Not opening position

18 Sep 2018, 03:33

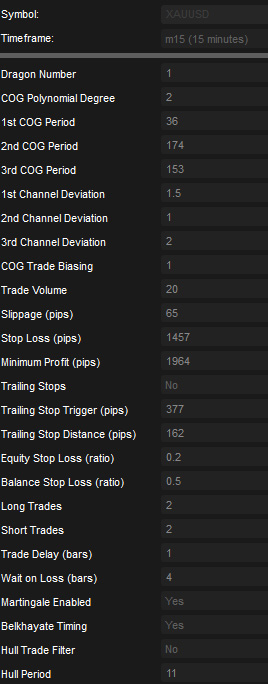

Hi, i optimized Golden Dragon II

but the bot won't open any trade & the log just stated bot is running. compiling is no problem since i just rename the indies it needed.

// Golden Dragon v2.0

// Released 20th May 2015

// Created by Craig Stone (except for trailing stops code which is drawn from Spotware's sample code)

using System;

using System.Linq;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using cAlgo.API.Requests;

using cAlgo.Indicators;

namespace cAlgo.Robots

{

[Robot(TimeZone = TimeZones.UTC)]

public class GoldenDragon : Robot

{

// Dragon instance number

[Parameter("Dragon Number", DefaultValue = 1, MinValue = 1)]

public int DragonNumber { get; set; }

// Polynomial regression degree

[Parameter("COG Polynomial Degree", DefaultValue = 3, MinValue = 1, MaxValue = 4)]

public int cogDegree { get; set; }

// Number of history bars to use for calculation of primary regression calculation

[Parameter("1st COG Period", DefaultValue = 110, MinValue = 1)]

public int cog1Periods { get; set; }

[Parameter("2nd COG Period", DefaultValue = 250, MinValue = 0)]

public int cog2Periods { get; set; }

[Parameter("3rd COG Period", DefaultValue = 465, MinValue = 0)]

public int cog3Periods { get; set; }

// Inner polynomial envelope offset, optionally used to set TP level

[Parameter("1st Channel Deviation", DefaultValue = 1.4, MinValue = 0.1)]

public double Inner { get; set; }

// Middle polynomial envelope offset, used to open a position

[Parameter("2nd Channel Deviation", DefaultValue = 1.8, MinValue = 0.1)]

public double Middle { get; set; }

// Outer polynomial envelope offset, optionally used to set SL

[Parameter("3rd Channel Deviation", DefaultValue = 2.2, MinValue = 0.1)]

public double Outer { get; set; }

// Centre of gravity trade filtering

[Parameter("COG Trade Biasing", DefaultValue = 3, MinValue = 0, MaxValue = 7)]

public int cogBias { get; set; }

// Default trade volume

[Parameter("Trade Volume", DefaultValue = 10, MinValue = 1)]

public int TradeVolume { get; set; }

// Maximum slippage

[Parameter("Slippage (pips)", DefaultValue = 10, MinValue = 0)]

public int Slippage { get; set; }

// Catastrophic Stop Loss

[Parameter("Stop Loss (pips)", DefaultValue = 1100, MinValue = 0)]

public int StopLoss { get; set; }

// Minimum Profit

[Parameter("Minimum Profit (pips)", DefaultValue = 50, MinValue = 0)]

public int MinimumPips { get; set; }

[Parameter("Trailing Stops", DefaultValue = false)]

public bool TrailingStops { get; set; }

[Parameter("Trailing Stop Trigger (pips)", DefaultValue = 500)]

public int TrailingStopTrigger { get; set; }

[Parameter("Trailing Stop Distance (pips)", DefaultValue = 500)]

public int TrailingStopDistance { get; set; }

// Equity Protection

[Parameter("Equity Stop Loss (ratio)", DefaultValue = 0.2, MinValue = 0, MaxValue = 1)]

