FX Martingale bot !!

14 Feb 2017, 12:23

My first attempt at FX Martingale ! I am exploring one FX martingale algo (based on fibo lots sizing ) to have sharp returns expecting i will be able to grow account faster than it blows first :)

It is dangerous and "can" blow your account <- I am aware of it but i am still giving it a go ( and simulatenously working on improving it ).

Here is myFXbook link for demo version -> https://www.myfxbook.com/members/TRMR/martingale-fx-v0/1977124

I am going to watch for 3-4 weeks before going live. Wish me luck !!!

Replies

trend_meanreversion

14 Feb 2017, 12:32

RE:

tmc. said:

Hey, good luck with that! Please keep us updated even if it doesn't go well. I am very interested on your results, me myself tried to achieve profitable martingale robot as well but didn't succeed.

Thanks tmc ! I have really liked your work so far on ctdn forums. I have created a successful DAX martingale ( not to boast , just to encourage you ). So good luck to you as well with your research.

@trend_meanreversion

trend_meanreversion

15 Feb 2017, 14:50

( Updated at: 21 Dec 2023, 09:20 )

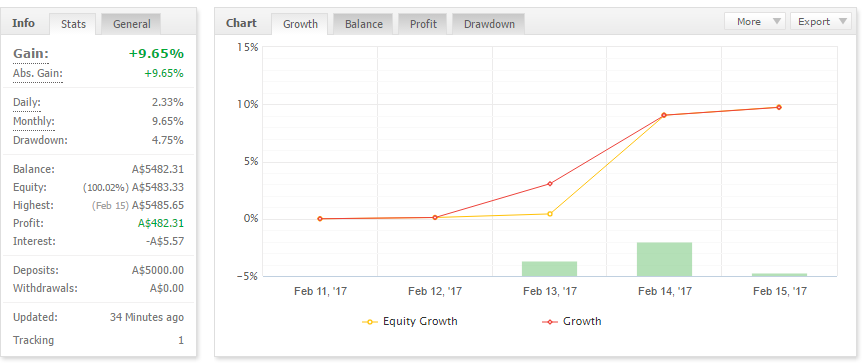

So far it is doing fine . 4 days with 9.5% return is not that bad. I have turned it on for 3 underlyings ( thinking it might bring some diversification of risk ) with 200$ per week target. 2 underlyings have hit the target and i will leave the third underlying to hit its target ( if it can ) , otherwise it will closed before weekend.

From next week , i will make the change to have weekly target of 500$ at account level rather than individual instrument level. Let's see how it goes.

@trend_meanreversion

trend_meanreversion

15 Feb 2017, 15:51

RE:

tmc. said:

Nearly 10% already?! O.O

Could you provide some backtest results of the strategy for let's say 1 year of historical data?

replied to your email mate ( Not sure why my reply here didn't get upload )

@trend_meanreversion

trend_meanreversion

20 Feb 2017, 10:43

Ok, mission started for this week ! ..Bot in ON :)

@trend_meanreversion

trend_meanreversion

22 Feb 2017, 05:14

( Updated at: 21 Dec 2023, 09:20 )

Tough day yesterday for algo as EUR had sharp one sided down move with no to little retracements. Fortunately , it was able to cope up and has made 5% in first 2 days of the week. Let's see if it can continue ( Target is ~500$ this week )

@trend_meanreversion

trend_meanreversion

23 Feb 2017, 02:09

( Updated at: 21 Dec 2023, 09:20 )

This week was definitely tough for strategy but despite having drawdowns , it came victorious !!

Target hit for the week already ( 500$ or 10% ) :)

Next week or probably next , i am going live .

@trend_meanreversion

suradi

23 Feb 2017, 13:06

( Updated at: 21 Dec 2023, 09:20 )

RE:

trend_meanreversion said:

This week was definitely tough for strategy but despite having drawdowns , it came victorious !!

Target hit for the week already ( 500$ or 10% ) :)

Next week or probably next , i am going live .

Looks great trend. Will you be posting a copy of your martingale cbot so we can test it out ? :)

trend_meanreversion

23 Feb 2017, 13:09

RE: RE:

suradi said:

trend_meanreversion said:

This week was definitely tough for strategy but despite having drawdowns , it came victorious !!

Target hit for the week already ( 500$ or 10% ) :)

Next week or probably next , i am going live .

Looks great trend. Will you be posting a copy of your martingale cbot so we can test it out ? :)

Thanks for the appreciation mate but i am currently in test mode myself. I don't see need to post my cBot because people will start complaining about being it too risky , blow the accounts etc, etc.. I will keep it to myself and will probably lease the algo once i feel it is more stable.

@trend_meanreversion

trend_meanreversion

25 Feb 2017, 13:45

( Updated at: 21 Dec 2023, 09:20 )

Hi All,

Please find my latest cBot which is much more stable that the above one .

