How to transfer consistent trading signals to bot

21 Feb 2022, 11:03

Hello,

I've built a very simple entry and liquidation signal that is produced in a customized indicator. It alternates between one trade signal and a liquidation signal.

However, despite signals sent, the SELL vs liquidation (LIQ) signals are not alternating, instead the SELL-bar = LIQ-bar. What is the problem?

Sincerely,

Björn Bernau

_________________________

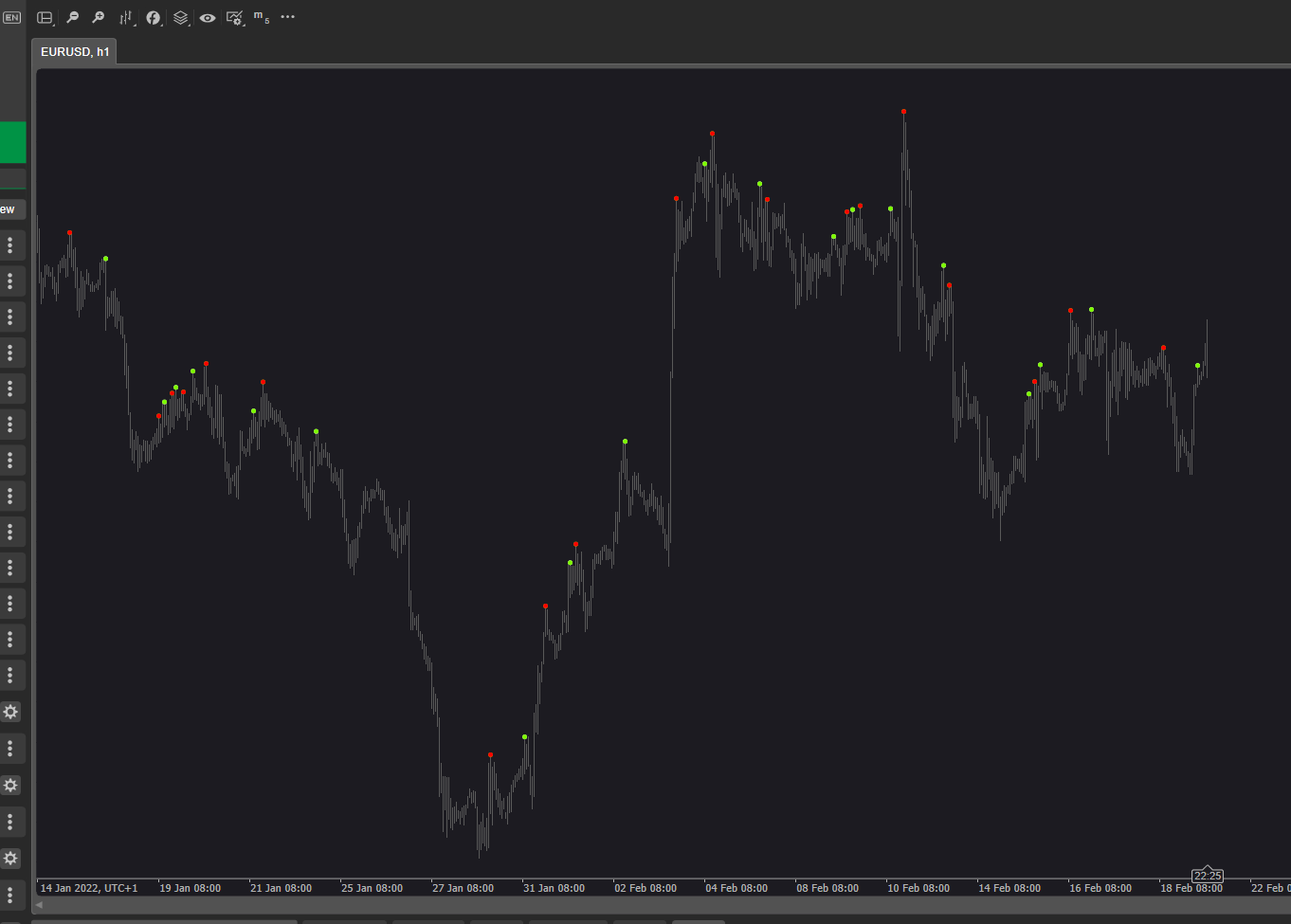

This is the indicator output

The signals in the c-bot

This are the signal data that the c-bot produces, an alternating on off at the same bar. Apparently, the LIQ signal is ignored. Delaying with a Last-bar “0” and “2” for SELL and LIQ respectively, as in eg., if (!double.IsNaN(S2.liq_ONE.Last(2)) == true), liberates basically the same result.

20/01/2022 01:00:00.000 | Backtesting started

20/01/2022 05:00:00.000 | SELL 129 IndicatorDataSeries (Count: 127, LastValue: NaN)

20/01/2022 05:00:00.000 | LIQ 129 IndicatorDataSeries (Count: 127, LastValue: NaN)

20/01/2022 12:00:00.000 | SELL 136 IndicatorDataSeries (Count: 134, LastValue: NaN)

20/01/2022 12:00:00.000 | LIQ 136 IndicatorDataSeries (Count: 134, LastValue: NaN)

21/01/2022 13:00:00.000 | SELL 161 IndicatorDataSeries (Count: 159, LastValue: NaN)

21/01/2022 13:00:00.000 | LIQ 161 IndicatorDataSeries (Count: 159, LastValue: NaN)

21/01/2022 18:00:00.000 | SELL 166 IndicatorDataSeries (Count: 164, LastValue: NaN)

21/01/2022 18:00:00.000 | LIQ 166 IndicatorDataSeries (Count: 164, LastValue: NaN)

24/01/2022 22:00:00.000 | SELL 194 IndicatorDataSeries (Count: 192, LastValue: NaN)

24/01/2022 22:00:00.000 | LIQ 194 IndicatorDataSeries (Count: 192, LastValue: NaN)

28/01/2022 18:00:00.000 | SELL 286 IndicatorDataSeries (Count: 284, LastValue: NaN)

28/01/2022 18:00:00.000 | LIQ 286 IndicatorDataSeries (Count: 284, LastValue: NaN)

31/01/2022 12:00:00.000 | SELL 304 IndicatorDataSeries (Count: 302, LastValue: NaN)

31/01/2022 12:00:00.000 | LIQ 304 IndicatorDataSeries (Count: 302, LastValue: NaN)

31/01/2022 23:01:00.000 | SELL 315 IndicatorDataSeries (Count: 313, LastValue: NaN)

31/01/2022 23:01:00.000 | LIQ 315 IndicatorDataSeries (Count: 313, LastValue: NaN)

01/02/2022 12:00:00.000 | SELL 328 IndicatorDataSeries (Count: 326, LastValue: NaN)

01/02/2022 12:00:00.000 | LIQ 328 IndicatorDataSeries (Count: 326, LastValue: NaN)

01/02/2022 15:00:00.000 | SELL 331 IndicatorDataSeries (Count: 329, LastValue: NaN)

01/02/2022 15:00:00.000 | LIQ 331 IndicatorDataSeries (Count: 329, LastValue: NaN)

02/02/2022 17:00:00.000 | SELL 357 IndicatorDataSeries (Count: 355, LastValue: NaN)

02/02/2022 17:00:00.000 | LIQ 357 IndicatorDataSeries (Count: 355, LastValue: NaN)

03/02/2022 20:00:00.000 | SELL 384 IndicatorDataSeries (Count: 382, LastValue: NaN)

03/02/2022 20:00:00.000 | LIQ 384 IndicatorDataSeries (Count: 382, LastValue: NaN)

04/02/2022 11:00:00.000 | SELL 399 IndicatorDataSeries (Count: 397, LastValue: NaN)

04/02/2022 11:00:00.000 | LIQ 399 IndicatorDataSeries (Count: 397, LastValue: NaN)

04/02/2022 15:00:00.000 | SELL 403 IndicatorDataSeries (Count: 401, LastValue: NaN)

04/02/2022 15:00:00.000 | LIQ 403 IndicatorDataSeries (Count: 401, LastValue: NaN)

07/02/2022 16:00:00.000 | SELL 428 IndicatorDataSeries (Count: 426, LastValue: NaN)

07/02/2022 16:00:00.000 | LIQ 428 IndicatorDataSeries (Count: 426, LastValue: NaN)

07/02/2022 20:00:00.000 | SELL 432 IndicatorDataSeries (Count: 430, LastValue: NaN)

07/02/2022 20:00:00.000 | LIQ 432 IndicatorDataSeries (Count: 430, LastValue: NaN)

