Problem with custom library

10 Mar 2024, 20:53

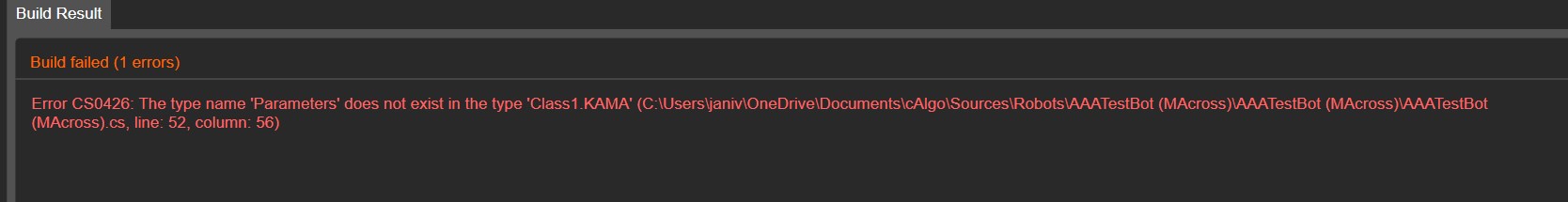

I want to build a library to consolidate some of my custom indicators. I am using VS 2022 and cTrader version 4.8.30.213183. I was able to construct the library and I added the reference to the cBot. I was able to build/compile the cBot and the Library in VS 2022 just fine. But when I tried to backtest the cBot I got an error message in cTrader Automate Build:

However, VS 2022 seems to build the code fine as I get:

1>C:\Users\janiv\OneDrive\Documents\cAlgo\CustomLibraries\CustomIndicatorLibrary\CustomIndicatorLibrary\Class1.cs(40,41,40,50): warning CS8618: Non-nullable field 'trueRange' must contain a non-null value when exiting constructor. Consider declaring the field as nullable.

1>C:\Users\janiv\OneDrive\Documents\cAlgo\CustomLibraries\CustomIndicatorLibrary\CustomIndicatorLibrary\Class1.cs(41,41,41,44): warning CS8618: Non-nullable field 'atr' must contain a non-null value when exiting constructor. Consider declaring the field as nullable.

1>CustomIndicatorLibrary -> C:\Users\janiv\OneDrive\Documents\cAlgo\CustomLibraries\CustomIndicatorLibrary\CustomIndicatorLibrary\bin\Debug\net6.0\CustomIndicatorLibrary.dll

1>Done building project "CustomIndicatorLibrary.csproj".

========== Rebuild All: 1 succeeded, 0 failed, 0 skipped ==========

========== Rebuild started at 10:32 PM and took 00,563 seconds ==========

I got some warnings but the build went through fine.

cBot code:

using System;

using System.Linq;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using cAlgo.Indicators;

using System.Threading;

using CustomIndicatorLibrary;

namespace cAlgo.Robots

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class AAATestBotMAcross : Robot

{

[Parameter(DefaultValue = "SuperTrendReference_cBot")]

public string cBotLabel { get; set; }

[Parameter("Trade Volume:", DefaultValue = 1000)]

public int Volume { get; set; }

[Parameter("Fast SMA Period", DefaultValue = 9)]

public int FastSMAPeriod { get; set; }

[Parameter("Slow SMA Period", DefaultValue = 21)]

public int SlowSMAPeriod { get; set; }

[Parameter("KAMA Period", DefaultValue = 10)]

public int KaMaPeriod { get; set; }

[Parameter("Take Profit (pips):", DefaultValue = 50.0)]

public double TakeProfit { get; set; }

[Parameter("Stop Loss (pips):", DefaultValue = 50.0)]

public double StopLoss { get; set; }

private MovingAverage fastSMA;

private MovingAverage slowSMA;

private CustomIndicatorLibrary.Class1.KAMA KAMA_;

protected override void OnStart()

{

fastSMA = Indicators.MovingAverage(Bars.ClosePrices, FastSMAPeriod, MovingAverageType.Simple);

slowSMA = Indicators.MovingAverage(Bars.ClosePrices, SlowSMAPeriod, MovingAverageType.Simple);

// Create an instance of the CustomKAMA indicator

KAMA_ = Indicators.GetIndicator<CustomIndicatorLibrary.Class1.KAMA>(

Symbol.Name,

TimeFrame,

new CustomIndicatorLibrary.Class1.KAMA.Parameters

{

Source = Bars.ClosePrices,

Period = KaMaPeriod,

Fast = 2,

Slow = 30,

ATRPeriod = 14,

BufferFactor = 1

});

}

protected override void OnBar()

{

var currentFastSMA = fastSMA.Result.LastValue;

var currentSlowSMA = slowSMA.Result.LastValue;

var previousFastSMA = fastSMA.Result.Last(1);

var previousSlowSMA = slowSMA.Result.Last(1);

// Check for a crossover

if (currentFastSMA > currentSlowSMA && previousFastSMA <= previousSlowSMA)

{

ExecuteMarketOrder(TradeType.Buy, SymbolName, Volume, "SMA Crossover - Buy", StopLoss, TakeProfit);

}

else if (currentFastSMA < currentSlowSMA && previousFastSMA >= previousSlowSMA)

{

ExecuteMarketOrder(TradeType.Sell, SymbolName, Volume, "SMA Crossover - Sell", StopLoss, TakeProfit);

}

}

private void OpenMarketOrder(TradeType tradeType, double dLots, double takeProfit, double stopLoss)