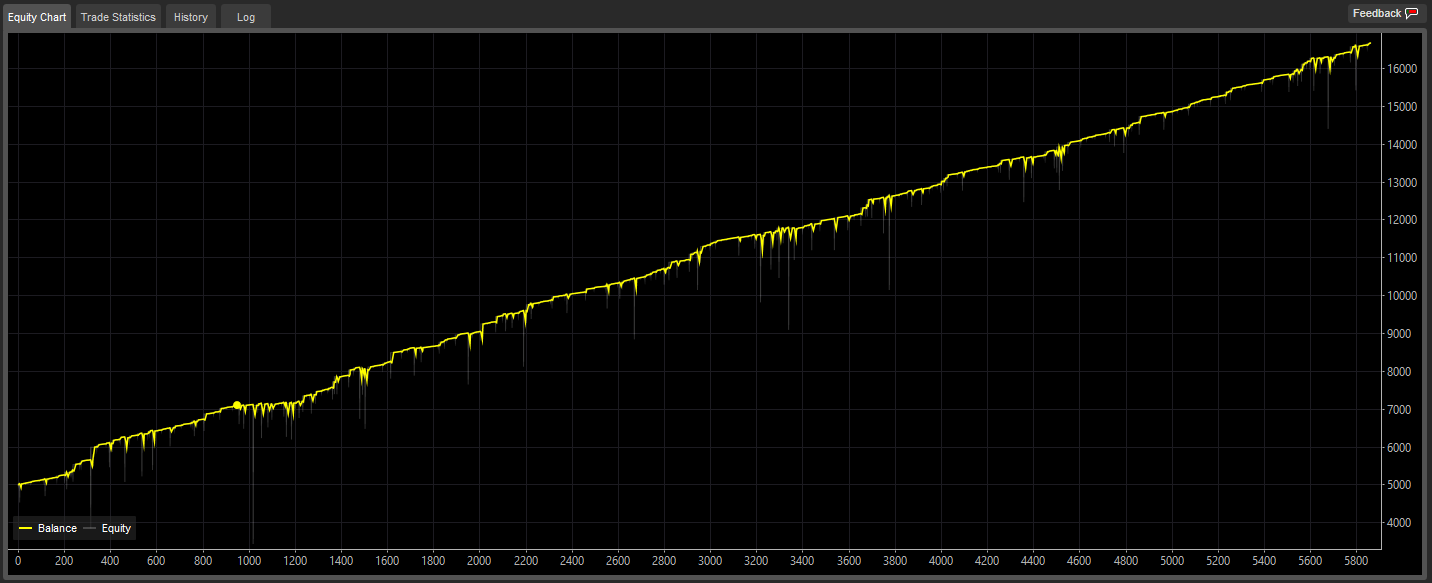

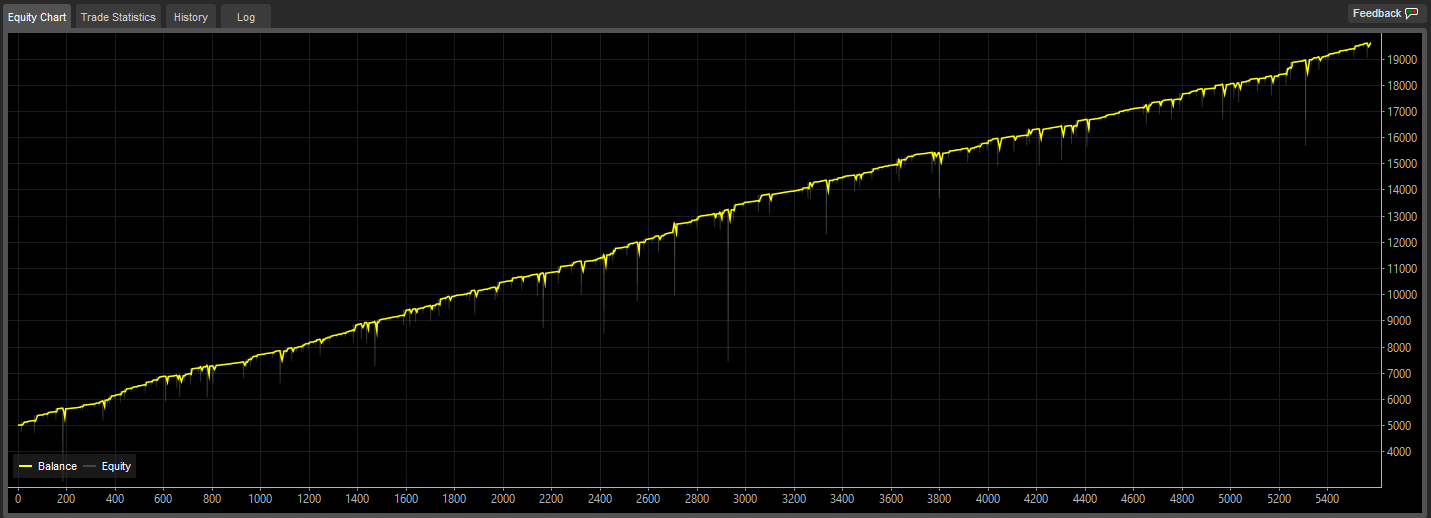

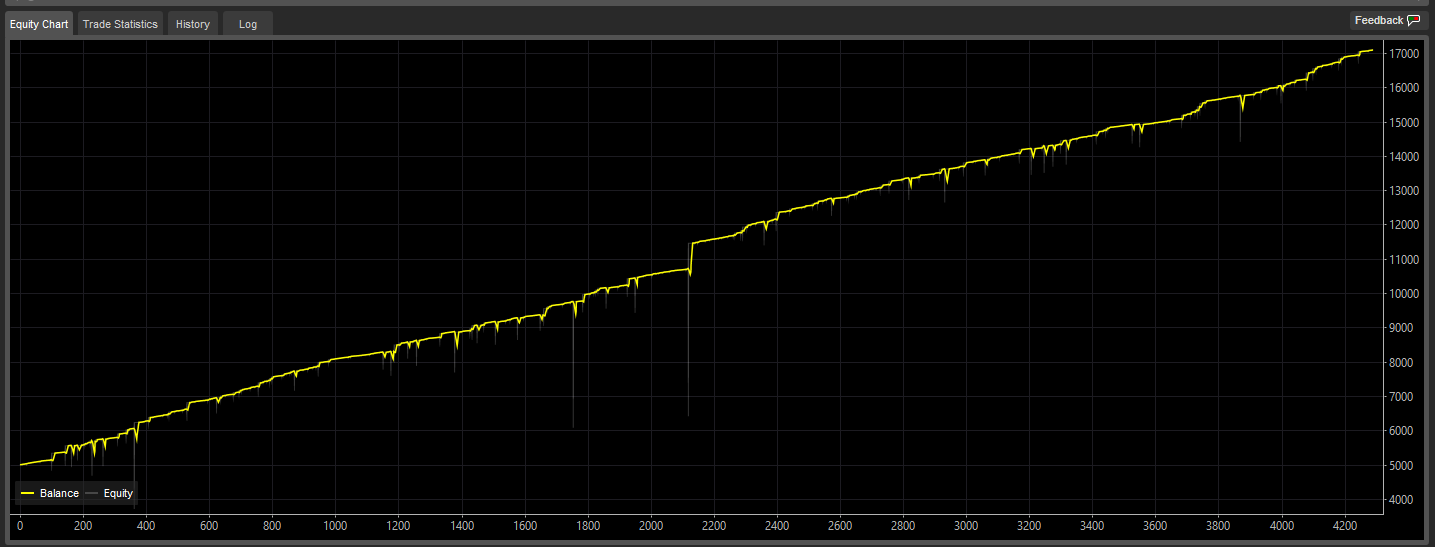

Results with 1min with tick data from 19 Jan 2014 - 23 Feb 2017 using 30$ per million commissions.

USDCAD

EURUSD

AUDUSD

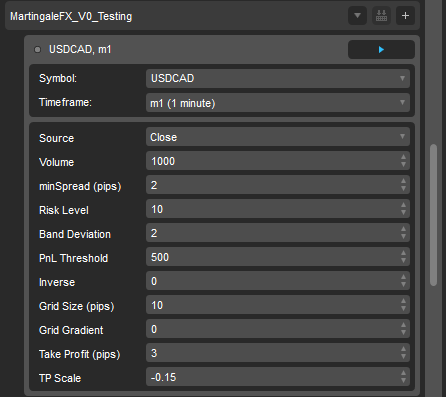

Parameters

Let me explain the parameters

1) TimeFrame: 1 Min (suggested). It is based on multi TimeFrame but still use the baseTime frame during signal generation.

2) Volume: 1K (suggested). It is a martingale strategy and it increases lot based on Fibonacci sequence so better to start with 1K for every 5K account balance.

3) minSpread(pips): 2 pips (suggested). It basically won't open trades unless spread is less than this spread Filter.

4) RiskLevel : 10 (suggested). Max number steps of martingale.

5) Band Deviation: 2 (suggested).

6) PnL Threshold: 500 (suggested). Martingale sequence to be closed after making this threshold unless closed through TP process.

7) Inverse: 0 (suggested). 0 means false and basically means that we sell when overbought and start martingale sequence. If set to '1" (true) then it will buy when overbought. You can also try with '1' as it is not necessarily not profitable.

8) Grid Size(pips): 10 (suggested). Min grid space in pips for martingale to start.

9) Grid Gradient: 0 (suggested). Gradient of exponential increasing grid function.

10) TakeProfit(pips) : 3 (suggested). Starting TakeProfit in pips with 'TP Scale' gradient applied for subsequent martingale steps net TakeProfit.

