The Complete Guide on How to Pick a Good Genuine Strategy Provider

28 Jul 2021, 00:54

Greetings Traders,

Disclaimer: This thread is on my personal tips on how to pick a good strategy provider. Some may disagree which is fine, we're not all going to agree. Please remember, THIS IS NOT AN INVESTMENT ADVICE.

It’s a long thread, but I believe you’ll find some useful information.

------------------------------------

How to pick a good strategy provider:

I. Filtering ROI Pumpers, Not much you could do but only two ways I found so far were:

- one filter would be to set Volume fee to $0

- the other is to sort results by copiers as most ROI Pumpers have few to no copiers whatsoever.

II. Volume Fee: I would avoid Providers with volume fee for now until spotware finds a solution for providers abusing it and bleeding their copiers accounts. That being said, Volume fee is actually a standard in the industry, I personally do like it but needs to have tighter restrictions in cTrader first.

So you're at the Strategies section of cTrader Copy, filter the volume fee to 0 and sort by copiers, looking at strategies now:

1- If ROI is too good to be true especially in a single month, skip to next provider. if anyone could just grow an account 200-1000% Monthly, they shouldn’t be here, they'll be hired immediately in biggest hedge funds in the world. Again, if too good to be true, stay away, provider most likely using someway to multiply the ROI daily.

2- If ROI curve is linear, no drawdowns whatsoever, again too good to be true, skip to next one.

3- If own funds are less than $1000, skip to next profile, if a strategy provider doesn’t have faith in his strategy to put decent amount of money in it then why should you? They're usually ROI pumpers anyways (Not all). If he doesn’t have the funds, then he's probably not a good trader anyways, and if he is, he can grow account first then offer to provide.

4- If Own funds less than Min. investment required, skip profile, unless it's a reputable strategy provider with previous track record.

Now you find a nice strategy that passes most tests above, you click on profile:

A- check Description, if little to no description, skip no need to continue.

B- If no way to contact offered, skip.

C- If you see some third-party verification link like myfxbook, fxblue or others, then that's a plus. I'll talk about myfxbook later. Myfxbook needs to be set to show trades history, if it doesn’t, then it’s useless as strategy provide may be hiding something.

D- if number of pips is too high for strategy age, provider most likely trading gold to make profile look good, that's a flag.

E- check if provider has other strategies.

G- scroll to ROI curve and switch to equity curve, check if drawdowns are deep and if provider keeps withdrawing and depositing funds, if so skip profile, he's making ROI curve look nice and most likely doesn’t use stops nor take losses, they likely hold until market comes back for them OR they blow up and start another ROI pumping scheme. I'm not going to post specific examples, but should be obvious when you see it.

H- scroll down and check Summary tab: If starting balance too low skip, they're an ROI pumpers

I- check Profit factor, if too low (below 1), skip, they're scalper making $0.6 per trade and taking $1 losses

J- if precent profitable too high 95% and above, skip, most likely they hold losing trades until they break even.

K- scroll down, check instruments traded, if they trade DSHUSD, skip profile immediately.

L- Check trades tab, if they trade gold, it'll be useless as somehow Gold pips are multiplied times 10 vs FX pairs, but check Average Trade Duration time if too low he's a "micro" scalper (I'll talk more about scalping below)

M- Scroll below, and click history tab, go thru history from beginning to end, check pips and Net profit. if net profit per trade $0.6-$1.00, he's a micro scalper

# Scalpers are actually good traders, and I mean regular scalpers NOT micro scalpers. so, a regular scalper will go for 5-10 pips per trade which is fine. Micro scalpers go for 1-3 pips, they do net profit but only a little, as commissions and spreads eat most of gain.

## Now for copiers, you'll likely net losses and spread will likely be wider for you or execution won’t be as good as scalpers using limit orders or market order with copier accounts getting out 1-2 seconds later, sometimes copiers make more as market moves more in profit in that time difference but usually you lose especially if broker has wide spreads. Now if provider has volume fee, you'd definitely lose on those trades, trade history may not show it but if you subtract the fees, you'd see you're netting a loss

### Following a REGULAR scalper is fine, and if they're really good then you shouldn’t worry about it. However, in my humble opinion, swing trades provide copiers with better cushion (Protection) against commissions and spreads, as they trade less AND make more per trade saving copier massive sums of money worth of commission and spreads. Overall, diversification is good, you can copy some regular scalpers and some swing traders and have a balance.