public double EquityStop { get; set; }

// Balance Protection

[Parameter("Balance Stop Loss (ratio)", DefaultValue = 0.2, MinValue = 0, MaxValue = 1)]

public double BalanceStop { get; set; }

// Maximum simultaneous long positions

[Parameter("Long Trades", DefaultValue = 2, MinValue = 0)]

public int MaxLongTrades { get; set; }

// Maximum simultaneous short positions

[Parameter("Short Trades", DefaultValue = 2, MinValue = 0)]

public int MaxShortTrades { get; set; }

// Minimum time delay between trades

[Parameter("Trade Delay (bars)", DefaultValue = 1, MinValue = 1)]

public int TradeDelay { get; set; }

// Trade suspension period on loss

[Parameter("Wait on Loss (bars)", DefaultValue = 0, MinValue = 0)]

public int WaitOnLoss { get; set; }

// Enables trade volume doubling when a stop loss is hit

[Parameter("Martingale Enabled", DefaultValue = false)]

public bool Martingale { get; set; }

// Enables Belkhayate entry filtering

[Parameter("Belkhayate Timing", DefaultValue = false)]

public bool BelkhayateTimingFilter { get; set; }

// Enables Hull MA filtering

[Parameter("Hull Trade Filter", DefaultValue = true)]

public bool HullFilter { get; set; }

// Hull MA Indicator Period

[Parameter("Hull Period", DefaultValue = 3, MinValue = 1)]

public int HullPeriod { get; set; }

private int LongPositions = 0, ShortPositions = 0, MaxLong = 0, MaxShort = 0;

private int BuyVolume = 0, TakeProfit = 0, Count = 0;

private double bid = 0, ask = 0, spread = 0, pipsize = 0, OpeningBalance = 0;

private int t1ix, t2ix, t3ix;

private double t1h3, t1h2, t1h1, t1c0, t1l1, t1l2, t1l3;

private double t2h3, t2h2, t2h1, t2c0, t2l1, t2l2, t2l3;

private double t3h3, t3h2, t3h1, t3c0, t3l1, t3l2, t3l3;

private int MartingaleActive = 0;

private bool TradeSafe = true, BuySafe = true, SellSafe = true, isTrigerred = false;

private BelkhayatePRC cog1, cog2, cog3;

private BelkhayateTiming timing;

private HMA hull;

private string DragonID;

protected override void OnStart()

{

DragonID = "Golden Dragon " + DragonNumber + " - " + Symbol.Code;

Positions.Closed += PositionsOnClosed;

BuyVolume = TradeVolume;

OpeningBalance = Account.Balance;

MaxLong = MaxLongTrades;

MaxShort = MaxShortTrades;

cog1 = Indicators.GetIndicator<BelkhayatePRC>(cogDegree, cog1Periods, Inner, Middle, Outer);

if (cog2Periods > 0)

cog2 = Indicators.GetIndicator<BelkhayatePRC>(cogDegree, cog2Periods, Inner, Middle, Outer);

if (cog3Periods > 0)

cog3 = Indicators.GetIndicator<BelkhayatePRC>(cogDegree, cog3Periods, Inner, Middle, Outer);

if (BelkhayateTimingFilter)

timing = Indicators.GetIndicator<BelkhayateTiming>();

if (HullFilter)

hull = Indicators.GetIndicator<HMA>(HullPeriod);

// Identify existing trades from this instance

foreach (var position in Positions)

{

if (position.Label == DragonID)

switch (position.TradeType)

{

case TradeType.Buy:

LongPositions++;

break;

case TradeType.Sell:

ShortPositions++;

break;

}

}

}

protected override void OnBar()

{

Count++;

// COGx1

t1ix = (int)cog1.ix;

t1h3 = (double)cog1.sqh3.LastValue;

t1h2 = (double)cog1.sqh2.LastValue;

t1h1 = (double)cog1.sqh.LastValue;

t1c0 = (double)cog1.prc.LastValue;

t1l1 = (double)cog1.sql.LastValue;

t1l2 = (double)cog1.sql2.LastValue;

t1l3 = (double)cog1.sql3.LastValue;