11) TP Scale: -0.15 (suggested). Gradient of exponential decay function using 'TakeProfit' parameter as starting sequence. If it is +ive then TakeProfit will reduce with number of martingale steps , otherwise will increase.

Algorithm looks to break even after RiskLevel -1 martingale steps irrespective of TakeProfit or TP Scale parameters.

Play around with parameters and let me know your feedback. I won't be able to implement all the requests which might come through as i have tested myself TrailingStops, Fixed Stops etc but i will try my best (but i don't guarantee anything).

Please note that it is a martingale strategy so it is RISKY.

Please use it with your own understanding and i don't advocate to use it on 'Live' at this moment.

cBot download ( no source code )

https://www.dropbox.com/s/z3mrchipq1mmy0o/MartingaleFX_V0_Trial.algo?dl=0

@trend_meanreversion

trend_meanreversion

27 Feb 2017, 15:09

Thanks for letting me know that TakeProfit(Pips) wasn't working properly. I have fixed it and updated the link in the first post ( /algos/cbots/show/1622 ). Do play around with settings and post the best ones that you see ( in backtest and forward test ).

I am working on improving the 'inverse' = true flag and trying to find some settings to have general profitability for most of the pairs . This would enable us to run 2 versions on each instrument ( inverse= 1 and inverse = 0 ) and if we can have 20-30% return on each subset and is working for 3-4 pairs , we can actually generate ~80-100% annual returns with manageable drawdowns. I will keep you guys updated.

