Description

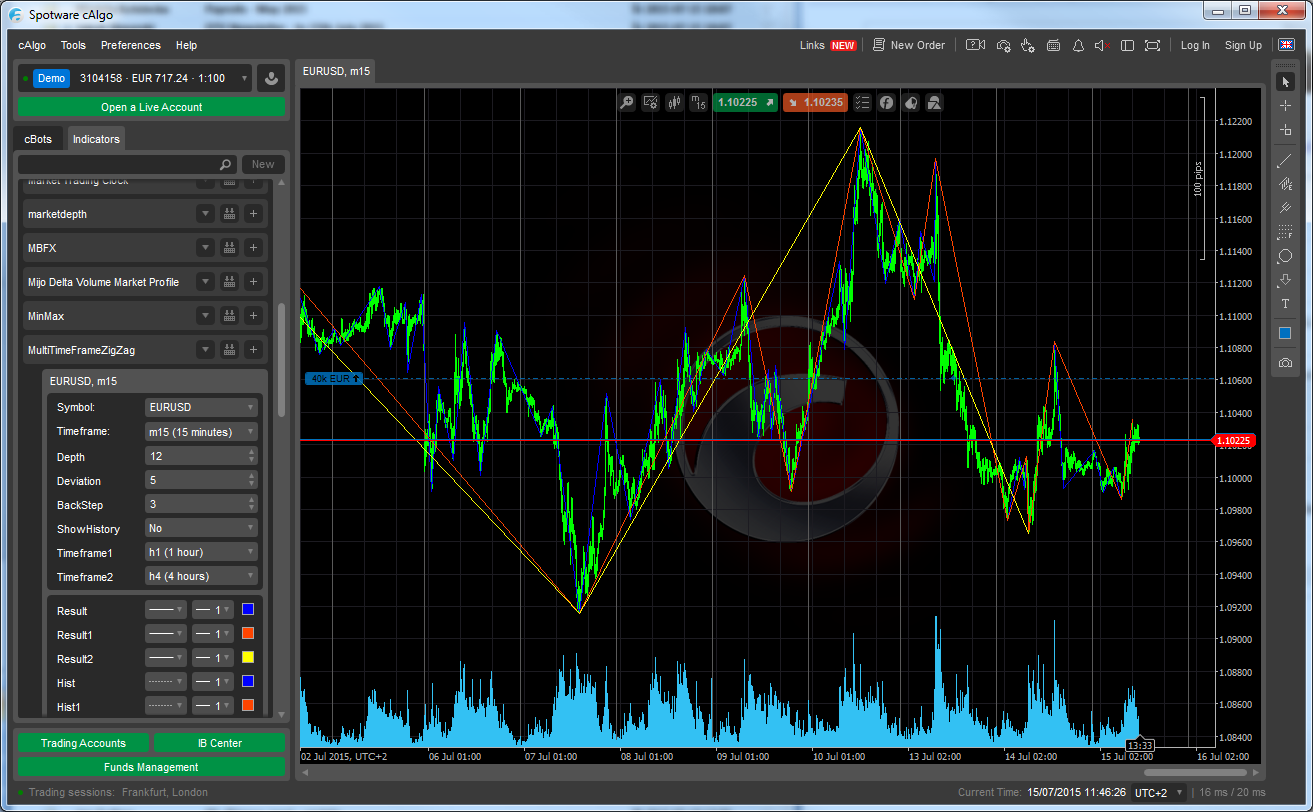

ZigZag indicator, allowing the usage of multiple TimeFrames within one indicator

In this sample three different TimeFrames, but it's expandable.

Show history-option: displays historical steps of ZigZag algorithm.

Based on kkostaki's ZigZag indicator, /algos/indicators/show/157 Thanks kkostaki!

// ZigZag indicator, allowing the usage of multiple TimeFrames within one indicator

// In this sample three different TimeFrames, but it's expandable

// Based on kkostaki's ZigZag indicator, http://ctdn.com/algos/indicators/show/157

// Thanks kkostaki!

