Backtesting Result Differences

16 Jan 2016, 01:40

Hello everyone and thanks for your time in advance, there is something that I don't understand

I did a backtest for my algo (which you can find beneath this thread) and the results are so different with different start and end dates.

Let me show you what I mean

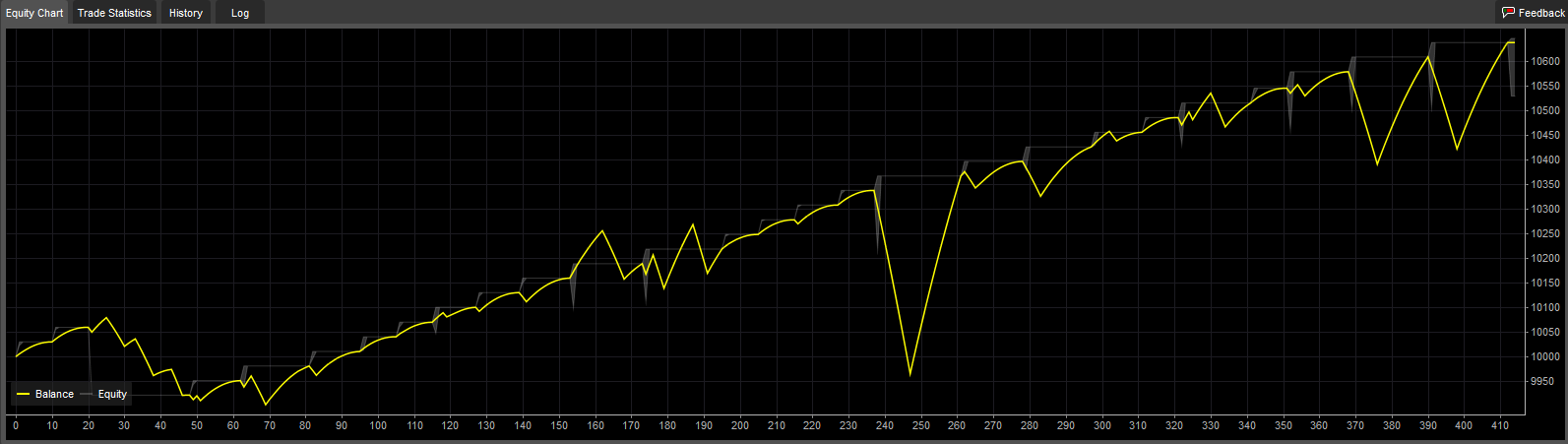

The parameters ,inputs, timeframe, currency and everything are the same in both charts