I am also working on a new version which is dependent on currency strength and will use the linear martingale concept, but unfortunately we can't back-test it ( cAlgo doesn't allow multi instrument backtesting at this moment ). I will release it soon (in a separate thread) and we all can run in demo version to see how it performs.

Wish me luck!!

@trend_meanreversion

trend_meanreversion

28 Feb 2017, 04:21

( Updated at: 21 Dec 2023, 09:20 )

Initial risky martingale version is doing good so far for this week. Made 5% in 2 days and looking strong ..Wait and watch is the name of the game :)

https://www.myfxbook.com/members/TRMR/martingale-fx-v0/1977124

@trend_meanreversion

trend_meanreversion

28 Feb 2017, 22:57

( Updated at: 21 Dec 2023, 09:20 )

10% target done for the week already ( in 2 days !! ) . Good work 'risky' martingale  . Next week $target will be revised to 600$ per week ( ~10% of balance )

. Next week $target will be revised to 600$ per week ( ~10% of balance )

@trend_meanreversion

trend_meanreversion

06 Mar 2017, 09:44

Race is ON for 600$ this week :)

C'mon Martingale ...

@trend_meanreversion

trend_meanreversion

08 Mar 2017, 00:47

Risky martingale is up 230$ already..C'mn target is 600$ for the week !

----------------------------------------------------------------------------------------------------------------------------------------------------------------

On other note, i have released V2 of stable martingale which has very attractive features ( atleast for me )

1) All trades will be open from Monday and will be closed by Friday, so no weekend risk.

2) PnL threshold acts as weekly take profit. No more trades for that week if PnL Threshold has hit.

Check here /algos/cbots/show/1622

@trend_meanreversion

trend_meanreversion

09 Mar 2017, 04:58

( Updated at: 21 Dec 2023, 09:20 )

Risky Martingale's Target (~600$) reached again within 3 days !! Loving it :)

Will do another run next week with 600$ target . So far it has passed the endurance test.

@trend_meanreversion

skoutz.rothchild

13 Mar 2017, 12:29

Hi trend_meanreversion,

I tried reproducing your results using backtesting but I couldn't. Can you please provide some instructions on how to reproduce your results for the specified period using backtesting? If i manage to reproduce it i might "invest" something also :).

Thanks!

@skoutz.rothchild

trend_meanreversion

13 Mar 2017, 12:38

RE:

skoutz.rothchild said:

Hi trend_meanreversion,

I tried reproducing your results using backtesting but I couldn't. Can you please provide some instructions on how to reproduce your results for the specified period using backtesting? If i manage to reproduce it i might "invest" something also :).

Thanks!

Mate, which part is not getting reproduced. Please check here if it helps -> https://www.forexfactory.com/showthread.php?t=643341

Also, make sure that you use tick data. I am using IC markets tick data with 30$ per million. Email me exactly what are you seeing once you have tried your best to reproduce it. Many people have been able to check the results themselves so i will find it strange if you don't :)

@trend_meanreversion

skoutz.rothchild

13 Mar 2017, 14:01

Hi,

I tried for the period Febuary 11th to March 8th but i dont get 40% return. I will try again and send you the screenshot and input paramerers.

Thanks

@skoutz.rothchild

trend_meanreversion

13 Mar 2017, 14:06

RE:

skoutz.rothchild said:

Hi,

I tried for the period Febuary 11th to March 8th but i dont get 40% return. I will try again and send you the screenshot and input paramerers.

Thanks

Oh..ok now i get it. I did tell in the thread that myFX book link is for RISKY Martingale bot ( which i haven't shared as it is quite risky ). But what i have shared are the more stable versions ( V0 & V2 ) and i have attached the screenshot for backtest results for V0.

Hope it helps.

@trend_meanreversion

trend_meanreversion

14 Mar 2017, 11:11

my VPS machine got restarted due to stupid Windows update so i have to restart my algo ( RISKY Martingale one). I closed all the positions (with a loss) and restarted the algo because some trades went missing.

Hoping that it could recover the loss !

@trend_meanreversion

trend_meanreversion

15 Mar 2017, 02:58

( Updated at: 21 Dec 2023, 09:20 )

Just to update you guys on CurrencyStrength Bot ( i haven't shared it yet )..it is doing great and it is definitely going to be part of my live algos next month.

Attached Image (click to enlarge)

So far i am thinking to go live with -> CurrencyStrenght Bot + V2 Stable Martingale . What do you say ?

Note: Yesterday my VPS got restarted so i lost several trades and thus has to close the algo ( take a loss ) and restart again . And guess what , now my algo is not even able to execute market orders (because of some technical issue as per log ) and thus my algos are failing. I doubt that broker would have done something ( but it is not completely unlikely also ). The good thing is that i will have to put some strong error checking in the code but i am highly suspicious about brokers.

@trend_meanreversion

trend_meanreversion

15 Mar 2017, 16:41

Updated both V0 and V2 bots files ( /algos/cbots/show/1622 ) to make it more reliable to execution errors which i recently faced and also less updates/modify messages sent to server making it light for broker's server. Hope you will find it useful.

Also extended expiry to mid April for everyone to play around !

@trend_meanreversion

trend_meanreversion

17 Mar 2017, 10:35

( Updated at: 21 Dec 2023, 09:20 )

Risky Martingale version has again done it's charm despite several issues faced during this week ! Instead of 10% made ~13%

Attached Image (click to enlarge)

Next week will be next run [ Going live(fully) from April ]

@trend_meanreversion

andi21

23 Mar 2017, 01:38

Hello trend_meanreversion,

i am watching the results of your bot in myfxbook a time long.