// Author: cmdpirx, creation date: 15.07.2015

using System;

using cAlgo.API;

using cAlgo.API.Internals;

namespace cAlgo.Indicators

{

[Indicator(IsOverlay = true, AccessRights = AccessRights.None)]

public class MultiTimeFrameZigZag : Indicator

{

[Parameter(DefaultValue = 12)]

public int Depth { get; set; }

[Parameter(DefaultValue = 5)]

public int Deviation { get; set; }

[Parameter(DefaultValue = 3)]

public int BackStep { get; set; }

[Parameter(DefaultValue = false)]

public bool ShowHistory { get; set; }

[Parameter("Timeframe1", DefaultValue = "Hour")]

public TimeFrame Timeframe1 { get; set; }

[Parameter("Timeframe2", DefaultValue = "Hour4")]

public TimeFrame Timeframe2 { get; set; }

[Output("Result", Color = Colors.Blue)]

public IndicatorDataSeries Result { get; set; }

[Output("Result1", Color = Colors.OrangeRed)]

public IndicatorDataSeries Result1 { get; set; }

[Output("Result2", Color = Colors.Yellow)]

public IndicatorDataSeries Result2 { get; set; }

[Output("Hist", Color = Colors.Blue, LineStyle = LineStyle.Dots)]

public IndicatorDataSeries Hist { get; set; }

[Output("Hist1", Color = Colors.OrangeRed, LineStyle = LineStyle.Dots)]

public IndicatorDataSeries Hist1 { get; set; }

[Output("Hist2", Color = Colors.Yellow, LineStyle = LineStyle.Dots)]

public IndicatorDataSeries Hist2 { get; set; }

#region Private fields

private ZigZag zigzag;

private ZigZag zigzag1;

private ZigZag zigzag2;

#endregion

protected override void Initialize()

{

zigzag = new ZigZag(this, MarketSeries.TimeFrame, Depth, Deviation, BackStep, ShowHistory);

zigzag1 = new ZigZag(this, Timeframe1, Depth, Deviation, BackStep, ShowHistory);

zigzag2 = new ZigZag(this, Timeframe2, Depth, Deviation, BackStep, ShowHistory);

}

public override void Calculate(int index)

{

zigzag.Calculate(index, Result, Hist);

zigzag1.Calculate(index, Result1, Hist1);

zigzag2.Calculate(index, Result2, Hist2);

}

}

public class ZigZag

{

private double m_lastLow;

private double m_lastHigh;

private double m_low;

private double m_high;

private int m_lastHighIndex;

private int m_lastLowIndex;

private int m_type;

private double m_point;

private int m_depth;

private int m_deviation;

private int m_backStep;

private bool m_showHistory;

private IndicatorDataSeries m_highZigZags;

private IndicatorDataSeries m_lowZigZags;

private MarketSeries m_ds;

private MultiTimeFrameZigZag m_indicator;

public ZigZag(MultiTimeFrameZigZag indicator, TimeFrame tm, int depth, int dev, int back, bool showHist)

{

m_indicator = indicator;

m_depth = depth;

m_deviation = dev;

m_backStep = back;

m_showHistory = showHist;

m_type = 0;

m_low = m_high = 0;

Initialize(tm);

}

public void Initialize(TimeFrame tm)

{

m_ds = m_indicator.MarketData.GetSeries(tm);

m_highZigZags = m_indicator.CreateDataSeries();

m_lowZigZags = m_indicator.CreateDataSeries();

m_point = m_indicator.Symbol.TickSize;

}

private double GetMax(MarketSeries series, int start, int lenght)

{

double m = 0;

int len = lenght;

while (len > 0)

{

if (series.High[start - len + 1] > m)

m = series.High[start - len + 1];

len--;

}

return m;

}

private double GetMin(MarketSeries series, int start, int lenght)

