Round number Grid

27 Jan 2021, 09:31

A possibility to set round number grid at any adjusted interval

Replies

smoothgeek2016

30 Jan 2021, 20:49

RE: RE:

yefahej464 said:

Not sure what do you mean, but I have an indicator that plots lines on round numbers 1000, 100. 50, 25 and you can set your own parameters.

5555577 said:

A possibility to set round number grid at any adjusted interval

Hi, where can I get this indicator ?

@smoothgeek2016

tradex1

01 Feb 2021, 03:47

Round No's Indicator

You can find indicators using the search button at the top right

Round Numbers Indicator | Algorithmic Forex Trading | cTrader Community

enjoy

cheers

@tradex1

yefahej464

03 Feb 2021, 04:02

( Updated at: 21 Dec 2023, 09:22 )

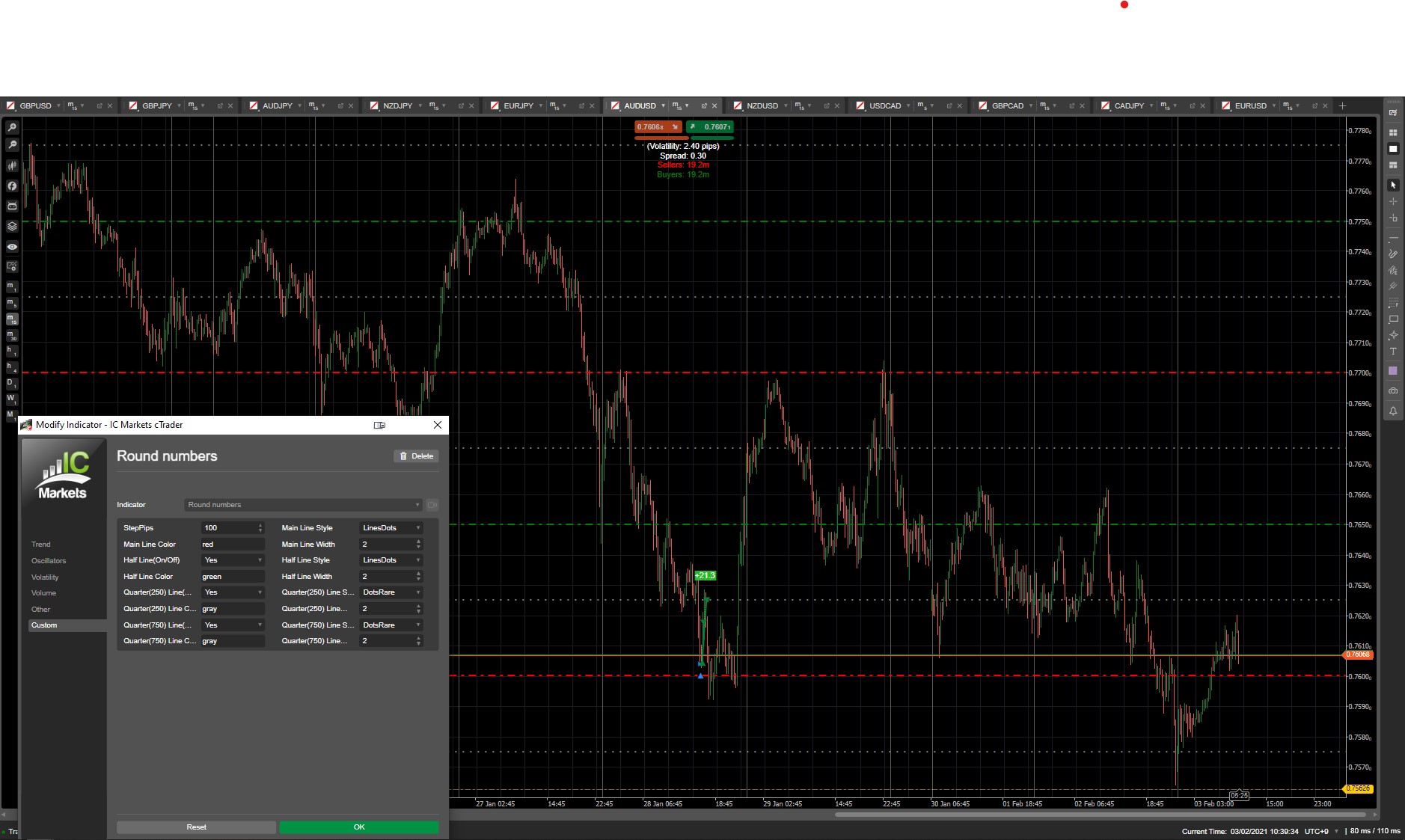

Round number indicator

You can't find it online. It's a private indicator I have had programmed as a custom order. Text me on shourai2100@gmail.com if you want it.

I can't imagine trading without round numbers. Have a look at how the market is reacting to it. Of course, it's not a holy grail and some pairs are reacting to RN more than others, but it's a big edge for me. You can get also great RRR around round numbers because markets are often reacting to it within 6 pips SL and make around 20 pips. If the market goes through it strongly, it often tests the RN from the opposite side so you can make a FLIP trade and fastly recover the loss.

Market often reacts 3 pips before RN, so trading just on the RN is not the best way. You have to do your backtest, statistics, and observations when the level is likely to be broken etc... For example I don't trade CHF and some other pairs, I don't trade at the beginning of US session and in the middle of the first hour of Frankfurt session (one hour before London open).

If there is a long consolidation for a long time, market often runs in one way after that, so it's better to stay away and wait for a flip trades or more distant RNLs and so on... :)

I'm a daytrader trading on 5m chart and my TP is around 20 pips, so have no idea how RN levels are working on higher TFs aiming for many pips.

@yefahej464

yefahej464

28 Jan 2021, 03:43

RE:

Not sure what do you mean, but I have an indicator that plots lines on round numbers 1000, 100. 50, 25 and you can set your own parameters.

5555577 said:

@yefahej464