The performance in my opinion is great!

I am working on a bot since several months (fulltime) incl. many many days of optimization ("sadly" i got many parameters).

I got quite good results in year 2016 (i optimized for that).

And yesterday i thought i am ready to go for forward testing and i runned 2014-2016. But strangely the year 2014 and 2015 performed not good (only even). So i thought i am getting crazy because the finish is getting further away...

I wanted to ask you if you can tell us what your bot is doing to get such great results (entry, sl, tp, exit etc.)? I mean it would be awesome if you could even share the sourcecode, but we cannot expect that because you did a lot of effort to get your bot like this.

Nevertheless no matter if you could provide some details to us or not (like i said i would understand that completely if not) good luck for your live going next month (risky martingale is running :) - but i did not see much risk in the results :) )!

Best Regards

Andi21

@andi21

trend_meanreversion

23 Mar 2017, 01:53

RE:

andi21 said:

Hello trend_meanreversion,

i am watching the results of your bot in myfxbook a time long.

The performance in my opinion is great!

I am working on a bot since several months (fulltime) incl. many many days of optimization ("sadly" i got many parameters).

I got quite good results in year 2016 (i optimized for that).

And yesterday i thought i am ready to go for forward testing and i runned 2014-2016. But strangely the year 2014 and 2015 performed not good (only even). So i thought i am getting crazy because the finish is getting further away...

I wanted to ask you if you can tell us what your bot is doing to get such great results (entry, sl, tp, exit etc.)? I mean it would be awesome if you could even share the sourcecode, but we cannot expect that because you did a lot of effort to get your bot like this.

Nevertheless no matter if you could provide some details to us or not (like i said i would understand that completely if not) good luck for your live going next month (risky martingale is running :) - but i did not see much risk in the results :) )!

Best Regards

Andi21

Hi Andi21,

First of all thanks for your words of appreciation ..it really helps and keeps me motivated !

My advice to you regarding martingale systems ( without revealing any secret sauce :P )

1) Put onus on entry levels..search for over-strech in market ( probably use multi time frames to confirm )

2) Grid spacing..try to be innovative here :) ..fixed , scaled version, ATR based etc etc..

3) Try different martingale position sizing ( there are hunderds.. linear, exponetial inreasing/decreasing, multiplier, doubling etc etc )

4) Try different TP schemes ( usually Martingale systems don't have SLs like mine and that's why i call it risky )..

I would suggest you to go through all of my posts/algo/comments which i have written in cTDN forums and i am sure you will be able to find something that will help you in some way or other.

I am already running live my Risky Martingale [ but usually quite conservative so lock in quite early ..like this week i locked in only 100$ even though risky martingale in demo is up 550$ :( ]

Most important thing for martingale systems is to understand associated risk which is 100% DD !! You can't avoid that , you can just delay it ! So make most of it till the time it hasn't seen that DD ,and that's where my stable version will help me. It has quite low probability of ruin ( but of-course can blow my account ). It has survived 3 years of tick data across multiple currency pairs which give me 'faith' in it .

Hope it helps and all the best !!

@trend_meanreversion

andi21

23 Mar 2017, 13:01

RE: RE:

trend_meanreversion said:

andi21 said:

Hello trend_meanreversion,

i am watching the results of your bot in myfxbook a time long.

The performance in my opinion is great!

I am working on a bot since several months (fulltime) incl. many many days of optimization ("sadly" i got many parameters).

I got quite good results in year 2016 (i optimized for that).

And yesterday i thought i am ready to go for forward testing and i runned 2014-2016. But strangely the year 2014 and 2015 performed not good (only even). So i thought i am getting crazy because the finish is getting further away...

I wanted to ask you if you can tell us what your bot is doing to get such great results (entry, sl, tp, exit etc.)? I mean it would be awesome if you could even share the sourcecode, but we cannot expect that because you did a lot of effort to get your bot like this.

Nevertheless no matter if you could provide some details to us or not (like i said i would understand that completely if not) good luck for your live going next month (risky martingale is running :) - but i did not see much risk in the results :) )!

Best Regards

Andi21

Hi Andi21,

First of all thanks for your words of appreciation ..it really helps and keeps me motivated !

My advice to you regarding martingale systems ( without revealing any secret sauce :P )

1) Put onus on entry levels..search for over-strech in market ( probably use multi time frames to confirm )

2) Grid spacing..try to be innovative here :) ..fixed , scaled version, ATR based etc etc..

3) Try different martingale position sizing ( there are hunderds.. linear, exponetial inreasing/decreasing, multiplier, doubling etc etc )

4) Try different TP schemes ( usually Martingale systems don't have SLs like mine and that's why i call it risky )..

I would suggest you to go through all of my posts/algo/comments which i have written in cTDN forums and i am sure you will be able to find something that will help you in some way or other.

I am already running live my Risky Martingale [ but usually quite conservative so lock in quite early ..like this week i locked in only 100$ even though risky martingale in demo is up 550$ :( ]

Most important thing for martingale systems is to understand associated risk which is 100% DD !! You can't avoid that , you can just delay it ! So make most of it till the time it hasn't seen that DD ,and that's where my stable version will help me. It has quite low probability of ruin ( but of-course can blow my account ). It has survived 3 years of tick data across multiple currency pairs which give me 'faith' in it .