{

int len = lenght;

double m = series.Low[start - len + 1];

while (len > 0)

{

if (series.Low[start - len + 1] < m)

m = series.Low[start - len + 1];

len--;

}

return m;

}

private void StatusDisplay(string s)

{

if (m_indicator.IsRealTime)

{

m_indicator.ChartObjects.RemoveObject("State1");

m_indicator.ChartObjects.DrawText("State1", s, StaticPosition.BottomRight, Colors.Yellow);

}

}

public void Calculate(int ix, IndicatorDataSeries Result, IndicatorDataSeries Hist)

{

//m_indicator.ChartObjects.DrawText("index1" + ix.ToString(), ix.ToString(), ix, m_indicator.MarketSeries.High[ix], VerticalAlignment.Bottom, HorizontalAlignment.Center, Colors.Yellow);

var index = m_ds.OpenTime.GetIndexByTime(m_indicator.MarketSeries.OpenTime[ix]);

if (index == -1)

{

m_indicator.Print("-1");

return;

}

if (index < m_depth)

{

return;

}

var _currentLow = GetMin(m_ds, index, m_depth);

var _currentHigh = GetMax(m_ds, index, m_depth);

//m_indicator.Print("A-{0:d4}/{1:d4}\t{6:d1}\t{2:f5}/{3:f5}\t{4:f5}/{5:f5}\t{7}/{8}\t{9}/{10}\t{11:f5}/{12:f5}", index, ix, m_lastLow, _currentLow, m_lastHigh, _currentHigh, m_type, m_low, m_high,

//m_lastLowIndex, m_lastHighIndex, m_lowZigZags[index], m_highZigZags[index]);

if (Math.Abs(_currentLow - m_lastLow) < double.Epsilon)

{

_currentLow = 0.0;

}

else

{

m_lastLow = _currentLow;

if ((m_ds.Low[index] - _currentLow) > (m_deviation * m_point))

_currentLow = 0.0;

else

{

for (int i = 1; i <= m_backStep; i++)

{

if (Math.Abs(m_lowZigZags[index - i]) > double.Epsilon && m_lowZigZags[index - i] > _currentLow)

m_lowZigZags[index - i] = 0.0;

}

}

}

if (Math.Abs(m_ds.Low[index] - _currentLow) < double.Epsilon)

{

m_lowZigZags[index] = m_ds.Low[index];

}

else

m_lowZigZags[index] = 0.0;

if (Math.Abs(_currentHigh - m_lastHigh) < double.Epsilon)

_currentHigh = 0.0;

else

{

m_lastHigh = _currentHigh;

if ((_currentHigh - m_ds.High[index]) > (m_deviation * m_point))

_currentHigh = 0.0;

else

{

for (int i = 1; i <= m_backStep; i++)

{

if (Math.Abs(m_highZigZags[index - i]) > double.Epsilon && m_highZigZags[index - i] < _currentHigh)

m_highZigZags[index - i] = 0.0;

}

}

}

if (Math.Abs(m_ds.High[index] - _currentHigh) < double.Epsilon)

{

m_highZigZags[index] = m_ds.High[index];

}

else

m_highZigZags[index] = 0.0;

//m_indicator.Print("B-{0}/{1}\t{6}\tL:{2}/{3}\tH:{4}/{5}\t{7}/{8}\t{9}/{10}\t{11}/{12}\t{13}/{14}", ix, index, m_lastLow, _currentLow, m_lastHigh, _currentHigh, m_type, m_low, m_high,

//m_lastLowIndex, m_lastHighIndex, m_lowZigZags[index], m_highZigZags[index], m_indicator.MarketSeries.Low[ix], m_indicator.MarketSeries.High[ix]);

switch (m_type)

{

case 0:

