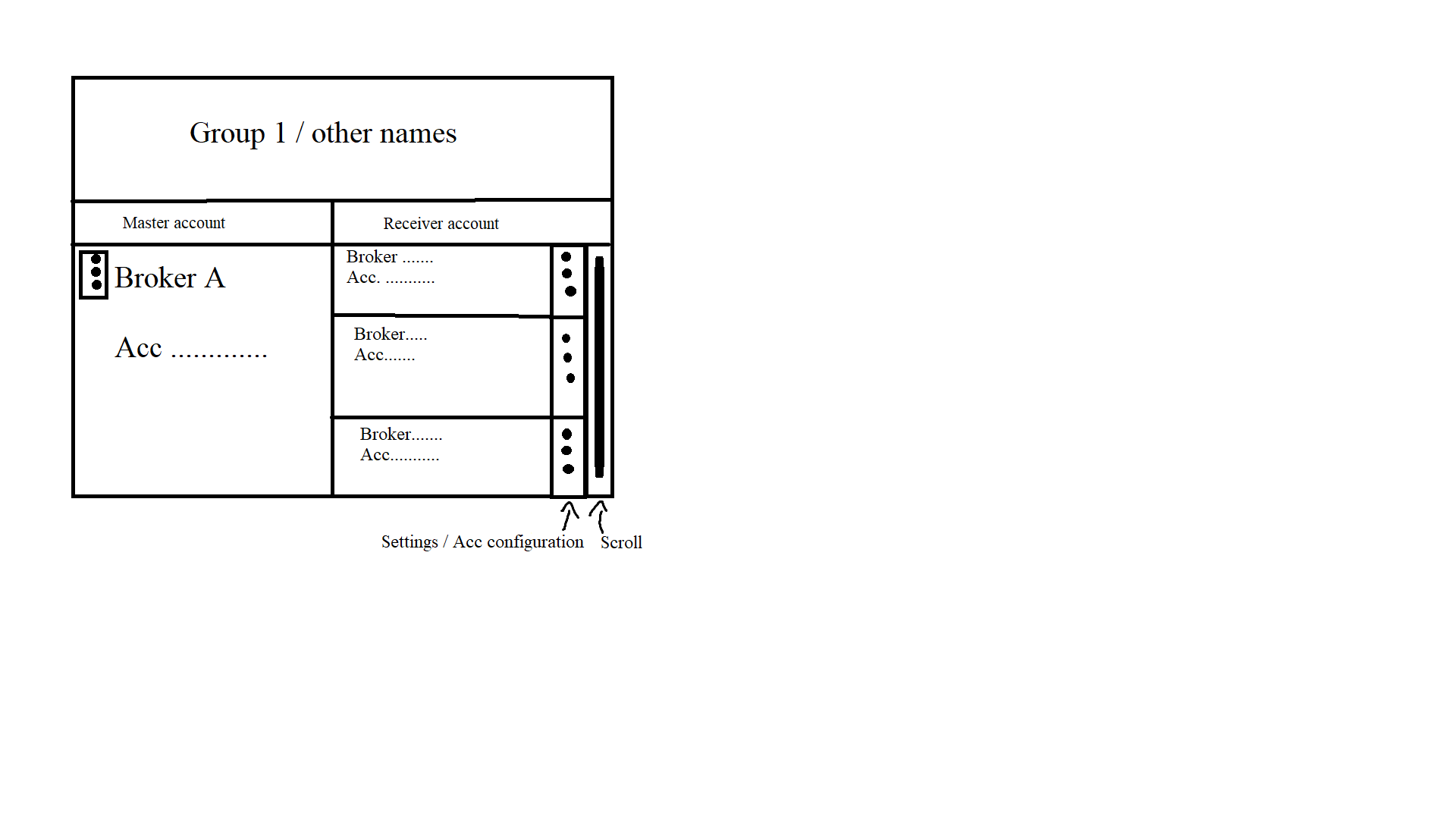

(image 1.a)

2. 3 types of lot size management:

A. Fixed: You only need to determine the lot size that you want to trade on your receiver account regardless of your main account balance.

Example: Fixed lot size: 0.5 lot -> main account market order -> receiver receives the trade specification & trade it on 0.5

B. Flexible: You need to determine the multiplier to determine the lot size, the receiver account will adjust to the main account balance automatically.

*You can choose not to use the multiplier

Example: Main account balance (M): $10,000 | Receiver account balance (R): $1,000 | Trade multiplier (m): 0.5 | Main account lot size (ML): 10 lots |

Receiver account lot size (x):

Step 1: (M/R = ML/x) (directly proportional formula) -> ($10,000/$1,000 = 10/x) -> x = 1 standard lot (without multiplier)

Step 2: x*m -> 1*0.5 -> 0.5 standard lot (with 0.5 multiplier) (skip if you didn't select a multiplier)

C. Scaling: The account balance need to break a certain threshold in order to increase the lot size

a. There are 2 types of acc scaling -> % scaling & fixed amount

1. %scaling: Receiver acc balance increase by x% -> increase lot size

2. Fixed amount: Receiver acc balance increase by $... (depends on the currency of the account) -> increase lot size

b. The way you increase lot size can be % (ex: increase lot size by 50%) / fixed amount (ex: increase lot size by 1 standard lot)

3. It's self explainable, if you adjust your TP/SL/advanced protection/other trade specification, it'll also adjust the trade specification on your receiver account.

4. This is also self explainable, some brokers have different symbol assigned to the same instrument. Therefore, the solution to that problem is to create some sort of dictionary that allows the program to reference the different symbols. (ex: GBPUSD (broker a) -> GBPUSDn (broker b)).