-------

%% On a separate note, some copiers are confused about Management Fee: it's basically a percentage per year usually between 2% to 10% but calculated daily.

Management fee is actually standard in any hedge fund or firm for many reasons, the most important one is giving your money manager a strong incentive to care about your money, the money manager will be more incentivized to manage risk better as he'd make less money on management fee of AUM (or in our case Live Copying Capital) if copiers lost money + he'd want to grow your money, so he can make more on management fee (as a percentage of total capital). Another reason would be long-term focus for strategy as this fee is taken as a function of time (It won’t be as if provider wants to make quick money from performance fee and disappear). Long term focus would result in steady low risk growth, in other words as a copier you can relax and let provider take care of your capital knowing that he'll treat it as his own money due to the percentage he'll gain from management fee.

Now let's think for a second, if Management fee was 5% per year, and you copied with $100, that would be only $4.16 per month ($0.14 per day). If you compare with other social trading platforms, they charge copiers from $25-$100 per month only to be able to use the platform, not counting subscription fee to strategy. (Zulu charges $25/Month subscription to copy trades)

-----------------------------------------

Now let's talk about myfxbook:

- As I've stated above, I don’t want to mention specific examples or screenshots of other traders strategies as not to misjudge anyone or get anyone upset with me, so I'll be talking about my own:

1- myfxbook is better to analyze a strategy than ctrader imho, that's why ROI pumpers wont share theirs and if they do they'll restrict most data on myfxbook (obviously ROI pumpers have otherways to make myfxbook look good)

2- That's why you want to see provider backing his strategy with an external strategy analysis service (Myfxbook is available to all cTrader users for free).

3- Even better if provider showed other strategies too from other accounts as proof of their value as a trader. at the end you don’t want to copy an amateur trying his luck.

Now let's drill down into my own strategy myfxbook:

www.myfxbook.com/members/FX_Quant/fx-quant/8697693

4- so when you go strategy page on myfxbook, you'll see multiple charts for Growth, balance, profit and DRAWDOWN, which is very important, every copier should set an equity stoploss that they're comfortable with, if provider consistently gets in unrealized 50% drawdowns (which won’t show on an ROI chart) you wanna run away, as eventually that 50% drawdown will turn into 80% and then margin call wiping your account with it.

5- Check data and flip thru charts, an important one would be the Balance tab, you want to see equity line (yellow) most of the time equal OR above balance line (red), it tells you trader closed trades end of day if equal, or carrying Profitable position into next day if yellow line above, and lastly carrying losing positions (drawdown) into next day if yellow line below.