// COGx2

if (cog2Periods > 0)

{

t2ix = (int)cog2.ix;

t2h3 = (double)cog2.sqh3.LastValue;

t2h2 = (double)cog2.sqh2.LastValue;

t2h1 = (double)cog2.sqh.LastValue;

t2c0 = (double)cog2.prc.LastValue;

t2l1 = (double)cog2.sql.LastValue;

t2l2 = (double)cog2.sql2.LastValue;

t2l3 = (double)cog2.sql3.LastValue;

}

// COGx4

if (cog3Periods > 0)

{

t3ix = (int)cog3.ix;

t3h3 = (double)cog3.sqh3.LastValue;

t3h2 = (double)cog3.sqh2.LastValue;

t3h1 = (double)cog3.sqh.LastValue;

t3c0 = (double)cog3.prc.LastValue;

t3l1 = (double)cog3.sql.LastValue;

t3l2 = (double)cog3.sql2.LastValue;

t3l3 = (double)cog3.sql3.LastValue;

}

}

protected override void OnTick()

{

bid = Symbol.Bid;

ask = Symbol.Ask;

spread = Symbol.Spread;

pipsize = Symbol.PipSize;

TradeSafe = true;

BuySafe = true;

SellSafe = true;

if (Account.Equity / Account.Balance < EquityStop)

{

Print("Equity protection stop triggered. All positions closed.");

ClosePositions();

Stop();

}

if (Account.Equity < Account.Balance * BalanceStop)

{

Print("Account balance protection triggered. All positions closed.");

ClosePositions();

Stop();

}

if (BelkhayateTimingFilter)

{

if (timing.Close.LastValue > timing.BuyLine1.LastValue)

BuySafe = false;

if (timing.Close.LastValue < timing.SellLine1.LastValue)

SellSafe = false;

}

if (HullFilter)

{

if (hull.hma.IsFalling())

BuySafe = false;

if (hull.hma.IsRising())

SellSafe = false;

}

if (cogBias > 0)

{

switch (cogBias)

{

case 1:

if (cog1.prc.IsRising())

SellSafe = false;

if (cog1.prc.IsFalling())

BuySafe = false;

break;

case 2:

if (cog2.prc.IsRising())

SellSafe = false;

if (cog2.prc.IsFalling())

BuySafe = false;

break;

case 3:

if (cog3.prc.IsRising())

SellSafe = false;

if (cog3.prc.IsFalling())

BuySafe = false;

break;

}

}

if (TrailingStops)

AdjustTrailingStops();

if (Count > TradeDelay && LongPositions < MaxLong && BuySafe == true && TradeSafe == true)

{

if ((cog2Periods == 0 && cog3Periods == 0 && ask < t1l3) || (cog2Periods > 0 && cog3Periods == 0 && ask < t1l3 && ask < t2l3) || (cog2Periods > 0 && cog3Periods > 0 && ask < t1l3 && ask < t2l3 && ask < t3l3))

{

OpenPosition(TradeType.Buy, BuyVolume * 3);

}

else if ((cog2Periods == 0 && cog3Periods == 0 && ask < t1l2) || (cog2Periods > 0 && cog3Periods == 0 && ask < t1l2 && ask < t2l2) || (cog2Periods > 0 && cog3Periods > 0 && ask < t1l2 && ask < t2l2 && ask < t3l2))

{

OpenPosition(TradeType.Buy, BuyVolume * 2);

}

else if ((cog2Periods == 0 && cog3Periods == 0 && ask < t1l1) || (cog2Periods > 0 && cog3Periods == 0 && ask < t1l1 && ask < t2l1) || (cog2Periods > 0 && cog3Periods > 0 && ask < t1l1 && ask < t2l1 && ask < t3l1))

{

OpenPosition(TradeType.Buy, BuyVolume * 1);