Hope it helps and all the best !!

Thank you for the tips! I will look after it to try to improve my bot more and more.

Thanks and good luck!

Best Regards,

Andi21

@andi21

trend_meanreversion

23 Mar 2017, 23:24

( Updated at: 21 Dec 2023, 09:20 )

yippie (tough week though ) !! Risky Martingale did perform to my expectations ..made 600$ for the week ! Took 4 days this time instead of 3 , but i shouldn't complain.

Attached Image (click to enlarge)

Next week will be last run for it and then you guys can contact me directly regarding the cBot.

Wish me luck !!!!

@andi21 : I don't optimize my bots using cAlgo optimization tab. I start with a basic parameter settings which i feel makes sense and tweek it with a sample data ( in-sample) to get 'robust' results ( not necessarily the best ) and then try it on out of sample data and several underlyings to check it robustness . It is a lot of manual work and i have to test atleast 100 settings before i could come up with a number i am happy with [ I am a difficult person to please and i am my best critic when it comes to trading :) ]

@trend_meanreversion

trend_meanreversion

30 Mar 2017, 08:28

( Updated at: 21 Dec 2023, 09:20 )

Waiting for 80$ more to be made for this week and martingale would have proved its worth !!..C'mn Risky Martingale

Attached Image (click to enlarge)

@trend_meanreversion

trend_meanreversion

31 Mar 2017, 02:40

( Updated at: 21 Dec 2023, 09:20 )

Finally did it ..Hurray ... ( 80% in 7 weeks ..~10% target per week )

Attached Image (click to enlarge)

No more demo run going forward. This martingale has shown promise and passed my litmus test of profitability. Wish me luck guys !!

Contact me directly if you are interested in stable versions .

@trend_meanreversion

trend_meanreversion

31 Mar 2017, 03:35

RE:

tmc. said:

Hi mate, wish you best of luck! Do you plan to become signal provider on cMirror?

Thanks a lot TMC..really need all the luck i can get lol !

I can become signal provider in cMirror but not sure if it does replicate trades really well to subscribers. Last time i tried for DAX HFT, i got complaints that it can't replicate trades in their accounts due to delay/latency i suppose ( That one i can understand because DAX HFT is really a sharp tick scalper for most part ). I will give it a shot for martingale account later.

@trend_meanreversion

trend_meanreversion

31 Mar 2017, 10:30

RE:

andi21 said:

Forgot something to ask:

do you have also an real account at icmarkets and if yes how long have been there with the real account and also are you satisfied with them?

Thanks in advance.

Been with them for more than a year now. No major issues but obviously they are like other brokers and will slow you down in terms of execution, login issues etc from time to time. But overall you to have choose the best among the beasts ! cTrader hasn't become that popular yet and most of the regulated brokers don't offer it and if they do , then terms aren't attractive ( spreads, commissions, products etc.. ). I have only 2 choices to be honest ICmarket or Pepperstone. Pepperstone charges much more in terms of commissions and IC is a little better in spreads + commissions.

@trend_meanreversion

andi21

31 Mar 2017, 11:17

RE: RE:

trend_meanreversion said:

andi21 said:

Forgot something to ask:

do you have also an real account at icmarkets and if yes how long have been there with the real account and also are you satisfied with them?

Thanks in advance.

Been with them for more than a year now. No major issues but obviously they are like other brokers and will slow you down in terms of execution, login issues etc from time to time. But overall you to have choose the best among the beasts ! cTrader hasn't become that popular yet and most of the regulated brokers don't offer it and if they do , then terms aren't attractive ( spreads, commissions, products etc.. ). I have only 2 choices to be honest ICmarket or Pepperstone. Pepperstone charges much more in terms of commissions and IC is a little better in spreads + commissions.

Thanks for your answer. I asked, because i am currently choosing between FxPro and IC Markets (running a lot of optimization runs before demo forward testing).

I think i will give both a try running two demo accounts in parallel when i am ready to run forward testing and then i see which of them performs better. Of course, afterwards when i am going live it could be getting different results (more worse), but i hope it does not. Let's see and try :).

But overall you to have choose the best among the beasts

You are absolutely right - that is why i asked ;).

@andi21

tintin131211@gmail.com

05 Apr 2017, 15:38

( Updated at: 21 Dec 2023, 09:20 )

RE:

trend_meanreversion said:

yippie (tough week though ) !! Risky Martingale did perform to my expectations ..made 600$ for the week ! Took 4 days this time instead of 3 , but i shouldn't complain.

Attached Image (click to enlarge)

Next week will be last run for it and then you guys can contact me directly regarding the cBot.

Wish me luck !!!!

@andi21 : I don't optimize my bots using cAlgo optimization tab. I start with a basic parameter settings which i feel makes sense and tweek it with a sample data ( in-sample) to get 'robust' results ( not necessarily the best ) and then try it on out of sample data and several underlyings to check it robustness . It is a lot of manual work and i have to test atleast 100 settings before i could come up with a number i am happy with [ I am a difficult person to please and i am my best critic when it comes to trading :) ]

Hi, Im interested in your Martingale cBots, how do i contact you to discuss further?

@tintin131211@gmail.com

trend_meanreversion

05 Apr 2017, 15:54

( Updated at: 21 Dec 2023, 09:20 )

RE: RE:

tintin131211@gmail.com said:

trend_meanreversion said:

yippie (tough week though ) !! Risky Martingale did perform to my expectations ..made 600$ for the week ! Took 4 days this time instead of 3 , but i shouldn't complain.

