Help with indicador Fractals API

19 Dec 2022, 16:38

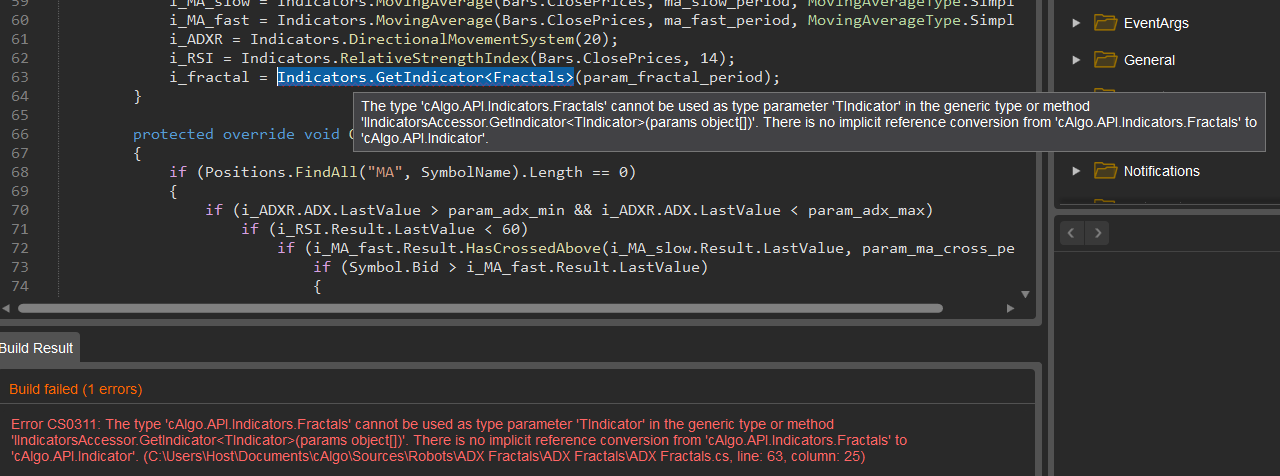

Can someone help me to fix this Fractals indicator error?

I've studied and researched and I couldn't get any references to correct.

using System;

using System.Collections;

using System.Linq;

using cAlgo.API;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using cAlgo.Indicators;

namespace cAlgo.Robots

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class ADXFractals : Robot

{

[Parameter("SMA Slow", DefaultValue = 100, MinValue = 50, MaxValue = 1000, Step = 50)]

public int ma_slow_period { get; set; }

[Parameter("SMA Fast", DefaultValue = 30, MinValue = 10, MaxValue = 100, Step = 10)]

public int ma_fast_period { get; set; }

[Parameter("MA Cross", DefaultValue = 30, MinValue = 10, MaxValue = 200, Step = 10)]

public int param_ma_cross_period { get; set; }

[Parameter("ADX Min Value", DefaultValue = 20, MinValue = 10, MaxValue = 100, Step = 1)]

public int param_adx_min { get; set; }

[Parameter("ADX Max Value", DefaultValue = 40, MinValue = 30, MaxValue = 100, Step = 5)]

public int param_adx_max { get; set; }

[Parameter("Fractal Period", DefaultValue = 10, MinValue = 10, MaxValue = 100, Step = 10)]

public int param_fractal_period { get; set; }

[Parameter("Fractal diff", DefaultValue = 0, MinValue = 0, MaxValue = 10, Step = 1)]

public int param_fractal_diff { get; set; }

[Parameter("Min SL", DefaultValue = 30, MinValue = 5, MaxValue = 100, Step = 1)]

public int param_min_stop_loss { get; set; }

[Parameter("Max SL", DefaultValue = 50, MinValue = 30, MaxValue = 50, Step = 5)]

public int param_max_stop_loss { get; set; }

[Parameter("Min TP", DefaultValue = 30, MinValue = 5, MaxValue = 50, Step = 5)]

public int param_min_take_profit { get; set; }

[Parameter("Max TP", DefaultValue = 50, MinValue = 30, MaxValue = 50, Step = 1)]

public int param_max_take_profit { get; set; }

[Parameter("Volume Units", DefaultValue = 100000, MinValue = 1000, MaxValue = 1000000, Step = 1000)]

public int volume_units { get; set; }

private MovingAverage i_MA_slow;

private MovingAverage i_MA_fast;

private DirectionalMovementSystem i_ADXR;

private RelativeStrengthIndex i_RSI;

private Fractals i_fractal;

protected override void OnStart()

{

i_MA_slow = Indicators.MovingAverage(Bars.ClosePrices, ma_slow_period, MovingAverageType.Simple);

i_MA_fast = Indicators.MovingAverage(Bars.ClosePrices, ma_fast_period, MovingAverageType.Simple);

i_ADXR = Indicators.DirectionalMovementSystem(20);

i_RSI = Indicators.RelativeStrengthIndex(Bars.ClosePrices, 14);

i_fractal = Indicators.GetIndicator<Fractals>(param_fractal_period);