//StatusDisplay(string.Format("â¼{0:F5}/{1:F5}\nâ²{2:F5}/{3:F5}\n{4:F5}\n{5}", _currentHigh, Math.Abs(m_ds.Close[index] - _currentHigh), _currentLow, Math.Abs(m_ds.Close[index] - _currentLow), (m_deviation * m_point), m_type));

if (Math.Abs(m_low - 0) < double.Epsilon && Math.Abs(m_high - 0) < double.Epsilon)

{

if (Math.Abs(m_highZigZags[index]) > double.Epsilon)

{

m_high = m_ds.High[index];

m_lastHighIndex = ix;

m_type = -1;

Result[ix] = m_high;

//m_indicator.ChartObjects.DrawText("index1" + ix.ToString(), ix.ToString(), ix, m_high, VerticalAlignment.Top, HorizontalAlignment.Center, Colors.Red);

}

if (Math.Abs(m_lowZigZags[index]) > double.Epsilon)

{

m_low = m_ds.Low[index];

m_lastLowIndex = ix;

m_type = 1;

Result[ix] = m_low;

//m_indicator.ChartObjects.DrawText("index1" + ix.ToString(), ix.ToString(), ix, m_low, VerticalAlignment.Top, HorizontalAlignment.Center, Colors.Red);

}

Hist[ix] = m_showHistory == true ? Result[ix] : double.NaN;

}

break;

case 1:

//StatusDisplay(string.Format("â¼{0:F5}/{1:F5}\n{2:F5}\n{3}", _currentHigh, Math.Abs(m_ds.Close[index] - _currentHigh), (m_deviation * m_point), m_type));

if (Math.Abs(Result[m_lastLowIndex] - m_indicator.MarketSeries.Low[ix]) < double.Epsilon && m_ds.TimeFrame != m_indicator.MarketSeries.TimeFrame)

{

Result[m_lastLowIndex] = double.NaN;

Hist[m_lastLowIndex] = m_showHistory == true ? Hist[m_lastLowIndex] : double.NaN;

m_lastLowIndex = ix;

Result[ix] = m_low;

Hist[ix] = m_showHistory == true ? Result[ix] : double.NaN;

}

if (Math.Abs(m_lowZigZags[index]) > double.Epsilon && m_lowZigZags[index] < m_low && Math.Abs(m_highZigZags[index] - 0.0) < double.Epsilon)

{

Result[m_lastLowIndex] = double.NaN;

m_lastLowIndex = ix;

m_low = m_lowZigZags[index];

Result[ix] = m_low;

Hist[ix] = m_showHistory == true ? Result[ix] : double.NaN;

//m_indicator.ChartObjects.DrawText("index1" + ix.ToString(), ix.ToString(), ix, m_low, VerticalAlignment.Top, HorizontalAlignment.Center, Colors.Blue);

}

if (Math.Abs(m_highZigZags[index] - 0.0) > double.Epsilon && Math.Abs(m_lowZigZags[index] - 0.0) < double.Epsilon)

{

m_high = m_highZigZags[index];

m_lastHighIndex = ix;

Result[ix] = m_high;

m_type = -1;

Hist[ix] = m_showHistory == true ? Result[ix] : double.NaN;

//m_indicator.ChartObjects.DrawText("index1" + ix.ToString(), ix.ToString(), ix, m_high, VerticalAlignment.Top, HorizontalAlignment.Center, Colors.Red);

}

break;

case -1:

//StatusDisplay(string.Format("â²{0:F5}/{1:F5}\n{2:F5}\n{3}", _currentLow, Math.Abs(m_ds.Close[index] - _currentLow), (m_deviation * m_point), m_type));

if (Math.Abs(Result[m_lastHighIndex] - m_indicator.MarketSeries.High[ix]) < double.Epsilon && m_ds.TimeFrame != m_indicator.MarketSeries.TimeFrame)

{

Result[m_lastHighIndex] = double.NaN;

Hist[m_lastHighIndex] = m_showHistory == true ? Hist[m_lastHighIndex] : double.NaN;

m_lastHighIndex = ix;

