What’s New in cMirror 2.0

18 Dec 2017, 11:13

Dear Traders,

We are excited to announce upcoming changes to cMirror in version 2.0 which will be released soon, with many more new features planned for 2018. This is just the first installment which contains mostly under-the-hood changes. Please find the details below.

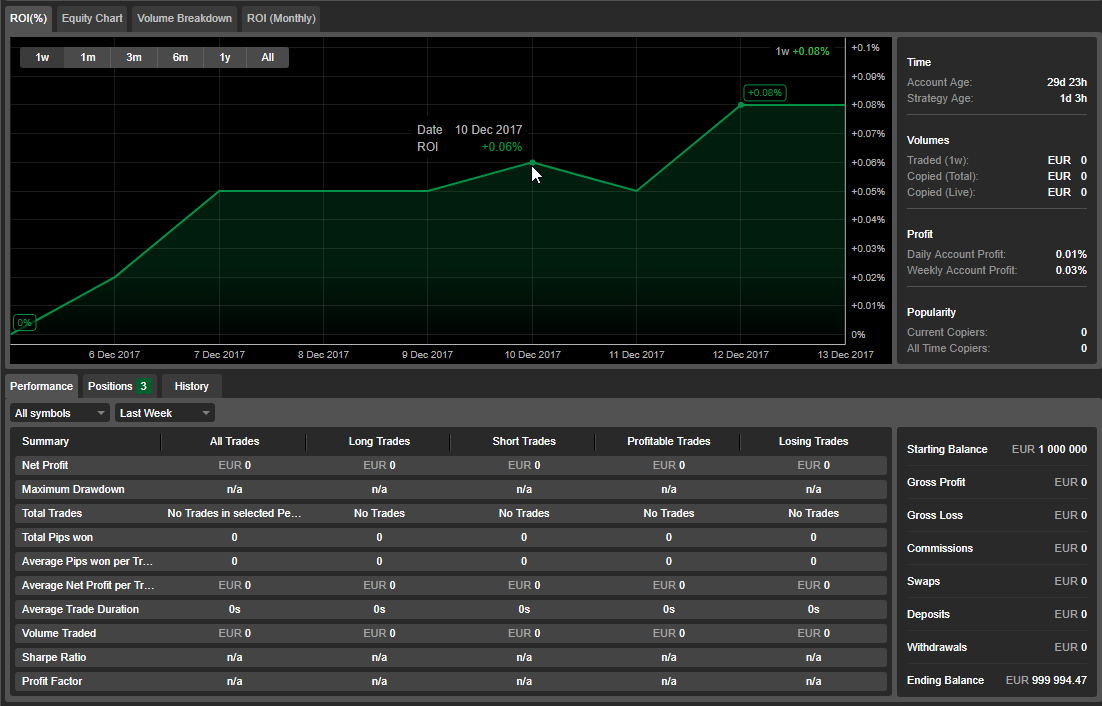

Time Weighted ROI

We have aligned cMirror with the industry standard calculation method and are now showing time-weighted ROI (TWR). TWR measurement is required by the Global Investment Performance Standards published by the CFA Institute. The time-weighted method supposes that cash inflows, cash outflows and amounts invested over different time periods have no impact on the resulted value. The migration to this new calculation method may cause your ROI to change due to the introduction of the new underlying calculation method. You can find more details on the calculation method here.

New Monthly ROI chart

We have introduced a new type of performance chart called Monthly ROI Chart. ROI per month is calculated as account's change in equity from the beginning of the month until the end of the month and offsets any deposits and withdrawals.

