Road map

27 May 2016, 12:01

Dear Spotware,

What is being worked on, what is planned for the future?

Can you provide us with a rough roadmap?

Cheers

Replies

Spotware

30 May 2016, 11:54

( Updated at: 21 Dec 2023, 09:20 )

Dear Traders,

We would like to inform you about the new order types that will be introduced in the upcoming releases of cTrader.

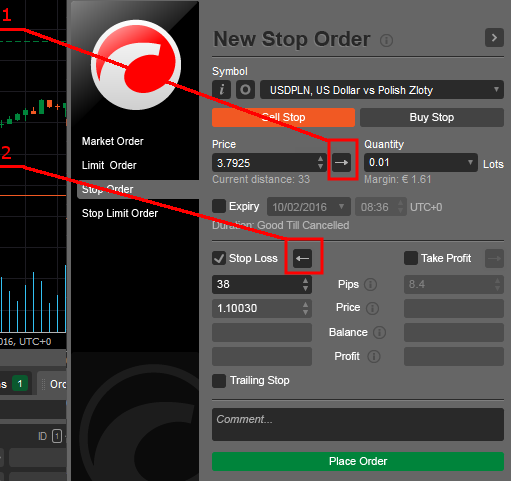

1. Trigger side for Stop Orders:

The trader will be able to choose the trigger side for Stop and Stop Loss orders using the new trigger side buttons illustrated below.

Behavior:

- Stop Order (#1 on Fig)

- Buy order

- Trade Side (Default) - the order will be triggered by the Ask price higher or equal to the order price

- Opposite Side - the order will be triggered by the Bid price higher or equal to the order price

- Sell order

- Trade Side (Default) - the order will be triggered by the Bid price less or equal to the order price

- Opposite Side - the order will be triggered by the Ask price less or equal to the order price

- Buy order

- Stop Loss Order (#2 on Fig)

- Buy position

- Trade Side (Default) - the order will be triggered by the Bid price higher or equal to the order price

- Opposite Side - the order will be triggered by the Ask price higher or equal to the order price

- Sell position

- Trade Side (Default) - the order will be triggered by the Ask price less or equal to the order price

- Opposite Side - the order will be triggered by the Bid price less or equal to the order price

- Buy position

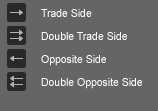

2. Double Trigger Method for pending orders

Behaviour:

- Stop Order/Stop Limit Order

- Buy order

- Double Trade Side - the order will be triggered by the two consecutive Ask prices higher or equal to the order price

- Double Opposite Side - the order will be triggered by the two consecutive Bid prices higher or equal to the order price

- Sell order

- Double Trade Side - the order will be triggered by the two consecutive Bid prices less or equal to the order price

- Double Opposite Side - the order will be triggered by the two consecutive Ask prices less or equal to the order price

- Buy order

- Stop Loss Order

- Buy position

- Double Trade Side - the order will be triggered by the two consecutive Bid prices less or equal to the order price

- Double Opposite Side - the order will be triggered by the two consecutive Ask prices less or equal to the order price

- Sell position

- Double Trade Side - the order will be triggered by the two consecutive Ask prices higher or equal to the order price

- Double Opposite Side - the order will be triggered by the two consecutive Bid prices higher or equal to the order price

- Buy position

- Limit Order

- Buy order

- Double Trade Side - the order will be triggered by the two consecutive Ask prices less or equal to the order price

- Sell order

- Double Trade Side - the order will be triggered by the two consecutive Bid prices higher or equal to the order price

- Buy order

- Take Profit Order

- Buy position

- Double Trade Side - the order will be triggered by the two consecutive Bid prices higher or equal to the order price

- Sell position

- Double Trade Side - the order will be triggered by the two consecutive Ask prices less or equal to the order price

- Buy position

Limit and Take Profit orders won't support the single/double Opposite Side trigger method. A full list of available trigger methods and trigger sides are shown below:

Relative Protection Levels:

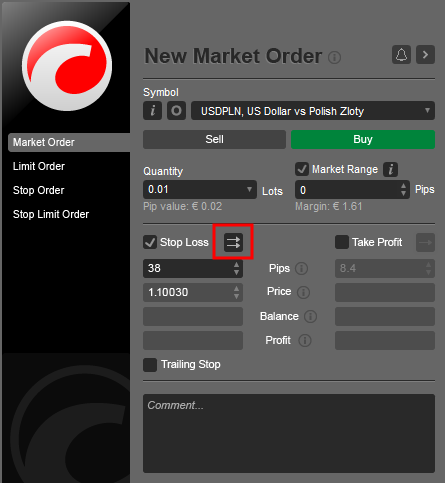

Traders will use either relative or absolute values when applying their Stop Loss, Trailing Stop Loss or Take Profit.

A trader may set the protection level in either Pips or absolute price . When the trader clicks the Pips field or the Price field, the field is becomes editable. The other field is disabled and changes value automatically depending on field which is actively being edited.

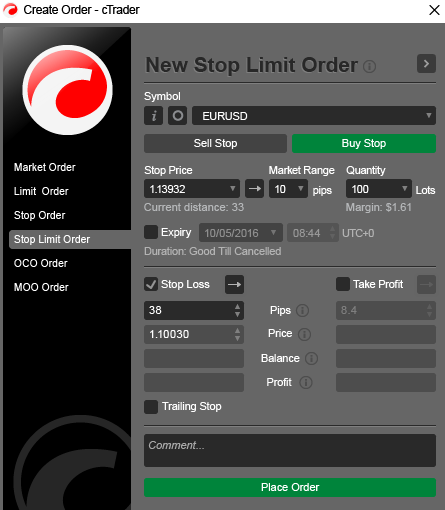

Stop Limit Orders:

Stop Limit Orders will be a newly introduced order type accessible through a new tab.

Behaviour:

Trader sets stop price and market range for limit order. Limit price will be above stop price for buy orders and below stop price for sell orders.

When the market reaches a specific rate the order is triggered like Stop Order.

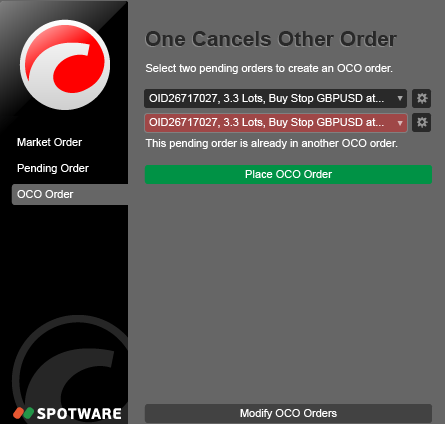

One Cancels Other Orders (OCO):

OCO Orders will be introduced and can be managed from OCO order windows and the Tradewatch in cTrader.

Behaviour:

A Trader can link 2 pending orders to become one OCO Order

If one order changes status from Accepted to Filled, the linked order is cancelled. The OCO Order is executed

If one order changed status from Accepted to Cancelled or Rejected, the OCO Order should be cancelled

@Spotware

smuttynutty

30 May 2016, 14:02

Thank you very much, it looks interesting

Especially double trigger order,

I guess you will be able to specify some parameter between the two triggering prices? Like: if within x seconds after reaching the first price, the second one is reached THEN enter/exit the trade?

Or is it something entirely automated?

Anyways, looking forward to

@smuttynutty

3183 Capital

03 Nov 2016, 00:31

How do I get One Cancels Other Orders (OCO) to show up on my cTrader platform?

@3183 Capital

iulianalinchiru

07 Jun 2017, 12:20

Is there the poss of having One Cancels Other Orders (OCO)?

I can't find it...

@iulianalinchiru

DAANIIK

28 May 2016, 17:19

Unfortunately nobody will tell you about future plans, but u think possible changes are:

1) Cfd (stocks) in cTrader

2) New order types

3) Pamm accounts (Multi-broker)

@DAANIIK