09/02/2022 07:00:00.000 | SELL 467 IndicatorDataSeries (Count: 465, LastValue: NaN)

09/02/2022 07:00:00.000 | LIQ 467 IndicatorDataSeries (Count: 465, LastValue: NaN)

09/02/2022 14:00:00.000 | SELL 474 IndicatorDataSeries (Count: 472, LastValue: NaN)

09/02/2022 14:00:00.000 | LIQ 474 IndicatorDataSeries (Count: 472, LastValue: NaN)

09/02/2022 17:00:00.000 | SELL 477 IndicatorDataSeries (Count: 475, LastValue: NaN)

09/02/2022 17:00:00.000 | LIQ 477 IndicatorDataSeries (Count: 475, LastValue: NaN)

09/02/2022 21:00:00.000 | SELL 481 IndicatorDataSeries (Count: 479, LastValue: NaN)

09/02/2022 21:00:00.000 | LIQ 481 IndicatorDataSeries (Count: 479, LastValue: NaN)

10/02/2022 13:00:00.000 | SELL 497 IndicatorDataSeries (Count: 495, LastValue: NaN)

10/02/2022 13:00:00.000 | LIQ 497 IndicatorDataSeries (Count: 495, LastValue: NaN)

10/02/2022 20:00:00.000 | SELL 504 IndicatorDataSeries (Count: 502, LastValue: NaN)

10/02/2022 20:00:00.000 | LIQ 504 IndicatorDataSeries (Count: 502, LastValue: NaN)

11/02/2022 17:00:00.000 | SELL 525 IndicatorDataSeries (Count: 523, LastValue: NaN)

11/02/2022 17:00:00.000 | LIQ 525 IndicatorDataSeries (Count: 523, LastValue: NaN)

11/02/2022 20:00:00.000 | SELL 528 IndicatorDataSeries (Count: 526, LastValue: NaN)

11/02/2022 20:00:00.000 | LIQ 528 IndicatorDataSeries (Count: 526, LastValue: NaN)

15/02/2022 14:00:00.000 | SELL 570 IndicatorDataSeries (Count: 568, LastValue: NaN)

15/02/2022 14:00:00.000 | LIQ 570 IndicatorDataSeries (Count: 568, LastValue: NaN)

15/02/2022 17:00:00.000 | SELL 573 IndicatorDataSeries (Count: 571, LastValue: NaN)

15/02/2022 17:00:00.000 | LIQ 573 IndicatorDataSeries (Count: 571, LastValue: NaN)

15/02/2022 20:00:00.000 | SELL 576 IndicatorDataSeries (Count: 574, LastValue: NaN)

15/02/2022 20:00:00.000 | LIQ 576 IndicatorDataSeries (Count: 574, LastValue: NaN)

16/02/2022 12:00:00.000 | SELL 592 IndicatorDataSeries (Count: 590, LastValue: NaN)

16/02/2022 12:00:00.000 | LIQ 592 IndicatorDataSeries (Count: 590, LastValue: NaN)

16/02/2022 23:01:00.000 | SELL 603 IndicatorDataSeries (Count: 601, LastValue: NaN)

16/02/2022 23:01:00.000 | LIQ 603 IndicatorDataSeries (Count: 601, LastValue: NaN)

18/02/2022 13:00:00.000 | SELL 641 IndicatorDataSeries (Count: 639, LastValue: NaN)

18/02/2022 13:00:00.000 | LIQ 641 IndicatorDataSeries (Count: 639, LastValue: NaN)

21/02/2022 00:59:00.000 | Backtesting finished

Signal code

using System;

using cAlgo.API;

using cAlgo.API.Internals;

using cAlgo.API.Indicators;

using cAlgo.Indicators;

namespace cAlgo

{

[Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class SELL_LIQ : Indicator

{

//// SELL SIGNAL ////

[Output("sell_ONE", PlotType = PlotType.Points, LineColor = "#B511F7", Thickness = 4)]

public IndicatorDataSeries sell_ONE { get; set; }

//// LIQUDATION SIGNAL ////

[Output("liq_ONE", PlotType = PlotType.Points, LineColor = "#FF7CFC00", Thickness = 4)]

public IndicatorDataSeries liq_ONE { get; set; }

//// BOLLINGER ////

[Parameter("Source")]

public DataSeries Source { get; set; }

[Parameter("BandPeriods", DefaultValue = 16)]

public int BandPeriod { get; set; }

[Parameter("Std", DefaultValue = 1.6)]

public double std { get; set; }

[Parameter("MAType")]

public MovingAverageType MAType { get; set; }

private BollingerBands boll;

protected override void Initialize()

{

boll = Indicators.BollingerBands(Source, BandPeriod, std, MAType);

}

int high = 0;

int HIGHstartCountIndexZERO = 0;

double d = double.NaN;

public override void Calculate(int index)

{

liquidator(index);

}

private void liquidator(int index)

{

high = 0;

double high0 = Bars.HighPrices[index - 0];

double high1 = Bars.HighPrices[index - 1];

double high2 = Bars.HighPrices[index - 2];

double high3 = Bars.HighPrices[index - 3];

double high4 = Bars.HighPrices[index - 4];

double close0 = Bars.ClosePrices[index - 0];

var BBT2 = boll.Top[index - 2];

if (high4 <= high2)

if (high3 <= high2)

if (high2 > BBT2)

if (high2 >= high1)

if (high2 >= close0)

{

high = 1;

}

if (high == 1)

{

HIGHstartCountIndexZERO += 1;

}

if (high == 0)

{

sell_ONE[index - 2] = d;

}

if (high == 1)

if (HIGHstartCountIndexZERO % 2 != 0)

{

sell_ONE[index - 2] = Bars.HighPrices[index - 2];

}

if (high == 0)

{

liq_ONE[index - 2] = d;

}

if (high == 1)

if (HIGHstartCountIndexZERO % 2 == 0)

{

liq_ONE[index - 2] = Bars.HighPrices[index - 2];

}

}

}

}

c-bot code

using System;

using System.Linq;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using cAlgo.Indicators;

namespace cAlgo

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class SELL_LIQ_220220 : Robot

{

////////////////////////////////////

///// TRADING PARAMETERS //////

////////////////////////////////////

[Parameter("Volume", DefaultValue = 1000)]

public int Volume { get; set; }

[Parameter("StopLoss", DefaultValue = 50)]

public int StopLoss { get; set; }

[Parameter("LIMIT", DefaultValue = 200)]

public int LIMIT { get; set; }

////////////////////////////

//// INITIAL PARAM ////

[Parameter("Source")]

public DataSeries Source { get; set; }

[Parameter("BandPeriods", DefaultValue = 16)]

public int BandPeriod { get; set; }

[Parameter("Std", DefaultValue = 1.6)]

public double std { get; set; }

[Parameter("MAType")]

public MovingAverageType MAType { get; set; }

//////////////////////////////

//// LITTERALS ////

[Parameter("littFACTOR", DefaultValue = 5)]

public double littFACTOR { get; set; }

private SELL_LIQ S2;

protected override void OnStart()

{

S2 = Indicators.GetIndicator<SELL_LIQ>(Source, BandPeriod, std, MAType);

}

protected override void OnBar()

{

if (!double.IsNaN(S2.sell_ONE.Last(0)) == true)

{

Print("SELL ", Bars.Count, " ", S2.sell_ONE);

}

if (!double.IsNaN(S2.liq_ONE.Last(0)) == true)

{

Print("LIQ ", Bars.Count, " ", S2.liq_ONE);

}

}

}

}

Replies

BJORNBERNAU

21 Feb 2022, 16:30

RE:

firemyst said:

Glancing at your code, a possible problem is you never actually set the last value of either data series.

You only ever populate [index - 2] of either sell_One or liq_one, never [index].

Therefore:

s2.liq_one.last(0) is NAN

s2.sell_one.last(0) is NAN

s2.liq_one.last(1) is NAN

s2.sell_one.last(1) is NAN

so the .Last(0) values are both the same, hence the reason they both print out and don't alternate.

Similarly, the .Last(1) values are both the same too.

Hello Firemyst,

And thank you for putting your time into this.