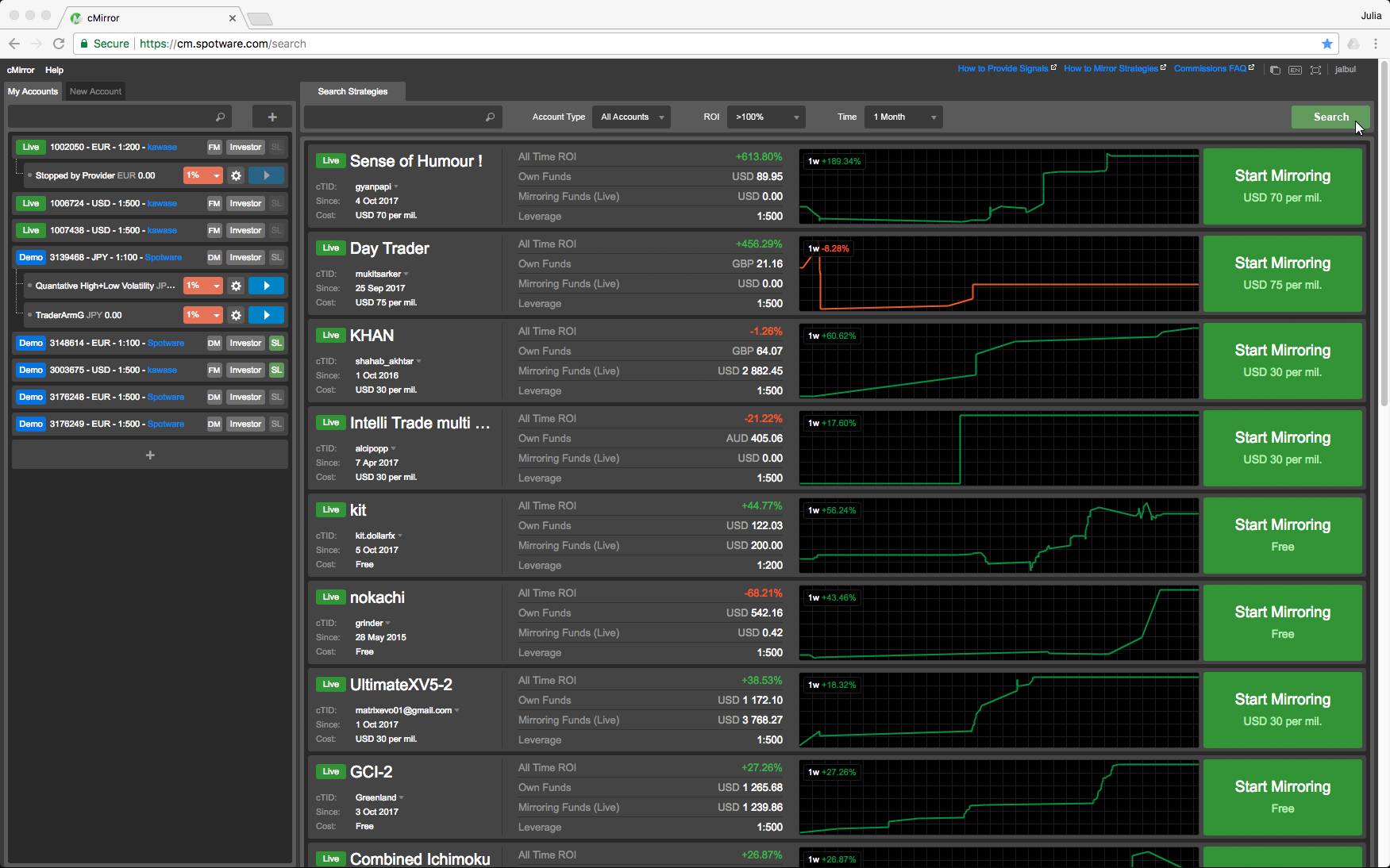

Improved ROI Filter

Previously, there was the ROI slider with which it was hard to adjust for necessary values. Now the slider is replaced with a drop down which offers predefined values. Now filtering is more user-friendly.

Pagination (Pages)

Sorting strategies has been moved to server-side and strategies are shown in pages as opposed to infinite scrolling style, this means cMirror does not request excessive data for strategies on launch but only the necessary data for the current page. Because of this cMirror works faster.

Yours Sincerely,

cTrader Team

Replies

PanagiotisCharalampous

21 Dec 2017, 09:59

Hi tradingu,

cTrader Copy which is coming soon will feature management and performance fees. Stay tuned!

Best Regards,

Panagiotis

@PanagiotisCharalampous

tradingu

22 Dec 2017, 02:20

Oh! that looks very very good.

But I do have a secondary question.

Will ctradercopy cater to professional money managers which work under a formal regulation like ASIC?

Because regulated money managers can only work with selected clients after they pass their KYC and other regulatory requirements. Some can only work with high net worth clients or other professional institutions, and not just with any unknown retail person or with US or Japan residents?

Or is it mainly aiming to be a retail copy trading platform?

@tradingu

tradingu

26 Jan 2018, 02:58

RE:

tradingu said:

Oh! that looks very very good.

But I do have a secondary question.

Will ctradercopy cater to professional money managers which work under a formal regulation like ASIC?

Because regulated money managers can only work with selected clients after they pass their KYC and other regulatory requirements. Some can only work with high net worth clients or other professional institutions, and not just with any unknown retail person or with US or Japan residents?

Or is it mainly aiming to be a retail copy trading platform?

Is it possible to get an answers for above questions :) ?

@tradingu

PanagiotisCharalampous

26 Jan 2018, 11:39

Hi tradingu,

cTrader Copy can cater both types of clients. Are there any features you believe professional money managers should have?

Best Regards,

Panagiotis

@PanagiotisCharalampous

burakbirer

03 Mar 2018, 13:22

( Updated at: 21 Dec 2023, 09:20 )

RE:

,Panagiotis Charalampous said:

Hi tradingu,

cTrader Copy can cater both types of clients. Are there any features you believe professional money managers should have?

Best Regards,

Panagiotis

Hi Panagiotis,

I have some fundamental thoughts about cMirror.

