Description

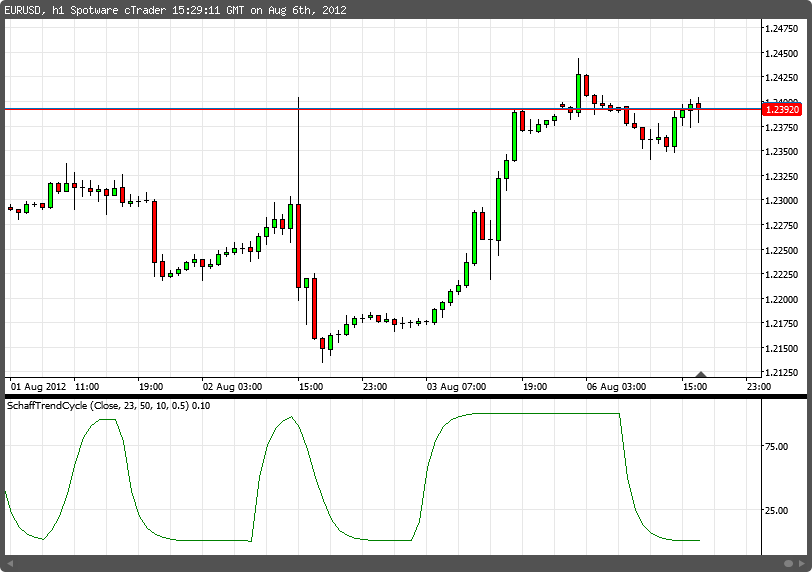

The Schaff Trend Cycle is a faster and more accurate indicator than the MACD because the currency cycle trends are factored into the equation of the MACD. The STC Indicator uses a 23- and 50-period EMA with a cycle component used as the 10-period signal line. Factoring in cycle trends based on a certain amount of days, indicates how far and how long a trend lasts. The algorithm involves applying the smoothed stochastic twice on the MACD Line. The result combines the benefits of both indicators. In trending markets it moves between 0 and 100, rising when an uptrend is accelerating and falling when a downtrend is accelerating.

u

sktrader

Joined on 03.08.2012

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: SchaffTrendCycle.algo

- Rating: 5

- Installs: 6468

- Modified: 13/10/2021 09:54

Comments

Hi, perhaps you can fix as follows.

Factor may be calculated as follows.

Factor = 2.0 / (1.0 + 0.5 * Period);

private double Highest(IndicatorDataSeries macd, int index)

{

double dblhigh = macd[index - Period];

for (int i = index - Period + 1; i <= index; i++)

{

if (macd[i] > dblhigh)

dblhigh = macd[i];

}

return dblhigh;

}

private double Lowest(IndicatorDataSeries macd, int index)

{

double dbllow = macd[index - Period];

for (int i = index - Period + 1; i <= index; i++)

{

if (macd[i] < dbllow)

dbllow = macd[i];

}

return dbllow;

}

Cheers

Hi, the display of the indicator when downloaded is totally different from the actually indicator. Can you check that out.

Cheers

Hello,

I know that Schaff is an oscillator. It should go from 0 to 100. I'm wrong?