}

}

if (Count > TradeDelay && ShortPositions < MaxShort && SellSafe == true && TradeSafe == true)

{

if ((cog2Periods == 0 && cog3Periods == 0 && bid > t1h3) || (cog2Periods > 0 && cog3Periods == 0 && bid > t1h3 && bid > t2h3) || (cog2Periods > 0 && cog3Periods > 0 && bid > t1h3 && bid > t2h3 && bid > t3h3))

{

OpenPosition(TradeType.Sell, BuyVolume * 3);

}

if ((cog2Periods == 0 && cog3Periods == 0 && bid > t1h2) || (cog2Periods > 0 && cog3Periods == 0 && bid > t1h2 && bid > t2h2) || (cog2Periods > 0 && cog3Periods > 0 && bid > t1h2 && bid > t2h2 && bid > t3h2))

{

OpenPosition(TradeType.Sell, BuyVolume * 2);

}

if ((cog2Periods == 0 && cog3Periods == 0 && bid > t1h1) || (cog2Periods > 0 && cog3Periods == 0 && bid > t1h1 && bid > t2h1) || (cog2Periods > 0 && cog3Periods > 0 && bid > t1h1 && bid > t2h1 && bid > t3h1))

{

OpenPosition(TradeType.Sell, BuyVolume * 1);

}

}

}

private void OpenPosition(TradeType tradetype, int quantity)

{

// check that the tube is ready

if (t1ix > cog1Periods)

{

switch (tradetype)

{

case TradeType.Buy:

if (cog3Periods > 0)

TakeProfit = (int)((t3c0 - ask) / pipsize);

else if (cog2Periods > 0)

TakeProfit = (int)((t2c0 - ask) / pipsize);

else

TakeProfit = (int)((t1c0 - ask) / pipsize);

LongPositions++;

Print("Opened LONG position {0} of {1}", LongPositions, MaxLong);

break;

case TradeType.Sell:

if (cog3Periods > 0)

TakeProfit = (int)((bid - t3c0) / pipsize);

else if (cog2Periods > 0)

TakeProfit = (int)((bid - t2c0) / pipsize);

else

TakeProfit = (int)((bid - t1c0) / pipsize);

ShortPositions++;

Print("Opened SHORT position {0} of {1}", ShortPositions, MaxShort);

break;

}

if (MartingaleActive > 0)

TakeProfit = (int)(StopLoss / 2);

ExecuteMarketOrder(tradetype, Symbol, quantity, DragonID, StopLoss, TakeProfit, Slippage, DragonID);

Count = 0;

}

Print("Period {0}, Long {1} of {2}, Short {3} of {4}", t1ix, LongPositions, MaxLong, ShortPositions, MaxShort);

}

protected override void OnPositionOpened(Position openedPosition)

{

switch (openedPosition.TradeType)

{

case TradeType.Buy:

LongPositions++;

break;

case TradeType.Sell:

ShortPositions++;

break;

}

}

private void ClosePositions()

{

foreach (var position in Positions)

{

if (position.Label == DragonID && position.GrossProfit < -10)

ClosePosition(position);

}

}

private void PositionsOnClosed(PositionClosedEventArgs args)

{

var position = args.Position;

switch (position.TradeType)

{

case TradeType.Buy:

LongPositions--;

Print("Closed LONG position. {0} of {1} remain open.", LongPositions, MaxLong);

break;

case TradeType.Sell:

ShortPositions--;

Print("Closed SHORT position. {0} of {1} remain open.", ShortPositions, MaxShort);

break;

}

if (position.GrossProfit < 0)

{

if (WaitOnLoss > 0)

Count = -WaitOnLoss;

if (Martingale)

{

MartingaleActive++;

BuyVolume = BuyVolume * 2;

}

}

else if (MartingaleActive > 0)

{

MartingaleActive--;

BuyVolume = (int)(BuyVolume / 2);