I actually tried this and in fact, there are indeed given IndicatorDataSeries as expected, they are not finalised as double.NAN as suggested. Adding printing snippets to the signal code, with the following script

if (high4 <= high2)

if (high3 <= high2)

if (high2 > BBT2)

if (high2 >= high1)

if (high2 >= close0)

{

high = 1;

}

if (high == 1)

{

HIGHstartCountIndexZERO += 1;

}

if (high == 0)

{

sell_ONE[index - 2] = d;

}

if (high == 1)

if (HIGHstartCountIndexZERO % 2 != 0)

{

sell_ONE[index - 2] = Bars.HighPrices[index - 2];

Print(index, " SELL ", sell_ONE);

}

if (high == 0)

{

liq_ONE[index - 2] = d;

}

if (high == 1)

if (HIGHstartCountIndexZERO % 2 == 0)

{

liq_ONE[index - 2] = Bars.HighPrices[index - 2];

Print(index, " LIQ ", liq_ONE);

}

}

liberates full data sets as I understand them. Alternating nicely. But they are not transferred correctly into the robot. Which is my current problem.

21/02/2022 14:26:10.032 | 22 SELL IndicatorDataSeries (Count: 21, LastValue: 1,16132)

21/02/2022 14:26:10.032 | 27 LIQ IndicatorDataSeries (Count: 26, LastValue: 1,1626)

21/02/2022 14:26:10.032 | 47 SELL IndicatorDataSeries (Count: 46, LastValue: 1,16144)

21/02/2022 14:26:10.032 | 54 LIQ IndicatorDataSeries (Count: 53, LastValue: 1,16922)

21/02/2022 14:26:10.032 | 95 SELL IndicatorDataSeries (Count: 94, LastValue: 1,15754)

21/02/2022 14:26:10.032 | 105 LIQ IndicatorDataSeries (Count: 104, LastValue: 1,16087)

21/02/2022 14:26:10.032 | 107 SELL IndicatorDataSeries (Count: 106, LastValue: 1,16092)

21/02/2022 14:26:10.032 | 118 LIQ IndicatorDataSeries (Count: 117, LastValue: 1,16134)

21/02/2022 14:26:10.032 | 144 SELL IndicatorDataSeries (Count: 143, LastValue: 1,15979)

21/02/2022 14:26:10.032 | 153 LIQ IndicatorDataSeries (Count: 152, LastValue: 1,16164)

21/02/2022 14:26:10.032 | 190 SELL IndicatorDataSeries (Count: 189, LastValue: 1,1563)

21/02/2022 14:26:10.032 | 200 LIQ IndicatorDataSeries (Count: 199, LastValue: 1,15684)

Cancelling out the “index-2” and setting it to "zero" - e.g.

liq_ONE[index - 0] = Bars.HighPrices[index - 0];

in both the Indicator and Robot liberates this, several SELL after one another and then flipping back to LIQ.

20/01/2022 01:00:00.000 | Backtesting started

20/01/2022 04:00:00.000 | LIQ 128 IndicatorDataSeries (Count: 128, LastValue: 1,13549)

20/01/2022 11:00:00.000 | LIQ 135 IndicatorDataSeries (Count: 135, LastValue: 1,13476)

21/01/2022 12:00:00.000 | LIQ 160 IndicatorDataSeries (Count: 160, LastValue: 1,13391)

21/01/2022 17:00:00.000 | LIQ 165 IndicatorDataSeries (Count: 165, LastValue: 1,1346)

24/01/2022 21:00:00.000 | LIQ 193 IndicatorDataSeries (Count: 193, LastValue: 1,13198)

28/01/2022 17:00:00.000 | LIQ 285 IndicatorDataSeries (Count: 285, LastValue: 1,11643)

31/01/2022 11:00:00.000 | LIQ 303 IndicatorDataSeries (Count: 303, LastValue: 1,11747)

31/01/2022 18:00:00.000 | LIQ 310 IndicatorDataSeries (Count: 310, LastValue: 1,12101)

31/01/2022 22:00:00.000 | SELL 314 IndicatorDataSeries (Count: 314, LastValue: 1,12354)

01/02/2022 11:00:00.000 | SELL 327 IndicatorDataSeries (Count: 327, LastValue: 1,12614)

01/02/2022 14:00:00.000 | SELL 330 IndicatorDataSeries (Count: 330, LastValue: 1,12617)

02/02/2022 16:00:00.000 | SELL 356 IndicatorDataSeries (Count: 356, LastValue: 1,13048)

03/02/2022 19:00:00.000 | SELL 383 IndicatorDataSeries (Count: 383, LastValue: 1,14436)

04/02/2022 10:00:00.000 | SELL 398 IndicatorDataSeries (Count: 398, LastValue: 1,14602)

04/02/2022 14:00:00.000 | SELL 402 IndicatorDataSeries (Count: 402, LastValue: 1,14655)

07/02/2022 15:00:00.000 | SELL 427 IndicatorDataSeries (Count: 427, LastValue: 1,14398)

07/02/2022 19:00:00.000 | SELL 431 IndicatorDataSeries (Count: 431, LastValue: 1,14186)

09/02/2022 06:00:00.000 | SELL 466 IndicatorDataSeries (Count: 466, LastValue: 1,14269)

09/02/2022 13:00:00.000 | SELL 473 IndicatorDataSeries (Count: 473, LastValue: 1,14295)

09/02/2022 16:00:00.000 | SELL 476 IndicatorDataSeries (Count: 476, LastValue: 1,14317)

09/02/2022 20:00:00.000 | SELL 480 IndicatorDataSeries (Count: 480, LastValue: 1,14326)

10/02/2022 12:00:00.000 | SELL 496 IndicatorDataSeries (Count: 496, LastValue: 1,14359)

10/02/2022 16:00:00.000 | SELL 500 IndicatorDataSeries (Count: 500, LastValue: 1,14074)

10/02/2022 19:00:00.000 | LIQ 503 IndicatorDataSeries (Count: 503, LastValue: 1,14645)

11/02/2022 16:00:00.000 | LIQ 524 IndicatorDataSeries (Count: 524, LastValue: 1,13888)

11/02/2022 19:00:00.000 | LIQ 527 IndicatorDataSeries (Count: 527, LastValue: 1,13966)

15/02/2022 13:00:00.000 | LIQ 569 IndicatorDataSeries (Count: 569, LastValue: 1,13459)

15/02/2022 16:00:00.000 | LIQ 572 IndicatorDataSeries (Count: 572, LastValue: 1,1322)

15/02/2022 19:00:00.000 | LIQ 575 IndicatorDataSeries (Count: 575, LastValue: 1,13586)

16/02/2022 11:00:00.000 | LIQ 591 IndicatorDataSeries (Count: 591, LastValue: 1,13775)

16/02/2022 22:00:00.000 | LIQ 602 IndicatorDataSeries (Count: 602, LastValue: 1,13821)

18/02/2022 12:00:00.000 | LIQ 640 IndicatorDataSeries (Count: 640, LastValue: 1,13611)

21/02/2022 00:59:00.000 | Backtesting finished

@BJORNBERNAU

firemyst

22 Feb 2022, 02:38

HI @BJORNBERNAU

Running through Visual studio on a chart:

most of the data series in the indicator itself is NaN as you can see above.

In your bot you never get the latest indicator values before checking the latest indicator values.

It could the "lazy loading" of indicators from cbots as @Panagiotis mentioned in your thread here from Aug 3, 2020:

Also see the last post in this thread:

So you need to force the indicator to call the calculate method before you access any of the indicator's data series.

@firemyst

BJORNBERNAU

22 Feb 2022, 09:40

( Updated at: 21 Dec 2023, 09:22 )

RE:

firemyst said:

HI @BJORNBERNAU

Running through Visual studio on a chart:

most of the data series in the indicator itself is NaN as you can see above.

In your bot you never get the latest indicator values before checking the latest indicator values.

It could the "lazy loading" of indicators from cbots as @Panagiotis mentioned in your thread here from Aug 3, 2020:

Also see the last post in this thread:

So you need to force the indicator to call the calculate method before you access any of the indicator's data series.

Again, thank you.

I've just posted a broader inquiry on this issue.

https://ctrader.com/forum/indicator-support/37673

A new problem arises when I define a VAR as you suggest. How then is it converted into a IndicatorDataSeries which is defined as a parameter in the program? In doing so the Indicator doesn't work anymore.

And do we really have to go that far as to define the LAZY class to use this system?

Thank you!

@BJORNBERNAU

BJORNBERNAU

22 Feb 2022, 09:43

( Updated at: 21 Dec 2023, 09:22 )

RE: RE:

BJORNBERNAU said:

firemyst said:

HI @BJORNBERNAU

Running through Visual studio on a chart:

most of the data series in the indicator itself is NaN as you can see above.

In your bot you never get the latest indicator values before checking the latest indicator values.

It could the "lazy loading" of indicators from cbots as @Panagiotis mentioned in your thread here from Aug 3, 2020:

Also see the last post in this thread:

So you need to force the indicator to call the calculate method before you access any of the indicator's data series.

Again, thank you.

