let both macd make the right decision together

26 Nov 2022, 15:30

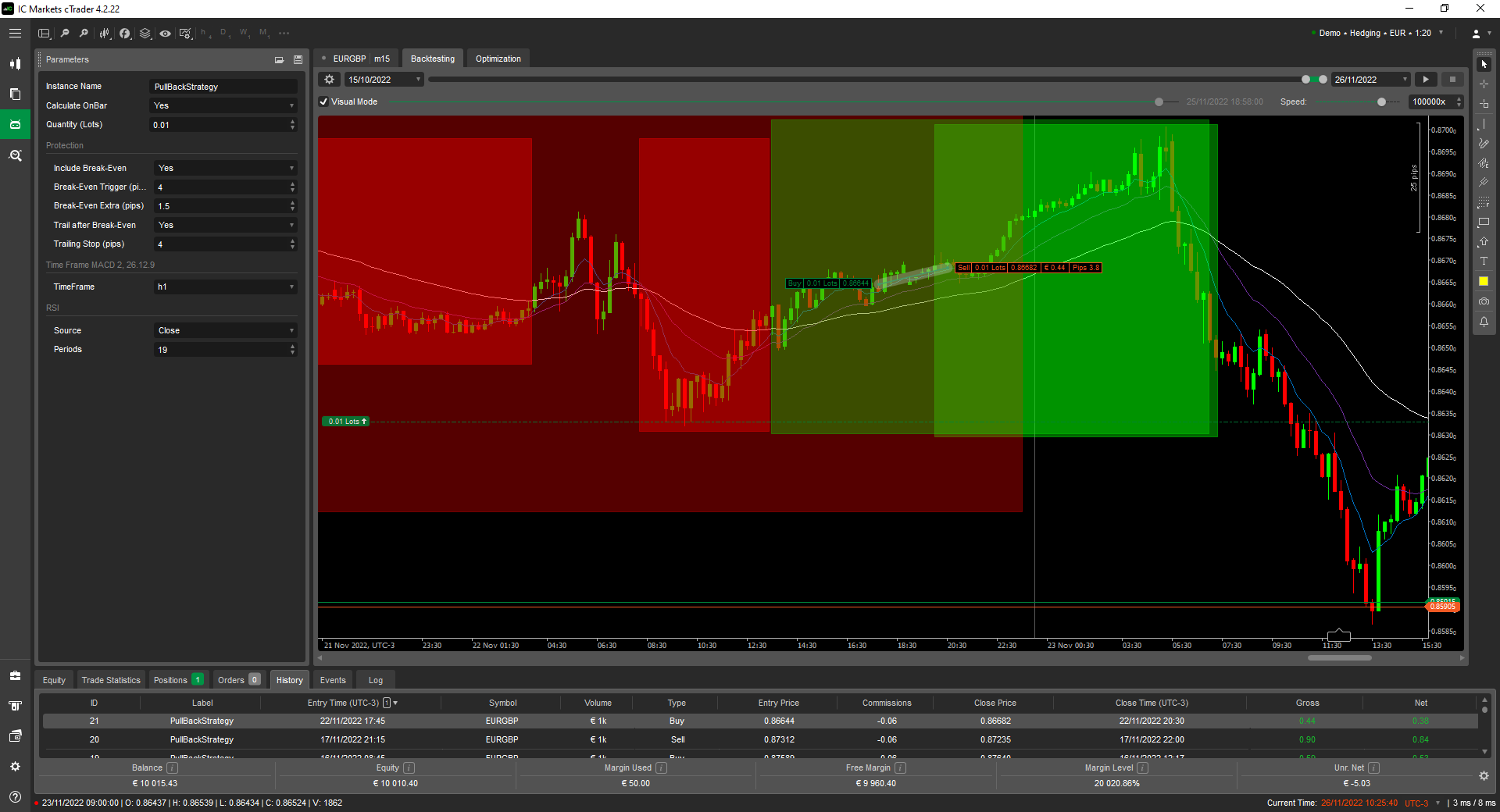

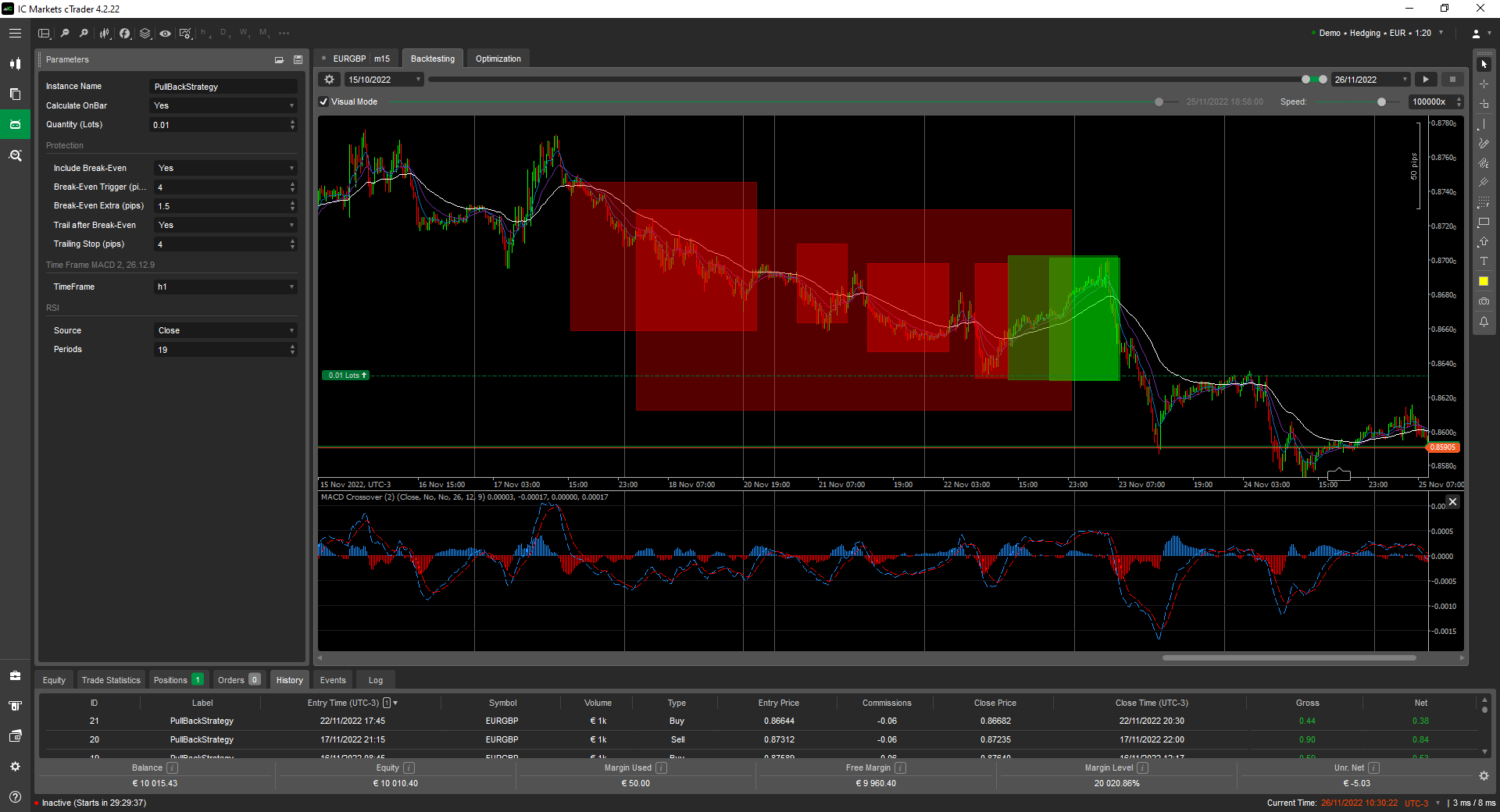

I can't figure out why both macd 1 of the chart at 15 min and the other at 1 hour don't work together. What I have tried to make is that both macd are used as a filter to determine the direction of the entry. If both macd are above or below the zero line, a position may be opened. Separately they do what I want. but not together.

