Trade Execution Speed

23 Sep 2017, 00:18

Hi,

We are experiencing somewhat slow trade execution speed. Based upon our measurements it takes approx 200-300 ms to execute the trade frrm the time is has been received by FIX / by the broker. Yet we know it can be processed much faster. Is there any reason for this slow processing ?

Please advise.

Alex

Replies

ales.sobotka@gmail.com

25 Sep 2017, 13:40

( Updated at: 21 Dec 2023, 09:20 )

RE:

Hi Panagiotis,

Here are more details:

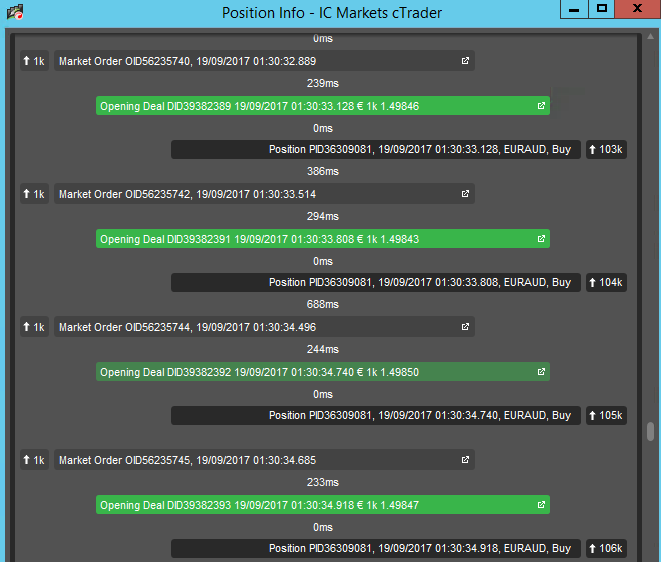

1) We use ICMarkets as a broker

2) Our server is located in The Netherland

3) I have attached a screen shot which clearly shows a rather slow execution speed. It takes well over 200ms for the Market Order (from the time it has been received) to get executed. Which is in essence slow.

Thank you for any insight you can provide.

Alex

Panagiotis Charalampous said:

Hi Alex,

It would be useful to have some additional information like the broker and your location, so that we can try this ourselves and see if it happens and if the delay is justifiable.

Best Regards,

Panagiotis

@ales.sobotka@gmail.com

PanagiotisCharalampous

26 Sep 2017, 16:37

Hi Alex,

Thanks for the additional info. We do not control the entire order routing, therefore we cannot provide a comprehensive explanation for the execution time. After orders leave cTrader, they go to a liquidity aggregator, then to a bank and back. That part is out of our control and might cause delay depending on the LPs location. So it would be good to advice with your broker as well on this subject.

Best Regards,

Panagiotis

@PanagiotisCharalampous

ales.sobotka@gmail.com

26 Sep 2017, 23:56

Dear Panagiotis,

Thank you for your reply. However, we do not really trade via cTrade yet via FIX API. In any case, for our better understanding, could you be so kind to describe the architecture and how Spotware is linked to IC Markets and how all things get executed ? Some sort of a workflow or architecture document would be great. Feel free to send it to my email only.

Thank you in advance, Alex

@ales.sobotka@gmail.com

PanagiotisCharalampous

27 Sep 2017, 10:29

Hi Alex,

The workflow is pretty simple and can be summarized to the following

cTrader/FIX/Connect -> cServer Proxy -> cServer -> LP aggregator -> Bank -> LP aggregator -> cServer -> cServer Proxy -> cTrader/FIX/Connect

We are not in control of the

... -> LP aggregator -> Bank -> LP aggregator -> ...

part.

Best Regards,

Panagiotis

@PanagiotisCharalampous

tradingu

14 Dec 2017, 14:23

RE:

Panagiotis Charalampous said:

Hi Alex,

The workflow is pretty simple and can be summarized to the following

cTrader/FIX/Connect -> cServer Proxy -> cServer -> LP aggregator -> Bank -> LP aggregator -> cServer -> cServer Proxy -> cTrader/FIX/Connect

Hi Panagiotis,

Is there any difference between algo execution speeds between FIX and Calgo? Considering condensed format of FIX protocol, is it any faster and if yes, then how much?

Or did you guys developed FIX to just make porting legacy FIX algos over to ctrader brokers more easily?

Thanks.

@tradingu

PanagiotisCharalampous

18 Dec 2017, 15:46

Hi tradingu,

There isn't a straightforward answer to your question, as speed of execution depends on many factors. However, in principle and all other variables being equal, using FIX API should be faster than cAlgo, as the protocol is optimized for speed and exchange of financial information. Regarding the "How much" question, I don't have any hard data available but it would be an interesting experiment to run.

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

25 Sep 2017, 09:06

Hi Alex,

It would be useful to have some additional information like the broker and your location, so that we can try this ourselves and see if it happens and if the delay is justifiable.

Best Regards,

Panagiotis

@PanagiotisCharalampous