I've just posted a broader inquiry on this issue.

https://ctrader.com/forum/indicator-support/37673

A new problem arises when I define a VAR as you suggest. How then is it converted into a IndicatorDataSeries which is defined as a parameter in the program? In doing so the Indicator doesn't work anymore.

And do we really have to go that far as to define the LAZY class to use this system?

Thank you!

This is what I tried. I don't know if it is in accordance with your recommendations.

if (high == 1)

{

HIGHstartCountIndexZERO += 1;

}

var sell_ONE = Bars.HighPrices.Last(0);

if (high == 0)

{

sell_ONE = d;

}

if (high == 1)

if (HIGHstartCountIndexZERO % 2 != 0)

{

sell_ONE = Bars.HighPrices.Last(0);

}

var liq_ONE = Bars.HighPrices.Last(0);

if (high == 0)

{

liq_ONE = d;

}

if (high == 1)

if (HIGHstartCountIndexZERO % 2 == 0)

{

liq_ONE = Bars.HighPrices[index - 0];

}

}

@BJORNBERNAU

BJORNBERNAU

22 Feb 2022, 09:59

( Updated at: 21 Dec 2023, 09:22 )

RE: RE: RE:

BJORNBERNAU said:

BJORNBERNAU said:

firemyst said:

HI @BJORNBERNAU

Running through Visual studio on a chart:

most of the data series in the indicator itself is NaN as you can see above.

In your bot you never get the latest indicator values before checking the latest indicator values.

It could the "lazy loading" of indicators from cbots as @Panagiotis mentioned in your thread here from Aug 3, 2020:

Also see the last post in this thread:

So you need to force the indicator to call the calculate method before you access any of the indicator's data series.

Again, thank you.

I've just posted a broader inquiry on this issue.

https://ctrader.com/forum/indicator-support/37673

A new problem arises when I define a VAR as you suggest. How then is it converted into a IndicatorDataSeries which is defined as a parameter in the program? In doing so the Indicator doesn't work anymore.

And do we really have to go that far as to define the LAZY class to use this system?

Thank you!

This is what I tried. I don't know if it is in accordance with your recommendations.

if (high == 1)

{

HIGHstartCountIndexZERO += 1;

}

var sell_ONE = Bars.HighPrices.Last(0);

if (high == 0)

{

sell_ONE = d;

}

if (high == 1)

if (HIGHstartCountIndexZERO % 2 != 0)

{

sell_ONE = Bars.HighPrices.Last(0);

}

var liq_ONE = Bars.HighPrices.Last(0);

if (high == 0)

{

liq_ONE = d;

}

if (high == 1)

if (HIGHstartCountIndexZERO % 2 == 0)

{

liq_ONE = Bars.HighPrices[index - 0];

}

}

Converting the HIGH sighnal to VAR does not help either.

public override void Calculate(int index)

{

liquidator(index);

}

private void liquidator(int index)

{

var high = 0;

double high0 = Bars.HighPrices[index - 0];

double high1 = Bars.HighPrices[index - 1];

double high2 = Bars.HighPrices[index - 2];

double high3 = Bars.HighPrices[index - 3];

double high4 = Bars.HighPrices[index - 4];

double close0 = Bars.ClosePrices[index - 0];

var BBT1 = boll.Top[index - 1];

var BBT2 = boll.Top[index - 2];

if (high4 <= high2)

if (high3 <= high2)

if (high2 > BBT2)

if (high2 >= high1)

if (high2 >= close0)

{

high = 1;

}

if (high == 1)

{

HIGHstartCountIndexZERO += 1;

}

if (high == 0)

{

sell_ONE[index - 2] = d;

}

if (high == 1)

if (HIGHstartCountIndexZERO % 2 != 0)

{

sell_ONE[index - 2] = Bars.HighPrices[index - 2];

// Print(index, " ", sell_ONE);

}

if (high == 0)

{

liq_ONE[index - 2] = d;

}

if (high == 1)

if (HIGHstartCountIndexZERO % 2 == 0)

{

liq_ONE[index - 2] = Bars.HighPrices[index - 2];

// Print(index, " ", liq_ONE);

}

}

@BJORNBERNAU

firemyst

22 Feb 2022, 10:00

RE: RE:

BJORNBERNAU said:

Again, thank you.

I've just posted a broader inquiry on this issue.

https://ctrader.com/forum/indicator-support/37673

A new problem arises when I define a VAR as you suggest. How then is it converted into a IndicatorDataSeries which is defined as a parameter in the program? In doing so the Indicator doesn't work anymore.

And do we really have to go that far as to define the LAZY class to use this system?

Thank you!

You're doing it wrong, and I see you don't appear to understand some basic concepts.

I have no idea why you changed liq_one and sell_one to get a double value? Those are indicator data series, so leave them be!

You just have to FORCE the indicator to return a value. The value returned will be a double. So just create a new double variable and assign it an indicator value _before_ you actually need to compare values in your indicator data series.

As per the second article link I provided:

var a = S2.sell_ONE.Last(0);

or you could do:

double a = S2.sell_ONE.Last(0);

Do the same for liq_one right after the sell_one:

a = S2.liq_ONE.Last(0); //who cares if you overwrite the value in "a" because it's just a dummy to force the indicator to run the calculate method.

Now that you've forced the indicator to run the calculate method, just leave the rest of the code as you had it and all the indicator's values will be "full loaded". So you DO NOT have to do:

.a = S2.liq_ONE.Last(1);

.a = S2.liq_ONE.Last(2)

etc etc;

@firemyst

amusleh

22 Feb 2022, 10:30

Hi,

I tried to find the issue, there were several issues on your indicator.

First it's repints, it returns data for two previous bar, and in cBot you are trying to get the current bar, that's one issue.

The other one is related to your indicator HIGHstartCountIndexZERO variable, this causes not deterministic results between cBot indicator and the one you attached on the chart.

Try my attached versions of your indicator and cBot, and you will see that their results will match on visual back test.

Indicator:

using cAlgo.API;

using cAlgo.API.Indicators;

namespace cAlgo

{

[Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class SELL_LIQ : Indicator

{

[Output("sell_ONE", PlotType = PlotType.Points, LineColor = "#B511F7", Thickness = 4)]

public IndicatorDataSeries sell_ONE { get; set; }

[Output("liq_ONE", PlotType = PlotType.Points, LineColor = "#FF7CFC00", Thickness = 4)]

public IndicatorDataSeries liq_ONE { get; set; }

[Parameter("Source")]

public DataSeries Source { get; set; }

[Parameter("BandPeriods", DefaultValue = 16)]

public int BandPeriod { get; set; }

[Parameter("Std", DefaultValue = 1.6)]

public double std { get; set; }

[Parameter("MAType")]

public MovingAverageType MAType { get; set; }

private BollingerBands boll;

protected override void Initialize()

{

boll = Indicators.BollingerBands(Source, BandPeriod, std, MAType);

}

private int HIGHstartCountIndexZERO = 0;

public override void Calculate(int index)

{

sell_ONE[index - 2] = double.NaN;

liq_ONE[index - 2] = double.NaN;

var high = 0;

double high1 = Bars.HighPrices[index - 1];

double high2 = Bars.HighPrices[index - 2];

double high3 = Bars.HighPrices[index - 3];

double high4 = Bars.HighPrices[index - 4];

double close = Bars.ClosePrices[index];

var BBT2 = boll.Top[index - 2];

if (high4 <= high2 && high3 <= high2 && high2 > BBT2 && high2 >= high1 && high2 >= close)

{

high = 1;

}

if (high == 0)

{

sell_ONE[index - 2] = double.NaN;

liq_ONE[index - 2] = double.NaN;

}

else if (high == 1)

{

// I changed the logic here to find what's causing the discrepancy

// between bot and indicator outputs

if (Bars.ClosePrices[index - 2] > Bars.OpenPrices[index - 2])

{

sell_ONE[index - 2] = Bars.HighPrices[index - 2];

}

else

{

liq_ONE[index - 2] = Bars.LowPrices[index - 2];

}

//HIGHstartCountIndexZERO += 1;

//if (HIGHstartCountIndexZERO % 2 != 0)

//{

// sell_ONE[index - 2] = Bars.HighPrices[index - 2];

//}

//else

//{

// liq_ONE[index - 2] = Bars.LowPrices[index - 2];

//}

}

}

}

}

cBot:

using cAlgo.API;

namespace cAlgo

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class SELL_LIQ_220220 : Robot

{

[Parameter("Source")]

public DataSeries Source { get; set; }

[Parameter("BandPeriods", DefaultValue = 16)]

public int BandPeriod { get; set; }

[Parameter("Std", DefaultValue = 1.6)]

public double std { get; set; }

[Parameter("MAType")]

public MovingAverageType MAType { get; set; }

private SELL_LIQ S2;

protected override void OnStart()

{

S2 = Indicators.GetIndicator<SELL_LIQ>(Source, BandPeriod, std, MAType);

}

protected override void OnTick()

{

var index = Bars.Count - 1;

var indicatorIndex = index - 2;

Chart.RemoveObject(indicatorIndex.ToString());

if (double.IsNaN(S2.sell_ONE[indicatorIndex]) == false)

{

Chart.DrawVerticalLine(indicatorIndex.ToString(), Bars.OpenTimes[indicatorIndex], Color.FromHex("#B511F7"));

}

else if (double.IsNaN(S2.liq_ONE[indicatorIndex]) == false)

{

Chart.DrawVerticalLine(indicatorIndex.ToString(), Bars.OpenTimes[indicatorIndex], Color.FromHex("#FF7CFC00"));

}

}

}

}

Attach the indicator on visual back test chart, do some back testing on tick data not m1 bars, my result:

cTrader back tester loads some bars without running the cBot on those bars for warming up the indicators.

