Why isn't this scalping working in TradingView but not Ctrader?

19 Dec 2022, 10:04

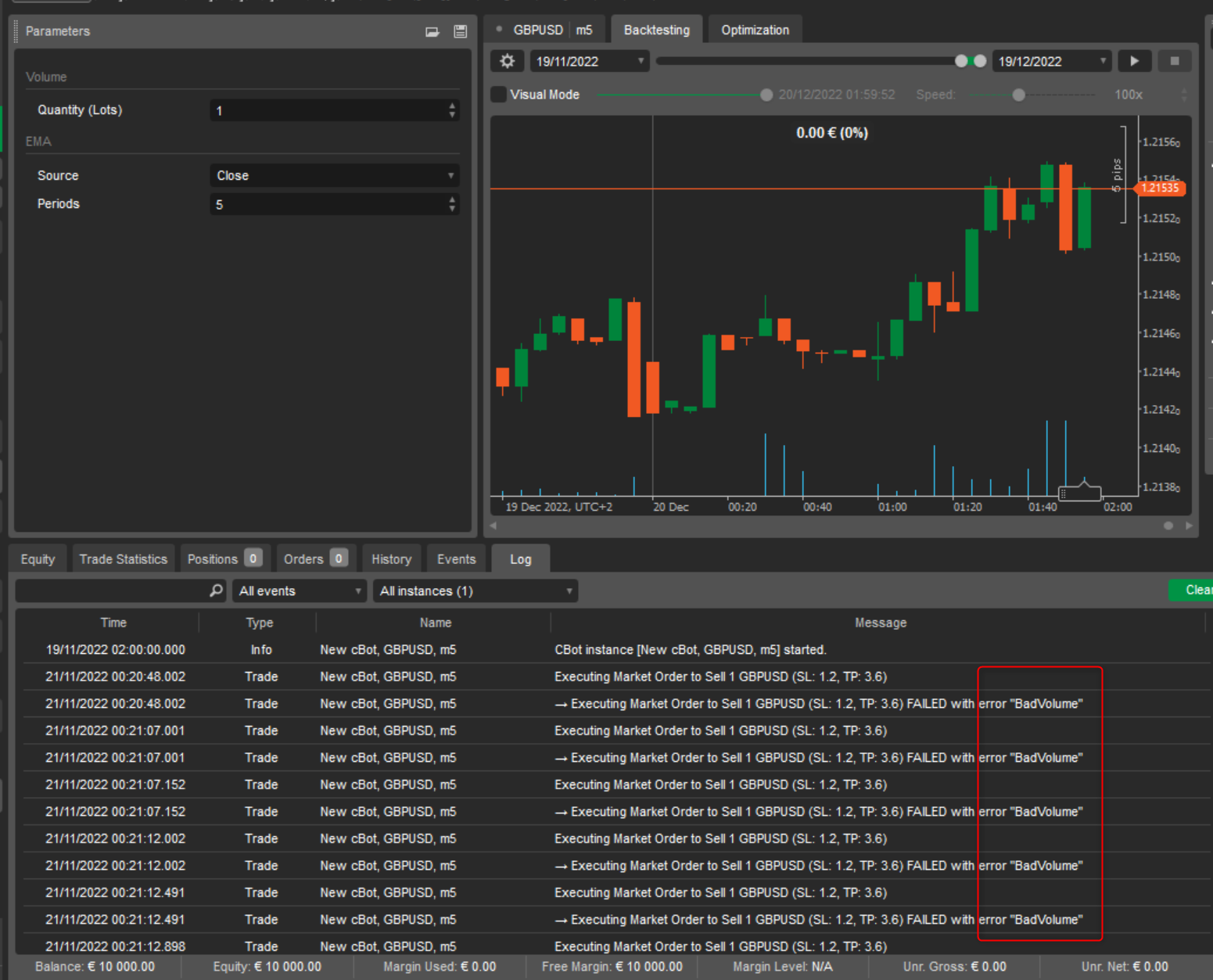

I coded the following automated strategy in cTrader, but it doesn't seem to open any positions while backtesting. But the same logic is working fine in TradingView. Am I doing something wrong here, or am I missing something? Any community help will be really helpful for me as i have just started using the cTrdader and C# language.

using cAlgo.API;

using cAlgo.API.Indicators;

namespace cAlgo

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class SampleEmacBot : Robot

{

[Parameter("Quantity (Lots)", Group = "Volume", DefaultValue = 1, MinValue = 0.01, Step = 0.01)]

public double Quantity { get; set; }

[Parameter("Source", Group = "EMA")]

public DataSeries Source { get; set; }

[Parameter("Periods", Group = "EMA", DefaultValue = 5)]

public int Periods { get; set; }

private ExponentialMovingAverage ema;

protected override void OnStart()

{

ema = Indicators.ExponentialMovingAverage(Source, Periods);

}

protected override void OnTick()