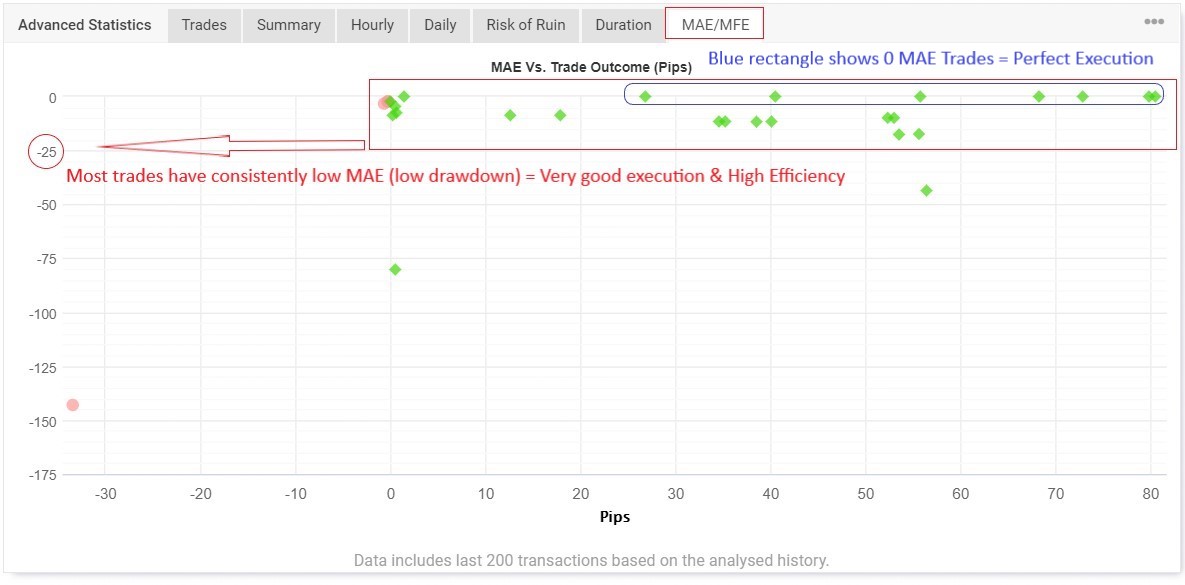

6- Scroll below and check other data, I'm not going to go over everything but one of the best tools in myfxbook is the MAE/MFE tab:

Maximum Adverse Excursion (MAE): The MAE is the largest experienced loss during a trade; it measures how far price went against you.

Maximum Favorable Excursion (MFE): The MFE is the opposite of the MAE and it measures the largest observed profit during a trade.

Let's focus on MAE, a low MAE means entry and timing were very good with very low intraday drawdown. Now MAE of 0 means PERFECT execution, means trade was entered and immediately went in trader's favor. On the other hand, a high MAE means poor execution and having to sit thru drawdown which is risky especially with high leverage.

Other platforms (like my futures account platform Tradestation) measure the same metric in percentage and calls it Efficiency, so low MAE means a very efficient strategy, high MAE (High drawdown) means inefficient strategy.

What you went to see in this chart is majority of points (trades) clustered above which means low MAE on Y-axis (low drawdown) and that would indicate a consistent highly efficient strategy. it's okay to have few bad trades, these would be outliers. As you can see from chart majority of my strategy trades are clustered above with only 2 outliers out of 36 total trades with some even at 0 MAE (Perfect execution)