}

Print("Period {0}, Long {1} of {2}, Short {3} of {4}", t1ix, LongPositions, MaxLong, ShortPositions, MaxShort);

}

private void AdjustTrailingStops()

{

foreach (var position in Positions)

{

if (position.Label == DragonID)

{

if (position.TradeType == TradeType.Buy)

{

double distance = Symbol.Bid - position.EntryPrice;

if (distance >= TrailingStopTrigger * Symbol.PipSize)

{

if (!isTrigerred)

{

isTrigerred = true;

Print("Trailing stop loss triggered on position {0}", position.Id);

}

double newStopLossPrice = Math.Round(Symbol.Bid - TrailingStopDistance * Symbol.PipSize, Symbol.Digits);

if (position.StopLoss == null || newStopLossPrice > position.StopLoss)

{

ModifyPosition(position, newStopLossPrice, position.TakeProfit);

}

}

}

else

{

double distance = position.EntryPrice - Symbol.Ask;

if (distance >= TrailingStopTrigger * Symbol.PipSize)

{

if (!isTrigerred)

{

isTrigerred = true;

Print("Trailing stop loss triggered on position {0}", position.Id);

}

double newStopLossPrice = Math.Round(Symbol.Ask + TrailingStopDistance * Symbol.PipSize, Symbol.Digits);

if (position.StopLoss == null || newStopLossPrice < position.StopLoss)

{

ModifyPosition(position, newStopLossPrice, position.TakeProfit);

}

}

}

}

}

}

protected void Message(int level, string message)

{

Print("[{0}] {1}", level, message);

}

protected override void OnStop()

{

Print("Dragon Sleeping");

}

}

}

Param:

I have 3 optimized result that produce good return. 2 of them are Martingales

it is only good if we do not withdraw the profit earned. even then it can turn to zero in an instance.

So, getting back to the bot. please advice from the senior staffs here on what to do . the bot does not open any trades eventhough backtesting with tick & real commisions work. Slippage is also less than. i am very confused. Thanksss

Replies

PanagiotisCharalampous

18 Sep 2018, 18:01

Hi anthony21xu,

It is not easy to advise how to use a 500 lines cBot we did not write. Did you try contacting the cBot's creator?

Best Regards,

Panagiotis

@PanagiotisCharalampous

anthony21xu

18 Sep 2018, 18:15

RE:

Panagiotis Charalampous said:

Hi anthony21xu,

It is not easy to advise how to use a 500 lines cBot we did not write. Did you try contacting the cBot's creator?

Best Regards,

Panagiotis

Hi Panagiotis,

Thanks a lot for the reply. in fact i did. but he has been away for a while. i just want to know what should i add to open position. the bot is the most downloaded in ctrader/bots section. many are using it. so it is positively working.

@anthony21xu

anthony21xu

18 Sep 2018, 18:30

RE: RE:

anthony21xu said:

Panagiotis Charalampous said:

Hi anthony21xu,

It is not easy to advise how to use a 500 lines cBot we did not write. Did you try contacting the cBot's creator?

Best Regards,

Panagiotis

Hi Panagiotis,

Thanks a lot for the reply. in fact i did. but he has been away for a while. i just want to know what should i add to open position. the bot is the most downloaded in ctrader/bots section. many are using it. so it is positively working.

slippage is a common problem for entry refuse. but i do everything right & backtesting also right. when live it refuses to open any position. logically it is the same settings.

@anthony21xu

anthony21xu

18 Sep 2018, 17:50

no love anyone? what about the warning below? is it the cause?

Error CS0672: Member 'cAlgo.Robots.GoldenDragon.OnPositionOpened(cAlgo.API.Position)' overrides obsolete member 'cAlgo.API.Robot.OnPositionOpened(cAlgo.API.Position)'. Add the Obsolete attribute to 'cAlgo.Robots.GoldenDragon.OnPositionOpened(cAlgo.API.Position)'.

@anthony21xu