HA

Robot forex help to fix error

08 Oct 2015, 17:33

I want stop all position when VerticalHorizontalFilter >= 0.39 and start again when VerticalHorizontalFilter <0.39 pls help!!!!

using System;

using System.Linq;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using cAlgo.Indicators;

namespace cAlgo.Robots

{

[Robot("Robot Forex", AccessRights = AccessRights.None)]

public class Robot_ForexBBandandSL : Robot

{

[Parameter(DefaultValue = 1000, MinValue = 1000)]

public int FirstLot { get; set; }

[Parameter("Take_Profit", DefaultValue = 180, MinValue = 10)]

public int TakeProfit { get; set; }

[Parameter("Tral_Start", DefaultValue = 50)]

public int Tral_Start { get; set; }

[Parameter("Tral_Stop", DefaultValue = 50)]

public int Tral_Stop { get; set; }

[Parameter(DefaultValue = 300)]

public int PipStep { get; set; }

[Parameter(DefaultValue = 5, MinValue = 2)]

public int MaxOrders { get; set; }

[Parameter("Source")]

public DataSeries Source { get; set; }

[Parameter("Band Height (pips)", DefaultValue = 40.0, MinValue = 0)]

public double BandHeightPips { get; set; }

[Parameter("Bollinger Bands Deviations", DefaultValue = 2)]

public double Deviations { get; set; }

[Parameter("Bollinger Bands Periods", DefaultValue = 20)]

public int Periods { get; set; }

[Parameter("Bollinger Bands MA Type")]

public MovingAverageType MAType { get; set; }

[Parameter("Vertical Horizontal Filter Periods", DefaultValue = 42)]

public int VHFPeriods { get; set; }

private Position position;

private bool RobotStopped;

private int LotStep = 1000;

private VerticalHorizontalFilter VHFilter;

BollingerBands bollingerBands;

string label = "Sample Breakout cBot";

int consolidation;

protected override void OnStart()

{

bollingerBands = Indicators.BollingerBands(Source, Periods, Deviations, MAType);

VHFilter = Indicators.VerticalHorizontalFilter(MarketSeries.Close, VHFPeriods);

}

protected override void OnTick()

{

double Bid = Symbol.Bid;

double Ask = Symbol.Ask;

double Point = Symbol.PointSize;

if (Trade.IsExecuting)

return;

if (Account.Positions.Count > 0 && RobotStopped)

return;

else

RobotStopped = false;

if (Account.Positions.Count == 0)

SendFirstOrder(FirstLot);

else

ControlSeries();

foreach (var position in Account.Positions)

{

if (position.SymbolCode == Symbol.Code)

{

if (position.TradeType == TradeType.Buy)

{

if (Bid - GetAveragePrice(TradeType.Buy) >= Tral_Start * Point)

if (Bid - Tral_Stop * Point >= position.StopLoss)

Trade.ModifyPosition(position, Bid - Tral_Stop * Point, position.TakeProfit);

}

if (position.TradeType == TradeType.Sell)

{

if (GetAveragePrice(TradeType.Sell) - Ask >= Tral_Start * Point)

if (Ask + Tral_Stop * Point <= position.StopLoss || position.StopLoss == 0)

Trade.ModifyPosition(position, Ask + Tral_Stop * Point, position.TakeProfit);

}

}

}

}

protected override void OnError(Error CodeOfError)

{

if (CodeOfError.Code == ErrorCode.NoMoney)

{

RobotStopped = true;

Print("ERROR!!! No money for order open, robot is stopped!");

}

else if (CodeOfError.Code == ErrorCode.BadVolume)

{

RobotStopped = true;

Print("ERROR!!! Bad volume for order open, robot is stopped!");

}

}

private void SendFirstOrder(int OrderVolume)

{

int Signal = GetStdIlanSignal();

if (!(Signal < 0))

switch (Signal)

{

case 0:

Trade.CreateBuyMarketOrder(Symbol, OrderVolume);

break;

case 1:

Trade.CreateSellMarketOrder(Symbol, OrderVolume);

break;

}

}

protected override void OnPositionOpened(Position openedPosition)

{

double? StopLossPrice = null;

double? TakeProfitPrice = null;

if (Account.Positions.Count == 1)

{

position = openedPosition;

if (position.TradeType == TradeType.Buy)

TakeProfitPrice = position.EntryPrice + TakeProfit * Symbol.PointSize;

if (position.TradeType == TradeType.Sell)

TakeProfitPrice = position.EntryPrice - TakeProfit * Symbol.PointSize;

}

else

switch (GetPositionsSide())

{

case 0:

TakeProfitPrice = GetAveragePrice(TradeType.Buy) + TakeProfit * Symbol.PointSize;

break;

case 1:

TakeProfitPrice = GetAveragePrice(TradeType.Sell) - TakeProfit * Symbol.PointSize;

break;

}

for (int i = 0; i < Account.Positions.Count; i++)

{

position = Account.Positions[i];

if (StopLossPrice != null || TakeProfitPrice != null)

Trade.ModifyPosition(position, position.StopLoss, TakeProfitPrice);

}

}

private double GetAveragePrice(TradeType TypeOfTrade)

{

double Result = Symbol.Bid;

double AveragePrice = 0;

long Count = 0;

for (int i = 0; i < Account.Positions.Count; i++)

{

position = Account.Positions[i];

if (position.TradeType == TypeOfTrade)

{

AveragePrice += position.EntryPrice * position.Volume;