{

var currentCandleClose = Bars.ClosePrices.Last(0);

var currentCandleOpen = Bars.OpenPrices.Last(0);

var previousCandleHigh = Bars.HighPrices.Last(1);

var previousCandleLow = Bars.LowPrices.Last(1);

var emaValue = ema.Result.Last(0);

var StopLossBuy = previousCandleLow;

var TakeProfitBuy = previousCandleLow*3;

var StopLossSell = previousCandleHigh;

var TakeProfitSell = previousCandleHigh*3;

if (((previousCandleHigh < emaValue )&& (currentCandleClose < emaValue)) && (currentCandleOpen <= currentCandleClose) )

{

ExecuteMarketOrder(TradeType.Buy, SymbolName, Quantity, "Buy", StopLossBuy, TakeProfitBuy);

}

if (((previousCandleLow > emaValue) && (currentCandleClose > emaValue)) && (currentCandleOpen >= currentCandleClose))

{

ExecuteMarketOrder(TradeType.Sell, SymbolName, Quantity, "Sell", StopLossSell, TakeProfitSell);

}

}

}

}

Replies

ashish.sah.np

20 Dec 2022, 15:37

( Updated at: 21 Dec 2023, 09:23 )

RE:

PanagiotisChar said:

Hi there,

Here is your problem

You are passing the volume as quantity but the input should be in units. See below

ExecuteMarketOrder(TradeType.Buy, SymbolName, Symbol.NormalizeVolumeInUnits(Quantity), "Buy", StopLossBuy, TakeProfitBuy);Need help? Join us on Telegram

Need premium support? Trade with us

Hello Thanks for the support. Really appreciate.

Could you please assist me in setting the previous high as a stop loss by converting the price difference in pips correctly? I have tried with the below code, but in the positions tab, T/P and S/L are showing blank for some trades while the majority of trades are closed, so I'm wondering if my below method is correct or not.

And the way I am taking the EMA value, is it correct? This will be a big help for me. Thanks in advance. May God bless your trading portfolio.

using cAlgo.API;

using System;

using cAlgo.API.Indicators;

namespace cAlgo

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class SampleEmacBot : Robot

{

[Parameter("Quantity (Lots)", Group = "Volume", DefaultValue = 1, MinValue = 0.01, Step = 0.01)]

public double Quantity { get; set; }

[Parameter("Source", Group = "EMA")]

public DataSeries Source { get; set; }

[Parameter("Periods", Group = "EMA", DefaultValue = 5)]

public int Periods { get; set; }

private ExponentialMovingAverage ema;

protected override void OnStart()

{

ema = Indicators.ExponentialMovingAverage(Source, Periods);

}

protected override void OnBar()

{

var currentCandleClose = Bars.ClosePrices.Last(1);

var currentCandleOpen = Bars.OpenPrices.Last(1);

var previousCandleHigh = Bars.HighPrices.Last(2);

var previousCandleLow = Bars.LowPrices.Last(2);

var StopLossBuy = (Math.Abs(previousCandleLow - Bars.OpenPrices.Last(0)))/Symbol.PipSize;

var TakeProfitBuy = ((Math.Abs(previousCandleLow - Bars.OpenPrices.Last(0)))/Symbol.PipSize)*4;

var StopLossSell = (Math.Abs(previousCandleHigh - Bars.OpenPrices.Last(0)))/Symbol.PipSize;

var TakeProfitSell =((Math.Abs(previousCandleHigh- Bars.OpenPrices.Last(0)))/Symbol.PipSize)*4;

var volumeInUnits = Symbol.QuantityToVolumeInUnits(Quantity);

if (((previousCandleHigh < ema.Result.Last(2) )&& (currentCandleClose < ema.Result.Last(1))) && (Bars.OpenPrices.Last(0) <= currentCandleClose) )

{

ExecuteMarketOrder(TradeType.Buy, SymbolName, volumeInUnits, "Buy", StopLossBuy, TakeProfitBuy);

}

if (((previousCandleLow > ema.Result.Last(2)) && (currentCandleClose > ema.Result.Last(1))) && (Bars.OpenPrices.Last(0) >= currentCandleClose))

{

ExecuteMarketOrder(TradeType.Sell, SymbolName, volumeInUnits, "Sell", StopLossSell, TakeProfitSell);

}

}

}

}

@ashish.sah.np

PanagiotisChar

21 Dec 2022, 09:40

Hi again,

Make sure your SL is set outside the spread. Else it won't be placed.

Need help? Join us on Telegram

Need premium support? Trade with us

@PanagiotisChar

ashish.sah.np

21 Dec 2022, 16:53

RE:

PanagiotisChar said:

Hi again,

Make sure your SL is set outside the spread. Else it won't be placed.

Is there anyway to check whether SL and TP are inside the spread and to excuse such trades?

@ashish.sah.np

PanagiotisChar

22 Dec 2022, 08:54

Hi,

Use Symbol.Spread

Need help? Join us on Telegram

Need premium support? Trade with us

@PanagiotisChar

PanagiotisChar

20 Dec 2022, 09:17

Hi there,

Here is your problem

You are passing the volume as quantity but the input should be in units. See below

Aieden Technologies

Need help? Join us on Telegram

Need premium support? Trade with us

@PanagiotisChar