SURVEY - how many people operate a profitable robot?

14 Mar 2016, 12:50

Hi all,

To give some of us real hope that automated profitable trading systems really do exist, I thought I would ask the community if anybody does actually make any profit using automated systems developed with cAlgo that they are running on cTrader. There are some very talented people out there who help out and post very informative and useful threads/replies (thanks guys!), but I wonder why they do this if they already have a bot that works well - it can't just be pure altruism can it..?

There's no need to give any techniques away, but if you're able to respond with the following information, I'm sure the people who are still striving to construct their systems would appreciate knowing that it is possible. I've tried to keep the questions fairly high-level to avoid revealing too much about your system:

1) Did you develop the system yourself?

2) Did you develop the bot yourself?

3) How many indicators does the system use (to give us an idea of complexity)?

4) How often does the bot trade?

5) How many pairs does the bot trade?

6) What level of return are you getting on average per trade (either by percent or by pips)?

7) How much maintenance does the bot require (i.e. can it be left running 24 hours a day for 1 week, 1 month, 1 year without intervention / updates)?

8) Any screenshots?

Thanks very much all.

Replies

trend_meanreversion

14 Mar 2016, 15:57

RE:

stevie.c said:

Hi all,

To give some of us real hope that automated profitable trading systems really do exist, I thought I would ask the community if anybody does actually make any profit using automated systems developed with cAlgo that they are running on cTrader. There are some very talented people out there who help out and post very informative and useful threads/replies (thanks guys!), but I wonder why they do this if they already have a bot that works well - it can't just be pure altruism can it..?

There's no need to give any techniques away, but if you're able to respond with the following information, I'm sure the people who are still striving to construct their systems would appreciate knowing that it is possible. I've tried to keep the questions fairly high-level to avoid revealing too much about your system:

1) Did you develop the system yourself?

2) Did you develop the bot yourself?

3) How many indicators does the system use (to give us an idea of complexity)?

4) How often does the bot trade?

5) How many pairs does the bot trade?

6) What level of return are you getting on average per trade (either by percent or by pips)?

7) How much maintenance does the bot require (i.e. can it be left running 24 hours a day for 1 week, 1 month, 1 year without intervention / updates)?

8) Any screenshots?

Thanks very much all.

Hi Steve,

Just to provide motivation to people working with cAlgo to come up with good bots which can survive the tough world of automated trading , i would like to say that i do run some strategies successfully using cBot. I have advertised my bots in the cTDN forums so you should be able to see some screenshots of them. Let's go through questions which you raised

1) Did you develop the system/bot yourself?

Yes, i don't know someone who can help me with 'my' ideas as i am the only one who can understand what i want ,so better to implement them myself. I have learned a lot during this process and still keeps learning as i have been out of touch in terms of programming. I won't say my systems/strategies are completely new but they treat things differently for sure .Normally i basically create a hypothesis , let's say that multi-time Frame moving averages should provide me some info when to enter in trend. Then i will create a bot which will dump the price information along with different moving averages value in an excel file which i can easily manipulate to see if i can create a simple logic which shows promise. Once it is done , i will code the bot with the same logic and back test it using only 'tick' data to validate my hypothesis. And then i run them in demo account to see how it performs in forward test and compare against the back test. Once satisfied , they run in live environment.

3) How many indicators does the system use (to give us an idea of complexity)?

Very few probably only 2-3 at max, but mostly it tries to interpret the price action which acts as the trigger.

4) How often does the bot trade?

This is the tricky part as ideally i want too many trades so that i can become rich quick :) , but what i have found so far that beating spread in long term is a difficult task and becomes difficult with the high number of trades. So now i focus on high probability trades with money management . This means i have limited trades but with better conviction. I have got one DAX scalper which trades relatively frequently but still nowhere near to what i want ( ideally i want at-least 2-3 trades per day )

5) How many pairs does the bot trade?

I have focused my energy so far on Index CFDs but i do have a couple of interesting ideas/bots on FX.

6) What level of return are you getting on average per trade (either by percent or by pips)?

My only criteria for any strategy is to have atleast 2-3 annual return to MaxDD ratio. I can then leverage and gain accordingly.

7) How much maintenance does the bot require (i.e. can it be left running 24 hours a day for 1 week, 1 month, 1 year without intervention / updates)?

I can't just let my bots run for 1 week psychologically, so i run them everyday and then close them manually and re-run again in morning.

8) Any screenshots?

Check my profile.

