Max DrawDown

05 Nov 2012, 15:02

Dear Support,

Could you please explain me how Max DrawDown is calculating in cAlgo backtest table?

I have not been reproduce it in MSExcel based on data.

Thanks!

Replies

rkokerti

06 Nov 2012, 01:51

( Updated at: 21 Dec 2023, 09:20 )

Dear Support,

Thanks for your quick answer.

After analyzed your example, I understood why I could not reproduced the Max DrawDown in Excel. The reason was the approach.

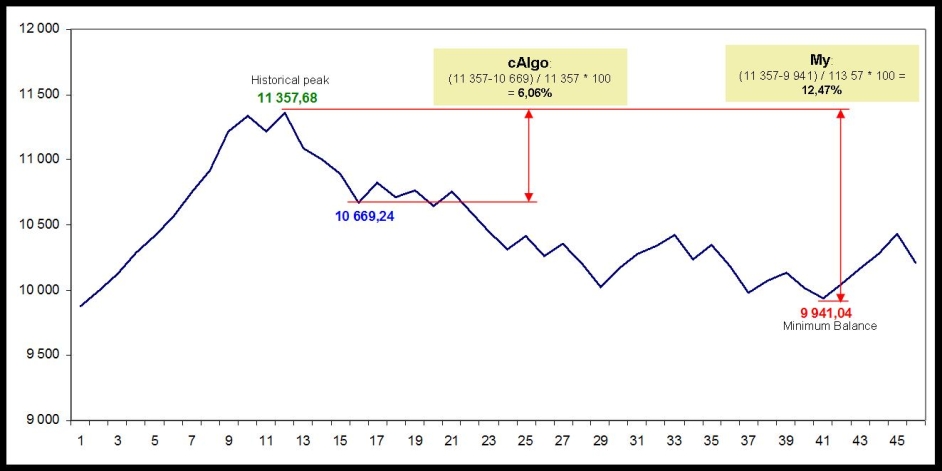

According to definition as far as I know, the Drawdown is the measure of the decline from a historical peak. The key word is the historical. I think it’s very important, that trader doesn’t loose money that has earned in a given period of time (backtest period).

But, cAlgo continually restart the calculation of Drawdown. So it’s like a block-calculation and not a historical one. And it’s very confusing and misleading for me.

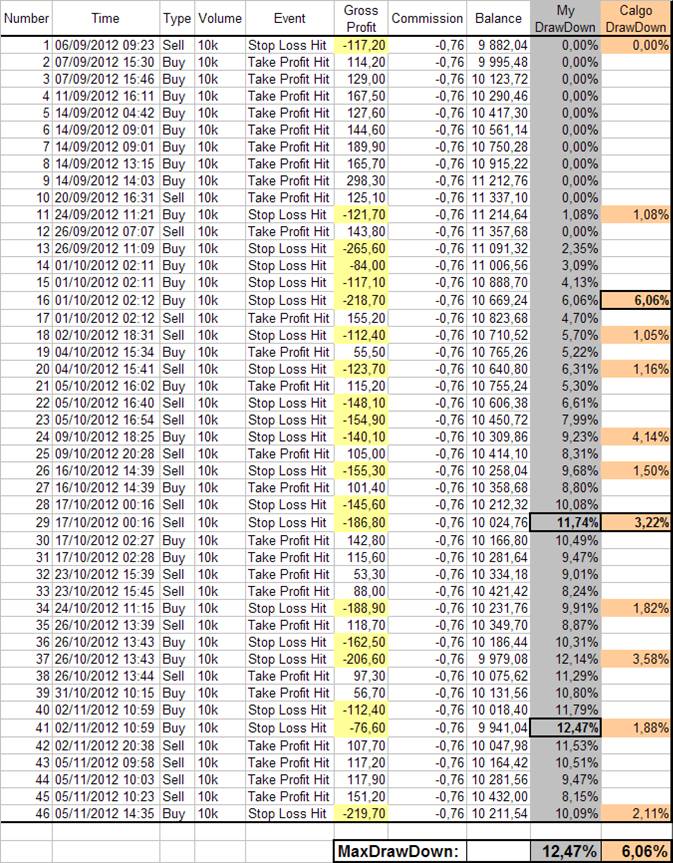

I attached a table below that shows the difference between the result of my calculation and cAlgo. Unfortunately there are significant differences.

Max DD - cAlgo calculation for all: 6.06%

Max DD - My calculation for all: 12,47%

What is your opinion about it?

Thanks

@rkokerti

admin

06 Nov 2012, 12:46

Hello,

The max drawdown is defined as the difference of the value at the peak before largest drop minus the lowest value before a new high divided by the value at the peak before largest drop.

So, a drawdown is established at a trough right before a new peak.

What you are describing is the percentage difference of the maximum value minus the minimum value.

We will have to think about implementing something like what you are describing but that will be somehing different that max drawdown.

@admin

rkokerti

06 Nov 2012, 15:17

( Updated at: 21 Dec 2023, 09:20 )

Hello,

Thanks for your answer!

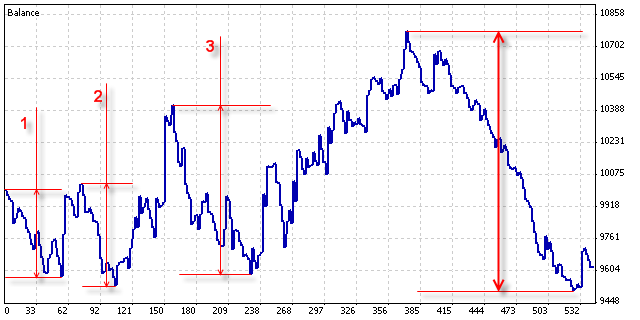

But, as I mentioned this is a very important index-number in a risk management point of view. So, I would like to know what is the measure of the decline, from a historical peak (when I reached a new higher-high in account balance)

see below the last bold arrow on picture:

If it’s possible please implement it into the backtest result table.

Thanks for your help!

@rkokerti

admin

05 Nov 2012, 18:12

The max drawdown is calculated based on the following:

Max Drop of Long Consequtive Losing Trades after a winning trade(long or short)

((Balance after winning trade(long or short) - Balance after last loosing long trade)/Balance after winning trade(long or short) )*100

Max Drop of Short Consequtive Losing Trades after a winning trade(long or short)

((Balance after winning trade(long or short) - Balance after last loosing short trade)/Balance after winning trade(long or short) )*100

For example:

@admin