Result[ix] = m_high;

Hist[ix] = m_showHistory == true ? Result[ix] : double.NaN;

}

if (Math.Abs(m_highZigZags[index]) > double.Epsilon && m_highZigZags[index] > m_high && Math.Abs(m_lowZigZags[index] - 0.0) < double.Epsilon)

{

Result[m_lastHighIndex] = double.NaN;

m_lastHighIndex = ix;

m_high = m_highZigZags[index];

Result[ix] = m_high;

Hist[ix] = m_showHistory == true ? Result[ix] : double.NaN;

//m_indicator.ChartObjects.DrawText("index1" + ix.ToString(), ix.ToString(), ix, m_high, VerticalAlignment.Top, HorizontalAlignment.Center, Colors.Red);

}

if (Math.Abs(m_lowZigZags[index]) > double.Epsilon && Math.Abs(m_highZigZags[index]) < double.Epsilon)

{

m_low = m_lowZigZags[index];

m_lastLowIndex = ix;

Result[ix] = m_low;

m_type = 1;

Hist[ix] = m_showHistory == true ? Result[ix] : double.NaN;

//m_indicator.ChartObjects.DrawText("index1" + ix.ToString(), ix.ToString(), ix, m_low, VerticalAlignment.Top, HorizontalAlignment.Center, Colors.Red);

}

break;

default:

return;

}

}

}

}

cmdpirx

Joined on 14.07.2015

- Distribution: Free

- Language: C#

- Trading platform: cTrader Automate

- File name: MultiTimeFrameZigZag.algo

- Rating: 5

- Installs: 6622

- Modified: 13/10/2021 09:54

Comments

Good job cmdpirx.

The same indicator but with added 3rd timeframe:

// ZigZag indicator, allowing the usage of multiple TimeFrames within one indicator

// In this sample three different TimeFrames, but it's expandable

// Based on kkostaki's ZigZag indicator, /algos/indicators/show/157

// Thanks kkostaki!

// Author: cmdpirx, creation date: 15.07.2015

using System;

using cAlgo.API;

using cAlgo.API.Internals;

namespace cAlgo.Indicators

{

[Indicator(IsOverlay = true, AccessRights = AccessRights.None)]

public class MultiTimeFrameZigZag : Indicator

{

[Parameter(DefaultValue = 12)]

public int Depth { get; set; }

[Parameter(DefaultValue = 5)]

public int Deviation { get; set; }

[Parameter(DefaultValue = 3)]

public int BackStep { get; set; }

[Parameter(DefaultValue = false)]

public bool ShowHistory { get; set; }

[Parameter("Timeframe1", DefaultValue = "Minute5")]

public TimeFrame Timeframe1 { get; set; }

[Parameter("Timeframe2", DefaultValue = "Hour")]

public TimeFrame Timeframe2 { get; set; }

[Parameter("Timeframe3", DefaultValue = "Hour4")]

public TimeFrame Timeframe3 { get; set; }

[Output("Result", Color = Colors.Blue)]

public IndicatorDataSeries Result { get; set; }

[Output("Result1", Color = Colors.OrangeRed)]

public IndicatorDataSeries Result1 { get; set; }

[Output("Result2", Color = Colors.Yellow)]

public IndicatorDataSeries Result2 { get; set; }

[Output("Result3", Color = Colors.Black)]

public IndicatorDataSeries Result3 { get; set; }

[Output("Hist", Color = Colors.Blue, LineStyle = LineStyle.Dots)]

public IndicatorDataSeries Hist { get; set; }

[Output("Hist1", Color = Colors.OrangeRed, LineStyle = LineStyle.Dots)]

public IndicatorDataSeries Hist1 { get; set; }

[Output("Hist2", Color = Colors.Yellow, LineStyle = LineStyle.Dots)]

public IndicatorDataSeries Hist2 { get; set; }

[Output("Hist3", Color = Colors.Black, LineStyle = LineStyle.Dots)]

public IndicatorDataSeries Hist3 { get; set; }

#region Private fields

private ZigZag zigzag;

private ZigZag zigzag1;

private ZigZag zigzag2;

private ZigZag zigzag3;

