Standard DoM interpretation

07 Jan 2014, 22:43

Hi,

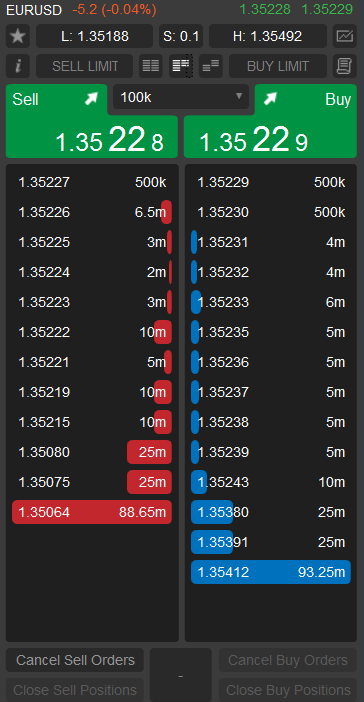

Can someone help me to interpret this standard DoM profiles from different brokers? Different Low / High, different Spreads, different Bid/Ask price at the same time, different entries and depht profile ...

Thanks

Replies

olddirtypipster

01 Aug 2014, 02:38

This is due to the fact that you do not have Direct Market Access (DMA) and so, you will not see your orders displayed on the orderbook.

Any given broker is partnered with several liquidity providers such as major banks (Barclays, RBS, BNP, etc) Hedge Funds, and other institutions that offer large volumes of liquidity. Each of these LP's may quote their own best prices in their individual orderbooks. A broker partnering with these institutions will be able to establish FIX gateway connections, obtain these price feeds, and aggregate them, thus compiling their own orderbook that they then display to you in their proprietary trade platforms.

For instance, when you see a price such as this: 1.61885@9m, one possible scenario is because let us say three of the liquidity providers partnered with the broker are offering the following volumes at that price: 1.61885@5m, 1.61885@@1m, 1.61885@3m. The broker will then aggregate these prices into one like so: 1.61885@@9m and offer this to the end user.

Now imagine that the Direct market is where these liquidity providers are. This is where large institutions and hedge funds move markets causing prices to change through large volumes of currencies being traded. In order for yo to see your orders being reflected in the orderbook being displayed by your broker, you would naturally have to be trading in the same marketplace as these large market makers.

You are simply not in that space. What you do is you submit an order to your broker, and the broker will basically match your price with an opposite trade all behind the scenes. You will never see this reflected in the market depth view.

Essentially, what we the little fish are actually doing is placing bets that the market will move in the direction that we hope it will, so that we can close out on a profit.This is very different to the game that the big fish are playing. What they are doing is buying/selling product A at what they believe to be a competitive price, and then competing with other big fish in getting product A sold/bought off at the best possible price.Depending on how this trade goes, the overall price of product A will increase or decrease accordingly. This is the reason why currencies fluctuate in this way.

Back on earth, we the little quys are completely oblivious to this level of competition, as we don't ever see this action. We simply realize that the price has either moved in or out of our favor, and we scratch our heads wondering what made it do that. The whole point of determining what and who is making the prices move up or down is called order flow analysis.

If you can figure out what the order-flow for a given currency is, you will be in a more informed position when you actually take a position.# in a trade. Hence the need to trade ordeflow as well as technical analysis.

@olddirtypipster

mDull

07 Feb 2014, 18:49 ( Updated at: 21 Dec 2023, 09:20 )

RE:

Sorry, I think we could not see the image. I try again.

oguti said:

@mDull