in the photo the dark red and dark green areas are the areas where the macd are both above or below the zero line

using System;

using System.Linq;

using System.Security.Cryptography;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

/* Indicators:

* indicator : EMA 8 periode

* indicator : EMA 20 periode

* indicator : EMA 50 periode

*

* Filters: (MACDLine > 0 && PrevMACDLine < 0 == MACDLine_2 > 0 && PrevMACDLine_2 < 0) for Buy position

* Filter : MACD chart (15m) 26,12,9

* Filter : MACD Multi time frame (1H) 26,12,9

* Filter : RSI

* Protection:

* Stop1 : Stoploss ATR

* Stop2 : Trailingstop ATR

* Target 1 : Trailstop ATR

* Target 2 : Takeprofit ATR

*

* Risk per trade : 1 - 5 % account balans

*

* Entry pullback behind de 20 and 50 EMA

*

* 23-11-2022 checkt the Break Even and the Trailing Stop. Check!!

* 24-11-2022 managment positition is not ready

*/

namespace cAlgo

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class PullBack_Strategy : Robot

{

#region User defined parameters

[Parameter("Instance Name", DefaultValue = "PullBackStrategy")]

public string PullBackStrategy { get; set; }

[Parameter("Calculate OnBar", DefaultValue = true)]// true

public bool CalculateOnBar { get; set; }

[Parameter("Quantity (Lots)", DefaultValue = 0.01)]

public double Quantity { get; set; }

#region Protection

[Parameter("Include Break-Even", DefaultValue = true, Group = "Protection")]

public bool IncludeBreakEven { get; set; }

[Parameter("Break-Even Trigger (pips)", DefaultValue = 3, MinValue = 1, Group = "Protection")]

public int BreakEvenPips { get; set; }

[Parameter("Break-Even Extra (pips)", DefaultValue = 0.5, MinValue = 0.1, Step = 0.1, Group = "Protection")]

public double BreakEvenExtraPips { get; set; }

[Parameter("Trail after Break-Even", DefaultValue = true, Group = "Protection")]

public bool Includetrail { get; set; }

[Parameter("Trailing Stop (pips)", DefaultValue = 2, MinValue = 1, Group = "Protection")]

public int Trailingstoppips { get; set; }

#endregion

#region Filters

[Parameter("TimeFrame", Group = "Time Frame MACD 2, 26.12.9", DefaultValue = "Hour")]//Hour

public TimeFrame TimeFrame2 { get; set; }

[Parameter("Source", Group = "RSI")]// Close

public DataSeries Source { get; set; }

[Parameter("Periods", Group = "RSI", DefaultValue = 19, MaxValue = 20, MinValue = 12, Step = 1)]// 14

public int Periods { get; set; }

//[Parameter("Overbold", Group = "RSI", DefaultValue = 70, MaxValue = 100, MinValue = 10, Step = 1)]// 70

// public int Overbold { get; set; }

// [Parameter("Oversold", Group = "RSI", DefaultValue = 30, MaxValue = 100, MinValue = 10, Step = 1)]//30

// public int Oversold { get; set; }

#endregion

#endregion

#region Indicator declarations

// Protection

private AverageTrueRange ATR_;

public double volumeInUnits;

// Filters

public Bars _marketSeries2;

public MacdCrossOver macd;

public MacdCrossOver macd_2;

public RelativeStrengthIndex rsi;

// Indicators

public MovingAverage i_MA_slow;

public MovingAverage i_MA_standart;

public MovingAverage i_MA_fast;

// Position

private Position position;

#endregion

#region cTrader events

/// <summary>

/// This is called when the robot first starts, it is only called once.