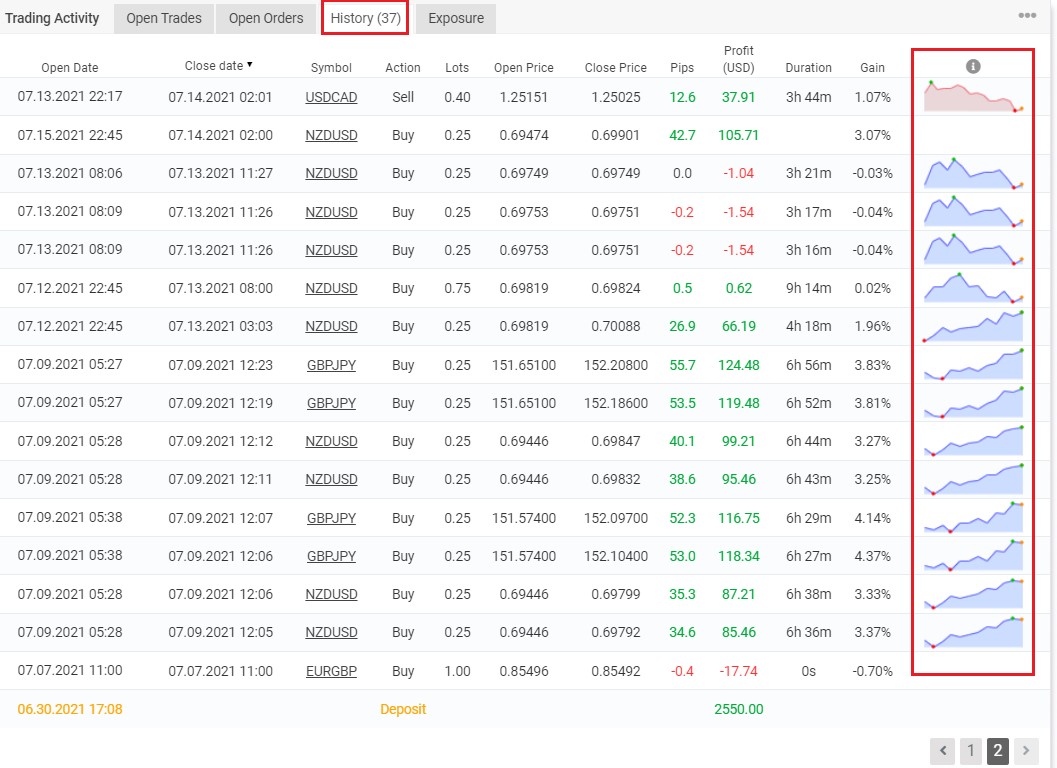

7- Another great feature of myfxbook is Trade analytics, so you scroll down go to the history tab, we already talked about what to watch for here when we were analyzing strategies in cTrader but here we want to focus on Trade analytics, it shows the chart of each trade PnL for execution to exist, you want to see majority of trades in Blue color meaning trade was entered efficiently, also you want to see majority of these blue charts in trend up chart indication positive profit from entry and profit was increasing up until exit.

as seen below from strategy chart, most were blue (efficient execution and trade went into profit immediately), and trending up (Profit was increasing until exit), some in screenshot were blue and trended up and then came down meaning profit was given away as market reversed and trader got stopped at breakeven (in my case showing slight loss as stop triggered slightly below breakeven)

****** It's very important to understand that NOT all trades will be good, but you want to see majority of trades in blue indicating very low drawdown per trade and efficient execution.

8- there are other extra features in myfxbook that you should discover and consider. However, it'll depend on strategy provider "providing" clear analytics into his strategy to make an informed decision whether his strategy satisfy your requirements and suits your risk level.

9- I've mentioned before that a great proof of value would if provider supplied another completely different successful strategy, NEVER ACCEPT A SCREENSHOT, as they could be faked.