#endregion

protected override void Initialize()

{

zigzag = new ZigZag(this, MarketSeries.TimeFrame, Depth, Deviation, BackStep, ShowHistory);

zigzag1 = new ZigZag(this, Timeframe1, Depth, Deviation, BackStep, ShowHistory);

zigzag2 = new ZigZag(this, Timeframe2, Depth, Deviation, BackStep, ShowHistory);

zigzag3 = new ZigZag(this, Timeframe2, Depth, Deviation, BackStep, ShowHistory);

}

public override void Calculate(int index)

{

zigzag.Calculate(index, Result, Hist);

zigzag1.Calculate(index, Result1, Hist1);

zigzag2.Calculate(index, Result2, Hist2);

zigzag3.Calculate(index, Result3, Hist3);

}

}

public class ZigZag

{

private double m_lastLow;

private double m_lastHigh;

private double m_low;

private double m_high;

private int m_lastHighIndex;

private int m_lastLowIndex;

private int m_type;

private double m_point;

private int m_depth;

private int m_deviation;

private int m_backStep;

private bool m_showHistory;

private IndicatorDataSeries m_highZigZags;

private IndicatorDataSeries m_lowZigZags;

private MarketSeries m_ds;

private MultiTimeFrameZigZag m_indicator;

public ZigZag(MultiTimeFrameZigZag indicator, TimeFrame tm, int depth, int dev, int back, bool showHist)

{

m_indicator = indicator;

m_depth = depth;

m_deviation = dev;

m_backStep = back;

m_showHistory = showHist;

m_type = 0;

m_low = m_high = 0;

Initialize(tm);

}

public void Initialize(TimeFrame tm)

{

m_ds = m_indicator.MarketData.GetSeries(tm);

m_highZigZags = m_indicator.CreateDataSeries();

m_lowZigZags = m_indicator.CreateDataSeries();

m_point = m_indicator.Symbol.TickSize;

}

private double GetMax(MarketSeries series, int start, int lenght)

{

double m = 0;

int len = lenght;

while (len > 0)

{

if (series.High[start - len + 1] > m)

m = series.High[start - len + 1];

len--;

}

return m;

}

private double GetMin(MarketSeries series, int start, int lenght)

{

int len = lenght;

double m = series.Low[start - len + 1];

while (len > 0)

{

if (series.Low[start - len + 1] < m)

m = series.Low[start - len + 1];

len--;

}

return m;

}

private void StatusDisplay(string s)

{

if (m_indicator.IsRealTime)

{

m_indicator.ChartObjects.RemoveObject("State1");

m_indicator.ChartObjects.DrawText("State1", s, StaticPosition.BottomRight, Colors.Yellow);

}

}

public void Calculate(int ix, IndicatorDataSeries Result, IndicatorDataSeries Hist)

{

//m_indicator.ChartObjects.DrawText("index1" + ix.ToString(), ix.ToString(), ix, m_indicator.MarketSeries.High[ix], VerticalAlignment.Bottom, HorizontalAlignment.Center, Colors.Yellow);

var index = m_ds.OpenTime.GetIndexByTime(m_indicator.MarketSeries.OpenTime[ix]);

if (index == -1)

{

m_indicator.Print("-1");

return;

}

if (index < m_depth)

{

return;

}

var _currentLow = GetMin(m_ds, index, m_depth);

var _currentHigh = GetMax(m_ds, index, m_depth);

//m_indicator.Print("A-{0:d4}/{1:d4}\t{6:d1}\t{2:f5}/{3:f5}\t{4:f5}/{5:f5}\t{7}/{8}\t{9}/{10}\t{11:f5}/{12:f5}", index, ix, m_lastLow, _currentLow, m_lastHigh, _currentHigh, m_type, m_low, m_high,