VOLUME

I believe subscribers should be able to copy the signal based on their available free margin as a percentage. This way if a signal provider is using %20 of his/her free margin than subscriber will use the %20 of his/her free margin. This way volume calculation will be fully automated.

FEE

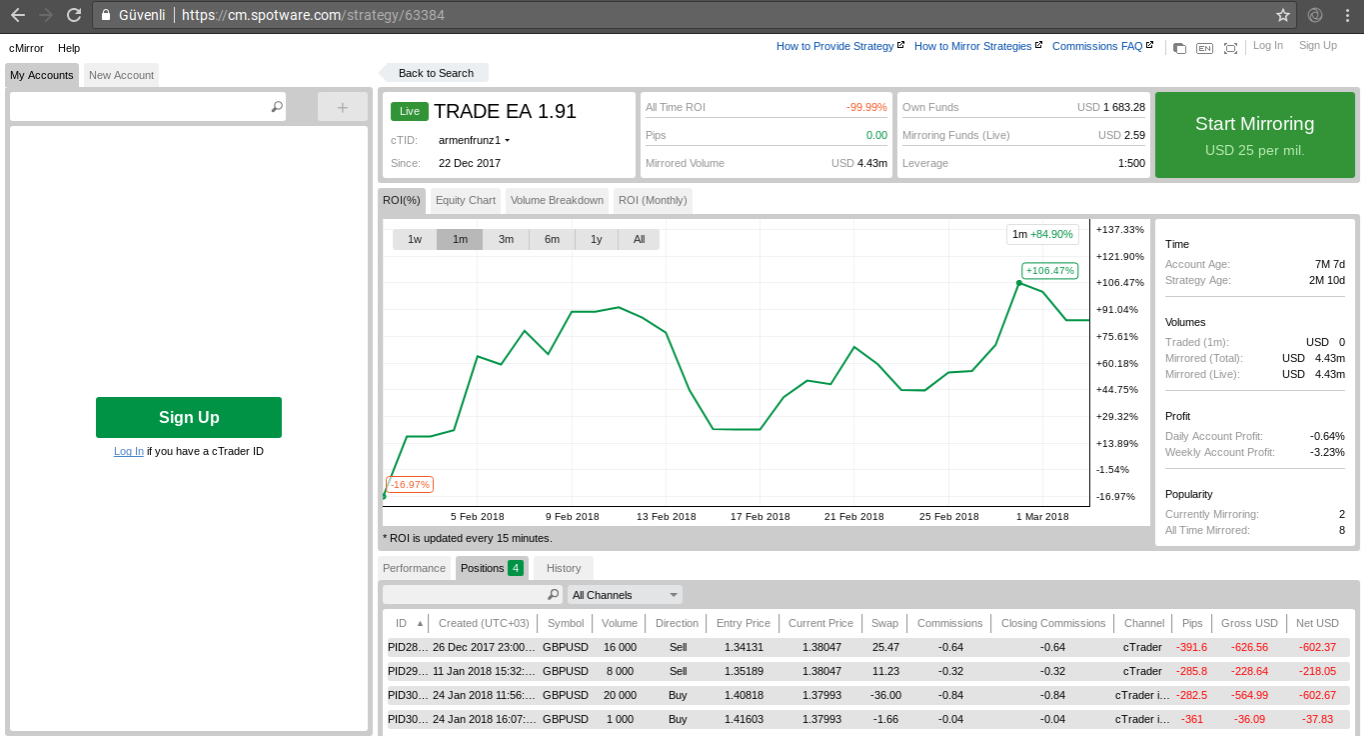

First of all, please understand that not all signals are scalping signals. Currently, you can copy/see long-term trades for free. Please see the screenshot.

So it's obvious that "open positions" should be subscribed users only. And a weekly / monthly fee is a must for subscribing.

COMMISIONS

After having a basic fee the reward for the signal providers might be based on winning trades only. No one would be happy to pay for a losing signal.

And again the reward/commission could be based on the realized profit's percentage instead of the position volume.

Please feel free to contact me.

@burakbirer

PanagiotisCharalampous

05 Mar 2018, 10:47

Hi burakbirer,

Thanks for your feedback. All the features you request will be a part of cTrader Copy, the successor of cMirror, which will be released soon. You can read more in the cTrader Copy section of our website.

Best Regards,

Panagiotis

@PanagiotisCharalampous

PanagiotisCharalampous

07 May 2018, 15:41

Hi sarxweb,

cTrader Copy has not been released yet. We will inform you as soon as this happens.

Best Regards,

Panagiotis

@PanagiotisCharalampous

tradingu

21 Dec 2017, 09:38

Currently providers can only charge per lot fees.

Are there any plans to add ability to charge admin and high water mark performance fees?

Cmirror has great potential, but it lacks basic features which even very old MAM/PAMM softwares like metafx for MT4 have.

@tradingu