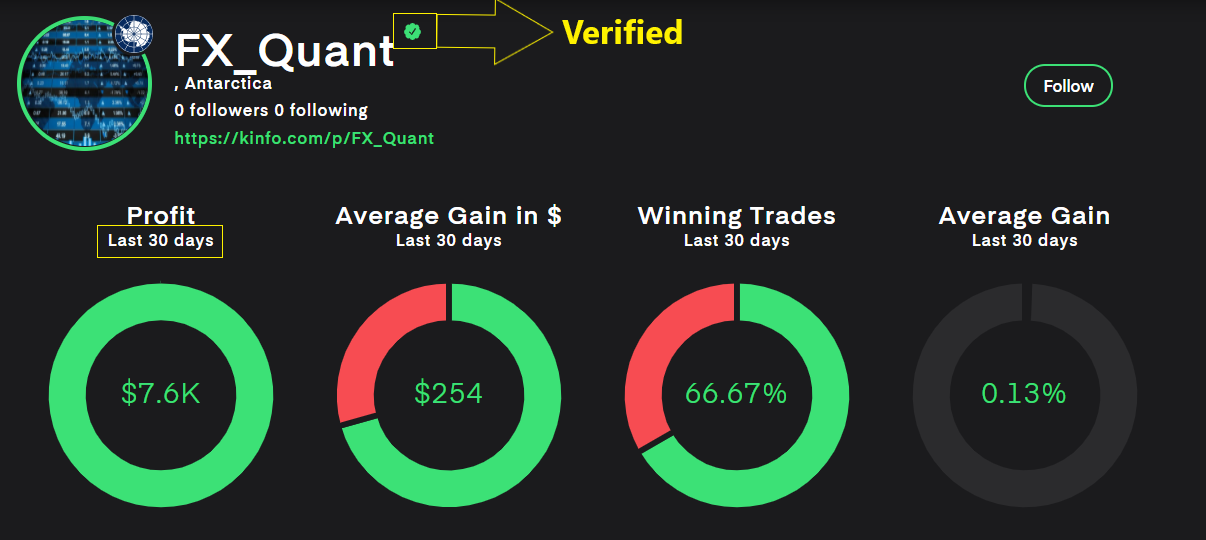

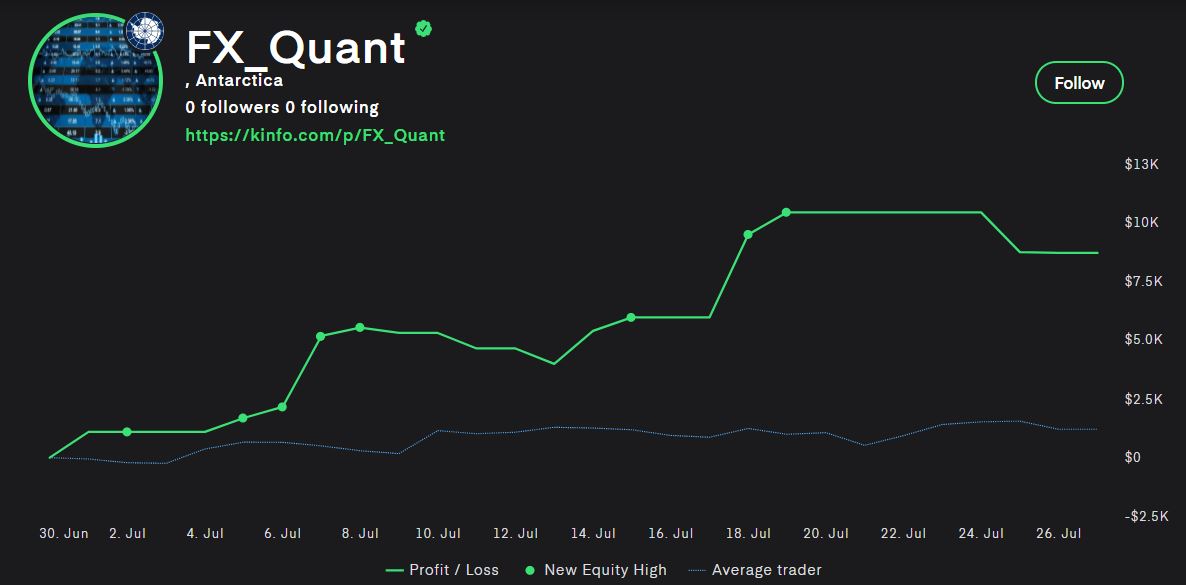

In My case, I’ll link to my KINFO account which verifies my futures account trades at Tradestation. This Futures account is completely run by my algos, they trade the account and I just check results end of day, I only intervene when risk is too high. Strategy in this account is different than the one being offered here, as mentioned before I run multiple accounts/strategies.

*Unfortunately KINFO only able to sync current month trades from my Tradestation account.

*I’ll leave account public for sometime, then take it private.

KINFO account link:

Additional thoughts:

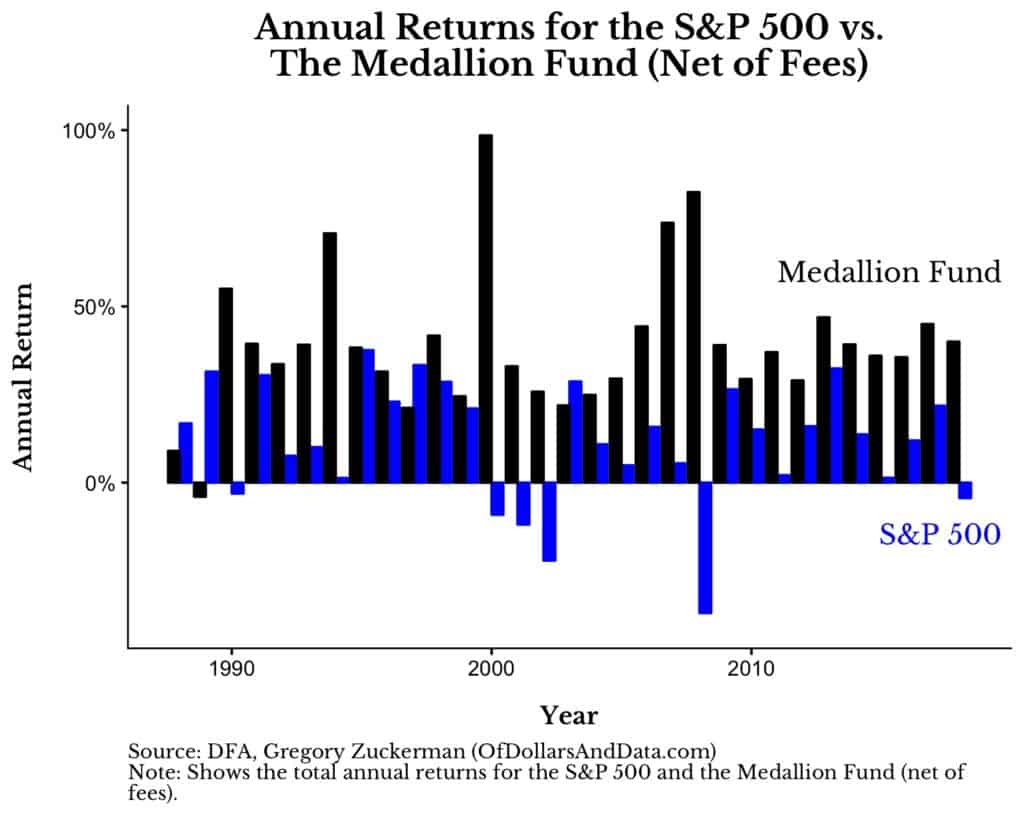

- If it's too good to be true, it's NOT! it's as simple as that. The best performing Firm/hedge fund is Renaissance’s flagship Medallion Fund generated 66% annualized returns (before fees) and 39% annualized returns (net of fees) from 1988-2018. And even with that they had some bad quarters with some drawdowns. Point is look for a realistic strategy, if you do find it, it should be a long term investment as every strategy will encounter drawdowns at some point.

- Diversification is key, best strategies trade different pairs. You either pick diversified strategies OR you diversify your money in different strategies.

---------------------------------------

My strategy with the description I have on cTrader:

https://ct.icmarkets.com/copy/strategy/33834

"Dark Knight Strategy: Trades will be executed manually according to my own developed Quant Model and Algorithms.

Full verified details:

www.myfxbook.com/members/FX_Quant/fx-quant/8697693

Different verified Strategy (Futures account):

www.kinfo.com/p/FX_Quant

- Strategy achieved 100% return on $2550 initial capital in only 2 weeks.

- Strategy only trades when Model gives signal NOT daily, July been a great month, Past performance is no guarantee of future results.

- Free for Demo and Live for everyone to gauge performance.

- NO trades will be initiated on major news release days even if Model gives signal.

- ALL trades are executed with Dynamic & adaptive Size, Stoploss & TP, to manage risk during volatile periods.

- This is swing Strategy, NOT scalping, so it WONT bleed investors accounts with commissions & slippage costs.

- Goal is to grow account steadily with low risk.

Follow on Twitter: FXQuant_

“

Notes:

- July has been fantastic, I highly doubt Strategy will perform as good every single month, but I believe it'll perform wonderfully well over the longterm. However, just like Medallion fund we may encounter some drawdowns once in a while, it's part of the game, anyone tells you otherwise is lying to you.

- My goal is LONG TERM, if you're looking for a massive quick gain, this isn’t the strategy for you.

----------------------

Finally, if you liked any part of this thread and found any useful information, then Please:

1- Leave a comment even a "thank you" is fine. if you disagree, please post your feedback so others could benefit too. Additional contribution would be appreciated and would help other copiers.

2- Check out my strategy and Myfxbook & Kinfo, if you like what you see, Demo or live copy if you like, it's free and probably going to stay free for a month or two.

3- Follow me on twitter @FXQuant_ , I'll post personal thoughts on market once in a while. if you need to contact me, do so on twitter or Telegram @FX_Quant. Other than Twitter/Telegram/Myfxbook/Kinfo, I have no other accounts, if I do add any I'll post on this thread, otherwise, it's not me.

