strange back test result

04 Oct 2013, 18:12

I use the same robot, the same random spread and commission for testing but get pretty big difference between 2011-04/2012 and the rest of 2012-todays date

The robot does not use bars/time frames

Is it possible that something is wrong with the back test data? or is it just luck!? for thousands of orders..

Also in 2011 it creates many more orders compared to 2012 and 2013

Check the screens below

2011-04/2012 - had to interrupt it on 04/2012 because cAlgo used all the 8GB of RAM and the PC was lagging too much.

04/2012-12/2012

01/2013-today

Replies

stoko

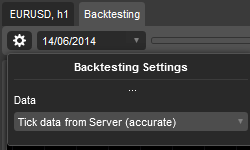

27 Aug 2014, 17:15

RE: RE:

Spotware said:

stoko said:

Yep, testing it since yesterday. Pretty impressive! Thank you!

Does it include what the spreads and commission would have been for each tick?

Spreads are historical. Commissions are fixed and must be specified in backtesting settings.

very nice!

thank you

@stoko

AlexanderRC

27 Aug 2014, 20:16

RE: RE:

Spotware said:

Spreads are historical. Commissions are fixed and must be specified in backtesting settings.

In real life commissions are not fixed. We in Romanov Capital assign each client (all of his or her accounts) to different groups with different commissions dynamically. It depends on the traded volume for all of the accounts of a client for the last 30 days. Recalculation and group assignment happens every day at a specified time. The more you trade, the less commissions you are charged.

Please vote for Add commissions for Symbol to cAlgo API on vote.spotware.com

@AlexanderRC

Spotware

08 Oct 2013, 10:00

Most probably your strategy relies on exact tick values, but currently we interpolate them from one-minute charts. In the past we have lower tick-volume so generated ticks for that period are a bit different. For testing such strategies you need backtesting based on real tick values (not interpolated), we are going to provide such ability in future.

We have decreased backtesting memory consumption in future versions.

@Spotware