Count += position.Volume;

}

}

if (AveragePrice > 0 && Count > 0)

Result = AveragePrice / Count;

return Result;

}

private int GetPositionsSide()

{

int Result = -1;

int i, BuySide = 0, SellSide = 0;

for (i = 0; i < Account.Positions.Count; i++)

{

if (Account.Positions[i].TradeType == TradeType.Buy)

BuySide++;

if (Account.Positions[i].TradeType == TradeType.Sell)

SellSide++;

}

if (BuySide == Account.Positions.Count)

Result = 0;

if (SellSide == Account.Positions.Count)

Result = 1;

return Result;

}

private void ControlSeries()

{

int _pipstep, NewVolume, Rem;

int BarCount = 25;

int Del = MaxOrders - 1;

if (PipStep == 0)

_pipstep = GetDynamicPipstep(BarCount, Del);

else

_pipstep = PipStep;

if (Account.Positions.Count < MaxOrders)

switch (GetPositionsSide())

{

case 0:

if (Symbol.Ask < FindLastPrice(TradeType.Buy) - _pipstep * Symbol.PointSize)

{

NewVolume = Math.DivRem((int)(FirstLot + FirstLot * Account.Positions.Count), LotStep, out Rem) * LotStep;

if (!(NewVolume < LotStep))

Trade.CreateBuyMarketOrder(Symbol, NewVolume);

}

break;

case 1:

if (Symbol.Bid > FindLastPrice(TradeType.Sell) + _pipstep * Symbol.PointSize)

{

NewVolume = Math.DivRem((int)(FirstLot + FirstLot * Account.Positions.Count), LotStep, out Rem) * LotStep;

if (!(NewVolume < LotStep))

Trade.CreateSellMarketOrder(Symbol, NewVolume);

}

break;

}

}

private int GetDynamicPipstep(int CountOfBars, int Del)

{

int Result;

double HighestPrice = 0, LowestPrice = 0;

int StartBar = MarketSeries.Close.Count - 2 - CountOfBars;

int EndBar = MarketSeries.Close.Count - 2;

for (int i = StartBar; i < EndBar; i++)

{

if (HighestPrice == 0 && LowestPrice == 0)

{

HighestPrice = MarketSeries.High[i];

LowestPrice = MarketSeries.Low[i];

continue;

}

if (MarketSeries.High[i] > HighestPrice)

HighestPrice = MarketSeries.High[i];

if (MarketSeries.Low[i] < LowestPrice)

LowestPrice = MarketSeries.Low[i];

}

Result = (int)((HighestPrice - LowestPrice) / Symbol.PointSize / Del);

return Result;

}

private double FindLastPrice(TradeType TypeOfTrade)

{

double LastPrice = 0;

for (int i = 0; i < Account.Positions.Count; i++)

{

position = Account.Positions[i];

if (TypeOfTrade == TradeType.Buy)

if (position.TradeType == TypeOfTrade)

{

if (LastPrice == 0)

{

LastPrice = position.EntryPrice;

continue;

}

if (position.EntryPrice < LastPrice)

LastPrice = position.EntryPrice;

}

if (TypeOfTrade == TradeType.Sell)

if (position.TradeType == TypeOfTrade)

{

if (LastPrice == 0)

{

LastPrice = position.EntryPrice;

continue;

}

if (position.EntryPrice > LastPrice)

LastPrice = position.EntryPrice;

}

}

return LastPrice;

}

private int GetStdIlanSignal()

{

int Result = -1;

int LastBarIndex = MarketSeries.Close.Count - 2;

int PrevBarIndex = LastBarIndex - 1;

var top = bollingerBands.Top.Last(1);

var bottom = bollingerBands.Bottom.Last(1);

if (Symbol.Bid < bottom)

Result = 0;

if (Symbol.Ask > top)

Result = 1;

return Result;

}

public void Stop()

{

double value = VHFilter.Result(MarketSeries.Close, VHFPeriods);

if (value > 0.39)

{

// close all account positions

foreach (var pos in Account.Positions)

{

Trade.Close(pos);

}

Stop();

// Stop the robot

}

}

}

}

Spotware

13 Oct 2015, 00:23

Dear Trader,

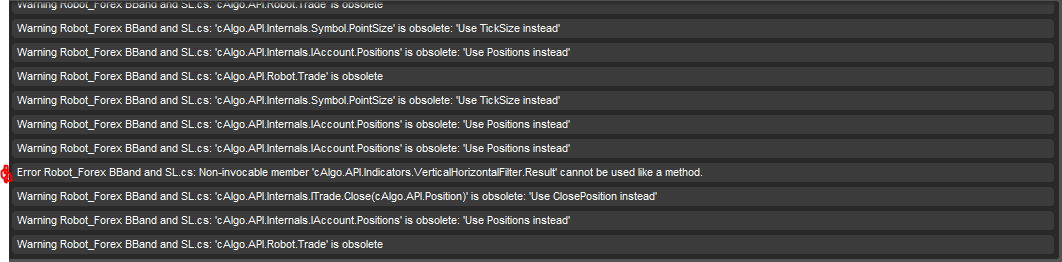

You are trying to assign an IndicatorDataSeries to a double variable which is not possible.

You should access a value stored in the IndicatorDataSeries using the index. e.g.

We would like to inform you that we do not provide coding assistance services. We more than glad to assist you with specific questions about cAlgo.API. You also can contact one of our Partners or post a job in Development Jobs section for further coding assistance.

@Spotware