Hope it helps. I just want to say that trading is tough and nothing comes easy. Try to leverage on information available on public domains, but think simple and particularly something which you can quantify easily ( so that you can code and backtest it with reliability ).

@trend_meanreversion

stevie.c

15 Mar 2016, 13:54

RE: RE:

trend_meanreversion said:

Hi Steve,

Just to provide motivation to people working with cAlgo to come up with good bots which can survive the tough world of automated trading , i would like to say that i do run some strategies successfully using cBot. I have advertised my bots in the cTDN forums so you should be able to see some screenshots of them. Let's go through questions which you raised

1) Did you develop the system/bot yourself?

Yes, i don't know someone who can help me with 'my' ideas as i am the only one who can understand what i want ,so better to implement them myself. I have learned a lot during this process and still keeps learning as i have been out of touch in terms of programming. I won't say my systems/strategies are completely new but they treat things differently for sure .Normally i basically create a hypothesis , let's say that multi-time Frame moving averages should provide me some info when to enter in trend. Then i will create a bot which will dump the price information along with different moving averages value in an excel file which i can easily manipulate to see if i can create a simple logic which shows promise. Once it is done , i will code the bot with the same logic and back test it using only 'tick' data to validate my hypothesis. And then i run them in demo account to see how it performs in forward test and compare against the back test. Once satisfied , they run in live environment.

3) How many indicators does the system use (to give us an idea of complexity)?

Very few probably only 2-3 at max, but mostly it tries to interpret the price action which acts as the trigger.

4) How often does the bot trade?

This is the tricky part as ideally i want too many trades so that i can become rich quick :) , but what i have found so far that beating spread in long term is a difficult task and becomes difficult with the high number of trades. So now i focus on high probability trades with money management . This means i have limited trades but with better conviction. I have got one DAX scalper which trades relatively frequently but still nowhere near to what i want ( ideally i want at-least 2-3 trades per day )

5) How many pairs does the bot trade?

I have focused my energy so far on Index CFDs but i do have a couple of interesting ideas/bots on FX.

6) What level of return are you getting on average per trade (either by percent or by pips)?

My only criteria for any strategy is to have atleast 2-3 annual return to MaxDD ratio. I can then leverage and gain accordingly.

7) How much maintenance does the bot require (i.e. can it be left running 24 hours a day for 1 week, 1 month, 1 year without intervention / updates)?

I can't just let my bots run for 1 week psychologically, so i run them everyday and then close them manually and re-run again in morning.

8) Any screenshots?

Check my profile.

Hope it helps. I just want to say that trading is tough and nothing comes easy. Try to leverage on information available on public domains, but think simple and particularly something which you can quantify easily ( so that you can code and backtest it with reliability ).

Hi T_MR,

Thanks for your well thought out and considered response - it is much appreciated and encouraging. Regarding backtesting, I have found that the trial bots I have developed seem to vary hugely in performance with only a tiny adjustment to parameters such as SL / TP. This makes me think that the bots are simply no use as they just would not be reliable in real operation.

@stevie.c

trend_meanreversion

15 Mar 2016, 14:29

RE: RE: RE:

stevie.c said:

trend_meanreversion said:

Hi Steve,

Just to provide motivation to people working with cAlgo to come up with good bots which can survive the tough world of automated trading , i would like to say that i do run some strategies successfully using cBot. I have advertised my bots in the cTDN forums so you should be able to see some screenshots of them. Let's go through questions which you raised

1) Did you develop the system/bot yourself?

Yes, i don't know someone who can help me with 'my' ideas as i am the only one who can understand what i want ,so better to implement them myself. I have learned a lot during this process and still keeps learning as i have been out of touch in terms of programming. I won't say my systems/strategies are completely new but they treat things differently for sure .Normally i basically create a hypothesis , let's say that multi-time Frame moving averages should provide me some info when to enter in trend. Then i will create a bot which will dump the price information along with different moving averages value in an excel file which i can easily manipulate to see if i can create a simple logic which shows promise. Once it is done , i will code the bot with the same logic and back test it using only 'tick' data to validate my hypothesis. And then i run them in demo account to see how it performs in forward test and compare against the back test. Once satisfied , they run in live environment.

3) How many indicators does the system use (to give us an idea of complexity)?

Very few probably only 2-3 at max, but mostly it tries to interpret the price action which acts as the trigger.

4) How often does the bot trade?

