Too large positions where opened

06 Mar 2020, 19:17

Hello,

I follow a strategy and some positions opened on my account are much bigger than the original positions opened on the account of the strategy provider. Because of this the margin level on my account is around 500% and the margin level of the strategy provider around 5000%.

Can you please investigate this issue?

The strategy name is HENDO

My account number is 1079999

Thanks in advance.

Peter

Replies

4valuetrading

09 Mar 2020, 09:37

( Updated at: 21 Dec 2023, 09:21 )

RE:

Yes, I know that it works like that. So because of that margin levels should be the same but last Friday my margin level was around 500% and the margin level of the strategy provider was around 5000%.

And at this point, because of the too large positions, my account has been liquidated. So no balance left because the strategy provider still have enough balance left.

The equity to equity ratio for the opened positions was not correct and therefor my account is liquidated.

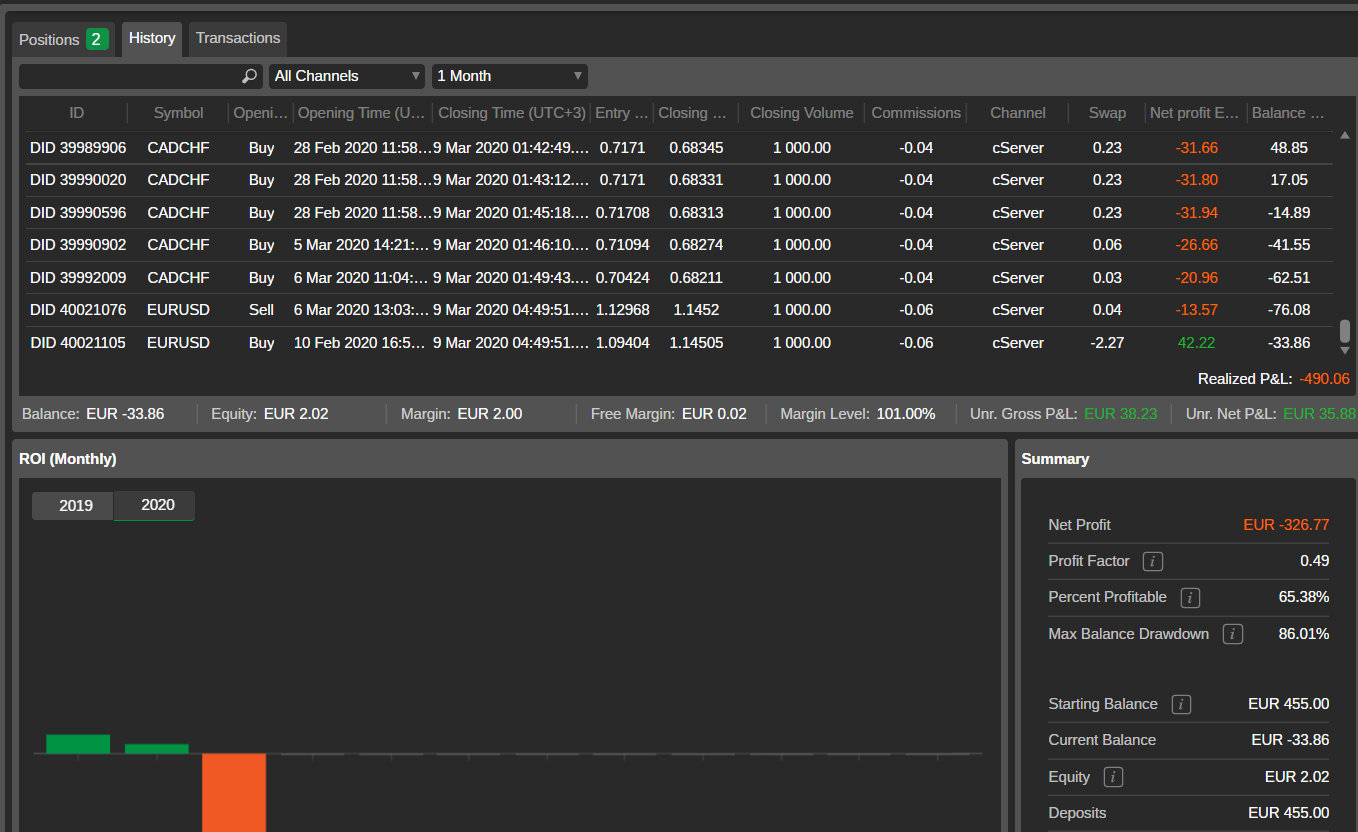

Here a print screen of the latest trade history and account balance of my account:

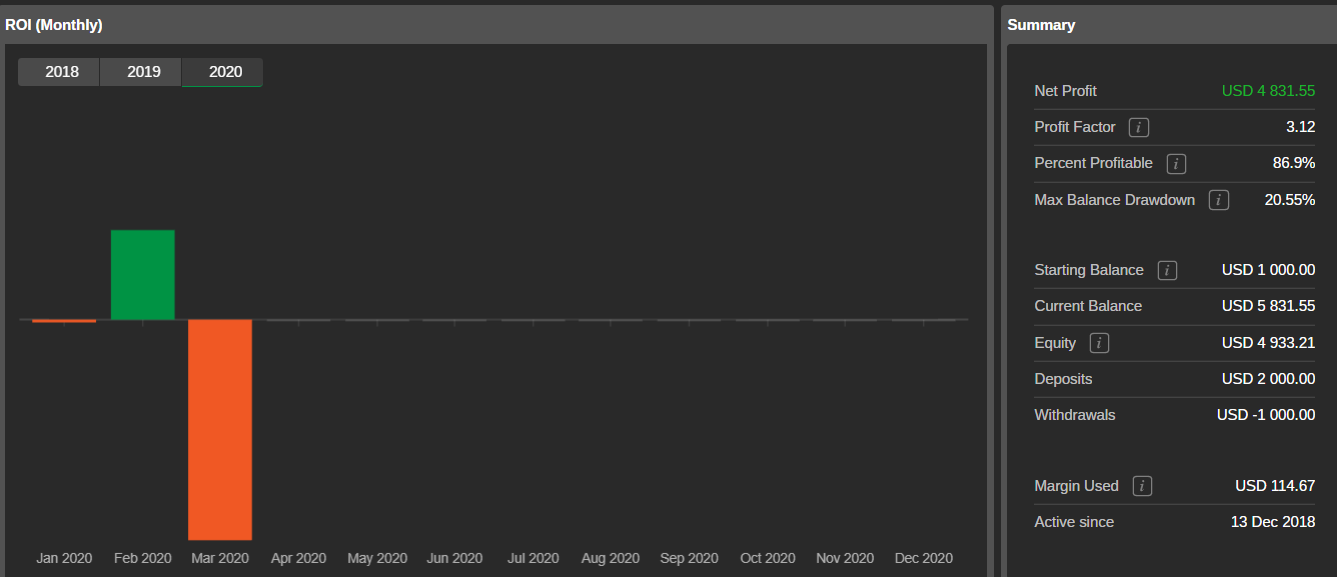

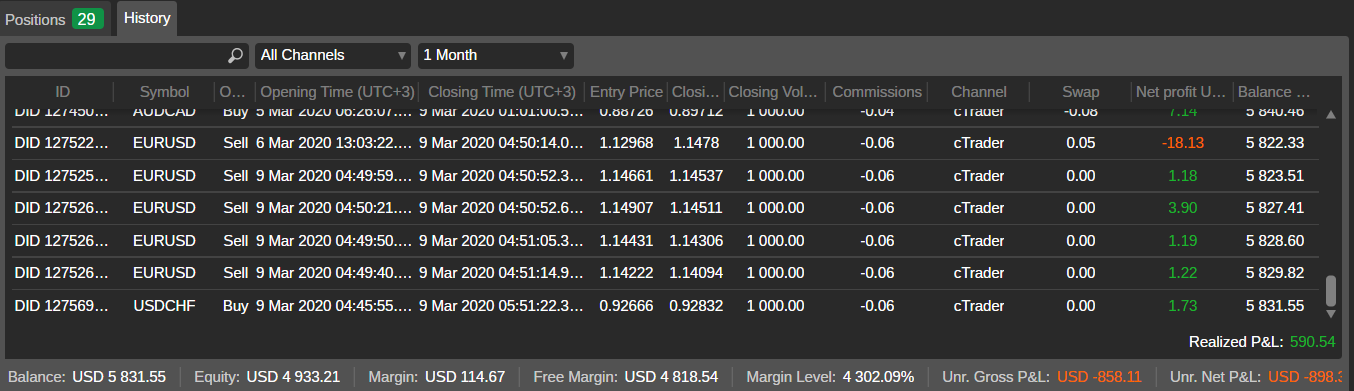

Here a print screens of the latest trade history and account balance of the strategy providers account:

@4valuetrading

PanagiotisCharalampous

09 Mar 2020, 09:50

Hi Peter,

Please note the following.

1) If your account size is smaller than the strategy provider's account then the equity to equity ratio might not be able to be kept due to restrictions like minimum volume allowed to be traded. From what I can see from the screenshots, your account is substantially smaller from your strategy provider's account while the strategy provider is opening positions using the minimum volume. This can result to greater exposure for your account.

2) Greater exposure can also be caused by different leverage settings. Please make sure you are using the same leverage as your strategy provider.

Best Regards,

Panagiotis

@PanagiotisCharalampous

4valuetrading

11 Mar 2020, 11:43

RE:

Hello Panagiotis,

Thanks for your reply.

Yes, my account balance is much smaller than the account of the strategy provider but it still met the minimum investment size required to follow the strategy.

Peter

@4valuetrading

deeej85

14 Mar 2020, 02:31

RE: RE:

pvandenberg99 said:

Hello Panagiotis,

Thanks for your reply.

Yes, my account balance is much smaller than the account of the strategy provider but it still met the minimum investment size required to follow the strategy.

Peter

Hey mate,

I have noticed a lot of strategy providers don't take into account their clients risk. You will see a lot that have a minimum investment of $100 but they may be trading a larger account just like the one you had followed. So in this case people will follow because the investment to start is very low. The problem with that is, If the strategy provider takes a trade with a 1% risk with a 100 pip stop then because your account is a lot smaller it will still take the trade with the minimum allowable volume but your loss may be 10% or more depending on the stop size and those kind of factors. So if you are going to follow someone the best is to follow with at minimum 1k. That way a 1% on the providers account will most likely be a 1% loss on yours also. Or close enough to it. That's how I have mine set up anyway. A minimum of 1k so it keeps my clients losses around the same percentage as my losses. Hope this helps and sorry if you already knew this.

@deeej85

PanagiotisCharalampous

09 Mar 2020, 08:49

Hi Peter,

cTrader Copy works on an equity to equity model. The size of the positions is relevant to your account size. You can read more information here. If you still have questions, please provide us more information like your account size, the strategy provider's account size and the relevant positions. Please post screenshots wherever applicable.

Best Regards,

Panagiotis

Join us on Telegram

@PanagiotisCharalampous