Settings used: Tick data from server , 01/01/2014 to 11/30/2014

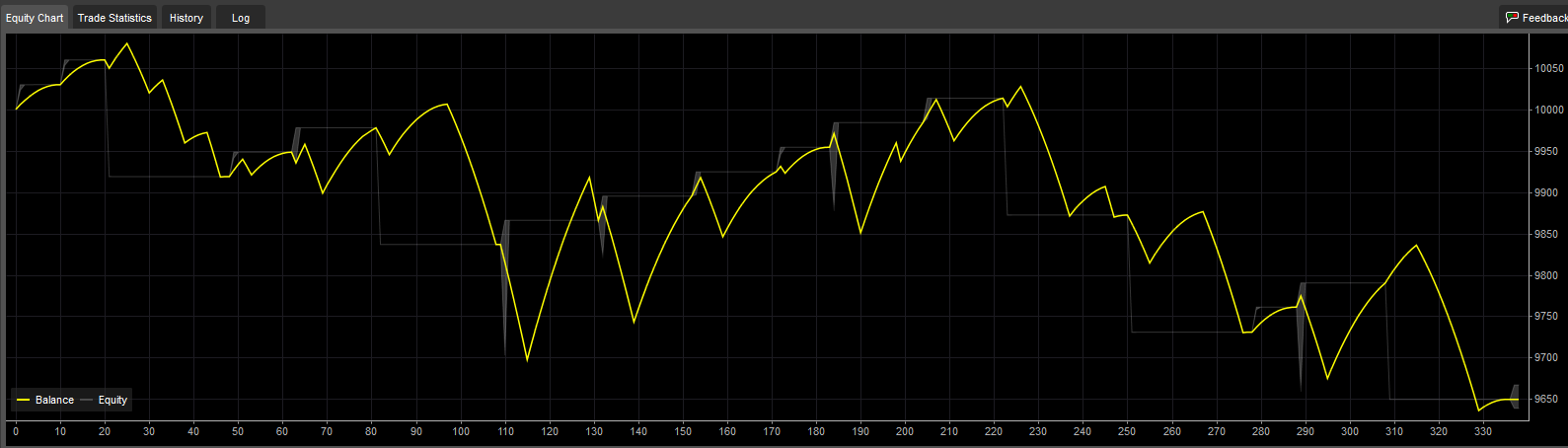

And this is the second chart. Settings used: Tick data from server, 01/01/2014 to 12/30/2014 (+1 month)

I don't understand why there are such big differences. I checked the first backtest and all trades were closed on October 29th. So basically, shouldn't the results be the same until that point? In both charts?

using System;

using System.Linq;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using cAlgo.Indicators;

namespace cAlgo

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class Grid : Robot

{

[Parameter(DefaultValue = 20)]

public int PipDifference { get; set; }

[Parameter(DefaultValue = 20)]

public int maxGrids { get; set; }

[Parameter(DefaultValue = 20)]

public int ProfitperGrid { get; set; }

protected override void OnStart()

{

int curGrid = 1;

double startprice = Symbol.Ask;

while (curGrid <= maxGrids / 2)

{

PlaceStopOrder(TradeType.Buy, Symbol, Symbol.QuantityToVolume(0.01), startprice + curGrid * PipDifference * Symbol.PipSize);

curGrid++;

}

while (curGrid <= maxGrids)

{

PlaceStopOrder(TradeType.Sell, Symbol, Symbol.QuantityToVolume(0.01), startprice - (curGrid - maxGrids / 2) * PipDifference * Symbol.PipSize);

curGrid++;

}

}

void nochmal()

{

int curGrid = 1;

double startprice = Symbol.Ask;

while (curGrid <= maxGrids / 2)

{

PlaceStopOrder(TradeType.Buy, Symbol, Symbol.QuantityToVolume(0.01), startprice + curGrid * PipDifference * Symbol.PipSize);

curGrid++;

}

while (curGrid <= maxGrids)

{

PlaceStopOrder(TradeType.Sell, Symbol, Symbol.QuantityToVolume(0.01), startprice - (curGrid - maxGrids / 2) * PipDifference * Symbol.PipSize);

curGrid++;

}

}

protected override void OnTick()

{

if (Positions.Count == maxGrids)

{

foreach (var ps in Positions)

{

ClosePosition(ps, Symbol.QuantityToVolume(0.01));

}

Print("Lost Grid");

nochmal();

}

if (Symbol.UnrealizedGrossProfit > ProfitperGrid)

{

Print("Won Grid");

foreach (var ps in Positions)

{

ClosePosition(ps, Symbol.QuantityToVolume(0.01));

}

foreach (var ps in PendingOrders)

{

CancelPendingOrder(ps);

}

nochmal();

}

}

protected override void OnStop()

{

}

}

}

Replies

danny.weckhuyzen

17 Jan 2016, 11:04

When I look into your code I see that you are using stop-orders. I've discouvered with this platform that the stoploss and takeprofit is not always correctly set when the entry-price is reached. In my code I especially made an extra routine to correct the stoploss-pips and takeprofit-pips after opening of the order. Regards

@danny.weckhuyzen

jan-vdh

17 Jan 2016, 18:29

RE:

danny.weckhuyzen said:

When I look into your code I see that you are using stop-orders. I've discouvered with this platform that the stoploss and takeprofit is not always correctly set when the entry-price is reached. In my code I especially made an extra routine to correct the stoploss-pips and takeprofit-pips after opening of the order. Regards

Thanks for your reply! But I'm not using Take Profits or Stop Losses in my code

But yeah currently I do think aswell that the backtesting system is just not accurate.

@jan-vdh

jan-vdh

16 Jan 2016, 05:30 ( Updated at: 21 Dec 2023, 09:20 )

Let me show a clear example. Same parameters, same everything. The trades were opened at the same time, but closed differently.

@jan-vdh