Attached Image (click to enlarge)

Next week will be last run for it and then you guys can contact me directly regarding the cBot.

Wish me luck !!!!

@andi21 : I don't optimize my bots using cAlgo optimization tab. I start with a basic parameter settings which i feel makes sense and tweek it with a sample data ( in-sample) to get 'robust' results ( not necessarily the best ) and then try it on out of sample data and several underlyings to check it robustness . It is a lot of manual work and i have to test atleast 100 settings before i could come up with a number i am happy with [ I am a difficult person to please and i am my best critic when it comes to trading :) ]

Hi, Im interested in your Martingale cBots, how do i contact you to discuss further?

You can contact me "trend_meanreversion@yahoo.com"

@trend_meanreversion

trend_meanreversion

08 Apr 2017, 11:30

I have created a new version of V2 ( which is updated in first post ) which contains 2 new parameters as requested by some users. Please have a look and play around. I have extended expiry till 22nd April !!

See first post for new algo file and explanation of parameters.

@trend_meanreversion

trend_meanreversion

15 Apr 2017, 08:11

RE:

How does this bot handle market reversal? I did a quick backtest and it blew the account eventually, like martingale always does.

Does this bot attempt anything different to recognise that situation?

@trend_meanreversion

trend_meanreversion

15 Apr 2017, 08:16

It does a couple of things like very good few stable martingales strategies 1) Find good entry 2) Have a determinsintic approach to grid 3) Have a proper approach for Take Profit. Of course you can use wrong settings and it is easy to blow account with a Martingale bot. Also such bots expect market reversals so not sure what were you asking. In any case, good luck !!

@trend_meanreversion

trend_meanreversion

17 Apr 2017, 14:42

RE:

Have you ever tried equity stop loss? If account equity drops below this proportion of the account balance, then all open trades are closed immediately and exit.

Tried and tested it mate. There isn't a single Martingale strategy which will get benefitted by a tight stop loss in long run. It reduces probability of ruin for sure but doesn't help in return . It is basically like having a good thought of tight stop loss. Every trader believes that having a tight stop loss with higher risk reward is going to help him , but you need a very good entry signal for such strategies and most of the time you won't find any such strategy. So in effect tight stop loss of let's say 5 pips will just reduce your equity way more often that you would want.

@trend_meanreversion

lewdomi77

18 Apr 2017, 23:07

WOW Situation on GBP/USD

Hi

Have you noticed what happened today? on the market at GBP/USD GBP/JPY GBP/AUD.

How did the robots behave?

My account has almost zeroed.

Luckily it's a demo account. Al earnedl profit almost lost one day.

@lewdomi77

raphael.mca@hotmail.com

20 Apr 2017, 14:16

RE:

trend_meanreversion said:

It does a couple of things like very good few stable martingales strategies 1) Find good entry 2) Have a determinsintic approach to grid 3) Have a proper approach for Take Profit. Of course you can use wrong settings and it is easy to blow account with a Martingale bot. Also such bots expect market reversals so not sure what were you asking. In any case, good luck !!

I'm following up with your work and recently I'm using your cBot in my demo account. I did countless backtest's and everyone gave me satisfactory results, congratulations for your work. I'll keep using the demo account to evaluate his behavior live. I have an excellent strategy and trend, but I do not have the necessary knowledge to create a cBot, if you are willing and with time, I can explain the step-by-step in detail so that you create the cBot and we can even merge the condition of Martingale next to my strategy, what do you think?

@raphael.mca@hotmail.com

trend_meanreversion

23 Apr 2017, 15:55

RE: RE:

raphael.mca@hotmail.com said:

trend_meanreversion said:

It does a couple of things like very good few stable martingales strategies 1) Find good entry 2) Have a determinsintic approach to grid 3) Have a proper approach for Take Profit. Of course you can use wrong settings and it is easy to blow account with a Martingale bot. Also such bots expect market reversals so not sure what were you asking. In any case, good luck !!I'm following up with your work and recently I'm using your cBot in my demo account. I did countless backtest's and everyone gave me satisfactory results, congratulations for your work. I'll keep using the demo account to evaluate his behavior live. I have an excellent strategy and trend, but I do not have the necessary knowledge to create a cBot, if you are willing and with time, I can explain the step-by-step in detail so that you create the cBot and we can even merge the condition of Martingale next to my strategy, what do you think?

Sure mate, drop me an email @ "trend_meanreversion@yahoo.com" and we can carry this conversation in detail there. I don't promise anything but dependant on your strategy, i can be able evaluate if it is under my expertise of implementation and value of my time/effort.

@trend_meanreversion

derekszyszka

24 Apr 2017, 02:12

Nice work, love this bot. Can I get a copy of the source code? I know a few minor tweaks I would like to try with the PnL limit.

@derekszyszka

trend_meanreversion

24 Apr 2017, 02:20

RE:

derekszyszka said:

Nice work, love this bot. Can I get a copy of the source code? I know a few minor tweaks I would like to try with the PnL limit.

Thanks for the appreciation mate but no source code will be shared for my bots. If you want , you can lease them directly with me (without source code though ).

@trend_meanreversion

derekszyszka

24 Apr 2017, 05:01

Weird, is your bot somehow disabled now? I am unable to run any back testing in cAlgo, or test this with an addon I build on a demo account.