{

var volumeInUnits = Symbol.QuantityToVolumeInUnits(dLots);

volumeInUnits = Symbol.NormalizeVolumeInUnits(volumeInUnits, RoundingMode.Down);

var result = ExecuteMarketOrder(tradeType, Symbol.Name, volumeInUnits, cBotLabel, takeProfit, stopLoss);

if (!result.IsSuccessful)

{

Print("Execute Market Order Error: {0}", result.Error.Value);

OnStop();

}

}

private int CalculatePositionsQnty(TradeType tradeType)

{

return Positions.FindAll(cBotLabel, Symbol.Name, tradeType).Length;

}

private void CloseAllPositions(TradeType tradeType)

{

foreach (var position in Positions.FindAll(cBotLabel, Symbol.Name, tradeType))

{

var result = ClosePosition(position);

if (!result.IsSuccessful)

{

Print("Closing market order error: {0}", result.Error);

}

}

}

}

}library code:

using System;

using cAlgo.API;

using cAlgo.API.Indicators;

namespace CustomIndicatorLibrary

{

public class Class1

{

[Indicator(IsOverlay = true, TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class KAMA : Indicator

{

[Parameter()]

public DataSeries Source { get; set; }

[Parameter("KAMA Period", DefaultValue = 10)]

public int Period { get; set; }

[Parameter("Fast MA", DefaultValue = 2)]

public double Fast { get; set; }

[Parameter("Slow MA", DefaultValue = 30)]

public int Slow { get; set; }

[Parameter("ATR Period", DefaultValue = 14)]

public int ATRPeriod { get; set; }

[Parameter("Buffer Factor", DefaultValue = 1)]

public double BufferFactor { get; set; }

[Output("KAMA", PlotType = PlotType.Line, LineColor = "Lime", Thickness = 2)]

public IndicatorDataSeries Kama { get; set; }

[Output("Up Buffer", PlotType = PlotType.Line, LineColor = "White", Thickness = 1, LineStyle = LineStyle.Lines)]

public IndicatorDataSeries UpBuff { get; set; }

[Output("Down Buffer", PlotType = PlotType.Line, LineColor = "White", Thickness = 1, LineStyle = LineStyle.Lines)]

public IndicatorDataSeries DownBuff { get; set; }

private IndicatorDataSeries diff;

private IndicatorDataSeries trueRange;

private IndicatorDataSeries atr;

double fastd;

double slowd;

protected override void Initialize()

{

diff = CreateDataSeries();

trueRange = CreateDataSeries();

atr = CreateDataSeries();

fastd = 2.0 / (Fast + 1);

slowd = 2.0 / (Slow + 1);

}

public override void Calculate(int index)

{

if (index >= 1)

{

diff[index] = Math.Abs(Source[index] - Source[index - 1]);

trueRange[index] = Math.Max(Math.Max(Bars.HighPrices[index] - Bars.LowPrices[index], Math.Abs(Bars.HighPrices[index] - Bars.ClosePrices[index - 1])), Math.Abs(Bars.LowPrices[index] - Bars.ClosePrices[index - 1]));

// Simple Moving Average for ATR

if (index >= ATRPeriod)

{

double atrSum = 0;

for (int i = index - ATRPeriod + 1; i <= index; i++)

{

atrSum += trueRange[i];

}

atr[index] = atrSum / ATRPeriod;

}

}

if (index < Period)

{

Kama[index] = Source[index];

return;

}

double signal = Math.Abs(Source[index] - Source[index - Period]);

double noise = 0.0;

for (int i = index - Period + 1; i <= index; i++)

{

noise += diff[i];

}

if (noise == 0)

{

Kama[index] = Kama[index - 1];

}

else

{

double smoothingFactor = Math.Pow(((signal / noise) * (fastd - slowd) + slowd), 2);

Kama[index] = Kama[index - 1] + smoothingFactor * (Source[index] - Kama[index - 1]);

}

if (index >= ATRPeriod)

{

UpBuff[index] = Kama[index] + atr[index] * BufferFactor;

DownBuff[index] = Kama[index] - atr[index] * BufferFactor;

}

}

}

}

}

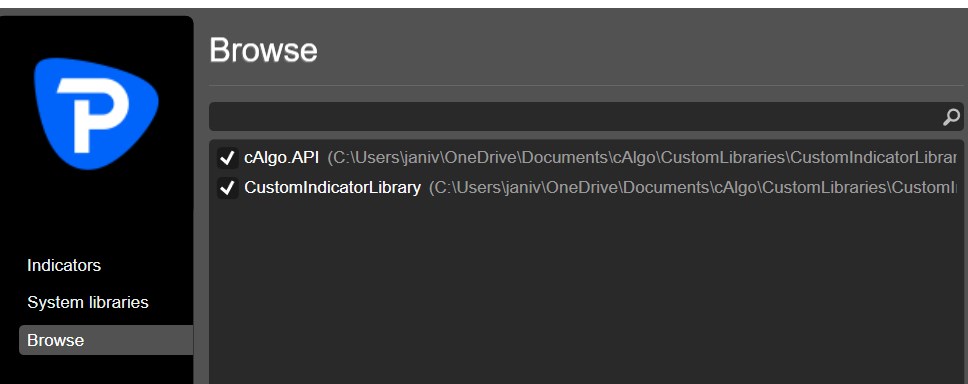

cBot references should be just fine:

Could someone help me with this issue?

jani

10 Mar 2024, 22:43

Sorry could not find the way to delete this thread. I solved the issue already. It was a problem with:

just needed to remove the "Parameters" and simplify the syntax

@jani