//m_lastLowIndex, m_lastHighIndex, m_lowZigZags[index], m_highZigZags[index]);

if (Math.Abs(_currentLow - m_lastLow) < double.Epsilon)

{

_currentLow = 0.0;

}

else

{

m_lastLow = _currentLow;

if ((m_ds.Low[index] - _currentLow) > (m_deviation * m_point))

_currentLow = 0.0;

else

{

for (int i = 1; i <= m_backStep; i++)

{

if (Math.Abs(m_lowZigZags[index - i]) > double.Epsilon && m_lowZigZags[index - i] > _currentLow)

m_lowZigZags[index - i] = 0.0;

}

}

}

if (Math.Abs(m_ds.Low[index] - _currentLow) < double.Epsilon)

{

m_lowZigZags[index] = m_ds.Low[index];

}

else

m_lowZigZags[index] = 0.0;

if (Math.Abs(_currentHigh - m_lastHigh) < double.Epsilon)

_currentHigh = 0.0;

else

{

m_lastHigh = _currentHigh;

if ((_currentHigh - m_ds.High[index]) > (m_deviation * m_point))

_currentHigh = 0.0;

else

{

for (int i = 1; i <= m_backStep; i++)

{

if (Math.Abs(m_highZigZags[index - i]) > double.Epsilon && m_highZigZags[index - i] < _currentHigh)

m_highZigZags[index - i] = 0.0;

}

}

}

if (Math.Abs(m_ds.High[index] - _currentHigh) < double.Epsilon)

{

m_highZigZags[index] = m_ds.High[index];

}

else

m_highZigZags[index] = 0.0;

//m_indicator.Print("B-{0}/{1}\t{6}\tL:{2}/{3}\tH:{4}/{5}\t{7}/{8}\t{9}/{10}\t{11}/{12}\t{13}/{14}", ix, index, m_lastLow, _currentLow, m_lastHigh, _currentHigh, m_type, m_low, m_high,

//m_lastLowIndex, m_lastHighIndex, m_lowZigZags[index], m_highZigZags[index], m_indicator.MarketSeries.Low[ix], m_indicator.MarketSeries.High[ix]);

switch (m_type)

{

case 0:

//StatusDisplay(string.Format("▼{0:F5}/{1:F5}\n▲{2:F5}/{3:F5}\n{4:F5}\n{5}", _currentHigh, Math.Abs(m_ds.Close[index] - _currentHigh), _currentLow, Math.Abs(m_ds.Close[index] - _currentLow), (m_deviation * m_point), m_type));

if (Math.Abs(m_low - 0) < double.Epsilon && Math.Abs(m_high - 0) < double.Epsilon)

{

if (Math.Abs(m_highZigZags[index]) > double.Epsilon)

{

m_high = m_ds.High[index];

m_lastHighIndex = ix;

m_type = -1;

Result[ix] = m_high;

//m_indicator.ChartObjects.DrawText("index1" + ix.ToString(), ix.ToString(), ix, m_high, VerticalAlignment.Top, HorizontalAlignment.Center, Colors.Red);

}

if (Math.Abs(m_lowZigZags[index]) > double.Epsilon)

{

m_low = m_ds.Low[index];

m_lastLowIndex = ix;

m_type = 1;

Result[ix] = m_low;

//m_indicator.ChartObjects.DrawText("index1" + ix.ToString(), ix.ToString(), ix, m_low, VerticalAlignment.Top, HorizontalAlignment.Center, Colors.Red);

}

Hist[ix] = m_showHistory == true ? Result[ix] : double.NaN;

}

break;

case 1:

//StatusDisplay(string.Format("▼{0:F5}/{1:F5}\n{2:F5}\n{3}", _currentHigh, Math.Abs(m_ds.Close[index] - _currentHigh), (m_deviation * m_point), m_type));

if (Math.Abs(Result[m_lastLowIndex] - m_indicator.MarketSeries.Low[ix]) < double.Epsilon && m_ds.TimeFrame != m_indicator.MarketSeries.TimeFrame)