This is the tricky part as ideally i want too many trades so that i can become rich quick :) , but what i have found so far that beating spread in long term is a difficult task and becomes difficult with the high number of trades. So now i focus on high probability trades with money management . This means i have limited trades but with better conviction. I have got one DAX scalper which trades relatively frequently but still nowhere near to what i want ( ideally i want at-least 2-3 trades per day )

5) How many pairs does the bot trade?

I have focused my energy so far on Index CFDs but i do have a couple of interesting ideas/bots on FX.

6) What level of return are you getting on average per trade (either by percent or by pips)?

My only criteria for any strategy is to have atleast 2-3 annual return to MaxDD ratio. I can then leverage and gain accordingly.

7) How much maintenance does the bot require (i.e. can it be left running 24 hours a day for 1 week, 1 month, 1 year without intervention / updates)?

I can't just let my bots run for 1 week psychologically, so i run them everyday and then close them manually and re-run again in morning.

8) Any screenshots?

Check my profile.

Hope it helps. I just want to say that trading is tough and nothing comes easy. Try to leverage on information available on public domains, but think simple and particularly something which you can quantify easily ( so that you can code and backtest it with reliability ).

Hi T_MR,

Thanks for your well thought out and considered response - it is much appreciated and encouraging. Regarding backtesting, I have found that the trial bots I have developed seem to vary hugely in performance with only a tiny adjustment to parameters such as SL / TP. This makes me think that the bots are simply no use as they just would not be reliable in real operation.

Hi Steve, I would say you should backtest your bots only on 'tick' data and never ever on any timeFrame OHLC data . As long as you have SL/TP in your bot, it needs the real time spread and tick data for proper simulation of the results. Let's say if you have a bot which opens on the open of the bar according to moving averages, but closes the position after 3 candleSticks . In this case, you don't necessarily need tick data backtesting unless you have SL/TP because the order of ticks will determine whether TP got hit first or SL and more importantly, how much slippage should be given to your SLs. All these small things matter most in backtesting and that's why i like tick data backtesting in cALgo. It provides the 'best' simulation of results and are quite close to real time trading.

@trend_meanreversion

trend_meanreversion

19 Mar 2016, 05:41

( Updated at: 21 Dec 2023, 09:20 )

I would share one of sub-strategy for DAX which should provide some hope for fellow traders that it is not necessarily 'rocket-science' to create profitable strategies.

If you have heard of GAP strategy , then you would know that GAPs tend to get filled. So basically, i am saying that if there are sharp moves in short time frame for DAX then they will get filled or at-least provide good buying opportunity in a sharp sell-off.

Buy if High (previous candle) - Low(current candle) >= 50 points, then buy and hold with 20 mins .

This is a very basic version of strategy and you can do 'magic' with it if you include money management/position management ..opportunities are endless here..

Please find link of strategy at -> http://www.filedropper.com/de30gapmodel

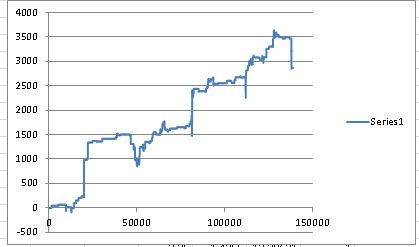

Equity without any money management looks something like this ( Return > 28% , MaxDD = ~8% )

Go crazy..i am sharing it just to give some hope to fellow traders that it is possible ( not easy ) to find an edge in this market :) . Have fun !

@trend_meanreversion

stevie.c

23 Mar 2016, 00:28

( Updated at: 21 Dec 2023, 09:20 )

RE:

trend_meanreversion said:

I would share one of sub-strategy for DAX which should provide some hope for fellow traders that it is not necessarily 'rocket-science' to create profitable strategies.

If you have heard of GAP strategy , then you would know that GAPs tend to get filled. So basically, i am saying that if there are sharp moves in short time frame for DAX then they will get filled or at-least provide good buying opportunity in a sharp sell-off.

Buy if High (previous candle) - Low(current candle) >= 50 points, then buy and hold with 20 mins .

This is a very basic version of strategy and you can do 'magic' with it if you include money management/position management ..opportunities are endless here..

Please find link of strategy at -> http://www.filedropper.com/de30gapmodel

Equity without any money management looks something like this ( Return > 28% , MaxDD = ~8% )

Go crazy..i am sharing it just to give some hope to fellow traders that it is possible ( not easy ) to find an edge in this market :) . Have fun !