And if your indicator has some kind of non deterministic code like yours then the results will not match.

You see on my result, the first signal is not marked by cBot, because those bars were loaded by back tester for warm up.

@amusleh

BJORNBERNAU

22 Feb 2022, 11:13

( Updated at: 21 Dec 2023, 09:22 )

RE:

amusleh said:

Hi,

I tried to find the issue, there were several issues on your indicator.

First it's repints, it returns data for two previous bar, and in cBot you are trying to get the current bar, that's one issue.

The other one is related to your indicator HIGHstartCountIndexZERO variable, this causes not deterministic results between cBot indicator and the one you attached on the chart.

Try my attached versions of your indicator and cBot, and you will see that their results will match on visual back test.

Indicator:

using cAlgo.API; using cAlgo.API.Indicators; namespace cAlgo { [Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)] public class SELL_LIQ : Indicator { [Output("sell_ONE", PlotType = PlotType.Points, LineColor = "#B511F7", Thickness = 4)] public IndicatorDataSeries sell_ONE { get; set; } [Output("liq_ONE", PlotType = PlotType.Points, LineColor = "#FF7CFC00", Thickness = 4)] public IndicatorDataSeries liq_ONE { get; set; } [Parameter("Source")] public DataSeries Source { get; set; } [Parameter("BandPeriods", DefaultValue = 16)] public int BandPeriod { get; set; } [Parameter("Std", DefaultValue = 1.6)] public double std { get; set; } [Parameter("MAType")] public MovingAverageType MAType { get; set; } private BollingerBands boll; protected override void Initialize() { boll = Indicators.BollingerBands(Source, BandPeriod, std, MAType); } private int HIGHstartCountIndexZERO = 0; public override void Calculate(int index) { sell_ONE[index - 2] = double.NaN; liq_ONE[index - 2] = double.NaN; var high = 0; double high1 = Bars.HighPrices[index - 1]; double high2 = Bars.HighPrices[index - 2]; double high3 = Bars.HighPrices[index - 3]; double high4 = Bars.HighPrices[index - 4]; double close = Bars.ClosePrices[index]; var BBT2 = boll.Top[index - 2]; if (high4 <= high2 && high3 <= high2 && high2 > BBT2 && high2 >= high1 && high2 >= close) { high = 1; } if (high == 0) { sell_ONE[index - 2] = double.NaN; liq_ONE[index - 2] = double.NaN; } else if (high == 1) { // I changed the logic here to find what's causing the discrepancy // between bot and indicator outputs if (Bars.ClosePrices[index - 2] > Bars.OpenPrices[index - 2]) { sell_ONE[index - 2] = Bars.HighPrices[index - 2]; } else { liq_ONE[index - 2] = Bars.LowPrices[index - 2]; } //HIGHstartCountIndexZERO += 1; //if (HIGHstartCountIndexZERO % 2 != 0) //{ // sell_ONE[index - 2] = Bars.HighPrices[index - 2]; //} //else //{ // liq_ONE[index - 2] = Bars.LowPrices[index - 2]; //} } } } }cBot:

using cAlgo.API; namespace cAlgo { [Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)] public class SELL_LIQ_220220 : Robot { [Parameter("Source")] public DataSeries Source { get; set; } [Parameter("BandPeriods", DefaultValue = 16)] public int BandPeriod { get; set; } [Parameter("Std", DefaultValue = 1.6)] public double std { get; set; } [Parameter("MAType")] public MovingAverageType MAType { get; set; } private SELL_LIQ S2; protected override void OnStart() { S2 = Indicators.GetIndicator<SELL_LIQ>(Source, BandPeriod, std, MAType); } protected override void OnTick() { var index = Bars.Count - 1; var indicatorIndex = index - 2; Chart.RemoveObject(indicatorIndex.ToString()); if (double.IsNaN(S2.sell_ONE[indicatorIndex]) == false) { Chart.DrawVerticalLine(indicatorIndex.ToString(), Bars.OpenTimes[indicatorIndex], Color.FromHex("#B511F7")); } else if (double.IsNaN(S2.liq_ONE[indicatorIndex]) == false) { Chart.DrawVerticalLine(indicatorIndex.ToString(), Bars.OpenTimes[indicatorIndex], Color.FromHex("#FF7CFC00")); } } } }Attach the indicator on visual back test chart, do some back testing on tick data not m1 bars, my result:

cTrader back tester loads some bars without running the cBot on those bars for warming up the indicators.

And if your indicator has some kind of non deterministic code like yours then the results will not match.

You see on my result, the first signal is not marked by cBot, because those bars were loaded by back tester for warm up.

Thank you!

Interesting set up. The vertical lines though, just flashed up once on back-testing and dissappeared.

@BJORNBERNAU

BJORNBERNAU

22 Feb 2022, 11:27

( Updated at: 21 Dec 2023, 09:22 )

RE: RE:

BJORNBERNAU said:

amusleh said:

Hi,

I tried to find the issue, there were several issues on your indicator.

First it's repints, it returns data for two previous bar, and in cBot you are trying to get the current bar, that's one issue.

The other one is related to your indicator HIGHstartCountIndexZERO variable, this causes not deterministic results between cBot indicator and the one you attached on the chart.

Try my attached versions of your indicator and cBot, and you will see that their results will match on visual back test.

Indicator:

using cAlgo.API; using cAlgo.API.Indicators; namespace cAlgo { [Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)] public class SELL_LIQ : Indicator { [Output("sell_ONE", PlotType = PlotType.Points, LineColor = "#B511F7", Thickness = 4)] public IndicatorDataSeries sell_ONE { get; set; } [Output("liq_ONE", PlotType = PlotType.Points, LineColor = "#FF7CFC00", Thickness = 4)] public IndicatorDataSeries liq_ONE { get; set; } [Parameter("Source")] public DataSeries Source { get; set; } [Parameter("BandPeriods", DefaultValue = 16)] public int BandPeriod { get; set; } [Parameter("Std", DefaultValue = 1.6)] public double std { get; set; } [Parameter("MAType")] public MovingAverageType MAType { get; set; } private BollingerBands boll; protected override void Initialize() { boll = Indicators.BollingerBands(Source, BandPeriod, std, MAType); } private int HIGHstartCountIndexZERO = 0; public override void Calculate(int index) { sell_ONE[index - 2] = double.NaN; liq_ONE[index - 2] = double.NaN; var high = 0; double high1 = Bars.HighPrices[index - 1]; double high2 = Bars.HighPrices[index - 2]; double high3 = Bars.HighPrices[index - 3]; double high4 = Bars.HighPrices[index - 4]; double close = Bars.ClosePrices[index]; var BBT2 = boll.Top[index - 2]; if (high4 <= high2 && high3 <= high2 && high2 > BBT2 && high2 >= high1 && high2 >= close) { high = 1; } if (high == 0) { sell_ONE[index - 2] = double.NaN; liq_ONE[index - 2] = double.NaN; } else if (high == 1) { // I changed the logic here to find what's causing the discrepancy // between bot and indicator outputs if (Bars.ClosePrices[index - 2] > Bars.OpenPrices[index - 2]) { sell_ONE[index - 2] = Bars.HighPrices[index - 2]; } else { liq_ONE[index - 2] = Bars.LowPrices[index - 2]; } //HIGHstartCountIndexZERO += 1; //if (HIGHstartCountIndexZERO % 2 != 0) //{ // sell_ONE[index - 2] = Bars.HighPrices[index - 2]; //} //else //{ // liq_ONE[index - 2] = Bars.LowPrices[index - 2]; //} } } } }cBot:

using cAlgo.API; namespace cAlgo { [Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)] public class SELL_LIQ_220220 : Robot { [Parameter("Source")] public DataSeries Source { get; set; } [Parameter("BandPeriods", DefaultValue = 16)] public int BandPeriod { get; set; } [Parameter("Std", DefaultValue = 1.6)] public double std { get; set; } [Parameter("MAType")] public MovingAverageType MAType { get; set; } private SELL_LIQ S2; protected override void OnStart() { S2 = Indicators.GetIndicator<SELL_LIQ>(Source, BandPeriod, std, MAType); } protected override void OnTick() { var index = Bars.Count - 1; var indicatorIndex = index - 2; Chart.RemoveObject(indicatorIndex.ToString()); if (double.IsNaN(S2.sell_ONE[indicatorIndex]) == false) { Chart.DrawVerticalLine(indicatorIndex.ToString(), Bars.OpenTimes[indicatorIndex], Color.FromHex("#B511F7")); } else if (double.IsNaN(S2.liq_ONE[indicatorIndex]) == false) { Chart.DrawVerticalLine(indicatorIndex.ToString(), Bars.OpenTimes[indicatorIndex], Color.FromHex("#FF7CFC00")); } } } }Attach the indicator on visual back test chart, do some back testing on tick data not m1 bars, my result:

cTrader back tester loads some bars without running the cBot on those bars for warming up the indicators.

And if your indicator has some kind of non deterministic code like yours then the results will not match.

You see on my result, the first signal is not marked by cBot, because those bars were loaded by back tester for warm up.

Thank you!

Interesting set up. The vertical lines though, just flashed up once on back-testing and dissappeared.

So, Firemyst!

I'm indeed not the professional, as you are, and trying to understand the meaning of the forcing of the Indicator method not to be lazy. How is the configuration made? This does not work

var a = sell_ONE.Last(0);

if (high == 1)

if (HIGHstartCountIndexZERO % 2 != 0)

{

a = sell_ONE.Last(0);

}

So how should you go about it?

Thank you!

@BJORNBERNAU

firemyst

22 Feb 2022, 12:17

protected override void OnTick()

{

//This is all you would have had to do:

double a = S2.sell_ONE.Last(0);

a = S2.liq_ONE.Last(0);

//That's it! Now the Calculate method has been

//forced to calculate for each sell_One and liq_one.

//You can now get any values from your indicator

//and they will be readily available.

var index = Bars.Count - 1;

var indicatorIndex = index - 2;

Chart.RemoveObject(indicatorIndex.ToString());

if (double.IsNaN(S2.sell_ONE[indicatorIndex]) == false)

{

Chart.DrawVerticalLine(indicatorIndex.ToString(), Bars.OpenTimes[indicatorIndex], Color.FromHex("#B511F7"));

}

else if (double.IsNaN(S2.liq_ONE[indicatorIndex]) == false)

{

Chart.DrawVerticalLine(indicatorIndex.ToString(), Bars.OpenTimes[indicatorIndex], Color.FromHex("#FF7CFC00"));

}

}

See code example above. It's not really necessary with amusleh's rewrite, but it illustrates the point. It's literally that simple. You'd have to do that for any other custom indicator you need values for.

Advice is to put all those calls into one method, and then just call the method at OnTick, OnBar, or whenever you'll need values from your indicators.

@firemyst

BJORNBERNAU

22 Feb 2022, 12:26

RE:

firemyst said:

protected override void OnTick() { //This is all you would have had to do: double a = S2.sell_ONE.Last(0); a = S2.liq_ONE.Last(0); //That's it! Now the Calculate method has been //forced to calculate for each sell_One and liq_one. //You can now get any values from your indicator //and they will be readily available. var index = Bars.Count - 1; var indicatorIndex = index - 2; Chart.RemoveObject(indicatorIndex.ToString()); if (double.IsNaN(S2.sell_ONE[indicatorIndex]) == false) { Chart.DrawVerticalLine(indicatorIndex.ToString(), Bars.OpenTimes[indicatorIndex], Color.FromHex("#B511F7")); } else if (double.IsNaN(S2.liq_ONE[indicatorIndex]) == false) { Chart.DrawVerticalLine(indicatorIndex.ToString(), Bars.OpenTimes[indicatorIndex], Color.FromHex("#FF7CFC00")); } }See code example above. It's not really necessary with amusleh's rewrite, but it illustrates the point. It's literally that simple. You'd have to do that for any other custom indicator you need values for.

Advice is to put all those calls into one method, and then just call the method at OnTick, OnBar, or whenever you'll need values from your indicators.

So the "forcing" is actually happening in the Robot, not the Indicator?

Then you have to convert the double.IsNaN(S2.liq_ONE[indicatorIndex]

into

double.IsNaN(a) == false

is it or how does the Robot find "a"?

@BJORNBERNAU

firemyst

22 Feb 2022, 12:42

RE: RE:

BJORNBERNAU said:

So the "forcing" is actually happening in the Robot, not the Indicator?

Yes. You don't need to do it in the indicator. The indicator always gets its own values. However, to save on resources, the robots don't load indicator data until they're actually needed. That's why you need to force it to load to tell the robot it's needed.

Then you have to convert the double.IsNaN(S2.liq_ONE[indicatorIndex]

into

double.IsNaN(a) == false

is it or how does the Robot find "a"?

You do not care about "a" any more as I said previously.

"a" is just used as some place to force a value to be returned from the indicator.

Now that the indicator data has been loaded by the bot, you can go about getting any values you want from the indicator. Nothing else in the code needs to be changed unless you need data from other indicators.

@firemyst

BJORNBERNAU

22 Feb 2022, 12:55

RE: RE: RE:

firemyst said:

BJORNBERNAU said:

So the "forcing" is actually happening in the Robot, not the Indicator?

Yes. You don't need to do it in the indicator. The indicator always gets its own values. However, to save on resources, the robots don't load indicator data until they're actually needed. That's why you need to force it to load to tell the robot it's needed.

Then you have to convert the double.IsNaN(S2.liq_ONE[indicatorIndex]

into

double.IsNaN(a) == false

is it or how does the Robot find "a"?

You do not care about "a" any more as I said previously.

"a" is just used as some place to force a value to be returned from the indicator.

Now that the indicator data has been loaded by the bot, you can go about getting any values you want from the indicator. Nothing else in the code needs to be changed unless you need data from other indicators.

Thank you! Well, I tried it. This does not change it. The code is now the following

protected override void OnBar()

{

double a = S2.sell_ONE.Last(0);

a = S2.liq_ONE.Last(0);

double b = S2.liq_ONE.Last(0);

b = S2.liq_ONE.Last(0);

if (!double.IsNaN(S2.sell_ONE.Last(0)) == true)

{

Print("SELL ", Bars.Count, " ", S2.sell_ONE);

}

if (!double.IsNaN(S2.liq_ONE.Last(0)) == true)

{

Print("LIQ ", Bars.Count, " ", S2.liq_ONE);

}

}

Resulting in this data stream - a block-wise procurement of SELL and LIQ.

21/02/2022 00:59:00.000 | Backtesting finished

18/02/2022 12:00:00.000 | LIQ 640 IndicatorDataSeries (Count: 640, LastValue: 1,13611)

16/02/2022 22:00:00.000 | LIQ 602 IndicatorDataSeries (Count: 602, LastValue: 1,13821)

16/02/2022 11:00:00.000 | LIQ 591 IndicatorDataSeries (Count: 591, LastValue: 1,13775)

15/02/2022 19:00:00.000 | LIQ 575 IndicatorDataSeries (Count: 575, LastValue: 1,13586)

15/02/2022 16:00:00.000 | LIQ 572 IndicatorDataSeries (Count: 572, LastValue: 1,1322)

15/02/2022 13:00:00.000 | LIQ 569 IndicatorDataSeries (Count: 569, LastValue: 1,13459)

11/02/2022 19:00:00.000 | LIQ 527 IndicatorDataSeries (Count: 527, LastValue: 1,13966)

11/02/2022 16:00:00.000 | LIQ 524 IndicatorDataSeries (Count: 524, LastValue: 1,13888)

10/02/2022 19:00:00.000 | LIQ 503 IndicatorDataSeries (Count: 503, LastValue: 1,14645)

10/02/2022 16:00:00.000 | SELL 500 IndicatorDataSeries (Count: 500, LastValue: 1,14074)

10/02/2022 12:00:00.000 | SELL 496 IndicatorDataSeries (Count: 496, LastValue: 1,14359)