/// </summary>

protected override void OnStart()

{

// construct the indicators

// Protection

ATR_ = Indicators.AverageTrueRange(14, MovingAverageType.Simple);

// Lotsize Lotsize - functie

volumeInUnits = Symbol.QuantityToVolumeInUnits(Quantity);

// Filters

_marketSeries2 = MarketData.GetBars(TimeFrame2, Symbol.Name);

macd = Indicators.MacdCrossOver(26, 12, 9);

macd_2 = Indicators.MacdCrossOver(_marketSeries2.ClosePrices, 26, 12, 9);

rsi = Indicators.RelativeStrengthIndex(Source, Periods);

//Indicators

i_MA_slow = Indicators.MovingAverage(Bars.ClosePrices, 50, MovingAverageType.Exponential);

i_MA_standart = Indicators.MovingAverage(Bars.ClosePrices, 20, MovingAverageType.Exponential);

i_MA_fast = Indicators.MovingAverage(Bars.ClosePrices, 8, MovingAverageType.Exponential);

// Positions

Positions.Opened += Positions_Opened;

Positions.Closed += Positions_Closed;

Positions.Modified += Positions_Modified;

}

private void Positions_Modified(PositionModifiedEventArgs obj)

{

var modifiedPosition = obj.Position;

}

private void Positions_Closed(PositionClosedEventArgs obj)

{

var closedPosition = obj.Position;

var closeReason = obj.Reason;

}

private void Positions_Opened(PositionOpenedEventArgs obj)

{

var openedPosition = obj.Position;

}

/// <summary>

/// This method is called every time the price changes for the symbol

/// </summary>

protected override void OnTick()

{

if (CalculateOnBar)

{

return;

}

ManagePositions();

}

/// <summary>

/// This method is called at every candle (bar) close, when it has formed

/// </summary>

protected override void OnBar()

{

if (position != null)

return;

if (!CalculateOnBar)

{

return;

}

if (IncludeBreakEven)

{

BreakEvenAdjustment();

}

ManagePositions();

}

#endregion

#region Position management

private void ManagePositions()

{

// Protection

// var ATRTP = ATR_TAKEPROFIT * ATR_.Result.LastValue * 1000;

//var ATRSL = 3 * ATR_.Result.LastValue * 1000;

// Filters MACD chart

var MACDLine = macd.MACD.Last(1);

var PrevMACDLine = macd.MACD.Last(2);

// MACD Multi Time Frame

var MACDLine_2 = macd_2.MACD.Last(1);

var PrevMACDLine_2 = macd_2.MACD.Last(2);

Print("MACD1 Value {0}, MACD1 Prev {1}", MACDLine, PrevMACDLine);

Print("MACD2 Value {0}, MACD2 Prev {1}", MACDLine_2, PrevMACDLine_2);

Print("Ema1: {0}, Ema2: {1}, Ema3: {2}", i_MA_fast.Result.LastValue, i_MA_standart.Result.LastValue, i_MA_slow.Result.LastValue);

// Strategy Rules

// if (rsi.Result.LastValue > 25 && rsi.Result.LastValue < 70)

{

if (MACDLine > 0 && PrevMACDLine < 0 == MACDLine_2 > 0 && PrevMACDLine_2 < 0)

{

if (i_MA_standart.Result.LastValue > i_MA_slow.Result.LastValue && i_MA_fast.Result.LastValue > i_MA_slow.Result.LastValue && i_MA_fast.Result.LastValue > i_MA_standart.Result.LastValue)

if (Bars.LowPrices.Last(2) < i_MA_standart.Result.LastValue && Bars.LowPrices.Last(2) > i_MA_slow.Result.LastValue && Bars.ClosePrices.LastValue > i_MA_fast.Result.LastValue)

// if there is no buy position open, open one and close any sell position that is open

if (!IsPositionOpenByType(TradeType.Buy))

{

OpenPosition(TradeType.Buy);

}

}

else if (MACDLine < 0 && PrevMACDLine > 0 == MACDLine_2 < 0 && PrevMACDLine_2 > 0)

{

if (i_MA_standart.Result.LastValue < i_MA_slow.Result.LastValue && i_MA_fast.Result.LastValue < i_MA_slow.Result.LastValue && i_MA_fast.Result.LastValue < i_MA_standart.Result.LastValue)

if (Bars.HighPrices.Last(2) > i_MA_standart.Result.LastValue && Bars.HighPrices.Last(2) < i_MA_slow.Result.LastValue && Bars.ClosePrices.LastValue < i_MA_fast.Result.LastValue)