Hi T_MR,

Thanks for that. I recall reading about gap trading a while ago - good to know that it is a workable strategy. Thanks for the file too. I'll see if I can work something up with it.

It is interesting that effectively you're the only one on these forums that has replied to this survey with any positivity. That makes me think that either the people who do run a profitable automated system don't want to let on (unlikely..?), or perhaps that there are no profitable strategies that work reliably (which I hope is also unlikely!).

@stevie.c

ironmine

31 Mar 2016, 15:11

( Updated at: 21 Dec 2023, 09:20 )

RE: RE:

stevie.c said:

trend_meanreversion said:

I would share one of sub-strategy for DAX which should provide some hope for fellow traders that it is not necessarily 'rocket-science' to create profitable strategies.

If you have heard of GAP strategy , then you would know that GAPs tend to get filled. So basically, i am saying that if there are sharp moves in short time frame for DAX then they will get filled or at-least provide good buying opportunity in a sharp sell-off.

Buy if High (previous candle) - Low(current candle) >= 50 points, then buy and hold with 20 mins .

This is a very basic version of strategy and you can do 'magic' with it if you include money management/position management ..opportunities are endless here..

Please find link of strategy at -> http://www.filedropper.com/de30gapmodel

Equity without any money management looks something like this ( Return > 28% , MaxDD = ~8% )

Go crazy..i am sharing it just to give some hope to fellow traders that it is possible ( not easy ) to find an edge in this market :) . Have fun !

Hi T_MR,

Thanks for that. I recall reading about gap trading a while ago - good to know that it is a workable strategy. Thanks for the file too. I'll see if I can work something up with it.

It is interesting that effectively you're the only one on these forums that has replied to this survey with any positivity. That makes me think that either the people who do run a profitable automated system don't want to let on (unlikely..?), or perhaps that there are no profitable strategies that work reliably (which I hope is also unlikely!).

If you want to earn money using Forex, you need to teach people how to trade, or publish books on trading, or sell web seminars. As long as you don't trade, you are going to be alright :)

@ironmine

TraderM

01 Apr 2016, 20:55

Hi Everyone,

some input from me on this interesting topic:

1) Did you develop the system yourself?

Yes, you must do this yourself!

2) Did you develop the bot yourself?

Yes, you must do this yourself!

3) How many indicators does the system use (to give us an idea of complexity)?

Robot1: 4 EMAs + time to trade, Hourly chart

Robot2: 1 EMA + time to trade, Hourly chart

The indicators are just small part of the process.

4) How often does the bot trade?

Robot1: When conditions are met, typically 1-2 times a week

Robot2: Once each day

5) How many pairs does the bot trade?

Live account: 6

Demo account (next week): around 30 to forward test. Testing real time forwards, as mentioned above (trend_meanreversion) is essential for me!

6) What level of return are you getting on average per trade (either by percent or by pips)?

Varies, SL between 40-50 pips, TP 50-70 pips. Many of the next set to be tested on the Demo account will have wider SL (up to 90 pips) and TP (up to 180 pips).

7) How much maintenance does the bot require (i.e. can it be left running 24 hours a day for 1 week, 1 month, 1 year without intervention / updates)?

No maintenance! For me that is the point - I want my trading to be able to do much more than if I was manually trading and it should do it better! The only thing I do regularly is check the Internet connection.

Other points: Keep it simple, money management is key. Learn about statistics and sampling. Test forwards. Balance with something else so if things don't work out, you still have a good life!

Hope this adds something useful to this thread!

TraderM

@TraderM

GS66

25 Nov 2016, 13:38

if you're trying to build strategies and then realise that are unprofittable You will lose time and money.

First read some books on Technical Analysis, for example I advice you read:

-trading-systems-and-methods-perry-kaufman

For forex market explanation

- Beat_the_forex_dealer an_insiders_look_into_trading_todays_foreign_exchange_market_-_a_silvani

For hedge funds like strategies

- Clenow-Following the Trend Diversified Managed Futures Trading

I've read hundred of books for every market tested many strategies.

What I've learned?

Stick to tried and tested. Every trend following strategy is profittable as long as you know how it works: many small loss with few large gains.

many retailers fails in forex cause they use too high leverage and can't afford the small loss.

If everyone is telling you something different, he/she is trying to sell you a "magic" indicator/system/bot.

You're into algo strategies you should have software like:

StrategyQuant

or

Adaptrade builder

@GS66

... Deleted by UFO ...

melser_studio

14 Mar 2016, 15:39

This post was removed by moderator.