09/02/2022 20:00:00.000 | SELL 480 IndicatorDataSeries (Count: 480, LastValue: 1,14326)

09/02/2022 16:00:00.000 | SELL 476 IndicatorDataSeries (Count: 476, LastValue: 1,14317)

09/02/2022 13:00:00.000 | SELL 473 IndicatorDataSeries (Count: 473, LastValue: 1,14295)

09/02/2022 06:00:00.000 | SELL 466 IndicatorDataSeries (Count: 466, LastValue: 1,14269)

07/02/2022 19:00:00.000 | SELL 431 IndicatorDataSeries (Count: 431, LastValue: 1,14186)

07/02/2022 15:00:00.000 | SELL 427 IndicatorDataSeries (Count: 427, LastValue: 1,14398)

04/02/2022 14:00:00.000 | SELL 402 IndicatorDataSeries (Count: 402, LastValue: 1,14655)

04/02/2022 10:00:00.000 | SELL 398 IndicatorDataSeries (Count: 398, LastValue: 1,14602)

03/02/2022 19:00:00.000 | SELL 383 IndicatorDataSeries (Count: 383, LastValue: 1,14436)

02/02/2022 16:00:00.000 | SELL 356 IndicatorDataSeries (Count: 356, LastValue: 1,13048)

01/02/2022 14:00:00.000 | SELL 330 IndicatorDataSeries (Count: 330, LastValue: 1,12617)

01/02/2022 11:00:00.000 | SELL 327 IndicatorDataSeries (Count: 327, LastValue: 1,12614)

31/01/2022 22:00:00.000 | SELL 314 IndicatorDataSeries (Count: 314, LastValue: 1,12354)

31/01/2022 18:00:00.000 | LIQ 310 IndicatorDataSeries (Count: 310, LastValue: 1,12101)

31/01/2022 11:00:00.000 | LIQ 303 IndicatorDataSeries (Count: 303, LastValue: 1,11747)

28/01/2022 17:00:00.000 | LIQ 285 IndicatorDataSeries (Count: 285, LastValue: 1,11643)

24/01/2022 21:00:00.000 | LIQ 193 IndicatorDataSeries (Count: 193, LastValue: 1,13198)

21/01/2022 17:00:00.000 | LIQ 165 IndicatorDataSeries (Count: 165, LastValue: 1,1346)

21/01/2022 12:00:00.000 | LIQ 160 IndicatorDataSeries (Count: 160, LastValue: 1,13391)

20/01/2022 11:00:00.000 | LIQ 135 IndicatorDataSeries (Count: 135, LastValue: 1,13476)

20/01/2022 04:00:00.000 | LIQ 128 IndicatorDataSeries (Count: 128, LastValue: 1,13549)

20/01/2022 01:00:00.000 | Backtesting started

@BJORNBERNAU

firemyst

22 Feb 2022, 13:28

( Updated at: 22 Feb 2022, 13:31 )

RE: RE: RE: RE:

BJORNBERNAU said:

Thank you! Well, I tried it. This does not change it. The code is now the following

protected override void OnBar()

{

double a = S2.sell_ONE.Last(0);

a = S2.liq_ONE.Last(0);

double b = S2.liq_ONE.Last(0);

b = S2.liq_ONE.Last(0);

if (!double.IsNaN(S2.sell_ONE.Last(0)) == true)

{

Print("SELL ", Bars.Count, " ", S2.sell_ONE);

}

if (!double.IsNaN(S2.liq_ONE.Last(0)) == true)

{

Print("LIQ ", Bars.Count, " ", S2.liq_ONE);

}

}

Resulting in this data stream - a block-wise procurement of SELL and LIQ.

double b = S2.liq_ONE.Last(0);

b = S2.liq_ONE.Last(0);

WHY ARE YOU DOING THIS?! Not only are you assigning the same value to "b" twice, but you're also declaring a new variable, of which there's no need to declare a new "double b".

As I said, who cares if "a" gets overwritten with a new value?? -- you don't care about the value, and you never use it again. Don't take up extra computing resources by declaring another "double" that's not going to be used anywhere and that you're just assigning the same value to it twice in a row.

As for your overall print statements, it is working now. Your original issue was it kept printing "LastValue: NaN". It no longer does that. That issue is resolved.

If there's other logic issues in your indicator code, you'll have to figure those out or ask for help from others. :-)

@firemyst

BJORNBERNAU

22 Feb 2022, 14:22

RE: RE: RE: RE: RE:

firemyst said:

BJORNBERNAU said:

Thank you! Well, I tried it. This does not change it. The code is now the following

protected override void OnBar()

{

double a = S2.sell_ONE.Last(0);

a = S2.liq_ONE.Last(0);

double b = S2.liq_ONE.Last(0);

b = S2.liq_ONE.Last(0);

if (!double.IsNaN(S2.sell_ONE.Last(0)) == true)

{

Print("SELL ", Bars.Count, " ", S2.sell_ONE);

}

if (!double.IsNaN(S2.liq_ONE.Last(0)) == true)

{

Print("LIQ ", Bars.Count, " ", S2.liq_ONE);

}

}

Resulting in this data stream - a block-wise procurement of SELL and LIQ.

double b = S2.liq_ONE.Last(0);

b = S2.liq_ONE.Last(0);WHY ARE YOU DOING THIS?! Not only are you assigning the same value to "b" twice, but you're also declaring a new variable, of which there's no need to declare a new "double b".

As I said, who cares if "a" gets overwritten with a new value?? -- you don't care about the value, and you never use it again. Don't take up extra computing resources by declaring another "double" that's not going to be used anywhere and that you're just assigning the same value to it twice in a row.

As for your overall print statements, it is working now. Your original issue was it kept printing "LastValue: NaN". It no longer does that. That issue is resolved.

If there's other logic issues in your indicator code, you'll have to figure those out or ask for help from others. :-)

What does your code mean?

If we declare

double a = S2.sell_ONE.Last(0);

a = S2.liq_ONE.Last(0);

does this mean that we INVOKE both SELL and LIQ - which is forcing the bot to retrieve both SELL and LIQ?

When I apply your code it liberates the below, if that is not true for you, please post the code for both the bot and indicator, so I am sure to see your point.

Thank you!

21/02/2022 00:59:00.000 | Backtesting finished

18/02/2022 12:00:00.000 | LIQ 640 IndicatorDataSeries (Count: 640, LastValue: 1,13611)

16/02/2022 22:00:00.000 | LIQ 602 IndicatorDataSeries (Count: 602, LastValue: 1,13821)

16/02/2022 11:00:00.000 | LIQ 591 IndicatorDataSeries (Count: 591, LastValue: 1,13775)

15/02/2022 19:00:00.000 | LIQ 575 IndicatorDataSeries (Count: 575, LastValue: 1,13586)

15/02/2022 16:00:00.000 | LIQ 572 IndicatorDataSeries (Count: 572, LastValue: 1,1322)

15/02/2022 13:00:00.000 | LIQ 569 IndicatorDataSeries (Count: 569, LastValue: 1,13459)

11/02/2022 19:00:00.000 | LIQ 527 IndicatorDataSeries (Count: 527, LastValue: 1,13966)

11/02/2022 16:00:00.000 | LIQ 524 IndicatorDataSeries (Count: 524, LastValue: 1,13888)

10/02/2022 19:00:00.000 | LIQ 503 IndicatorDataSeries (Count: 503, LastValue: 1,14645)

10/02/2022 16:00:00.000 | SELL 500 IndicatorDataSeries (Count: 500, LastValue: 1,14074)

10/02/2022 12:00:00.000 | SELL 496 IndicatorDataSeries (Count: 496, LastValue: 1,14359)

09/02/2022 20:00:00.000 | SELL 480 IndicatorDataSeries (Count: 480, LastValue: 1,14326)

09/02/2022 16:00:00.000 | SELL 476 IndicatorDataSeries (Count: 476, LastValue: 1,14317)

09/02/2022 13:00:00.000 | SELL 473 IndicatorDataSeries (Count: 473, LastValue: 1,14295)

09/02/2022 06:00:00.000 | SELL 466 IndicatorDataSeries (Count: 466, LastValue: 1,14269)

07/02/2022 19:00:00.000 | SELL 431 IndicatorDataSeries (Count: 431, LastValue: 1,14186)

07/02/2022 15:00:00.000 | SELL 427 IndicatorDataSeries (Count: 427, LastValue: 1,14398)

04/02/2022 14:00:00.000 | SELL 402 IndicatorDataSeries (Count: 402, LastValue: 1,14655)