// if there is no sell position open, open one and close any buy position that is open

if (!IsPositionOpenByType(TradeType.Sell))

{

OpenPosition(TradeType.Sell);

}

}

}

}

#endregion

#region

/// <summary>

/// Opens a new long position

/// </summary>

/// <param name="type"></param>

private void OpenPosition(TradeType type)

{

if (Positions.Count == 0)

// open a new position

{

ExecuteMarketOrder(type, this.SymbolName, volumeInUnits, PullBackStrategy, null, null);

}

}

/// <summary>

///

/// </summary>

/// <param name="type"></param>

private void ClosePosition(TradeType type)

{

var p = Positions.Find(PullBackStrategy, this.SymbolName, type);

if (p != null)

{

ClosePosition(p);

}

}

#endregion

#region Position Information

/// <summary>

///

/// </summary>

/// <param name="type"></param>

/// <returns></returns>

private bool IsPositionOpenByType(TradeType type)

{

var p = Positions.FindAll(PullBackStrategy, SymbolName, type);

if (p.Length >= 1)

{

return true;

}

return false;

}

#endregion

#region Stops

/// <summary>

/// This method is called when your robot stops, can be used to clean-up memory resources.

/// </summary>

protected override void OnStop()

{

// unused

}

#endregion

#region Break Even

// code from clickalgo.com

private void BreakEvenAdjustment()

{

var allPositions = Positions.FindAll(PullBackStrategy, SymbolName);

foreach (Position position in allPositions)

{

var entryPrice = position.EntryPrice;

var distance = position.TradeType == TradeType.Buy ? Symbol.Bid - entryPrice : entryPrice - Symbol.Ask;

// move stop loss to break even plus and additional (x) pips

if (distance >= BreakEvenPips * Symbol.PipSize)

{

if (position.TradeType == TradeType.Buy)

{

if (position.StopLoss <= position.EntryPrice + (Symbol.PipSize * BreakEvenExtraPips) || position.StopLoss == null)

{

// && position.Pips >= trailingstoppips)

if (Includetrail)

{

//ModifyPosition(position, position.EntryPrice);

position.ModifyStopLossPrice(position.EntryPrice + (Symbol.PipSize * BreakEvenExtraPips));

Print("Stop Loss to Break Even set for BUY position {0}", position.Id);

if (position.Pips >= Trailingstoppips)

position.ModifyTrailingStop(true);

}

else if (!Includetrail)

{

//ModifyPosition(position, position.EntryPrice + (Symbol.PipSize * BreakEvenExtraPips), position.TakeProfit);

position.ModifyStopLossPrice(position.EntryPrice + (Symbol.PipSize * BreakEvenExtraPips));

Print("Stop Loss to Break Even set for BUY position {0}", position.Id);

}

}

}

else

{

if (position.StopLoss >= position.EntryPrice - (Symbol.PipSize * BreakEvenExtraPips) || position.StopLoss == null)

{

// && position.Pips >= trailingstoppips)

if (Includetrail)

{

ModifyPosition(position, entryPrice - (Symbol.PipSize * BreakEvenExtraPips), position.TakeProfit);

Print("Stop Loss to Break Even set for SELL position {0}", position.Id);

if (position.Pips >= Trailingstoppips)

position.ModifyTrailingStop(true);

}

else if (!Includetrail)

{

ModifyPosition(position, entryPrice - (Symbol.PipSize * BreakEvenExtraPips), position.TakeProfit);

Print("Stop Loss to Break Even set for SELL position {0}", position.Id);

}

}

}

}

}

}

#endregion

}

}

Alwin123

26 Nov 2022, 16:32

i found it following my

if (MACDLine > 0 && PrevMACDLine < 0)

{

if( MACDLine_2 > 0 && PrevMACDLine_2 < 0)

@Alwin123