}

protected override void OnTick()

{

if (Positions.FindAll("MA", SymbolName).Length == 0)

{

if (i_ADXR.ADX.LastValue > param_adx_min && i_ADXR.ADX.LastValue < param_adx_max)

if (i_RSI.Result.LastValue < 60)

if (i_MA_fast.Result.HasCrossedAbove(i_MA_slow.Result.LastValue, param_ma_cross_period))

if (Symbol.Bid > i_MA_fast.Result.LastValue)

{

Open_Buy_Order();

return;

}

if (i_ADXR.ADX.LastValue > param_adx_min && i_ADXR.ADX.LastValue < param_adx_max)

if (i_RSI.Result.LastValue > 40)

if (i_MA_fast.Result.HasCrossedBelow(i_MA_slow.Result.LastValue, param_ma_cross_period))

if (Symbol.Bid < i_MA_fast.Result.LastValue)

{

Open_Sell_Order();

return;

}

}

}

private void Open_Buy_Order()

{

double tp = 0, sl = 0;

tp = getTakeProfit(TradeType.Buy);

sl = getStopLoss(TradeType.Buy);

if (tp > param_min_take_profit && tp < param_max_take_profit && sl > param_min_stop_loss && sl < param_max_stop_loss)

ExecuteMarketOrder(TradeType.Buy, SymbolName, volume_units, "MA", sl + param_fractal_diff, tp - param_fractal_diff);

}

private void Open_Sell_Order()

{

double tp = 0, sl = 0;

tp = getTakeProfit(TradeType.Sell);

sl = getStopLoss(TradeType.Sell);

if (tp > param_min_take_profit && tp < param_max_take_profit && sl > param_min_stop_loss && sl < param_max_stop_loss)

ExecuteMarketOrder(TradeType.Sell, SymbolName, volume_units, "MA", sl + param_fractal_diff, tp - param_fractal_diff);

}

private double getTakeProfit(TradeType type)

{

double tp = 0;

if (type == TradeType.Buy)

{

for (int i = i_fractal.UpFractal.Count; i > 0; i--)

{

if (!double.IsNaN(i_fractal.UpFractal[i]))

{

if ((i_fractal.UpFractal[i] - Symbol.Bid) / Symbol.PipSize > param_min_take_profit)

if ((i_fractal.UpFractal[i] - Symbol.Bid) / Symbol.PipSize < param_max_take_profit)

{

tp = (i_fractal.UpFractal[i] - Symbol.Bid) / Symbol.PipSize;

break;

}

}

}

}

if (type == TradeType.Sell)

{

for (int i = i_fractal.DownFractal.Count; i > 0; i--)

{

if (!double.IsNaN(i_fractal.DownFractal[i]))

{

if ((Symbol.Bid - i_fractal.DownFractal[i]) / Symbol.PipSize > param_min_stop_loss)

if ((Symbol.Bid - i_fractal.DownFractal[i]) / Symbol.PipSize < param_max_stop_loss)

{

tp = (Symbol.Bid - i_fractal.DownFractal[i]) / Symbol.PipSize;

break;

}

}

}

}

return tp;

}

private double getStopLoss(TradeType type)

{

double sl = 0;

if (type == TradeType.Buy)

{

for (int i = i_fractal.DownFractal.Count; i > 0; i--)

{

if (!double.IsNaN(i_fractal.DownFractal[i]))

{

if ((Symbol.Bid - i_fractal.DownFractal[i]) / Symbol.PipSize > param_min_stop_loss)

if ((Symbol.Bid - i_fractal.DownFractal[i]) / Symbol.PipSize < param_max_stop_loss)

{

sl = (Symbol.Bid - i_fractal.DownFractal[i]) / Symbol.PipSize;

break;

}

}

}

}

if (type == TradeType.Sell)

{

for (int i = i_fractal.UpFractal.Count; i > 0; i--)

{

if (!double.IsNaN(i_fractal.UpFractal[i]))

{

if ((i_fractal.UpFractal[i] - Symbol.Bid) / Symbol.PipSize > param_min_take_profit)

if ((i_fractal.UpFractal[i] - Symbol.Bid) / Symbol.PipSize < param_max_take_profit)

{

sl = (i_fractal.UpFractal[i] - Symbol.Bid) / Symbol.PipSize;

break;

}

}

}

}

return sl;

}

}

}

Replies

Host

20 Dec 2022, 16:05

RE:

PanagiotisChar said:

Hi there,

Here you go

i_fractal = Indicators.Fractals(param_fractal_period);Need help? Join us on Telegram

Need premium support? Trade with us

Thank you very much!!

@Host

PanagiotisChar

20 Dec 2022, 09:30

Hi there,

Here you go

Aieden Technologies

Need help? Join us on Telegram

Need premium support? Trade with us

@PanagiotisChar