04/02/2022 10:00:00.000 | SELL 398 IndicatorDataSeries (Count: 398, LastValue: 1,14602)

03/02/2022 19:00:00.000 | SELL 383 IndicatorDataSeries (Count: 383, LastValue: 1,14436)

02/02/2022 16:00:00.000 | SELL 356 IndicatorDataSeries (Count: 356, LastValue: 1,13048)

01/02/2022 14:00:00.000 | SELL 330 IndicatorDataSeries (Count: 330, LastValue: 1,12617)

01/02/2022 11:00:00.000 | SELL 327 IndicatorDataSeries (Count: 327, LastValue: 1,12614)

31/01/2022 22:00:00.000 | SELL 314 IndicatorDataSeries (Count: 314, LastValue: 1,12354)

31/01/2022 18:00:00.000 | LIQ 310 IndicatorDataSeries (Count: 310, LastValue: 1,12101)

31/01/2022 11:00:00.000 | LIQ 303 IndicatorDataSeries (Count: 303, LastValue: 1,11747)

28/01/2022 17:00:00.000 | LIQ 285 IndicatorDataSeries (Count: 285, LastValue: 1,11643)

24/01/2022 21:00:00.000 | LIQ 193 IndicatorDataSeries (Count: 193, LastValue: 1,13198)

21/01/2022 17:00:00.000 | LIQ 165 IndicatorDataSeries (Count: 165, LastValue: 1,1346)

21/01/2022 12:00:00.000 | LIQ 160 IndicatorDataSeries (Count: 160, LastValue: 1,13391)

20/01/2022 11:00:00.000 | LIQ 135 IndicatorDataSeries (Count: 135, LastValue: 1,13476)

20/01/2022 04:00:00.000 | LIQ 128 IndicatorDataSeries (Count: 128, LastValue: 1,13549)

20/01/2022 01:00:00.000 | Backtesting started

@BJORNBERNAU

BJORNBERNAU

22 Feb 2022, 14:32

RE: RE: RE: RE: RE: RE:

BJORNBERNAU said:

firemyst said:

BJORNBERNAU said:

Thank you! Well, I tried it. This does not change it. The code is now the following

protected override void OnBar()

{

double a = S2.sell_ONE.Last(0);

a = S2.liq_ONE.Last(0);

double b = S2.liq_ONE.Last(0);

b = S2.liq_ONE.Last(0);

if (!double.IsNaN(S2.sell_ONE.Last(0)) == true)

{

Print("SELL ", Bars.Count, " ", S2.sell_ONE);

}

if (!double.IsNaN(S2.liq_ONE.Last(0)) == true)

{

Print("LIQ ", Bars.Count, " ", S2.liq_ONE);

}

}

Resulting in this data stream - a block-wise procurement of SELL and LIQ.

double b = S2.liq_ONE.Last(0);

b = S2.liq_ONE.Last(0);WHY ARE YOU DOING THIS?! Not only are you assigning the same value to "b" twice, but you're also declaring a new variable, of which there's no need to declare a new "double b".

As I said, who cares if "a" gets overwritten with a new value?? -- you don't care about the value, and you never use it again. Don't take up extra computing resources by declaring another "double" that's not going to be used anywhere and that you're just assigning the same value to it twice in a row.

As for your overall print statements, it is working now. Your original issue was it kept printing "LastValue: NaN". It no longer does that. That issue is resolved.

If there's other logic issues in your indicator code, you'll have to figure those out or ask for help from others. :-)

What does your code mean?

If we declare

double a = S2.sell_ONE.Last(0);

a = S2.liq_ONE.Last(0);does this mean that we INVOKE both SELL and LIQ - which is forcing the bot to retrieve both SELL and LIQ?

When I apply your code it liberates the below, if that is not true for you, please post the code for both the bot and indicator, so I am sure to see your point.

Thank you!

21/02/2022 00:59:00.000 | Backtesting finished

18/02/2022 12:00:00.000 | LIQ 640 IndicatorDataSeries (Count: 640, LastValue: 1,13611)

16/02/2022 22:00:00.000 | LIQ 602 IndicatorDataSeries (Count: 602, LastValue: 1,13821)

16/02/2022 11:00:00.000 | LIQ 591 IndicatorDataSeries (Count: 591, LastValue: 1,13775)

15/02/2022 19:00:00.000 | LIQ 575 IndicatorDataSeries (Count: 575, LastValue: 1,13586)

15/02/2022 16:00:00.000 | LIQ 572 IndicatorDataSeries (Count: 572, LastValue: 1,1322)

15/02/2022 13:00:00.000 | LIQ 569 IndicatorDataSeries (Count: 569, LastValue: 1,13459)

11/02/2022 19:00:00.000 | LIQ 527 IndicatorDataSeries (Count: 527, LastValue: 1,13966)

11/02/2022 16:00:00.000 | LIQ 524 IndicatorDataSeries (Count: 524, LastValue: 1,13888)

10/02/2022 19:00:00.000 | LIQ 503 IndicatorDataSeries (Count: 503, LastValue: 1,14645)

10/02/2022 16:00:00.000 | SELL 500 IndicatorDataSeries (Count: 500, LastValue: 1,14074)

10/02/2022 12:00:00.000 | SELL 496 IndicatorDataSeries (Count: 496, LastValue: 1,14359)

09/02/2022 20:00:00.000 | SELL 480 IndicatorDataSeries (Count: 480, LastValue: 1,14326)

09/02/2022 16:00:00.000 | SELL 476 IndicatorDataSeries (Count: 476, LastValue: 1,14317)

09/02/2022 13:00:00.000 | SELL 473 IndicatorDataSeries (Count: 473, LastValue: 1,14295)

09/02/2022 06:00:00.000 | SELL 466 IndicatorDataSeries (Count: 466, LastValue: 1,14269)

07/02/2022 19:00:00.000 | SELL 431 IndicatorDataSeries (Count: 431, LastValue: 1,14186)

07/02/2022 15:00:00.000 | SELL 427 IndicatorDataSeries (Count: 427, LastValue: 1,14398)

04/02/2022 14:00:00.000 | SELL 402 IndicatorDataSeries (Count: 402, LastValue: 1,14655)

04/02/2022 10:00:00.000 | SELL 398 IndicatorDataSeries (Count: 398, LastValue: 1,14602)

03/02/2022 19:00:00.000 | SELL 383 IndicatorDataSeries (Count: 383, LastValue: 1,14436)

02/02/2022 16:00:00.000 | SELL 356 IndicatorDataSeries (Count: 356, LastValue: 1,13048)

01/02/2022 14:00:00.000 | SELL 330 IndicatorDataSeries (Count: 330, LastValue: 1,12617)

01/02/2022 11:00:00.000 | SELL 327 IndicatorDataSeries (Count: 327, LastValue: 1,12614)

31/01/2022 22:00:00.000 | SELL 314 IndicatorDataSeries (Count: 314, LastValue: 1,12354)

31/01/2022 18:00:00.000 | LIQ 310 IndicatorDataSeries (Count: 310, LastValue: 1,12101)

31/01/2022 11:00:00.000 | LIQ 303 IndicatorDataSeries (Count: 303, LastValue: 1,11747)

28/01/2022 17:00:00.000 | LIQ 285 IndicatorDataSeries (Count: 285, LastValue: 1,11643)

24/01/2022 21:00:00.000 | LIQ 193 IndicatorDataSeries (Count: 193, LastValue: 1,13198)

21/01/2022 17:00:00.000 | LIQ 165 IndicatorDataSeries (Count: 165, LastValue: 1,1346)

21/01/2022 12:00:00.000 | LIQ 160 IndicatorDataSeries (Count: 160, LastValue: 1,13391)

20/01/2022 11:00:00.000 | LIQ 135 IndicatorDataSeries (Count: 135, LastValue: 1,13476)

20/01/2022 04:00:00.000 | LIQ 128 IndicatorDataSeries (Count: 128, LastValue: 1,13549)

20/01/2022 01:00:00.000 | Backtesting started

The code does not ALTERNATE between SELL and LIQ.

@BJORNBERNAU

firemyst

21 Feb 2022, 15:16 ( Updated at: 21 Feb 2022, 15:26 )

Glancing at your code, a possible problem is you never actually set the last value of either data series.

You only ever populate [index - 2] of either sell_One or liq_one, never [index].

Therefore:

s2.liq_one.last(0) is NAN

s2.sell_one.last(0) is NAN

s2.liq_one.last(1) is NAN

s2.sell_one.last(1) is NAN

so the .Last(0) values are both the same, hence the reason they both print out and don't alternate.

Similarly, the .Last(1) values are both the same too.

@firemyst