{

Result[m_lastLowIndex] = double.NaN;

Hist[m_lastLowIndex] = m_showHistory == true ? Hist[m_lastLowIndex] : double.NaN;

m_lastLowIndex = ix;

Result[ix] = m_low;

Hist[ix] = m_showHistory == true ? Result[ix] : double.NaN;

}

if (Math.Abs(m_lowZigZags[index]) > double.Epsilon && m_lowZigZags[index] < m_low && Math.Abs(m_highZigZags[index] - 0.0) < double.Epsilon)

{

Result[m_lastLowIndex] = double.NaN;

m_lastLowIndex = ix;

m_low = m_lowZigZags[index];

Result[ix] = m_low;

Hist[ix] = m_showHistory == true ? Result[ix] : double.NaN;

//m_indicator.ChartObjects.DrawText("index1" + ix.ToString(), ix.ToString(), ix, m_low, VerticalAlignment.Top, HorizontalAlignment.Center, Colors.Blue);

}

if (Math.Abs(m_highZigZags[index] - 0.0) > double.Epsilon && Math.Abs(m_lowZigZags[index] - 0.0) < double.Epsilon)

{

m_high = m_highZigZags[index];

m_lastHighIndex = ix;

Result[ix] = m_high;

m_type = -1;

Hist[ix] = m_showHistory == true ? Result[ix] : double.NaN;

//m_indicator.ChartObjects.DrawText("index1" + ix.ToString(), ix.ToString(), ix, m_high, VerticalAlignment.Top, HorizontalAlignment.Center, Colors.Red);

}

break;

case -1:

//StatusDisplay(string.Format("▲{0:F5}/{1:F5}\n{2:F5}\n{3}", _currentLow, Math.Abs(m_ds.Close[index] - _currentLow), (m_deviation * m_point), m_type));

if (Math.Abs(Result[m_lastHighIndex] - m_indicator.MarketSeries.High[ix]) < double.Epsilon && m_ds.TimeFrame != m_indicator.MarketSeries.TimeFrame)

{

Result[m_lastHighIndex] = double.NaN;

Hist[m_lastHighIndex] = m_showHistory == true ? Hist[m_lastHighIndex] : double.NaN;

m_lastHighIndex = ix;

Result[ix] = m_high;

Hist[ix] = m_showHistory == true ? Result[ix] : double.NaN;

}

if (Math.Abs(m_highZigZags[index]) > double.Epsilon && m_highZigZags[index] > m_high && Math.Abs(m_lowZigZags[index] - 0.0) < double.Epsilon)

{

Result[m_lastHighIndex] = double.NaN;

m_lastHighIndex = ix;

m_high = m_highZigZags[index];

Result[ix] = m_high;

Hist[ix] = m_showHistory == true ? Result[ix] : double.NaN;

//m_indicator.ChartObjects.DrawText("index1" + ix.ToString(), ix.ToString(), ix, m_high, VerticalAlignment.Top, HorizontalAlignment.Center, Colors.Red);

}

if (Math.Abs(m_lowZigZags[index]) > double.Epsilon && Math.Abs(m_highZigZags[index]) < double.Epsilon)

{

m_low = m_lowZigZags[index];

m_lastLowIndex = ix;

Result[ix] = m_low;

m_type = 1;

Hist[ix] = m_showHistory == true ? Result[ix] : double.NaN;

//m_indicator.ChartObjects.DrawText("index1" + ix.ToString(), ix.ToString(), ix, m_low, VerticalAlignment.Top, HorizontalAlignment.Center, Colors.Red);

}

break;

default:

return;

}

}

}

}

Very good job!

Thank you for your indicator , but if it faster on any timeframe. It will be better. i hope we will have a perfect swingzigzag on next time.