AL

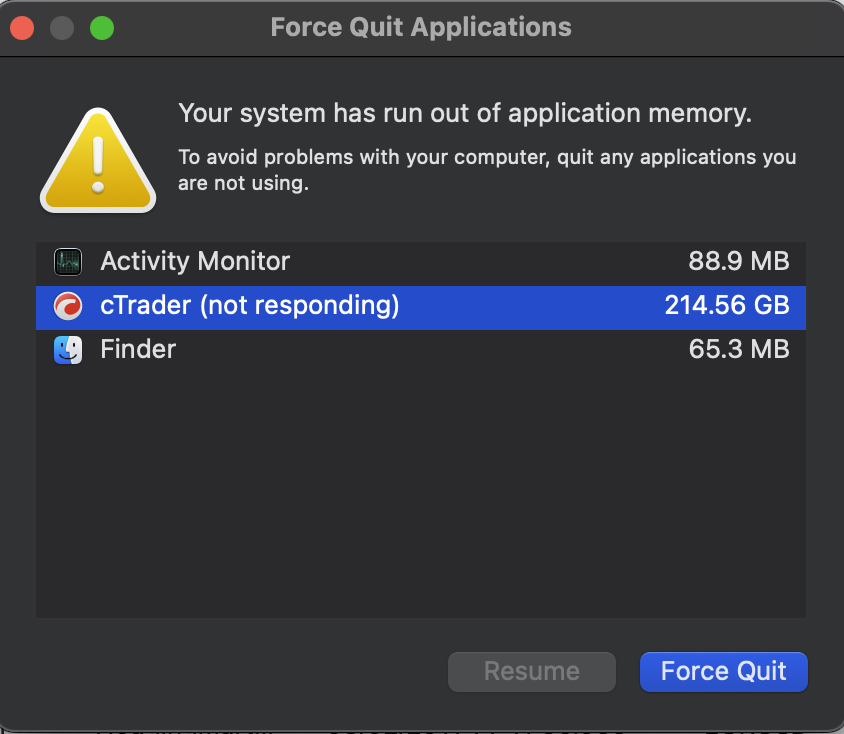

CTrader Crash/Memory Deficit on this Source Code

15 Dec 2024, 19:53

The CTrader on Mac having difficulties with this code , It first does only one day backtest on 1timeframe 15m, and then after stuck I have pressed stop button and memory consumption was over 200GB.

Sample of crash - https://www.file.io/FRe2/download/wv5wFzFm5kxO

Code is included below

// -------------------------------------------------------------------------------------------------

//

// This code is a cAlgo API sample.

//

// This cBot is intended to be used as a sample and does not guarantee any particular outcome or

// profit of any kind. Use it at your own risk

//

// The "Sample Martingale cBot" creates a random Sell or Buy order. If the Stop loss is hit, a new

// order of the same type (Buy / Sell) is created with double the Initial Volume amount. The cBot will

// continue to double the volume amount for all orders created until one of them hits the take Profit.

// After a Take Profit is hit, a new random Buy or Sell order is created with the Initial Volume amount.

//

// -------------------------------------------------------------------------------------------------

using System;

using System.Linq;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using cAlgo.Indicators;

namespace cAlgo

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class HedgingMartingale : Robot

{

[Parameter("Initial Quantity (Lots)", DefaultValue = 0.01, MinValue = 0.01, Step = 0.01)]

public double InitialQuantity { get; set; }

[Parameter("Restart Initial Quantity (Lots)", DefaultValue = 0.01, MinValue = 0.01, Step = 0.01)]

public double RestartInitialQuantity { get; set; }

[Parameter("Take Profit / StopLoss", DefaultValue = 35)]

public int TakeProfitStopLoss { get; set; }

[Parameter("Max Loss In Row", DefaultValue = 11)]

public int MaxLossInRow { get; set; }

// Timer-based check to ensure positions are only opened during the desired time range

private const int StartHour = 12; // 12:00 UTC

private const int EndHour = 15; // 15:00 UTC

private Random random = new Random();

private int LossInRowLong = 0;

private int LossInRowShort = 0;

protected override void OnTick()

{

// Get the current UTC time

var currentTime = Server.Time;

// Check if it's within the allowed time range for opening positions (12:00 to 15:00)

if (currentTime.Hour >= StartHour && currentTime.Hour < EndHour)

{ Positions.Closed += OnPositionsClosed;

var position = Positions.Find("HedgingMartingale");

ExecuteOrder(RestartInitialQuantity, TradeType.Buy);

ExecuteOrder(RestartInitialQuantity, TradeType.Sell);

}

}

private void ExecuteOrder(double quantity, TradeType tradeType)

{

Print("The Spread of the symbol is: {0}", Symbol.Spread);

var volumeInUnits = Symbol.QuantityToVolume(quantity);

var result = ExecuteMarketOrder(tradeType, Symbol, volumeInUnits, "HedgingMartingale", TakeProfitStopLoss, TakeProfitStopLoss);

if (result.Error == ErrorCode.NoMoney)

Stop();

}

private void OnPositionsClosed(PositionClosedEventArgs args)

{

Print("Closed");

var position = args.Position;

if (position.Label != "HedgingMartingale" || position.SymbolCode != Symbol.Code)

return;

if (position.GrossProfit > 0)

{

if (position.TradeType == TradeType.Buy)

{

LossInRowLong = 0;

}

else if (position.TradeType == TradeType.Sell)

{

LossInRowShort = 0;

}

ExecuteOrder(InitialQuantity, position.TradeType);

}

else

{

if (position.TradeType == TradeType.Buy)

{

LossInRowLong = LossInRowLong + 1;

}

else if (position.TradeType == TradeType.Sell)

{

LossInRowShort = LossInRowShort + 1;

}

if (LossInRowLong > MaxLossInRow || LossInRowShort > MaxLossInRow)

{

ExecuteOrder(InitialQuantity, position.TradeType);

}

else

{

ExecuteOrder(position.Quantity * 2, position.TradeType);

}

}

}

private TradeType GetRandomTradeType()

{

return random.Next(2) == 0 ? TradeType.Buy : TradeType.Sell;

}

}

}

algobeginner

16 Dec 2024, 12:04

This seem to do the trick , no memory crash and does tested multiple days

@algobeginner