@derekszyszka

trend_meanreversion

24 Apr 2017, 05:04

RE:

derekszyszka said:

Weird, is your bot somehow disabled now? I am unable to run any back testing in cAlgo, or test this with an addon I build on a demo account.

Check post #42 mate ---->

trend_meanreversion said:

I have created a new version of V2 ( which is updated in first post ) which contains 2 new parameters as requested by some users. Please have a look and play around. I have extended expiry till 22nd April !!

See first post for new algo file and explanation of parameters.

@trend_meanreversion

derekszyszka

24 Apr 2017, 05:14

Its expired, thats too bad. I wanted to add my PnL percentage code, mixed with my api for automatic account transfers. That way you cant blow up your account on a sudden large movement swing because its constantly taking your profits out.

@derekszyszka

raphael.mca@hotmail.com

24 Apr 2017, 14:34

RE: RE: RE:

trend_meanreversion said:

raphael.mca@hotmail.com said:

trend_meanreversion said:

It does a couple of things like very good few stable martingales strategies 1) Find good entry 2) Have a determinsintic approach to grid 3) Have a proper approach for Take Profit. Of course you can use wrong settings and it is easy to blow account with a Martingale bot. Also such bots expect market reversals so not sure what were you asking. In any case, good luck !!I'm following up with your work and recently I'm using your cBot in my demo account. I did countless backtest's and everyone gave me satisfactory results, congratulations for your work. I'll keep using the demo account to evaluate his behavior live. I have an excellent strategy and trend, but I do not have the necessary knowledge to create a cBot, if you are willing and with time, I can explain the step-by-step in detail so that you create the cBot and we can even merge the condition of Martingale next to my strategy, what do you think?

Sure mate, drop me an email @ "trend_meanreversion@yahoo.com" and we can carry this conversation in detail there. I don't promise anything but dependant on your strategy, i can be able evaluate if it is under my expertise of implementation and value of my time/effort.

I emailed you with some information about my proposal.

@raphael.mca@hotmail.com

raphael.mca@hotmail.com

24 Apr 2017, 14:38

RE:

derekszyszka said:

Its expired, thats too bad. I wanted to add my PnL percentage code, mixed with my api for automatic account transfers. That way you cant blow up your account on a sudden large movement swing because its constantly taking your profits out.

Do you have an API that automatically transfers your funds to another account / bank?

@raphael.mca@hotmail.com

derekszyszka

24 Apr 2017, 16:43

RE: RE: RE: RE:

raphael.mca@hotmail.com said:

trend_meanreversion said:

raphael.mca@hotmail.com said:

trend_meanreversion said:

It does a couple of things like very good few stable martingales strategies 1) Find good entry 2) Have a determinsintic approach to grid 3) Have a proper approach for Take Profit. Of course you can use wrong settings and it is easy to blow account with a Martingale bot. Also such bots expect market reversals so not sure what were you asking. In any case, good luck !!I'm following up with your work and recently I'm using your cBot in my demo account. I did countless backtest's and everyone gave me satisfactory results, congratulations for your work. I'll keep using the demo account to evaluate his behavior live. I have an excellent strategy and trend, but I do not have the necessary knowledge to create a cBot, if you are willing and with time, I can explain the step-by-step in detail so that you create the cBot and we can even merge the condition of Martingale next to my strategy, what do you think?

Sure mate, drop me an email @ "trend_meanreversion@yahoo.com" and we can carry this conversation in detail there. I don't promise anything but dependant on your strategy, i can be able evaluate if it is under my expertise of implementation and value of my time/effort.

I emailed you with some information about my proposal.

I did not get any email. I emailed you directly to trend_meanreversion@yahoo.com

@derekszyszka

trend_meanreversion

25 Apr 2017, 00:27

RE: RE: RE: RE: RE:

derekszyszka said:

raphael.mca@hotmail.com said:

trend_meanreversion said:

raphael.mca@hotmail.com said:

trend_meanreversion said:

It does a couple of things like very good few stable martingales strategies 1) Find good entry 2) Have a determinsintic approach to grid 3) Have a proper approach for Take Profit. Of course you can use wrong settings and it is easy to blow account with a Martingale bot. Also such bots expect market reversals so not sure what were you asking. In any case, good luck !!I'm following up with your work and recently I'm using your cBot in my demo account. I did countless backtest's and everyone gave me satisfactory results, congratulations for your work. I'll keep using the demo account to evaluate his behavior live. I have an excellent strategy and trend, but I do not have the necessary knowledge to create a cBot, if you are willing and with time, I can explain the step-by-step in detail so that you create the cBot and we can even merge the condition of Martingale next to my strategy, what do you think?

Sure mate, drop me an email @ "trend_meanreversion@yahoo.com" and we can carry this conversation in detail there. I don't promise anything but dependant on your strategy, i can be able evaluate if it is under my expertise of implementation and value of my time/effort.

I emailed you with some information about my proposal.

I did not get any email. I emailed you directly to trend_meanreversion@yahoo.com

Hi derekszyszka:: That statement of proposal was directed to me from raphael.mca@hotmail.com . Hope it clears the doubt.

@trend_meanreversion

whis.gg

14 Feb 2017, 12:28

Hey, good luck with that! Please keep us updated even if it doesn't go well. I am very interested on your results, me myself tried to achieve profitable martingale robot as well but didn't succeed.

@whis.gg