Strategy: https://ct.icmarkets.com/copy/strategy/33834

Myfxbook: https://www.myfxbook.com/members/FX_Quant/fx-quant/8697693

Kinfo (different Strategy): https://kinfo.com/p/FX_Quant

Twitter: @FXQuant_

Telegram: @FX_Quant

Best of luck.

-------------------

Thread is over at this point but it’s not really complete without some feedback for Spotware:

A- New Calculation method for ROI, NOT based on initial funding but more of weighted average deposits or something similar.

B- Default sorting should be based on Net Profit not ROI, it's not hard to create multiple $100 accounts and try to double one and delete rest, but it's harder and capital consuming to be done with $1000.

C- Impose $1000 minimum funding and maintain for strategy to be eligible for providing, if balance falls below $1000, Strategy resets. For example, a Provider funds with $2000 if balance falls below $1000 he shouldn’t be providing a strategy if he just lost 50% of capital. If trader uses high leverage, he can fund with 5-10K or more, sky is the limit.

D- More Sorting options, More filtering options.

E- Give copiers right to report suspicious providers to help moderators clean providers list from ROI pumpers

F- Volume Fee should be regulated somehow to genuine providers only. one way would be that right to charge volume fee is earned, let's say 6 months of strategy growth with sufficient live copying capital. Another way, to limit volume fee being charged to say 5 winning trades per day WITH copier netting profit after volume fee, meaning providers scalping 1 or 2 pips shouldn’t get volume fee.

G- Suspicious activity in provider account should be flagged somehow. Maybe some people would contribute more to this point.

H- Equity and balance curves should be replaced by change in net Pnl, growth lines, or it'd be in another tap. Equity curve shouldn’t have deposits and withdrawals as they distort the curve and it's harder to pinpoint equity drawdowns.

Replies

... Deleted by UFO ...

josepruitt5678

31 Jul 2023, 07:43

RE: The Complete Guide on How to Pick a Good Genuine Strategy Provider

militen870 said:

You are correct that the definition of a "good" yield curve can be subjective and depends on individual risk tolerance and investment objectives. Some investors prefer steady, consistent growth with minimal drawdowns, while others may be willing to tolerate higher volatility in pursuit of higher returns. The key is to align your strategy with your own risk appetite and goals. The same excitement can be found in online games, if it is interesting to try without your own investment, you can find Slot Gallery no deposit bonus https://www.casino.org and then play on your own. While it is true that a perfectly linear ROI curve with no drawdowns is highly unlikely in most real-world scenarios, this does not mean that a strategy should be ignored just because it has some ups and downs. In fact, even in well-performing strategies, some level of drawdown can be expected. The important aspect is to manage risk effectively and ensure that drawdowns are manageable within the risk tolerance.

agree with you

@josepruitt5678

... Deleted by UFO ...

Capt.Z-Fort.Builder

28 Jul 2021, 12:21 ( Updated at: 28 Jul 2021, 13:08 )

Quote:

"2- If ROI curve is linear, no drawdowns whatsoever, again too good to be true, skip to next one."

It's difficult to define what kind of ROI curve is linear, and also difficult to define how deep a drawdown is deep enough to shape a 'good' ROI curve (in your imagination). All I know is ROI goes up is good, goes down is not. We should not consider ROI curve shape as a factor to choose a strategy.

"3- If own funds are less than $1000, skip to next profile, if a strategy provider doesn’t have faith in his strategy to put decent amount of money in it then why should you? They're usually ROI pumpers anyways (Not all). If he doesn’t have the funds, then he's probably not a good trader anyways, and if he is, he can grow account first then offer to provide."

I don't agree with this point. strategy 'ASTRO' trade with £100 and now followers accumulated near $200,000 capitals. The investors have proved even small capital could bring well and steady profit.

The logic to support my point is that, as long as more copiers join the strategy, each trade will trigger the market's movement with a larger volume of trading, so the market's reaction would be the same as a strategy with a larger capital. The real test of a strategy is the actual volume put into the market, 0.01 lots ASTRO actually equal 1.3-1.4 lots of each trade, even ASTRO itself only trade with 0.01 lot.

Most of the other points are good tips for novice investors, worth giving a glance and bear in mind.

@Capt.Z-Fort.Builder